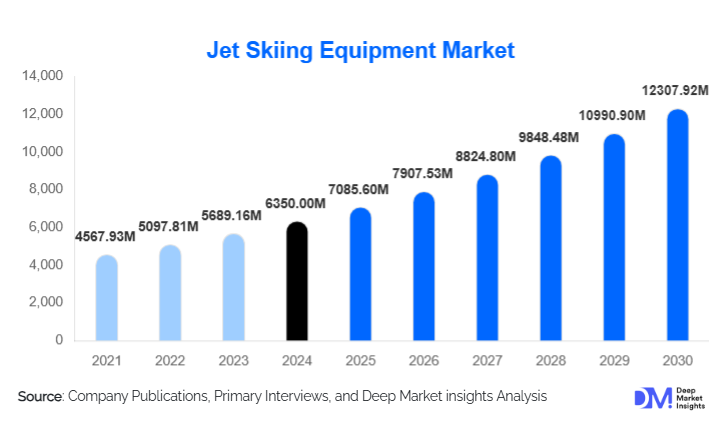

Jet Skiing Equipment Market Size

According to Deep Market Insights, the global jet skiing equipment market size was valued at USD 6,350.00 million in 2024 and is projected to grow from USD 7,085.60 million in 2025 to reach USD 12,307.92 million by 2030, expanding at a CAGR of 11.6% during the forecast period (2025–2030). The market growth is primarily driven by rising participation in recreational water sports, expanding coastal and adventure tourism, increasing demand from commercial rental operators, and continuous technological advancements in personal watercraft (PWC) performance, safety, and sustainability.

Key Market Insights

- Personal watercraft (PWCs) dominate the market, accounting for over 60% of total revenue due to their high unit value and consistent replacement cycles.

- Commercial rental operators are the fastest-growing end-use segment, driven by tourism recovery and the expansion of water sports infrastructure.

- North America leads global demand, supported by strong recreational spending, extensive coastline access, and an established marine sports culture.

- Asia-Pacific is the fastest-growing regional market, fueled by rising disposable income, coastal tourism development, and growing middle-class participation.

- Electric and hybrid jet skis are gaining momentum, particularly in environmentally regulated regions and eco-tourism destinations.

- Aftermarket parts, accessories, and safety gear are emerging as high-margin, recurring revenue segments.

What are the latest trends in the jet skiing equipment market?

Electrification and Low-Emission PWCs

The jet skiing equipment market is witnessing a gradual but significant shift toward electric and hybrid propulsion technologies. Environmental regulations governing marine emissions and noise pollution are accelerating adoption, particularly in Europe and selected inland waterways in North America. Electric jet skis offer reduced operating costs, quieter performance, and minimal environmental impact, making them ideal for resorts, lakes, and eco-sensitive zones. While electric PWCs currently represent a small share of total sales, they are expected to grow at a CAGR exceeding 20% through 2030, supported by improvements in battery density, fast-charging systems, and lightweight composite hulls.

Premiumization and Smart Technology Integration

Manufacturers are increasingly focusing on premium features such as touchscreen displays, GPS navigation, performance analytics, rider-assist systems, and smartphone connectivity. Touring and luxury PWCs are incorporating IoT-enabled diagnostics, theft-prevention systems, and customizable ride modes. This trend is driven by experienced riders and commercial operators seeking enhanced safety, operational efficiency, and differentiated user experiences. Premiumization is enabling OEMs to improve margins while catering to affluent recreational consumers and high-end tourism operators.

What are the key drivers in the jet skiing equipment market?

Growth in Recreational and Adventure Tourism

Global growth in adventure tourism and coastal leisure activities is a major driver for the jet skiing equipment market. Jet skiing is increasingly offered as a standard attraction by beach resorts, cruise operators, and water sports centers. Government and private investments in coastal tourism infrastructure across Asia-Pacific, the Middle East, and Latin America are directly translating into higher demand for PWCs, safety gear, and accessories.

Expansion of Commercial Rental Fleets

Commercial rental operators represent a high-growth demand segment, as they regularly upgrade fleets to maintain safety, reliability, and customer satisfaction. Rental operators typically replace PWCs every 3–5 years, creating predictable replacement demand. This segment also drives aftermarket sales of spare parts, maintenance components, and protective equipment, strengthening long-term market stability.

What are the restraints for the global market?

High Initial Equipment Costs

The high upfront cost of jet skis, particularly performance and touring models, remains a key restraint. Premium PWCs often exceed USD 15,000 per unit, limiting affordability in price-sensitive regions. Additional costs related to maintenance, insurance, storage, and fuel further restrict adoption among entry-level consumers.

Regulatory and Environmental Restrictions

Stringent regulations related to emissions, noise levels, and waterway access can limit jet ski usage in certain regions. Environmental concerns and restricted riding zones in lakes and coastal areas may reduce demand growth, especially where alternative water sports are promoted as more sustainable options.

What are the key opportunities in the jet skiing equipment industry?

Electric Jet Skis for Eco-Tourism and Resorts

The rise of eco-tourism presents a strong opportunity for electric jet skis, particularly in resorts, private islands, and inland water bodies where environmental regulations are strict. Manufacturers offering quiet, zero-emission PWCs tailored for rental fleets can gain early-mover advantages in this niche but fast-growing segment.

Digital Services and Subscription-Based Models

Opportunities are emerging in software-enabled services such as fleet management platforms, predictive maintenance, and subscription-based feature upgrades. OEMs and technology providers can generate recurring revenue by bundling digital services with hardware sales, especially for commercial operators managing large fleets.

Product Type Insights

Personal watercraft (PWCs) remain the largest and most influential product category in the global jet skiing equipment market, accounting for approximately 62% of total market revenue in 2024. This dominance is driven by strong recreational demand, fleet expansion among commercial rental operators, and rising consumer preference for high-performance, technologically advanced models. Recreational and performance PWCs lead individual consumer purchases due to their versatility, ease of use, and enhanced features such as stability, fuel efficiency, and rider safety. Commercial rental operators prefer durable, easy-to-maintain PWCs capable of withstanding heavy usage, driving recurring demand for parts, components, and maintenance services.

Safety and protection equipment holds around 14% of the market share, fueled by mandatory safety regulations, rising awareness of water sport hazards, and increasing adoption of life jackets, helmets, and impact vests. Accessories and add-ons contribute roughly 11% of market revenue, benefiting from growing customization trends, social media-driven content creation, and action sports filming. Parts and components account for about 9%, supported by aftermarket maintenance, replacement cycles, and fleet servicing needs. Apparel and riding gear, while a smaller segment, represent high-margin sales opportunities, particularly in markets with premium recreational activity adoption.

End-Use Insights

Recreational consumers constitute nearly 55% of total demand, primarily driven by lifestyle adoption, increased disposable income, and the rising popularity of water sports activities. Commercial rental operators, representing approximately 35% of the market, are the fastest-growing end-use segment. Growth in this segment is fueled by post-pandemic tourism recovery, investments in coastal and inland water sport facilities, and frequent fleet replacement cycles. Law enforcement, rescue agencies, and other government organizations account for the remaining share, using jet skis for coastal patrol, emergency response, search-and-rescue operations, and disaster management, further sustaining niche demand for durable and high-performance models.

Distribution Channel Insights

OEM-authorized dealers dominate the distribution landscape due to the technical complexity of PWCs and the need for certified after-sales support, ensuring product safety and performance. Specialty water sports retailers remain significant, particularly for safety gear, accessories, and apparel, offering consumers expert guidance and hands-on demonstrations. Online and e-commerce channels are witnessing rapid growth for accessories, riding gear, and replacement parts, driven by direct-to-consumer strategies, increasing internet penetration, and the convenience of home delivery. Leading brands are also leveraging digital platforms to provide virtual demonstrations, warranty support, and integrated purchase options, enhancing overall market accessibility.

| By Product Type | By End-Use | By Distribution Channel | By Propulsion/Technology |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global jet skiing equipment market, with the United States representing the largest single-country market. Strong recreational boating culture, high disposable income, and widespread access to lakes, rivers, and coastal regions are major growth drivers. The demand is particularly robust for premium and performance PWCs, fueled by technological innovation, advanced safety features, and brand loyalty. Additionally, supportive regulatory frameworks, established dealer networks, and a culture of marine leisure activities contribute to sustained market expansion.

Europe

Europe holds around 24% of the global market, driven primarily by demand in France, Italy, Spain, and the U.K. Environmental regulations and emission standards are promoting the adoption of electric and hybrid PWCs, particularly in inland waterways and coastal tourist destinations. Key growth drivers include high safety awareness, a growing emphasis on eco-friendly recreation, and investments in maritime infrastructure. Rising tourism in Mediterranean countries and increased participation in water sports among middle-aged and affluent demographics are supporting long-term demand for both recreational and commercial PWCs.

Asia-Pacific

Asia-Pacific represents roughly 22% of the market and is the fastest-growing region globally. Countries such as China, Japan, Australia, Thailand, and Indonesia are driving market expansion due to growing middle-class affluence, rapid coastal tourism development, and increased leisure spending. Drivers include government initiatives promoting domestic tourism, investment in water sports infrastructure, and rising participation in adventure and experiential recreation. Additionally, social media influence and exposure to international marine lifestyle trends are motivating younger consumers to adopt personal watercraft and related accessories, further accelerating regional growth.

Latin America

Latin America contributes approximately 7% of global market demand, led by Mexico and Brazil. Growth is primarily driven by expanding beach and coastal tourism, increasing urban disposable income, and growing adoption of commercial rental models for water sports. Additional drivers include government investments in tourism infrastructure, promotional initiatives for adventure sports, and the emergence of boutique water sports operators catering to domestic and international tourists. Recreational and rental demand for PWCs is further supported by seasonal festivals and water-based leisure events.

Middle East & Africa

The Middle East and Africa account for around 9% of the market, with high demand from the UAE, Saudi Arabia, and select North African nations. Drivers include luxury tourism expansion, high-income consumer spending, and government-led coastal development projects aimed at attracting leisure and adventure tourism. Additionally, strong investment in resort-based water sports facilities, the presence of high-end rental operators, and growing awareness of water sport safety standards are fueling demand for PWCs, safety equipment, and accessories. In Africa, intra-regional tourism and increasing adventure-oriented travel are also contributing to market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Jet Skiing Equipment Market

- Yamaha Motor Co.

- Kawasaki Heavy Industries

- BRP Inc. (Sea-Doo)

- Honda Motor Co.

- Taiga Motors

- Belassi GmbH

- Narke Yachts