Kids Flossers Market Size

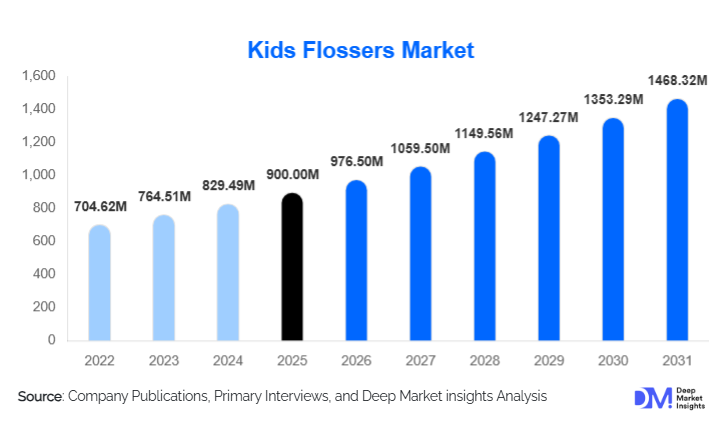

According to Deep Market Insights, the global kids flossers market size was valued at USD 900.00 million in 2025 and is projected to grow from USD 976.50 million in 2026 to reach USD 1468.32 million by 2031, expanding at a CAGR of 8.5% during the forecast period (2026–2031). The market’s growth trajectory reflects a structural shift in pediatric oral care, where flossing is increasingly positioned as a preventive daily hygiene practice rather than a supplementary dental activity.

Key Market Insights

- Kids flossers are transitioning into high-frequency FMCG products, supported by daily-use recommendations from pediatric dentists.

- Handle-style flossers dominate global consumption, driven by superior safety, ease of grip, and higher compliance among children.

- Asia-Pacific is the largest volume market, while North America remains the most value-dense region.

- Biodegradable and plant-based flossers are the fastest-growing category, driven by sustainability-led purchasing behavior.

- E-commerce and DTC subscriptions are reshaping distribution economics, improving margins and customer lifetime value.

- The top five manufacturers control ~46% of global revenue, indicating moderate but stable market consolidation.

What are the latest trends in the kids flossers market?

Design-Led Compliance and Behavioral Engineering

Product innovation in the kids flossers market is increasingly centered on behavioral compliance rather than purely mechanical performance. Manufacturers are applying child-centric design principles such as ergonomic grips sized for smaller hands, reduced floss tension to minimize discomfort, flexible heads to lower gum injury risk, and character-themed or brightly colored handles to improve acceptance. These features are engineered to reduce resistance and anxiety associated with flossing, particularly among first-time users.

Compliance-driven design has shown the strongest impact in the 5–7 age group, where parental supervision remains high and habit formation is most effective. As a result, novelty and character-based flossers have transitioned from seasonal or promotional products into core SKUs. This shift has increased average usage frequency per child and extended product lifecycles, strengthening recurring revenue for established brands.

Sustainability-Driven Product Reengineering

Environmental scrutiny of single-use plastics is reshaping material choices and product architectures across the kids flossers market. Parents in North America and Europe are increasingly evaluating material composition, recyclability, and packaging waste when purchasing oral-care products. In response, manufacturers are accelerating the transition toward biodegradable handles, plant-based polymers, reduced-plastic designs, and recyclable outer packaging.

This shift has required incremental CapEx investment in alternative material processing and supplier realignment. However, it has also enabled premium pricing for eco-certified flossers, particularly in European markets where regulatory pressure and sustainability awareness are highest. Brands that successfully align product safety, durability, and environmental compliance are gaining shelf preference and long-term brand trust.

What are the key drivers in the kids flossers market?

Institutionalization of Early Oral Hygiene

Pediatric dental guidelines increasingly recommend flossing from as early as age two to prevent early-stage cavities, interdental plaque buildup, and gum inflammation. This guidance has repositioned flossers as a preventive healthcare necessity rather than an optional hygiene accessory. Pediatric dentists and healthcare providers are reinforcing flossing as a daily habit alongside brushing.

As parents become more aware of the long-term cost advantages of preventive oral care, flossers are being integrated into daily routines at an earlier age. This has resulted in stable, non-cyclical demand patterns and reduced sensitivity to short-term economic fluctuations.

Expansion of Pediatric Dental Infrastructure

The expansion of pediatric dental clinics and specialized oral-care centers across Asia-Pacific, Latin America, and the Middle East has strengthened professional recommendation channels. Pediatric dentists increasingly prescribe age-specific flossers during routine checkups, reinforcing trust-based purchasing behavior.

This professional endorsement supports premiumization, as parents are more willing to purchase branded, dentist-recommended products. Urban markets with higher clinic density show stronger uptake of higher-priced flossers with safety certifications and ergonomic differentiation.

Retail Bundling and Cross-Selling Strategies

Manufacturers are increasingly bundling kids flossers with toothbrushes, toothpaste, and complete oral-care kits to increase shelf visibility and basket value. Bundled offerings simplify purchasing decisions for parents and position flossing as a standard component of daily hygiene rather than an add-on.

These strategies are particularly effective in supermarkets, pharmacies, and large-format retail, where impulse purchasing and promotional pricing convert first-time buyers into repeat consumers.

What are the restraints for the global market?

Low Penetration in Price-Sensitive and Rural Markets

In many developing regions, flossing remains secondary to brushing due to limited awareness, affordability constraints, and low exposure to pediatric dental guidance. Rural markets, in particular, show low penetration due to restricted access to oral-care education and modern retail channels.

As a result, volume growth outside major urban centers remains gradual, limiting market expansion despite favorable demographic fundamentals.

Regulatory and Environmental Pressure on Plastic Products

Single-use plastic flossers are facing increasing regulatory scrutiny related to waste reduction and environmental safety. Compliance with evolving material standards raises manufacturing costs and increases product redesign cycles.

Brands that fail to transition toward sustainable alternatives risk regulatory penalties, reduced shelf access, and declining acceptance among environmentally conscious consumers.

What are the key opportunities in the kids flossers industry?

Public Oral-Health Programs and Institutional Procurement

Government-led school dental programs, early-childhood healthcare initiatives, and community oral-health campaigns present scalable procurement opportunities. Inclusion of flossers in publicly funded oral-care kits enables manufacturers to access large user bases while supporting preventive healthcare objectives.

These programs also help normalize flossing behavior among children at an early age, supporting long-term market expansion.

Subscription-Based and Digital-First Distribution

Direct-to-consumer subscription models offering monthly pediatric oral-care kits are gaining traction among urban and digitally engaged parents. These models improve demand predictability, reduce reliance on traditional retail intermediaries, and increase customer lifetime value.

Subscription platforms also allow personalization by age group, supporting smoother product upgrades as children grow.

Product Type Insights

Handle flossers dominate the market, accounting for approximately 48% of global revenue in 2025. Their dominance is driven by ease of handling, reduced injury risk, and high acceptance among younger children. Dual-arm and refillable flossers are gaining traction among pre-teens, while novelty-driven designs continue to support repeat purchases and brand loyalty.

Material Insights

Plastic-based flossers retain a 62% market share due to cost efficiency, durability, and manufacturing scalability. However, biodegradable and plant-based flossers are the fastest-growing segment, expanding at over 8% CAGR, supported by sustainability-driven purchasing behavior and regulatory alignment in developed markets.

Application Insights

Household use accounts for more than 72% of total demand, reflecting daily hygiene routines under parental supervision. Professional dental settings represent the fastest-growing application segment, as flossers are increasingly recommended during pediatric consultations. Institutional usage in schools and daycare programs is emerging as a secondary growth driver.

Distribution Channel Insights

Supermarkets and hypermarkets contribute approximately 34% of global sales, supported by bundled promotions and impulse buying behavior. Online retail and direct-to-consumer platforms are expanding rapidly due to convenience and subscription adoption, while pharmacies remain a trusted channel for dentist-recommended products.

Age Group Insights

Children aged 5–7 years represent the largest demand segment, accounting for around 41% of market consumption. High parental supervision and routine formation drive consistent usage. Toddlers (2–4 years) represent a growing segment, while pre-teens (8–12 years) increasingly adopt refillable and premium flossers aligned with greater independence.

| Product Type | Material | Age Group | Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global kids flossers market with approximately 34% share in 2025, supported by large pediatric populations, rising urbanization, and improving awareness of preventive oral healthcare. China and India are the primary growth engines, together accounting for more than half of regional demand. In China, strong penetration of modern retail and rapid growth in pediatric dental clinics are accelerating adoption of age-specific flossers in urban households. In India, increasing parental focus on early oral hygiene and the expansion of private pediatric dental practices in Tier I and Tier II cities are driving volume growth.

Japan and South Korea represent mature but stable markets, characterized by high product quality standards and strong acceptance of ergonomic and safety-certified flossers. Southeast Asian countries, including Indonesia, Thailand, and Vietnam, are emerging growth markets, where rising middle-class income and improving access to oral-care education are supporting gradual penetration beyond metropolitan areas.

North America

North America accounts for approximately 31% of global revenue, driven by high parental awareness, strong professional endorsement from pediatric dentists, and widespread availability of premium oral-care products. The United States dominates regional demand, supported by early adoption of flossing in daily hygiene routines and strong integration of kids flossers into retail and pharmacy assortments.

Canada contributes steady demand, characterized by high uptake of eco-friendly and biodegradable flossers. Subscription-based oral-care kits and direct-to-consumer platforms are expanding rapidly across the region, improving repeat purchase rates and customer lifetime value. Regulatory emphasis on product safety and material compliance continues to influence product design and pricing structures.

Europe

Europe holds approximately 22% share of the global kids flossers market, with demand concentrated in Germany, France, and the UK. These markets are defined by strong sustainability awareness, stringent material regulations, and high trust in dentist-recommended products. Biodegradable and plant-based flossers are gaining traction faster in Europe than in other regions, supported by regulatory alignment and consumer preference.

Nordic countries and the Netherlands show high per-capita consumption, driven by preventive healthcare culture and early oral-hygiene education. Southern and Eastern European markets, including Spain, Italy, and Poland, are gradually expanding, supported by improving retail penetration and rising pediatric dental visits.

Latin America

Latin America represents nearly 8% of global demand, led by Brazil and Mexico. Urban centers in these countries are witnessing increased adoption of kids flossers, supported by growth in private dental clinics and rising awareness of preventive oral care. However, penetration remains uneven, with demand largely concentrated in middle- and high-income urban households.

Other countries such as Chile, Colombia, and Argentina are emerging markets, where modern retail expansion and oral-health education initiatives are supporting gradual uptake. Price sensitivity remains a constraint, influencing product mix toward cost-effective and entry-level flossers.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global demand but represents the fastest-growing market, expanding at over 8% CAGR. Growth is driven by government investments in pediatric healthcare, increasing private dental infrastructure, and rising awareness of preventive oral hygiene in urban populations.

Saudi Arabia and the UAE lead regional demand, supported by high healthcare spending and strong penetration of premium oral-care products. In Africa, South Africa remains the most developed market, while countries such as Kenya and Nigeria are emerging, supported by urbanization and expanding access to private dental care. Institutional oral-health programs are expected to play a larger role in driving long-term demand across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The kids flossers market is moderately consolidated. The top five players collectively account for approximately 46% of global revenue, reflecting strong brand equity, dentist endorsement, and retail penetration.

Key Players in the Kids Flossers Market

- Dr. Fresh

- Jordan Oral Care

- The Humble Co.

- Radius Corporation

- DenTek

- Plackers

- Lion Corporation

- Pigeon Corporation

- Forhans

- Babyganics