Interactive LED Floor Tile Market Size

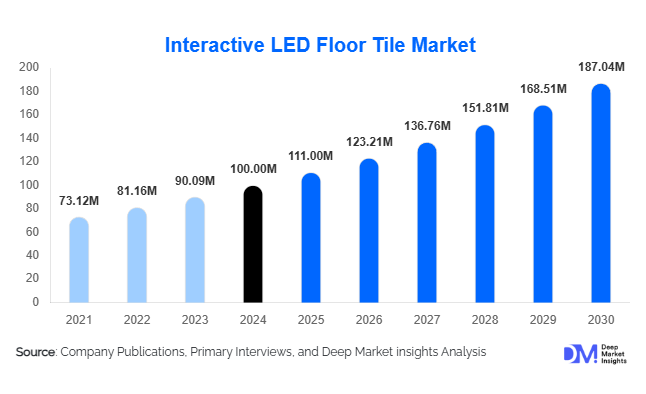

According to Deep Market Insights, the global interactive LED floor tile market size was valued at USD 100 million in 2024 and is projected to grow from USD 111.00 million in 2025 to reach USD 187.04 million by 2030, expanding at a CAGR of 11% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for immersive experiences in retail, entertainment, and public infrastructure, rising adoption of modular and sensor-based LED floor solutions, and expanding applications in smart-city and experiential retail environments.

Key Market Insights

- Modular and portable interactive LED floor tiles are gaining traction, offering flexibility for events, exhibitions, and temporary installations, reducing upfront costs and increasing adoption across diverse industries.

- Retail and shopping malls dominate applications, with interactive flooring enhancing customer engagement, brand experience, and foot traffic analytics.

- Asia-Pacific leads the global market, driven by rapid urbanization, retail expansion, entertainment infrastructure, and smart-city projects in China, India, and Southeast Asia.

- North America holds a significant share, supported by large-scale retail, entertainment, and corporate adoption of interactive floors.

- Technological integration, including sensor-based systems, IoT connectivity, AI-driven content, and gesture-based interactions, is reshaping market expectations and increasing deployment in premium and mid-range installations.

- Rental and modular business models are emerging, enabling short-term deployments and flexible use for events, exhibitions, and experiential marketing campaigns.

Latest Market Trends

Modular and Sensor-Driven Solutions Expanding

Interactive LED floor tiles are increasingly being deployed as modular, sensor-enabled systems that allow flexible installation for temporary or semi-permanent use. Events, exhibitions, and pop-up retail experiences favor modular solutions, which reduce installation time and enable easy transportation and reuse. Advances in motion, pressure, and proximity sensors are allowing floor tiles to react dynamically to user interaction, creating immersive and personalized experiences. Software-driven content management platforms provide seamless integration of visuals, animations, and branding elements, enhancing customer engagement and marketing effectiveness.

Integration with Smart Infrastructure

Interactive LED floor tiles are being incorporated into public infrastructure projects, airports, transportation hubs, and smart-city initiatives. Tiles with embedded sensors and AI-enabled content can provide wayfinding assistance, advertising, and real-time analytics. Cities and governments are investing in public installations to create interactive and engaging pedestrian spaces, combining aesthetics with functional insights. This integration not only expands the market but also positions interactive LED flooring as part of broader urban innovation and experience-driven planning.

Interactive LED Floor Tile Market Drivers

Demand for Immersive Experiences

Across retail, entertainment, hospitality, and public spaces, businesses increasingly prioritize engaging, interactive environments. Interactive LED floor tiles deliver dynamic visuals, responsive content, and gamified interactions that enhance customer experience and foot traffic. Retailers use these tiles for brand activation, gamification, and event-driven marketing, while entertainment venues leverage sensor-based interaction for shows, concerts, and nightclubs.

Falling LED and Sensor Costs

Technological advancements and manufacturing scale have significantly reduced the cost of LED panels and sensor systems. This makes interactive floor tiles more accessible for mid-range retail, educational, and corporate applications. Cost reductions, combined with improvements in durability and ease of installation, are enabling wider adoption across multiple end-use sectors.

Expanding Applications Across Industries

The market is benefiting from diversification in end-use sectors, including retail, hospitality, corporate offices, education, public spaces, and logistics. Emerging applications such as interactive floors for educational gamification, office lobbies, and warehouse guidance are expanding the addressable market. This broader application base supports long-term growth and encourages new entrants to target niche verticals.

Market Restraints

High Upfront Costs and Installation Complexity

Despite cost reductions, interactive LED floor tiles remain expensive compared to traditional flooring or static LED panels. Installation often requires reinforced flooring, precise calibration, cabling, and integration with software systems, which may deter smaller organizations or venues from adoption.

Durability and Maintenance Challenges

High-traffic areas and outdoor installations require tiles with strong IP ratings, slip resistance, and durability. Lack of unified standards and maintenance complexity for sensor-based systems can slow adoption. Additionally, replacement and repair costs for embedded LED and sensor modules can impact the total cost of ownership.

Interactive LED Floor Tile Market Opportunities

Smart City and Public Infrastructure Projects

Cities worldwide are investing in interactive public spaces, transit hubs, and pedestrian zones. Interactive LED floor tiles integrated into urban infrastructure can provide advertising, wayfinding, and real-time analytics. Government-driven smart-city initiatives provide large-scale contracts and long-term deployment opportunities for manufacturers and integrators.

Experiential Retail Expansion

Retailers are increasingly using interactive LED flooring to enhance customer engagement, gamify shopping experiences, and capture footfall analytics. Flagship stores, malls, and experiential marketing campaigns present lucrative opportunities to supply high-end interactive tiles combined with content management and analytics platforms.

Modular and Rental Business Models

Events, exhibitions, and pop-up retail spaces benefit from modular, portable interactive tiles that reduce upfront investment and allow multiple deployments. Rental and short-term use models enable broader adoption among SMEs and smaller event organizers, expanding market reach and creating recurring revenue opportunities.

Product Type Insights

Modular and portable interactive LED floor tiles dominate the market due to flexibility and rental potential. Standard fixed tiles continue to serve permanent installations in retail and corporate venues. Custom and bespoke tiles cater to high-end applications, combining tailored design, advanced sensor integration, and content customization for premium entertainment and hospitality projects.

Application Insights

Retail and shopping malls are the largest application segment, leveraging interactive flooring for immersive customer experiences and analytics. Entertainment venues such as concert halls, stage floors, and nightclubs are rapidly adopting sensor-enabled tiles to enhance shows and audience engagement. Emerging applications include education, corporate offices, transportation hubs, and public infrastructure, where tiles provide interactivity, guidance, and analytics.

Distribution Channel Insights

Direct sales from manufacturers to end-users dominate, particularly for large-scale permanent installations. Rental and event-based deployment models are gaining traction, offering flexible, short-term solutions. Online platforms and integrated solution providers offering hardware, software, and content management are also emerging as important distribution channels.

End-Use Industry Insights

Retail is the leading end-use industry, followed by entertainment & events, hospitality, and public infrastructure. Emerging use-cases in corporate offices, education, and logistics are driving incremental growth. Export-driven demand is particularly notable from manufacturers in the Asia-Pacific supplying North America, Europe, and the Middle East markets for retail and events installations.

| By Product Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 25% of the 2024 market. The U.S. leads due to strong retail, entertainment, and corporate adoption. Canada follows. Adoption is supported by high disposable income, experiential retail trends, and large event infrastructures.

Europe

Europe represents 20% of the 2024 market, with Germany, the UK, and France leading demand. Growth is driven by retail modernization, exhibition spaces, and smart-building initiatives. Eco-conscious installations and content-driven experiences are gaining importance.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region (35% share in 2024), with China, India, and Southeast Asia driving adoption through retail, entertainment, and smart-city projects. Rapid urbanization and infrastructure expansion are major growth catalysts.

Latin America

Latin America accounts for 7–8% of the market. Brazil and Mexico are key contributors, with rising demand in retail, exhibitions, and events. Growth is accelerated by international brand deployments and emerging experiential retail trends.

Middle East & Africa

MEA represents 8–10% of the 2024 market. The GCC countries (UAE, Saudi Arabia) are the primary drivers, with investments in luxury retail, hospitality, and event venues. Africa remains a niche market, focused on high-end entertainment and public installations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Interactive LED Floor Tile Market

- Leyard

- ROE Visual

- Unilumin

- Hikvision

- Daktronics

- Uniview

- Dingli LED

- Lighthouse LED

- MileStrong

- OptoTech

- digiLED

- Absen

- Barco

- Christie Digital

- Infiled

Recent Developments

- In 2025, Leyard expanded its modular interactive LED floor tile solutions across North America, emphasizing sensor integration and software-enabled content management.

- In 2025, ROE Visual launched outdoor-rated, IP65-certified LED floor tiles for stadiums and public spaces, enhancing durability and interactivity.

- In 2025, Unilumin introduced AI-powered content platforms for interactive flooring, enabling real-time analytics and dynamic visual programming in retail and event venues.