Kids Activity Box Market Size

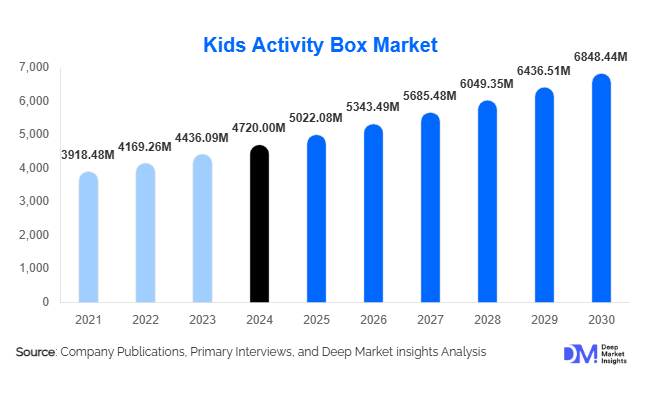

According to Deep Market Insights, the global kids activity box market size was valued at USD 4,720 million in 2024 and is projected to grow from USD 5,022.08 million in 2025 to reach USD 6,848.44 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). This growth is primarily driven by increasing parental demand for educational and screen-free play, rising adoption of subscription-based models, and expanding reach into emerging markets with growing middle-class populations.

Key Market Insights

- STEAM and STEM-based boxes dominate globally, as parents increasingly prioritize early exposure to science, technology, engineering, arts, and mathematics, positioning kids' activity boxes as valuable developmental tools.

- Subscription-based and e-commerce delivery models lead distribution, enabling convenience, recurring revenue for sellers, and regular novelty for children, making monthly/quarterly boxes a preferred choice for busy parents.

- There is a strong shift toward screen-free, hands-on learning and creative play, reflecting growing parental concern around excessive screen time and a desire for tactile, developmental activities for children.

- Emerging regions, especially Asia-Pacific and parts of Latin America, are among the fastest-growing markets, driven by rising disposable incomes, growing urban middle classes, and increasing awareness of early childhood education.

- Hybrid and tech-integrated offerings (e.g., AR-enhanced kits, coding & robotics boxes) are gaining traction, appealing to modern parents seeking a blend of physical activity and future-ready skills for children.

- Home-based learning and gift-use remain the primary applications, complemented by growing adoption in after-school programs, preschools, and extracurricular enrichment centers.

Latest Market Trends

Growing Preference for Screen-Free Educational & Creative Play

Parents around the world are increasingly looking for alternatives to digital entertainment for their children. Kids' activity boxes, featuring crafts, puzzles, experiments, and hands-on learning, meet this demand by offering tactile, meaningful play experiences at home. This trend is especially strong among families with preschoolers and early-school-age children, who value developmental benefits such as fine motor skills, creativity, and cognitive growth. As a result, demand for arts & crafts, educational, and mixed-theme boxes has surged in many developed markets, driving overall market growth.

Rise of Subscription and E-commerce Models

The adoption of subscription-based delivery models continues to accelerate. Monthly or quarterly curated boxes delivered directly to consumers ensure convenience for parents and recurring revenue streams for companies. E-commerce penetration across developed and emerging markets, supported by efficient logistics and global shipping, has made it easier for families to subscribe and receive boxes regardless of location. This model also encourages customer loyalty and higher lifetime value compared to one-time purchases.

Integration of Technology and Hybrid Educational Offerings

To differentiate in a crowded market, many providers are blending traditional activity kits with digital enhancements. Examples include AR-enabled storytelling, companion apps for guided experiments, coding or robotics kits, and interactive digital content that complements the physical materials. These hybrid offerings appeal to modern parents who want their children to build relevant STEM skills while engaging in hands-on play, effectively combining physical, creative, and digital learning experiences.

Market Drivers

Parental Emphasis on Early Childhood Development and Skill-Building

Globally, parents are increasingly aware of the importance of early childhood development, cognitive growth, and foundational skill-building for children’s future success. Kids' activity boxes, especially those focused on STEM/STEAM, creativity, and educational learning, provide structured, guided, and safe ways to support learning at home. This emphasis supports demand across a wide demographic, from preschool to early school-age children.

Urbanization, Rising Disposable Incomes, and Middle-Class Growth in Emerging Markets

In many emerging economies, growing urbanization and expanding middle-class populations are fueling increased spending on children’s education, enrichment, and extracurricular activities. As disposable incomes rise, more families are willing to spend on educational toys and subscription boxes that combine learning and play. This economic transformation is opening new growth corridors, especially in markets where organized children’s play products were previously underpenetrated.

Convenience and Flexibility of Subscription-Based Business Models

Subscription-based models offer unparalleled convenience; boxes arrive at the doorstep regularly, eliminating the need for parents to hunt for new toys or activity sets. This recurring delivery model aligns well with busy lifestyles and ensures that children continuously receive fresh, engaging content. For providers, it supports predictable cash flows, efficient inventory planning, and stronger customer retention, which in turn drives reinvestment and innovation.

Market Restraints

Regulatory, Safety, and Material Compliance Challenges Across Regions

Because kids' activity boxes often contain small parts, chemicals (e.g., for science experiments), or craft materials, they are subject to strict toy-safety regulations and standards, which vary widely across different countries. For companies aiming for global reach, navigating this patchwork of rules demands significant investment in compliance, testing, certification, and safe packaging. This adds to production costs and can delay market entry or expansion.

Competition from Digital Entertainment and Free/Low-Cost Online Learning Resources

While many parents value screen-free play, children remain highly attracted to digital entertainment, apps, games, video content, and free educational platforms. These digital alternatives are often cheaper (or free) and continuously updated, undermining the appeal of physical activity boxes, especially in price-sensitive markets. As digital content becomes more interactive, affordable, and ubiquitous, convincing parents to invest in subscription or one-time purchase boxes may become increasingly challenging.

Market Opportunities

Emerging Markets Expansion Across Asia-Pacific and Latin America

Rapid urbanization, rising incomes, and growing middle-class populations in countries such as India, China, Brazil, and Southeast Asian nations offer attractive, underpenetrated markets for kids' activity boxes. Localized content (language, culture, themes), affordable price points, and effective e-commerce networks can help new entrants build strong customer bases. With limited existing competition in many regions, early movers may achieve high brand loyalty and dominate local market share.

Integration of Technology: Hybrid Kits, AR, and Digital Learning Platforms

Combining traditional physical boxes with technological add-ons, such as augmented reality, coding modules, companion apps, and interactive digital curricula, presents a powerful differentiator. Tech-enhanced boxes can command premium pricing, increase perceived value, enable educational depth, and support long-term engagement. As global demand for STEM/STEAM education grows, tech-integrated boxes offer a strategic avenue for companies to innovate, stand out, and tap into future-ready learning trends.

Institutional Partnerships with Schools, Early-Education Centers, and After-School Programs

Activity boxes need not be limited to home use. There is growing potential for collaborations with schools, kindergartens, early-childhood centers, and after-school enrichment programs. Supplying curated boxes for classroom projects, group activities, or supplementary curricula can drive bulk orders, steady institutional demand, and repeated purchase cycles. As educational systems globally evolve toward experiential and STEAM-based learning, institutional adoption becomes a strong growth driver.

Product Type Insights

Among the various types of kids' activity boxes, STEM/STEAM-based kits lead in global popularity, especially those that combine coding, science experiments, and hands-on engineering projects. These command premium price points and are preferred by parents aiming to develop future-ready skills in children. In contrast, arts & crafts boxes and educational learning kits remain popular for younger children, offering creativity, motor-skills development, and foundational learning at more accessible price points. Mixed-theme boxes (combining educational plus creative, plus exploratory elements) are gaining traction as versatile all-in-one options, especially in subscription models.

Application Insights

The majority of activity boxes are used for home-based learning and play, especially for preschoolers and early school-age children, enabling parents to supplement formal education or offer creative engagement during leisure time. Gift and occasional purchases continue to be a substantial use case; parents buy boxes for birthdays, holidays, or special occasions. Importantly, there is an emerging trend of after-school programs, enrichment centers, and kindergartens incorporating these boxes into group activities and curricula, expanding the application scope beyond just home use.

Distribution Channel Insights

E-commerce platforms and direct-to-consumer subscription models dominate the distribution landscape, providing convenience, variety, and global reach. Online marketplaces and brand websites enable easy ordering and delivery to homes worldwide. Meanwhile, in some markets, notably emerging economies, offline retail through toy stores, bookstores, and specialty retailers still plays a role, especially for one-time gift boxes. The subscription model’s recurring nature also supports stable revenue for companies, higher customer retention, and continuous innovation in themes and content.

Age Group Insights

Children aged 4–8 years (preschool to early school age) represent the largest and fastest-growing demographic for activity boxes. Parents of preschoolers (4–5 years) value activity boxes that combine creativity, motor skill development, and early learning, while parents of early school-age children (6–8 years) increasingly prefer STEM/STEAM-based kits that reinforce cognitive skills and problem-solving. Boxes targeting toddlers (1–3 years) remain popular, though often simpler in content (sensory play, basic crafts). Demand decreases somewhat for older children (9–12 years) and teens, but hybrid STEM and coding kits have begun to capture interest in those age ranges.

| By Product Type | By Application | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for kids' activity boxes, comprising an estimated 38–40% of global revenue in 2024. High parental spending power, strong adoption of subscription-based e-commerce, and cultural emphasis on early childhood enrichment drive demand. The United States is the primary market within the region, where families widely adopt STEAM-based and creative boxes for preschoolers to early school-age children. In addition, awareness of screen-time limitations and desire for hands-on educational toys support steady growth.

Europe

Europe accounts for roughly 25–30% of the global market in 2024, with leading demand from countries such as the United Kingdom, Germany, and France. European parents value educational quality, sustainability, and creative development, fueling demand for arts & crafts boxes, STEM kits, and eco-friendly packaging. Subscription-based models are popular, and growth is supported by widespread e-commerce infrastructure, parental interest in early childhood development, and growing environmental consciousness influencing packaging and material choices.

Asia-Pacific (APAC)

Asia-Pacific is among the fastest-growing regions globally. Although its share in 2024 is smaller (approximately 20–25% of global sales), growth rates are the highest across all regions. Rapid urbanization, rising incomes, expanding middle class, and increasing parental awareness of early education, particularly in countries such as India, China, and Southeast Asian nations, are driving growth. Local companies offering culturally relevant, affordable activity boxes are emerging, and e-commerce platforms are facilitating broad distribution. APAC is expected to gain substantial market share by 2030 as penetration increases.

Latin America

Latin America currently represents a smaller portion (together with the Middle East & Africa) of the global market, likely around 4–6% in 2024. However, as urbanization increases and middle-class populations expand in countries such as Brazil and Mexico, interest in children’s educational products and enrichment is rising. With growing online retail infrastructure and regional players entering the market, Latin America presents potential for steady long-term growth.

Middle East & Africa

The Middle East & Africa region currently holds a modest share of the global market, under 5% combined. Market penetration is limited by lower disposable incomes in many countries, limited awareness of activity-box products, and a relatively underdeveloped e-commerce infrastructure. Nonetheless, pockets of affluence (Gulf countries) and growing urbanization in certain African markets offer potential opportunities for future expansion, especially if companies adapt price points and content to regional contexts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Kids Activity Box Market

- KiwiCo

- Little Passports

- ToucanBox

- Green Kid Crafts

- MEL Science

- Bitsbox

- Flintobox

- Creation Crate

- Wonder Crate

- Genius Box

- HobbyKidsBox

- Craft + Boogie

- Smartivity

- Zingy Box

- EduPlay Activity Kits

Recent Developments

- March 2025: KiwiCo launched a localized subscription offering in South Asia with tailored content for toddlers and preschoolers, incorporating regional languages and culturally relevant themes to capture emerging markets.

- May 2025: MEL Science introduced a new AR-enabled science box series, integrating smartphone-guided experiments and interactive digital modules targeted at children aged 8–12.

- July 2025: Smartivity, an India-based manufacturer, raised a significant round of venture funding to expand manufacturing capacity and distribution across Southeast Asia, signaling increased investor interest in emerging-market activity box demand.

- August 2025: Green Kid Crafts committed to fully sustainable packaging, replacing plastic components with recyclable materials, responding to growing consumer demand for eco-friendly children’s products.