Karaoke System Market Size

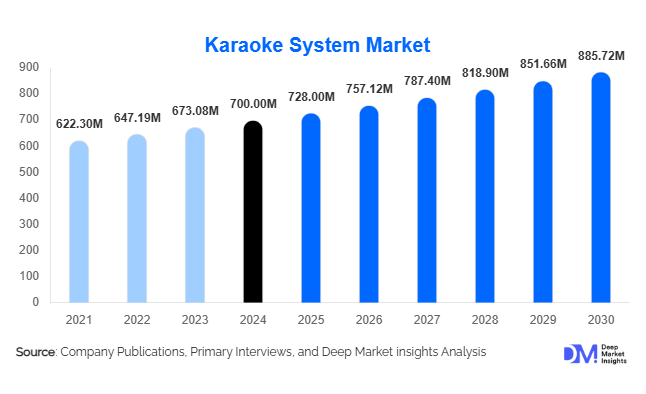

According to Deep Market Insights, the global karaoke system market size was valued at USD 700.00 million in 2024 and is projected to grow from USD 728.00 million in 2025 to reach USD 885.72 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for home entertainment solutions, integration of advanced technologies such as AI and online streaming, and the increasing popularity of portable and commercial karaoke systems. Rapid adoption of digital karaoke applications and platforms has further fueled global growth, providing consumers with enhanced music experiences across different regions.

Key Market Insights

- Home entertainment and social singing are major growth drivers, fueled by increasing disposable income and the popularity of music-based leisure activities among all age groups.

- Portable karaoke systems are leading innovation, with wireless connectivity and AI-enabled features, enhancing user convenience and global adoption.

- Asia-Pacific dominates the market, driven by countries such as Japan, China, and South Korea, where karaoke culture is deeply entrenched and technologically advanced systems are widely used.

- North America maintains steady growth, with high demand for commercial karaoke setups in bars and home entertainment solutions in the U.S. and Canada.

- Europe and Latin America are emerging markets, showing increasing interest in portable and digital karaoke systems for home and commercial use.

- Technological integration, including AI-based vocal scoring, real-time streaming, and mobile app connectivity, is enhancing the overall consumer experience.

What are the emerging trends shaping the global karaoke system market?

Integration of Artificial Intelligence and Smart Features

Karaoke systems increasingly incorporate AI to provide personalized song recommendations, real-time voice modulation, and performance analytics. This trend enhances user engagement and broadens market appeal, particularly among younger, tech-savvy consumers. AI-enabled systems are also being integrated with smart home devices, allowing seamless use and interconnectivity, which has become a differentiator for premium products.

Rise of Mobile and Online Karaoke Platforms

Mobile apps and online platforms have expanded the reach of karaoke systems beyond traditional setups. Consumers can now sing, record, and share performances globally, creating a social dimension to karaoke entertainment. This trend has significantly influenced market growth in emerging regions and is increasing demand for cloud-compatible, portable systems.

Which factors are driving the growth of the karaoke system market worldwide?

Technological Advancements

Improvements in audio quality, wireless connectivity, and AI-based features have enhanced the appeal of karaoke systems. Portable systems with high-fidelity sound and integrated streaming capabilities are gaining traction in both home and commercial segments, driving overall market expansion.

Social Media Influence

Platforms such as TikTok, YouTube, and Instagram encourage sharing of karaoke performances, fostering a culture of entertainment and competition. This social integration has led to increased system adoption, particularly among younger demographics and content creators.

Cultural Popularity and Home Entertainment Demand

Karaoke continues to be a popular social activity worldwide. Rising interest in home-based entertainment solutions, particularly post-pandemic, has led to greater adoption of compact and user-friendly systems for personal use.

What challenges or restraints could hinder the expansion of the karaoke system market?

High Initial Costs

Premium karaoke systems with advanced features can be expensive, restricting market penetration among price-sensitive consumers. This cost factor limits widespread adoption in some developing regions.

Market Saturation in Mature Regions

In established markets such as North America and Japan, high penetration rates have led to slower growth and intense competition among existing players, which may affect overall market expansion.

What key opportunities are expected to create growth potential in the karaoke system industry?

Emerging Markets

Countries in the Asia-Pacific and Latin America offer significant growth potential due to rising disposable incomes, expanding middle-class populations, and increasing interest in entertainment technology. New entrants can capitalize on these untapped markets with affordable and portable systems.

AI and Smart Feature Integration

Companies can leverage AI for vocal scoring, interactive gaming, and personalized music recommendations. Integration with smart home ecosystems provides additional value to consumers and opens new revenue streams for manufacturers.

Expansion of Digital Platforms

The rising popularity of online and mobile karaoke applications enables companies to offer cloud-based services, subscription models, and interactive social features. This digital expansion supports global outreach and recurring revenue generation.

Product Type Insights

Portable karaoke systems are leading the market, accounting for approximately 38% of the 2024 market. These systems are favored for their convenience, wireless connectivity, and integration with mobile apps. Fixed and integrated systems, while slightly less popular, cater to commercial and home users seeking premium experiences, contributing to steady market growth.

Application Insights

Home use dominates the karaoke system market, representing about 45% of the 2024 revenue. The trend of home entertainment, combined with affordable digital platforms, has made karaoke systems a household leisure activity. Commercial applications in bars, restaurants, and entertainment centers account for roughly 35% of the market and continue to grow with themed entertainment venues.

Distribution Channel Insights

Online retail is the leading distribution channel, capturing over 40% of sales in 2024. Platforms provide broad product selection, competitive pricing, and direct-to-consumer delivery. Physical retail remains important for premium systems, especially in Asia-Pacific and North America, where consumers prefer hands-on demonstration before purchase.

End-Use Insights

Home entertainment, karaoke bars, and restaurants are the primary end users. Home entertainment is the fastest-growing segment due to rising disposable income and increasing digital content availability. Commercial adoption is also expanding, with themed entertainment venues integrating advanced karaoke systems to attract customers. Export-driven demand is increasing, particularly from Asia-Pacific to North America and Europe, creating significant growth potential for manufacturers.

| Product Type | Component | Feature Set |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. and Canada account for approximately 28% of the global market in 2024. Strong consumer demand for home entertainment, combined with high disposable incomes, drives growth. Karaoke bars and restaurants are also expanding, supporting commercial adoption.

Asia-Pacific

Asia-Pacific dominates the market with around a 35% share in 2024, led by Japan, China, and South Korea. Japan remains a mature and technologically advanced market, while China and South Korea are high-growth markets due to rising middle-class incomes and digital adoption. APAC is the fastest-growing region, projected to maintain strong growth through 2030.

Europe

Europe, led by the U.K. and Germany, represents a growing market focused on home entertainment and themed commercial venues. Consumers increasingly adopt digital platforms, supporting portable and smart system sales.

Latin America

Brazil and Mexico are the primary contributors, with growth driven by rising disposable incomes and cultural affinity for music. Adoption is still emerging, but urban centers show high demand for commercial karaoke systems.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are key markets, supported by entertainment infrastructure and luxury hospitality adoption. Home entertainment adoption is increasing, although penetration remains lower than in APAC and North America.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Karaoke System Market

- Sony Corporation

- Shinco

- Samson Technologies

- Singtrix

- BMB

- JBL

- Karaoke USA

- ION Audio

- Karaoke Cloud

- Memorex

- Roland Corporation

- BOSE Corporation

- Denon

- Pyle Audio

- Karaoke Channel

Recent Developments

- In January 2025, Singtrix launched a new AI-powered portable karaoke system featuring vocal effects and real-time scoring.

- In March 2025, Sony introduced a cloud-based karaoke platform integrated with mobile apps to enhance user connectivity and song availability.

- In July 2024, JBL expanded its karaoke product portfolio with wireless portable systems targeting emerging markets in Asia-Pacific and Latin America.