Intelligent Lighting Controls Market Size

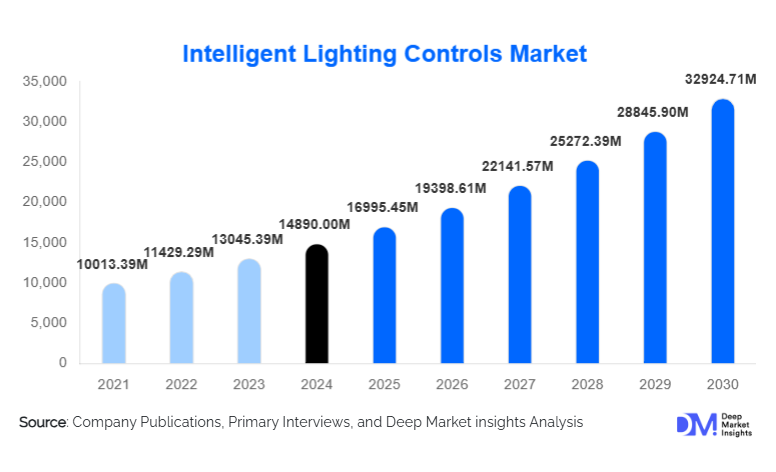

According to Deep Market Insights, the global intelligent lighting controls market size was valued at USD 14,890.00 million in 2024 and is projected to grow from USD 16,995.45 million in 2025 to reach USD 32,924.71 million by 2030, expanding at a CAGR of 14.14% during the forecast period (2025–2030). The intelligent lighting controls market is experiencing rapid expansion driven by energy-efficiency mandates, accelerated adoption of LED + sensor integration, and the rise of smart buildings requiring real-time monitoring, analytics, and automated lighting optimization. Increasing urbanization, large-scale streetlighting modernization projects, and the adoption of wireless smart lighting controls in commercial and industrial sectors are also fueling growth.

Key Market Insights

- Strong shift toward wireless lighting controls such as Bluetooth Mesh, Zigbee, and Thread, supporting large-scale retrofit demand globally.

- Commercial buildings remain the dominant end-user segment, driven by ESG reporting pressures, smart office demand, and enterprise-grade BMS integration.

- North America leads the global intelligent lighting controls market in value terms due to high retrofit activity and strong regulatory frameworks.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, industrial expansion, and government-led smart city programs.

- Software and cloud-connected services are reshaping vendor strategies, shifting revenue toward analytics, monitoring, and managed lighting services.

- Integration with IoT, HVAC, and building automation platforms is driving enterprise-wide adoption and increasing system complexity.

What are the latest trends in the intelligent lighting controls market?

Growing Adoption of Wireless & Retrofit-Friendly Lighting Systems

Wireless controls, including Bluetooth Mesh, Zigbee, and proprietary RF, are rapidly becoming the standard for retrofit deployments. These technologies eliminate complex cabling requirements, reduce installation time, and offer scalable device pairing in commercial buildings, warehouses, and multi-site retail environments. The retrofit wave is expected to intensify as global real estate portfolios prioritize energy optimization and tenant experience improvements. Cloud-connected wireless nodes further enable predictive maintenance, occupancy heatmaps, and energy benchmarking, positioning wireless systems as the backbone of next-generation intelligent lighting.

Rise of AI-Driven & Human-Centric Lighting Solutions

Artificial intelligence is increasingly being incorporated into lighting ecosystems to automate brightness, color temperature, and scheduling based on occupancy patterns and circadian rhythm research. Human-centric lighting, particularly in offices, healthcare, and education, is driving premium adoption. AI-enabled luminaires with embedded sensors can learn user behavior, support space optimization decisions, and integrate with HVAC for holistic energy management. These capabilities create new value streams for lighting OEMs and SaaS providers through subscription-based analytics platforms.

What are the key drivers in the intelligent lighting controls market?

Regulatory Push Toward Energy Efficiency

Global building codes and government-led decarbonization programs are compelling commercial and public infrastructure owners to adopt intelligent controls. Mandatory use of daylight harvesting, occupancy sensing, and automated dimming in new construction is accelerating adoption in North America and Europe. Incentives, rebates, and carbon-reduction mandates further strengthen adoption across developing economies.

Rapid Decline in Sensor, Microcontroller & Wireless Module Costs

As component prices fall, intelligent lighting controls have become more cost-effective for bulk deployments. Lower manufacturing costs for LED drivers, sensors, and connectivity chipsets allow OEMs to embed intelligence at scale. This cost advantage is especially important in industrial facilities and public lighting projects, where large volumes of luminaires require retrofitting.

Increasing Demand for Smart Buildings, Analytics & ESG Reporting

Organizations increasingly require granular energy data, occupancy analytics, and automated lighting adjustments to meet ESG goals. Intelligent lighting controls serve as the foundational sensor network for broader smart-building platforms. Vendors offering open APIs, cloud dashboards, and AI-driven insights are capturing higher recurring revenues and gaining strategic importance in the building automation ecosystem.

What are the restraints for the global market?

Interoperability Challenges Across Lighting Protocols

The coexistence of multiple standards, DALI, Zigbee, Bluetooth Mesh, proprietary RF, Ethernet/IP, creates integration complexity. Building operators often hesitate to commit to systems that may lead to vendor lock-in or compatibility issues with existing BMS platforms. This slows down procurement cycles, especially for large campuses and multi-building projects.

Cybersecurity & Lifecycle Management Complexity

As lighting becomes a connected digital infrastructure, cybersecurity risks increase. Ensuring secure firmware updates, device authentication, and network segmentation raises the total cost of ownership. Many end users lack the IT resources required to maintain large smart lighting networks, which limits adoption in cost-sensitive markets.

What are the key opportunities in the intelligent lighting controls industry?

Smart City & Municipal Streetlighting Programs

Governments worldwide are investing in large-scale smart streetlighting deployments. Adaptive dimming, remote monitoring, and integrated sensors (air quality, traffic analytics) create a multi-use digital infrastructure that generates recurring service revenue for vendors. ESCo-financed contracts are expanding access for municipalities with budget constraints.

Commercial & Industrial Retrofit Acceleration

Massive installed bases of legacy lighting systems present long-term retrofit opportunities. Wireless retrofit kits, AI-enabled luminaires, and enterprise-level analytics platforms offer rapid payback periods. Integrators that provide turnkey energy audit–to–installation services will be well-positioned to capture share as organizations seek compliance with sustainability requirements.

Integration with Building Automation, IoT & Space Optimization Platforms

Lighting systems are evolving into sensor-rich networks that support not only illumination but also occupancy analytics, environmental monitoring, and space planning. Vendors that develop interoperable APIs and partnerships with building automation providers can unlock high-margin recurring revenue from cloud software and enterprise analytics subscriptions.

Product Type Insights

Controllers and gateways dominate the intelligent lighting controls market, accounting for approximately 28% of the total 2024 revenue. Their leadership stems from their central role in integrating luminaires, sensors, and building automation systems. As enterprises expand IoT deployments, controllers increasingly function as data routers, security gateways, and workflow automation engines. Sensor modules and embedded-intelligent luminaires continue to grow rapidly, driven by urban lighting upgrades and occupancy analytics demand. Cloud software and lighting management platforms represent the fastest-growing product segment due to rising adoption of subscription-based offerings across commercial real estate, industrial plants, and public infrastructure.

Application Insights

Commercial buildings lead the market with a 35% share of 2024 demand, driven by office modernization, energy-efficiency retrofits, and increased adoption of BMS-integrated intelligent lighting. Industrial facilities are rapidly expanding their share due to automation, workplace safety initiatives, and IoT integration within smart factories. Outdoor and streetlighting applications represent a major growth frontier, enabled by government-led modernization programs and emerging smart city platforms. Residential smart lighting continues growing in volume, especially through wireless and voice-controlled technologies, but contributes a smaller share to market revenue due to lower average selling prices.

Distribution Channel Insights

System integrators and professional electrical contractors dominate distribution due to the complexity of commercial and industrial installations. Direct OEM sales are common for large municipal or enterprise contracts. Online channels and marketplace platforms are rising, particularly for residential and small-business deployments, where DIY-friendly wireless systems are increasingly popular. Software providers and cloud service platforms are creating new digital distribution models, offering subscription-based remote lighting management, analytics dashboards, and automated compliance reporting.

End-User Insights

Commercial enterprises, offices, retail chains, hospitality, and corporate campuses represent the largest and most profitable end-user base. Industrial and warehouse environments show the fastest growth, driven by automation workflows, energy-saving mandates, and Industry 4.0 integration. Public-sector demand, particularly in municipalities and transportation hubs, continues to scale with smart-city investments. Healthcare and education are emerging as high-value niches due to the adoption of human-centric and circadian lighting solutions that enhance wellness and learning outcomes.

Age Group Insights (Reinterpreted as Buyer Profiles)

Decision-makers aged 31–50 represent the majority of enterprise procurement, reflecting their leadership roles in corporate sustainability and facility operations. Younger professionals (18–30) drive the adoption of app-based residential smart lighting, while buyers aged 51–65 dominate investment decisions in commercial real estate portfolios and industrial upgrades. These demographic patterns influence design preferences, feature expectations, and software adoption behaviors.

| By Product Type | By Connectivity Protocol | By Application | By Installation Type | By Business Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 31% of the 2024 global revenue. The U.S. leads due to strong energy regulations, extensive commercial retrofit activity, and high adoption of smart building technologies. Enterprises increasingly prioritize energy reporting and occupancy analytics, strengthening demand for advanced lighting management platforms. Canada demonstrates strong municipal interest in smart streetlighting and public building retrofits.

Europe

Europe accounts for 25% of the 2024 market share, driven by stringent EPBD regulations, carbon-reduction mandates, and early adoption of DALI-2 and open-standard solutions. Germany, the U.K., France, and the Nordics lead in intelligent lighting adoption. Smart city initiatives, combined with a mature commercial real estate sector, continue to drive steady market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by rapid urban expansion, industrial construction, and government-funded smart city projects. China leads in both production and deployment, while India’s large-scale streetlighting and commercial retrofit programs are accelerating regional growth. Japan and South Korea continue to adopt high-end integrated lighting systems in advanced manufacturing and enterprise campuses.

Latin America

Brazil, Chile, and Mexico are the key markets in Latin America, driven by municipal modernization programs and increasing private-sector investments in energy-efficient retrofits. Adoption remains in early stages but is expanding rapidly due to improved financing access and lower hardware costs.

Middle East & Africa

GCC countries, including the UAE and Saudi Arabia, are investing heavily in smart city mega-projects such as NEOM, driving significant demand for intelligent controls. Africa’s adoption is rising through donor-funded public lighting upgrades and multi-country infrastructure development programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Intelligent Lighting Controls Market

- Signify (Philips Lighting)

- Acuity Brands

- Schneider Electric

- Legrand

- Lutron Electronics

- ams OSRAM

- ABB

- Eaton

- Honeywell

- Zumtobel Group

- Hubbell Incorporated

- Panasonic Corporation

- Cisco Systems

- Delta Electronics

- Siemens

Recent Developments

- In March 2025, Signify enhanced its Interact IoT lighting platform with AI-driven predictive analytics for large commercial facilities.

- In January 2025, Acuity Brands announced expanded Bluetooth Mesh product lines targeting cost-sensitive retrofit projects across North America and Europe.

- In November 2024, Schneider Electric launched new DALI-2 certified controllers optimized for integration with its EcoStruxure building automation ecosystem.