Kids Trolley Bags Market Size

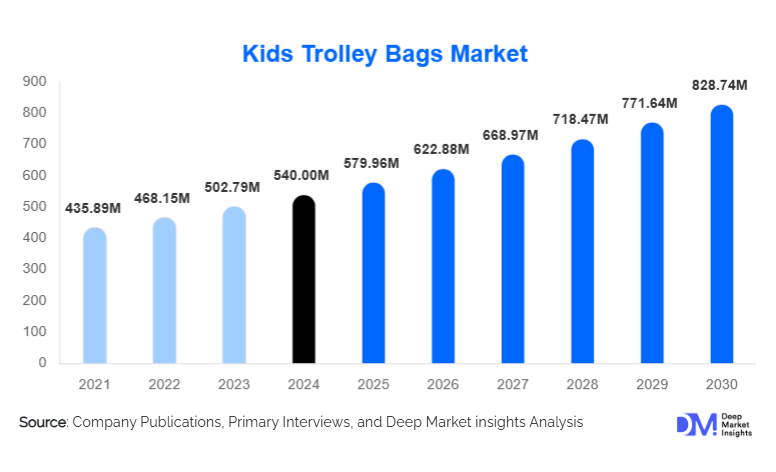

According to Deep Market Insights, the global kids trolley bags market size was valued at USD 540.00 million in 2024 and is projected to grow from USD 579.96 million in 2025 to reach USD 828.74 million by 2030, expanding at a CAGR of 7.40% during the forecast period (2025–2030). The market’s growth is primarily driven by increasing family travel, rising demand for character-themed and ergonomically designed luggage for children, and the surge in online retail platforms offering personalized and innovative trolley bag designs.

Key Market Insights

- Soft-shell trolley bags lead global adoption due to their lightweight build, affordability, and suitability for school and day-to-day travel for children.

- Four-wheel spinner trolley bags dominate wheel configurations, offering smoother maneuverability and child-friendly handling.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, a growing child population, and expanding domestic tourism markets.

- Licensed character-themed trolley bags remain a major demand driver, influenced by global entertainment franchises and children's animated brands.

- Mid-range price segment continues to hold the largest share, reflecting parents’ preference for durable yet affordable products.

- Sustainable materials and recycled plastics are gaining popularity as manufacturers shift toward eco-conscious product lines to meet evolving consumer expectations.

What are the latest trends in the kids trolley bags market?

Eco-Friendly and Sustainable Kids Luggage

Sustainability has become a defining trend in the kids trolley bags market, with brands increasingly integrating recycled polyester (rPET), biodegradable plastics, and plant-based fabrics into their product lines. Parents are actively seeking environmentally responsible options that reduce plastic waste without compromising durability. Manufacturers are responding by adopting circular manufacturing practices, offering eco-certified collections, and launching recycling programs where old bags can be returned for refurbishment or material recovery. European and North American markets are driving this shift, supported by strict chemical safety and sustainability regulations. This trend strengthens brand loyalty and enables companies to command higher margins in the premium and mid-range segments.

Character Licensing and Personalization Driving Purchases

Character-branded trolley bags remain a dominant market trend, with popular franchises influencing purchase decisions among children aged 2–12. Movie releases, anime culture, and gaming characters significantly shape buyer preferences. Personalization has also gained traction, with companies offering name-tag customization, themed prints, interchangeable badges, and limited-edition designs. Digital printing advancements allow brands to launch seasonal collections quickly, aligning product drops with entertainment releases. This high-engagement trend has strengthened collaborations between luggage brands and entertainment studios, creating a strong recurring demand cycle.

What are the key drivers in the kids trolley bags market?

Growth in Family Tourism and Child Mobility

Post-pandemic recovery in global tourism and the rise of family vacation culture have significantly increased the demand for kids trolley bags. Children now participate more actively in educational trips, sports events, weekend travel, and family excursions, creating recurring luggage needs across age groups. International and domestic air travel volumes continue to climb, encouraging parents to invest in lightweight, roller-friendly bags for easier airport navigation. This trend is especially strong in Asia-Pacific and the Middle East, where tourism infrastructure continues to expand rapidly.

Rising Parental Spending on Premium and Ergonomic Kids Products

Increasing disposable incomes in both developed and emerging economies have led parents to prioritize premium, durable, and branded luggage options for their children. Enhanced product features, shock-resistant hard shells, multi-directional wheels, adjustable handles, and TSA-friendly designs are helping premium brands capture higher-value customers. Growing awareness of ergonomic design also influences purchases, as parents seek trolley bags that reduce strain and improve handling comfort for young users. This shift toward quality-oriented buying behavior fuels long-term industry expansion.

What are the restraints for the global market?

Raw Material Cost Volatility

The kids trolley bags market is highly sensitive to fluctuations in prices of key materials such as ABS plastic, polycarbonate, nylon, and polyester. Global supply chain disruptions and inflationary pressures continue to elevate production costs, squeezing margins for manufacturers and retailers. Price increases are especially challenging in price-sensitive markets across Asia and Latin America, where consumers frequently opt for unbranded alternatives, limiting growth in branded mid-range and premium segments.

Intense Market Competition and Product Imitation

High competition from local manufacturers and unbranded segments poses a major challenge for established companies. Low-cost replicas, especially of character-themed designs, dilute brand value and pressure companies to innovate continuously. Additionally, online marketplaces have accelerated the presence of lesser-known brands, creating pricing complexities and reducing differentiation. This fragmentation makes sustained profitability challenging unless firms shift toward branding, technology, and sustainable materials.

What are the key opportunities in the kids trolley bags industry?

Smart Trolley Bags with Integrated Technology

The integration of digital features represents a significant opportunity for premium brands. Smart kids trolley bags equipped with Bluetooth-enabled trackers, LED safety lights, motion sensors, and anti-lost alerts appeal to tech-savvy parents seeking enhanced safety and convenience. As smart luggage technology becomes more affordable, its adoption is expected to accelerate across North America, Europe, and advanced Asian markets such as Japan and South Korea. These innovations can help companies differentiate themselves and achieve higher customer retention rates.

Expansion in Emerging Global Markets

Rapid urbanization and a large youth population in markets such as India, Indonesia, Brazil, Vietnam, and the Philippines present substantial room for growth. Increasing tourism, rising middle-class incomes, and expanding retail penetration, both online and offline, are accelerating demand for kids trolley bags. Government initiatives promoting local manufacturing, such as “Make in India,” also create opportunities for global players to establish regional production hubs. Tailoring product designs to local cultural preferences and price points can enable brands to capture high-growth segments in these emerging markets.

Product Type Insights

Soft-shell trolley bags dominate the global market due to their lightweight construction, affordability, and flexibility for school and travel use. They hold approximately 46% of the product-type market share in 2024, driven by higher adoption in emerging countries and strong availability across retail channels. Hard-shell bags, typically made from ABS or polycarbonate, are gaining popularity among families seeking durable and scratch-resistant designs for air travel. Hybrid bags, combining hard and soft material advantages, represent a smaller but steadily growing niche supported by premium buyers seeking both structure and flexibility.

Application Insights

Travel and tourism account for the largest share of kids trolley bag applications, driven by rising domestic tourism and increased frequency of short family trips. School-related use, including excursions, sports activities, and day camps, represents the second-largest segment, with growing demand for mid-sized (15–25L) trolley bags that provide both durability and style. Sports and hobby-related activities are the fastest-growing application segment, supported by rising participation in extracurricular activities and travel-based competitions. Customizable sports-themed bags, reinforced compartments, and lightweight rollers are expanding consumer preference within this category.

Distribution Channel Insights

Online distribution channels dominate global sales, accounting for roughly 48% of the market in 2024. E-commerce platforms offer parents greater convenience, a wider assortment of designs, and competitive pricing, making digital retail the fastest-growing channel. Direct-to-consumer (D2C) brand websites are gaining momentum due to improved product personalization, exclusive collections, and premium packaging options. Offline retail, including specialty luggage stores, hypermarkets, and department stores, continues to serve as a key channel in emerging markets, where tactile product evaluation remains important for buyers.

Age Group Insights

Children aged 6–9 years represent the largest consumer group in the kids trolley bags market, making up 40% of total demand in 2024. Their higher involvement in travel, school excursions, and sports activities drives repeat purchases. Toddlers (2–5 years) play a significant role in licensed character bag sales, especially for animated and preschool-themed designs. Pre-teens (10–12 years) increasingly prefer more mature designs and structured hard-shell cases, with growing demand seen in premium and semi-premium categories.

| By Product Type | By Wheel Configuration | By Age Group | By Capacity | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a strong share of global demand, driven by high family travel spending, widespread adoption of licensed merchandise, and a strong preference for premium, durable luggage. The U.S. remains a major importer of kids trolley bags, supported by robust e-commerce penetration and a large gift-driven purchasing culture.

Europe

Europe’s market is characterized by increasing adoption of eco-friendly trolley bags and strong regulatory standards for children’s products. Countries including Germany, France, and the U.K. show rising demand for premium and sustainably produced kids luggage. Seasonal gifting and holiday travel patterns further support market growth across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by large youth populations in China and India, rising disposable incomes, and expanding domestic tourism. Japan and South Korea lead in premium product adoption, while Southeast Asia shows rapid mid-range market expansion. Manufacturing hubs in China, Vietnam, and India also contribute significantly to global export volumes.

Latin America

Demand in Latin America is rising steadily, particularly in Brazil, Mexico, and Argentina. Market growth is supported by increased online purchasing, expanding retail infrastructure, and a rising interest in character-themed merchandise. Mid-range and economy segments dominate due to price sensitivity.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows strong demand for premium trolley bags tied to rising family tourism and high purchasing power. Africa's market, while smaller, is growing in regions such as South Africa and Kenya due to increased urbanization and expanding retail networks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Kids Trolley Bags Market

- Samsonite

- American Tourister

- VIP Industries

- Delsey

- Disney Luggage

- Heys International

- Trunki

- Smiggle

- Skip Hop

- LittleLife

- Totto

- Travel Blue

- Wildkin

- Kakashi/Anime Merchandise Brands

- Carlton

Recent Developments

- In March 2025, Samsonite launched an eco-friendly kids' luggage collection using 100% recycled plastics, targeting sustainable travel segments in Europe and North America.

- In January 2025, VIP Industries expanded its licensed character product line across India, collaborating with major animation studios for new seasonal releases.

- In February 2025, Trunki introduced a smart-tracking kids trolley bag equipped with Bluetooth and anti-lost alerts, targeting premium online buyers.