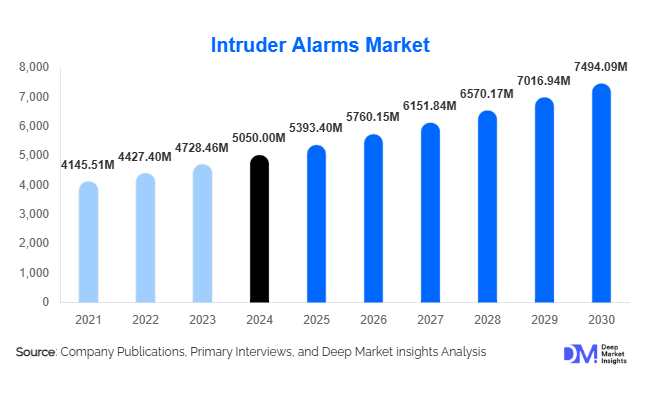

Intruder Alarms Market Size

According to Deep Market Insights, the global intruder alarms market size was valued at USD 5,050.00 million in 2024 and is projected to grow from USD 5,393.40 million in 2025 to reach USD 7,494.09 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). Market growth is driven by rising concerns over property security, increasing adoption of smart homes and connected buildings, expansion of commercial infrastructure, and growing investments in integrated electronic security systems across residential, commercial, industrial, and public sectors.

Key Market Insights

- Wireless and hybrid intruder alarm systems are gaining rapid adoption due to ease of installation, retrofit compatibility, and smart home integration.

- Integrated security systems combining intrusion detection, video surveillance, and access control dominate enterprise deployments, particularly in commercial and public infrastructure.

- North America leads global demand, driven by high security awareness, insurance compliance, and strong smart home penetration.

- Asia-Pacific is the fastest-growing region, supported by urbanization, infrastructure investments, and expanding middle-class residential demand.

- Sensors and detectors represent the largest product category, benefiting from frequent upgrades and replacement cycles.

- AI-enabled detection and cloud-based monitoring are transforming intruder alarms from hardware-centric to service-driven security solutions.

What are the latest trends in the intruder alarms market?

Shift Toward Smart and Connected Intruder Alarm Systems

The intruder alarms market is increasingly shifting toward smart, IoT-enabled systems that allow real-time monitoring, mobile alerts, and remote system management. Consumers and enterprises are favoring alarm systems that integrate seamlessly with smart locks, video doorbells, lighting systems, and building management platforms. Cloud connectivity enables centralized monitoring, predictive maintenance, and software-based upgrades, enhancing system reliability and long-term value. This trend is particularly strong in residential and commercial segments, where users prioritize convenience, scalability, and remote access.

Integration of AI and Advanced Analytics

Artificial intelligence is being embedded into intruder alarm systems to reduce false alarms and improve threat detection accuracy. AI-powered analytics help distinguish between genuine intrusion events and non-threatening movements, such as pets or environmental factors. Advanced systems now leverage behavioral analytics, pattern recognition, and multi-sensor data fusion, improving reliability for high-security applications. These capabilities are driving adoption in industrial facilities, logistics hubs, and critical infrastructure, where operational disruptions from false alarms can be costly.

What are the key drivers in the intruder alarms market?

Rising Property Crime and Security Awareness

Increasing incidents of burglary, vandalism, and unauthorized access across urban and semi-urban areas are significantly driving demand for intruder alarm systems. Residential communities, retailers, warehouses, and offices are investing in intrusion detection to protect assets, reduce losses, and enhance occupant safety. Heightened awareness of security risks has made intruder alarms a standard component of modern buildings, supporting consistent market growth.

Growth of Smart Homes and Commercial Infrastructure

The rapid expansion of smart homes, smart offices, and smart cities is accelerating the adoption of advanced intruder alarms. New residential developments increasingly include pre-installed security systems, while commercial real estate projects integrate intrusion detection as part of intelligent building designs. Government-led smart city initiatives and infrastructure modernization programs are further boosting large-scale deployments.

What are the restraints for the global market?

High Initial Installation and Integration Costs

Advanced intruder alarm systems, particularly integrated and enterprise-grade solutions, involve high upfront costs for hardware, installation, and system integration. This can limit adoption among small businesses and price-sensitive residential consumers, especially in developing regions. Budget constraints remain a key challenge despite long-term operational benefits.

False Alarms and Regulatory Penalties

False alarms continue to be a concern, leading to reduced customer confidence and, in some regions, regulatory fines. Poor system calibration, environmental interference, and user error contribute to false triggers. Vendors must invest in sensor accuracy and intelligent analytics to address this restraint.

What are the key opportunities in the intruder alarms industry?

Public Infrastructure and Smart City Security

Governments worldwide are increasing investments in public infrastructure security, including transportation hubs, educational institutions, and government buildings. Intruder alarms integrated with access control and surveillance systems are becoming mandatory in many public projects, creating long-term opportunities for system providers and integrators.

Recurring Revenue Through Security-as-a-Service

The transition toward subscription-based monitoring, cloud management, and predictive maintenance services presents a major growth opportunity. Vendors can generate recurring revenue by offering managed security services, particularly for commercial and industrial customers seeking centralized and scalable solutions.

Product Type Insights

Sensors and detectors dominate the intruder alarms market, accounting for approximately 38% of total revenue in 2024. Motion sensors, door and window contacts, and dual-technology detectors are widely deployed across all end-use sectors. Control panels and communication modules form the backbone of system functionality, while alarm signaling devices such as sirens and strobes remain essential for deterrence and alerting.

System Type Insights

Integrated security systems represent nearly 55% of the global market, driven by enterprise and government demand for unified platforms. Standalone intruder alarm systems remain popular in residential applications, particularly for small homes and apartments where simplicity and affordability are prioritized.

Installation Mode Insights

Wireless intruder alarm systems lead the market with about 47% share in 2024, supported by ease of installation and compatibility with smart ecosystems. Wired systems remain relevant in large industrial and legacy installations, while hybrid systems bridge the gap between reliability and flexibility.

End-Use Insights

The commercial segment holds the largest market share at approximately 41%, driven by retail chains, offices, and financial institutions. Industrial facilities represent a fast-growing segment due to expanding logistics and warehousing infrastructure. Residential demand is growing rapidly, fueled by smart home adoption and falling prices of wireless alarm kits.

| By Product Architecture | By Detection Technology | By Installation Mode | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 34% of the global intruder alarms market, led by the United States. Strong security awareness, insurance mandates, and high penetration of smart homes support sustained demand. Commercial and residential upgrades remain key growth drivers.

Europe

Europe represents around 28% of global demand, with Germany, the U.K., and France as major contributors. Strict regulatory standards, commercial renovations, and smart building initiatives drive market expansion across the region.

Asia-Pacific

Asia-Pacific holds approximately 24% market share and is the fastest-growing region, expanding at over 8% CAGR. China, India, and Japan are leading the demand due to urbanization, infrastructure development, and rising residential security awareness.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growth is supported by expanding retail infrastructure and rising investments in commercial security systems.

Middle East & Africa

The Middle East & Africa region benefits from large-scale public infrastructure and commercial projects, particularly in the UAE and Saudi Arabia. Government spending on security modernization supports steady demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Intruder Alarms Market

- Honeywell International

- Bosch Building Technologies

- Johnson Controls

- Siemens

- Hikvision

- Dahua Technology

- ASSA ABLOY

- Panasonic

- ADT Inc.

- Axis Communications

- Teledyne FLIR

- Hanwha Vision

- ABB

- Schneider Electric

- Ingersoll Rand