Keratin Products Market Size

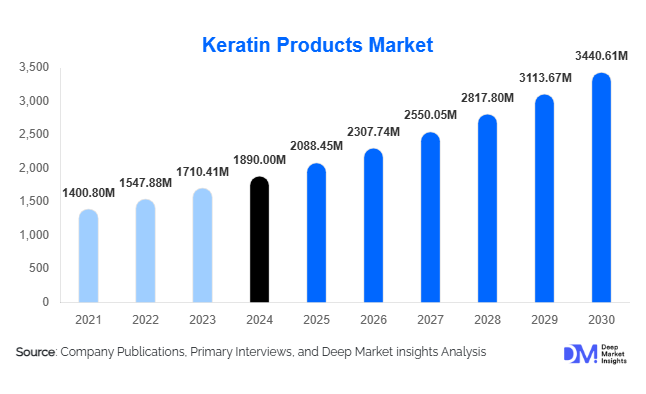

According to Deep Market Insights, the global keratin products market size was valued at USD 1,890 million in 2024 and is projected to grow from USD 2,088.45 million in 2025 to reach USD 3,440.61 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The keratin products market growth is primarily driven by the rising demand for hair restoration and strengthening solutions, increased consumer awareness of protein-based hair care, and the expansion of premium salon-grade product lines across emerging markets.

Key Market Insights

- Rising consumer inclination toward chemical-free, protein-enriched hair treatments is accelerating the adoption of keratin-based shampoos, conditioners, and serums.

- Premium salon and at-home treatment segments are expanding rapidly, driven by increased beauty spending among urban consumers and social media influence on haircare trends.

- Asia-Pacific dominates the keratin products market, supported by large populations, growing disposable income, and increasing hair damage concerns due to pollution and humidity.

- North America remains a key innovation hub, with brands focusing on cruelty-free, vegan keratin alternatives and advanced delivery technologies.

- Online retail channels are witnessing exponential growth, providing global access to professional-grade keratin formulations and niche brands.

- Technological advancements in biomimetic keratin extraction are reshaping product development and enabling sustainable sourcing from plant and wool-derived proteins.

What are the latest trends in the keratin products market?

Vegan and Plant-Based Keratin Alternatives Rising

Consumers are increasingly seeking cruelty-free and sustainable haircare options. As traditional keratin is often derived from animal sources, manufacturers are shifting toward plant-based or biomimetic keratin proteins that mimic natural hair structure without animal extraction. Brands are emphasizing ethical production, eco-friendly packaging, and clean-label claims to attract conscious consumers. This trend is particularly strong in Europe and North America, where regulatory scrutiny and ethical awareness are high.

Home-Based Keratin Treatments on the Rise

With the rise of DIY beauty culture, home-use keratin kits are gaining popularity. Consumers are opting for professional-grade formulations that deliver salon-like results at a fraction of the cost. E-commerce platforms and influencer marketing have further boosted visibility and accessibility. These at-home solutions often emphasize convenience, safety, and sulfate-free formulations that maintain long-term hair smoothness and shine.

What are the key drivers in the keratin products market?

Rising Demand for Hair Repair and Damage Protection

Frequent chemical treatments, styling, and environmental stressors have intensified the global demand for restorative haircare. Keratin-infused formulations help rebuild hair structure, reduce frizz, and improve elasticity, making them a preferred choice among consumers with damaged or color-treated hair. Increased awareness of hair health and the long-lasting benefits of keratin-based care are key growth drivers across all demographics.

Premiumization and Brand Innovation

Manufacturers are launching advanced formulations featuring hydrolyzed keratin, nanotechnology-based delivery systems, and hybrid products that combine keratin with natural oils and vitamins. The premium segment is growing particularly fast, driven by salon-exclusive brands expanding into direct-to-consumer models. Celebrity endorsements, influencer collaborations, and social media trends continue to fuel this momentum.

What are the restraints for the global market?

High Cost and Potential Chemical Concerns

Keratin treatments, especially salon-grade options, remain expensive and are often associated with concerns over formaldehyde emissions and harsh chemical usage. Although cleaner alternatives are emerging, negative perceptions persist among some consumers, limiting widespread adoption. Regulatory scrutiny around formulation safety is also expected to challenge market players in certain regions.

Availability of Substitutes

The growing popularity of natural oils, collagen-based, and peptide-infused hair products offers alternative solutions for consumers seeking repair and nourishment, increasing competition within the broader haircare segment.

What are the key opportunities in the keratin products market?

Expansion into Men’s Haircare

Male consumers are showing growing interest in grooming and hair repair solutions. This presents a significant opportunity for brands to develop keratin-based products specifically formulated for men, focusing on strengthening, anti-hair fall, and scalp health benefits.

Emerging Markets Driving Growth

Rapid urbanization, increased disposable income, and the influence of global beauty standards are boosting keratin product adoption in regions such as Asia-Pacific and Latin America. Local production partnerships, influencer-led campaigns, and region-specific formulations (e.g., anti-humidity or anti-pollution variants) are expected to accelerate growth in these markets.

Product Type Insights

Keratin shampoos and conditioners continue to dominate the market due to their widespread use, affordability, and effectiveness in daily hair care routines. Treatments and serums are gaining significant traction in the premium segment, providing long-lasting smoothing, damage repair, and frizz control. Spray-based leave-in products are emerging as one of the fastest-growing categories, offering lightweight application, quick absorption, and convenient daily protection, catering especially to busy urban consumers seeking low-maintenance hair care. The growth of this segment is largely driven by rising consumer demand for hair-strengthening and smoothing solutions, as keratin-infused formulations effectively rebuild hair structure, enhance shine, and improve elasticity.

Distribution Channel Insights

Online retail is the dominant distribution channel for keratin products, fueled by e-commerce expansion, social media-driven brand discovery, and the convenience of home delivery. Consumers increasingly rely on online platforms to access both premium and mass-market keratin products, often comparing formulations, reviews, and prices before purchase. Salons remain a critical channel for professional-grade treatments, where the preference for effective keratin-based hair straightening and repair solutions drives consistent adoption. Supermarkets and specialty beauty stores continue to serve mass-market consumers with affordable shampoos, conditioners, and serums. Subscription-based haircare models are gaining popularity, enabling personalized keratin-based regimens delivered directly to consumers, further enhancing accessibility and engagement.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global keratin products market, driven by rapid urbanization, rising disposable incomes, and increasing awareness of hair care and beauty standards. Key countries such as China, India, and South Korea are experiencing robust growth due to rising hair damage caused by humidity, pollution, heat styling, and chemical treatments. The popularity of salon services and premium at-home keratin solutions further boosts adoption. Additionally, consumer preference for frizz control, hair strengthening, and anti-hair fall formulations is a significant growth driver. Local and international brands are expanding portfolios with region-specific variants, such as humidity-resistant and anti-pollution keratin treatments, to cater to regional hair concerns and diverse consumer needs.

North America

North America remains a mature, innovation-driven market with a strong emphasis on personal grooming and appearance, which fuels demand for keratin-based hair care products. Consumers increasingly prefer clean-label, vegan, and cruelty-free formulations, driving innovation in plant-based and biomimetic keratin products. The U.S. and Canada dominate in professional keratin treatments and premium salon services, supported by high disposable incomes and cultural emphasis on beauty and self-care. The leading driver for this market is the combination of consumer awareness for hair repair and the growing popularity of salon-exclusive keratin treatments, which reinforces both retail and professional channels.

Europe

Europe’s keratin products market is shaped by strong demand for sustainable, eco-friendly, and ethically sourced formulations. Regulatory frameworks emphasizing formaldehyde-free and safer ingredients have prompted brands to innovate in plant-based keratin and clean-label solutions. Premium brands from France, Italy, and Germany dominate the luxury haircare segment, offering high-quality treatments that address hair damage, frizz, and smoothness. The primary driver here is Europe’s focus on sustainability, which increases the attractiveness of ethically sourced and environmentally friendly keratin products, appealing to conscious consumers and driving product adoption across both retail and professional channels.

Latin America

Brazil serves as a global hub for keratin innovation, leveraging decades of expertise in hair smoothing and straightening treatments. The demand is further supported by the region’s predominantly curly and thick hair types, which benefit significantly from keratin-based solutions. Regional brands are expanding internationally, capitalizing on their reputation for long-lasting, high-performance formulations. Growth in Latin America is driven by the preference for professional hair treatments, increasing beauty expenditure, and the rising popularity of premium at-home keratin products. Urban centers in Brazil, Mexico, and Argentina are the key markets with strong salon culture and consumer awareness.

Middle East & Africa

The Middle East and Africa markets are primarily driven by high humidity, heat, and increasing awareness of hair care routines, which heighten the demand for keratin treatments that reduce frizz and strengthen hair. The UAE, Saudi Arabia, and other Gulf countries are witnessing rising beauty spending and expanding salon culture. In Africa, professional hair treatments are gaining traction, supported by urbanization and rising disposable income. The key growth drivers in this region include the growing salon and professional segment, the popularity of premium keratin-based solutions, and the increasing adoption of at-home keratin treatments that address regional hair concerns such as dryness, frizz, and chemical damage.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Keratin Products Market

- L’Oréal S.A.

- Procter & Gamble Co.

- Henkel AG & Co. KGaA

- Unilever PLC

- Keratin Complex

- Brasil Cacau

- Schwarzkopf Professional

- Moroccanoil

Recent Developments

- In June 2025, L’Oréal launched a new line of vegan keratin haircare products under its professional division, featuring plant-derived proteins and eco-friendly packaging.

- In April 2025, Unilever expanded its premium brand TRESemmé’s “Keratin Smooth” range with sulfate-free and humidity-resistant variants targeting tropical markets.

- In January 2025, Henkel introduced a next-generation hydrolyzed keratin complex with enhanced penetration technology under its Schwarzkopf Professional line.