Juice Extractors Market Size

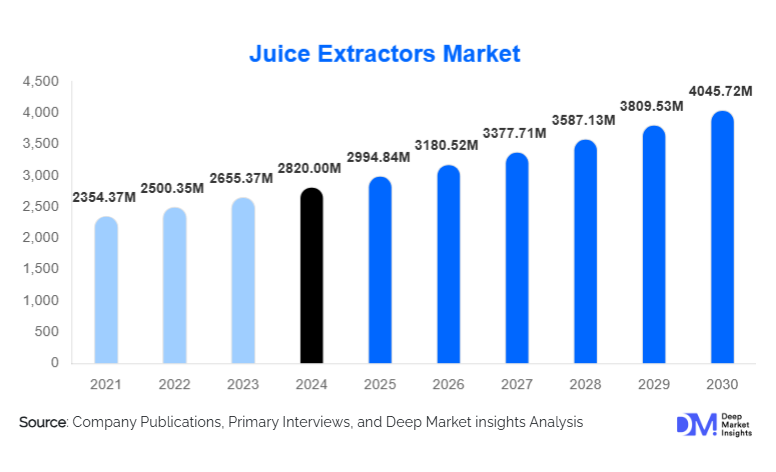

According to Deep Market Insights, the global juice extractors market size was valued at USD 2,820.00 million in 2024 and is projected to grow from USD 2,994.84 million in 2025 to reach USD 4,045.72 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The juice extractors market growth is primarily driven by rising global health consciousness, increasing consumption of natural and fresh beverages, and rapid technological advancements in juicing equipment tailored for both residential and commercial applications.

Key Market Insights

- Centrifugal juice extractors dominate the market, accounting for more than half of global demand due to their affordability, speed, and wide household adoption.

- Cold-press (masticating) juicers are the fastest-growing category, driven by rising consumer preference for nutrient-rich juices.

- Asia-Pacific leads global volume growth, fueled by expanding middle-class demographics in China and India.

- Online retail is becoming the strongest distribution channel, supported by aggressive e-commerce penetration and brand-direct sales strategies.

- Commercial juicing equipment demand is accelerating as juice bars, cafés, and wellness-focused outlets expand globally.

- Technological innovations, including quieter motors, auto-pulp ejection, smart-enabled juicers, and multifunction kitchen systems, are reshaping buying behavior.

What are the latest trends in the Juice Extractors Market?

Health-Driven, Nutrition-Focused Juicing Trends

Growing global interest in wellness, clean-label nutrition, and immunity-boosting food habits is reshaping the juice extractors market. Cold-press and slow-juicers are gaining traction as consumers prioritize nutrient preservation, enzyme retention, and fresher taste profiles. Social media trends around detox diets, at-home juice cleanses, and whole-fruit nutrition are further accelerating adoption. Brands are responding by introducing models designed for minimal oxidation, higher juice yield, and improved fiber control. The trend toward premium, health-optimized juicing is expected to remain a core growth driver through 2030.

Smart, Connected & Multipurpose Juicing Appliances

Technology integration is becoming a major differentiator as manufacturers adopt IoT-enabled features, app-based nutrition tracking, and AI-assisted juicing recommendations. Smart juicers can now guide users through recipes, monitor motor load to prevent overheating, and analyze juice composition. Meanwhile, multifunction appliances, combining juicing, blending, food processing, and grinding, are attracting modern consumers seeking compact, space-efficient kitchen solutions. Enhanced design features such as noise reduction, self-cleaning mechanisms, and automatic pulp ejection are becoming standard across mid- and premium-tier products.

What are the key drivers in the Juice Extractors Market?

Rising Global Health Awareness

Consumers worldwide are seeking healthier diets, fresh beverages, and nutrient-rich food alternatives. Increasing cases of lifestyle diseases such as obesity, diabetes, and hypertension are prompting households to incorporate fresh juices into their daily routines. This shift has significantly boosted demand for both entry-level centrifugal juicers and high-end cold-press models. Marketing campaigns promoting immunity, detoxification, and natural health benefits continue to reinforce the adoption of home juicing appliances.

Convenience & Urban Lifestyle Shifts

Urbanization, busy work schedules, and the growing preference for quick yet healthy meal options have strengthened the appeal of juice extractors. Compact, easy-to-clean, and fast-operating models are particularly popular among urban residents living in smaller households or apartments. Rising participation in fitness and wellness routines further contributes to the demand for portable and multifunction juice extractors, enabling consumers to prepare fresh beverages on demand.

Technological Innovation & Product Diversification

Advances in motor efficiency, blade technology, stainless-steel build quality, noise reduction, and multifunctional capabilities have boosted product performance and appeal. Manufacturers are introducing innovations such as anti-clog reverse functions, drip-free spouts, enhanced pulp control, and energy-efficient designs. Premium models now offer variable speed settings, higher torque, quieter operation, and improved durability, catering to both residential and commercial users seeking reliability and superior output.

What are the restraints for the global market?

High Cost of Premium Juicers

While centrifugal juicers remain affordable for mass markets, premium categories such as cold-press, hydraulic, and twin-gear juicers come with significantly higher price points. In developing regions, cost sensitivity limits the adoption of these models, slowing market penetration. Rising global material and logistics costs have further impacted retail pricing, making premium juicers a considered purchase rather than a routine kitchen upgrade.

Competition from Alternative Appliances

Blenders, food processors, and multifunction mixers offer overlapping functionality, reducing the necessity for a dedicated juice extractor. Additionally, consumers in some regions prefer buying fresh juice from cafés or juice bars instead of preparing it at home. Cleaning difficulty, noise concerns, and storage constraints also affect purchase decisions, serving as barriers to wider market adoption.

What are the key opportunities in the Juice Extractors Market?

High-Growth Potential in Emerging Markets

Rapid urbanization, rising incomes, and expanding e-commerce access across Asia-Pacific, Latin America, and parts of Africa create substantial opportunities for manufacturers. Consumers in these regions are increasingly investing in small kitchen appliances that enhance convenience and health. Affordable, energy-efficient models tailored to regional needs, such as compact designs for urban kitchens, can unlock large-scale adoption. Local manufacturing encouraged by government initiatives also supports competitive pricing and improved distribution reach.

Commercial Juicing Expansion in Hospitality & Foodservice

The proliferation of juice bars, wellness cafés, fitness clubs, and nutritionally focused eateries is creating new demand for heavy-duty commercial juicers. These establishments require high-capacity extractors capable of handling continuous use while maintaining consistency and nutrient quality. Manufacturers offering durable stainless-steel models, service contracts, and after-sales support can capture significant B2B market share. The trend toward freshly prepared beverages in hotels and restaurants further strengthens this opportunity.

Product Type Insights

Centrifugal juicers dominate the global market, accounting for approximately 50–55% of total 2024 revenue. Their affordability, ease of use, and fast extraction capabilities make them the preferred choice for households, especially in developing regions. Cold-press and masticating juicers represent the fastest-growing category, driven by rising health awareness and interest in nutrient-dense juice preparation. Citrus juicers maintain strong demand in regions with high citrus consumption, while twin-gear and hydraulic press juicers serve niche professional and enthusiast markets.

Application Insights

Residential use represents the largest share of the juice extractors market, accounting for over 55% of global demand in 2024. Growing household focus on wellness, detox diets, and fresh beverage preparation drives this segment. The commercial segment, including cafés, juice bars, hotels, and fitness centers, is expanding rapidly as businesses capitalize on fresh-juice trends. Institutional users, such as small food manufacturers and community kitchens, are increasingly adopting industrial-grade extractors for small-batch production, broadening the market’s application base.

Distribution Channel Insights

Online retail is the leading and fastest-growing distribution channel, driven by e-commerce expansion, discounting strategies, and consumer preference for detailed product comparisons. Direct-to-consumer brand websites, online marketplaces, and digital advertising are fueling rapid sales growth. Brick-and-mortar outlets such as appliance stores and supermarkets remain relevant for customers who prefer in-person demonstrations. B2B distribution networks support commercial buyers seeking customized configurations, warranties, and long-term service packages.

| By Product Type | By Application / End-Use | By Distribution Channel | By Material / Build Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a major market for mid- and premium-range juice extractors, supported by high disposable incomes and strong adoption of wellness-oriented appliances. The U.S. leads regional demand, driven by juice cleanse trends, home fitness movements, and widespread e-commerce penetration. Commercial applications, especially in cafés and specialty juice bars, also contribute significantly to regional revenue.

Europe

Europe exhibits mature but stable growth, with strong demand for premium cold-press juicers in Germany, France, the U.K., and Italy. European consumers prioritize energy efficiency, durability, and nutrient preservation, making slow juicers particularly popular. Growing interest in sustainable, plant-based diets further stimulates the market. Despite saturation in some Western European countries, Eastern Europe shows rising adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region and is expected to hold the highest market share by 2030. Rapid urbanization, rising middle-class populations, and increasing health awareness in China and India drive strong growth. India’s juicer market, valued at USD 93 million in 2024, shows accelerating adoption fueled by e-commerce penetration and consumer lifestyle upgrades. Japan, South Korea, and Australia represent additional high-value markets with strong demand for premium juicing appliances.

Latin America

Latin America is experiencing steady growth, particularly in Brazil and Mexico. Rising consumer interest in homemade natural beverages and expanding retail networks support the regional market. Economic recovery and lifestyle improvements enhance demand for mid-range and compact juicers.

Middle East & Africa

MEA remains an emerging market with rising demand in Gulf countries, where high-income households increasingly adopt premium kitchen appliances. Africa’s urban centers show gradual adoption, supported by improving retail infrastructure and awareness of health benefits. Commercial juicing demand is also growing in hospitality-rich markets such as the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Juice Extractors Market

- Breville

- Hurom

- Omega Juicers

- Kuvings

- Panasonic

- Cuisinart

- Ninja (SharkNinja)

- Hamilton Beach Brands

- Philips Domestic Appliances

- Smeg

- Black+Decker

- Russell Hobbs

- Tefal

- Magimix

- Tribest

Recent Developments

- In March 2024, Breville introduced a high-efficiency cold-press juicer with advanced noise reduction technology aimed at premium home users.

- In January 2024, Hurom launched its smart touchscreen juicer with automated recipe guidance and integrated cleaning assistance.

- In September 2023, Omega unveiled a commercial-grade extractor designed for juice bars and cafés, featuring continuous-feed extraction and heavy-duty stainless-steel construction.