Lacrosse Goals Market Size

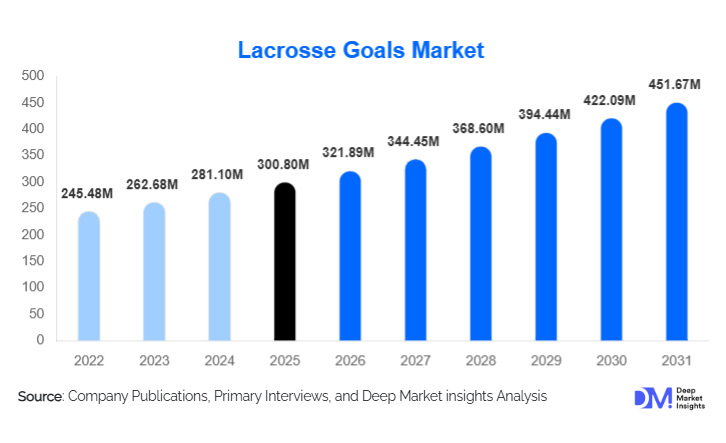

According to Deep Market Insights, the global lacrosse goals market size was valued at USD 300.80 million in 2025 and is projected to grow from USD 321.89 million in 2026 to reach USD 451.67 million by 2031, expanding at a CAGR of 7.01% during the forecast period (2026–2031). The lacrosse goals market growth is primarily driven by the steady expansion of organized lacrosse programs across schools, colleges, and professional leagues, rising participation in women’s and youth lacrosse, and increasing investments in sports infrastructure and training equipment globally.

Key Market Insights

- Institutional demand from schools and colleges dominates the market, supported by structured sports funding and mandatory compliance with league equipment standards.

- Field lacrosse goals represent the largest product segment, accounting for nearly half of global demand due to widespread adoption in professional and collegiate play.

- North America remains the largest regional market, led by the U.S. and Canada, where lacrosse is deeply embedded in school and university sports culture.

- Asia-Pacific is the fastest-growing region, driven by rising participation in Japan and Australia and growing investments in organized sports.

- Portable and training-specific lacrosse goals are gaining traction, particularly among recreational users and sports academies.

- Material innovation, including lightweight aluminum and composite frames, is improving durability, safety compliance, and ease of transport.

What are the latest trends in the lacrosse goals market?

Rising Demand for Portable and Training-Oriented Goals

One of the most prominent trends in the lacrosse goals market is the increasing adoption of portable, collapsible, and training-focused goal systems. Recreational players, youth programs, and training academies prefer lightweight and easy-to-assemble goals that can be used across multiple locations. Manufacturers are responding by introducing foldable frames, quick-lock mechanisms, and integrated rebounders that support skill development. These products are also well-suited for e-commerce distribution, further accelerating their adoption among individual consumers and small clubs.

Standardization and Safety Compliance Across Leagues

Another key trend is the growing emphasis on standardized goal dimensions and enhanced safety features. Governing bodies and school leagues are increasingly mandating compliance with World Lacrosse and national federation standards. This has driven demand for regulation-certified goals with reinforced frames, weather-resistant coatings, and secure anchoring systems. As a result, replacement cycles in institutional settings are becoming more predictable, supporting stable long-term demand for certified lacrosse goals.

What are the key drivers in the lacrosse goals market?

Expansion of School and Collegiate Lacrosse Programs

The expansion of lacrosse programs across schools and universities is a primary driver of market growth. Educational institutions are investing in sports infrastructure to promote physical activity, competitive athletics, and student engagement. Lacrosse goals are a core requirement for these programs, generating consistent procurement demand. In North America and parts of Europe, government and private funding for school sports is directly translating into higher equipment purchases.

Growth of Women’s and Youth Lacrosse

Women’s and youth lacrosse are among the fastest-growing segments of the sport. Dedicated leagues and tournaments require specialized goal specifications, expanding the overall addressable market. Rising participation rates are driving incremental demand not only for match goals but also for practice and training variants, benefiting manufacturers with diversified product portfolios.

What are the restraints for the global market?

Limited Popularity Outside Core Regions

Despite steady growth, lacrosse remains concentrated in a few core regions, particularly North America. Limited awareness and lower participation levels in many emerging economies restrict rapid global scaling. This regional concentration limits volume growth and increases dependence on replacement demand rather than new installations.

Budget Constraints in Amateur and Recreational Segments

Price sensitivity among schools, amateur clubs, and recreational users can delay purchasing decisions or shift demand toward lower-cost alternatives. Budget constraints often lead to extended replacement cycles, which can temporarily slow market growth, particularly during periods of reduced public sports funding.

What are the key opportunities in the lacrosse goals industry?

International Market Expansion and Grassroots Development

Emerging lacrosse markets in Europe, Asia-Pacific, and Latin America present strong long-term opportunities. National federations and sports associations are promoting lacrosse through grassroots programs and international competitions. Manufacturers that partner with governing bodies, offer region-specific pricing, and provide entry-level products can establish early brand presence and benefit from long-term demand growth.

Technology-Integrated Training Solutions

There is a growing opportunity in advanced training solutions, such as rebounder-equipped goals and sensor-enabled systems that support performance analytics. Professional teams and academies are increasingly adopting data-driven training tools, allowing manufacturers to differentiate through innovation and command premium pricing in the training segment.

Product Type Insights

Field lacrosse goals dominate the market, accounting for approximately 46% of global revenue in 2024, supported by widespread use in professional, collegiate, and high school competitions. Box lacrosse goals represent a significant niche segment, particularly in Canada, where indoor lacrosse formats are popular. Women’s lacrosse goals are growing rapidly due to rising participation, while training and practice goals are gaining share as recreational play and skill-development programs expand worldwide.

Material Insights

Steel lacrosse goals lead the market with an estimated 38% share, driven by durability and suitability for permanent installations. Aluminum goals follow closely, favored for their lightweight properties and corrosion resistance. Composite and PVC-based goals are increasingly used in portable and youth-focused applications, where ease of transport and affordability are key purchasing factors.

Application Insights

School and collegiate sports programs represent the largest application segment, contributing around 41% of total demand in 2024. Professional and semi-professional leagues generate steady replacement demand for regulation-compliant goals. Recreational use and training academies are emerging as high-growth applications, supported by increasing participation and the popularity of portable goal systems.

Distribution Channel Insights

Direct institutional sales dominate the lacrosse goals market, accounting for approximately 44% of global revenue, as schools and clubs procure equipment through bulk contracts. Online sales channels are expanding rapidly, driven by growing consumer preference for direct-to-brand purchasing and e-commerce convenience. Specialty sports retailers and distributors continue to play a key role, particularly in regions with established lacrosse communities.

| By Product Type | By Material | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 62% of the global lacrosse goals market in 2024, with the U.S. accounting for the majority share, followed by Canada. Strong school sports infrastructure, professional leagues, and high participation rates underpin demand. Continuous upgrades of athletic facilities support stable replacement cycles.

Europe

Europe accounts for around 17% of the global market, led by the U.K., Germany, and the Nordic countries. Increasing adoption of lacrosse in schools and universities and support from national sports bodies are driving steady growth across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 9% CAGR. Japan and Australia lead regional demand, supported by organized leagues, international tournaments, and rising awareness of lacrosse as a competitive sport.

Latin America

Latin America represents a small but emerging market, with Brazil and Mexico showing early signs of adoption through university sports programs and international collaborations.

Middle East & Africa

Demand in the Middle East & Africa remains nascent but is supported by international schools, expatriate communities, and growing investments in multi-sport facilities, particularly in the UAE and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Lacrosse Goals Market

- STX

- Warrior Sports

- Maverik Lacrosse

- Brine Lacrosse

- StringKing

- Champro Sports

- Gared Sports

- Jaypro Sports

- Harrow Sports

- BSN Sports

- PowerNet

- Gladiator Lacrosse

- Rage Cage

- First Team Sports

- EZ Goal