Instant Print Camera Market Size

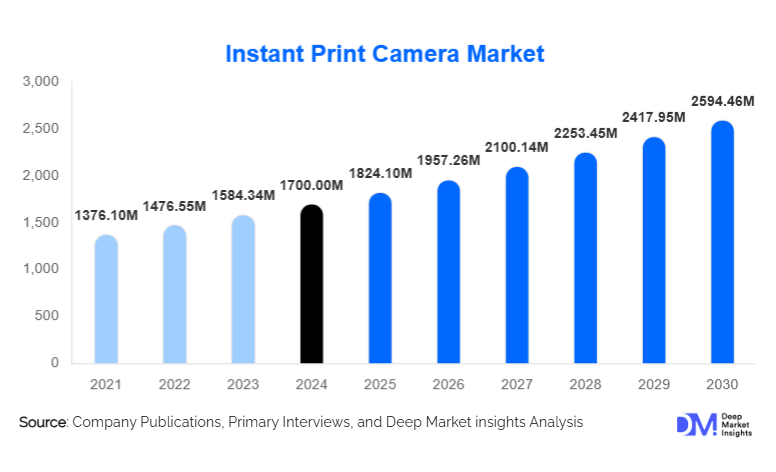

According to Deep Market Insights, the global instant print camera market size was valued at USD 1,700.00 million in 2024 and is projected to grow from USD 1,824.10 million in 2025 to reach USD 2,594.46 million by 2030, expanding at a CAGR of 7.30% during the forecast period (2025–2030). The market growth is primarily driven by the resurgence of consumer interest in tangible photo prints, the integration of digital and instant-print technologies, and increasing adoption in event-based and commercial applications.

Key Market Insights

- Nostalgia-driven consumer demand is a primary growth factor, with Millennials and Gen Z valuing physical prints as keepsakes and gifts.

- Hybrid digital-analog cameras with smartphone connectivity and cloud integration are expanding product appeal, particularly among tech-savvy users.

- Asia-Pacific leads growth in the global market, driven by rising middle-class affluence, travel culture, and youth-driven social media trends.

- Event and commercial applications, such as weddings, photo booths, and brand activations, are creating recurring revenue streams through consumables like film cartridges.

- Offline retail dominates sales, although e-commerce is rapidly gaining traction in both mature and emerging markets.

- Innovation in print technology, including zero-ink (ZINK), hybrid film-digital cameras, and customizable print formats, is reshaping product differentiation.

What are the latest trends in the instant print camera market?

Hybrid Digital-Analog Integration

Manufacturers are increasingly combining digital photography capabilities with instant printing. Features such as Bluetooth/Wi-Fi connectivity, smartphone apps for remote printing, and cloud-based storage enhance convenience and user experience. Consumers can edit, filter, and personalize prints before printing, appealing to younger demographics who seek both creative expression and tangible outputs. Hybrid models also cater to the social media trend of sharing printed memories alongside digital content.

Event-Driven and Commercial Applications

Demand is growing for instant print cameras in weddings, parties, corporate events, and tourism. Businesses and event organizers are leveraging cameras to create memorable experiences and branded keepsakes. Photo booth setups with instant print options are becoming common at events, driving sales of devices and recurring revenue through consumable film cartridges. This trend has opened new B2B applications beyond personal use, expanding market potential.

What are the key drivers in the instant print camera market?

Nostalgia and Tangible Print Appeal

Consumers increasingly desire physical prints in a digital-first world. The ability to instantly hold a photograph satisfies emotional and experiential needs that smartphones cannot replicate. This driver is particularly strong among Millennials and Gen Z, who enjoy gifting printed memories and decorating personal spaces with photos.

Social Media and Experiential Photography

The rise of social media and content sharing encourages the creation of physical prints for creative display or personal branding. Event photography and travel photography are driving repeat purchases of devices and consumables. Platforms like Instagram and TikTok further amplify interest in visually unique, instantly printed photographs.

Innovation in Printing Technology

Technological advancements, including ZINK printing, hybrid digital-film cameras, customizable print formats, and app integration, are expanding market appeal. These innovations attract tech-savvy users and help manufacturers differentiate from competitors, stimulating upgrades and repeat sales.

What are the restraints for the global market?

High Consumable Costs and Limited Film Availability

Recurring costs for film cartridges and specialized prints can deter frequent usage. In emerging markets, limited availability of film formats and inconsistent supply chains may inhibit adoption, affecting overall market growth.

Competition from Smartphones and Digital Cameras

Smartphones provide high-quality images and convenience, reducing the addressable market for instant print cameras. Portable smartphone photo printers further act as substitutes, creating price and feature competition.

What are the key opportunities in the instant print camera industry?

Emerging Markets in Asia-Pacific and Latin America

Rapidly rising middle-class incomes, growing youth populations, and increased social media engagement are driving demand in China, India, Southeast Asia, Brazil, and Mexico. Manufacturers can tailor affordable models and local marketing strategies to penetrate these markets effectively.

Expansion into Event and Commercial Applications

Beyond personal use, instant print cameras are increasingly adopted for weddings, corporate events, tourism, and promotional campaigns. Bundled solutions, including cameras, film cartridges, and customization options, provide recurring revenue streams and strengthen brand presence.

Smart and Connected Product Innovations

Integration of digital technologies, app connectivity, cloud storage, and custom print options offers differentiation opportunities. Companies investing in hybrid or connected cameras can tap into tech-savvy consumer segments and drive premium pricing.

Product Type Insights

Compact / pocket instant cameras dominate the market (45% share) due to portability, affordability, and social gifting appeal. Single-lens film-based models remain the largest revenue contributor (60% share) because of established brand familiarity and nostalgia-driven demand. Large-format and twin-lens cameras serve niche segments, providing premium experiences for enthusiasts and professional photographers.

Application Insights

Personal use accounts for the largest market share (65%), driven by gifting, travel, and social-sharing habits. Event photography and commercial applications are growing rapidly, supported by rising demand for photo booths, brand activations, and tourism experiences. Black & white and special-format films remain niche but appeal to collectors and creative users.

Distribution Channel Insights

Offline retail (55% of revenue) remains dominant due to tactile product evaluation, immediate purchase convenience, and film availability. Online sales channels are expanding rapidly, particularly in the Asia-Pacific region, enabling direct-to-consumer sales, subscription services for films, and broader market penetration.

End-User Insights

Consumer/personal users lead demand, while professional studios and event organizers represent fast-growing segments. Tourism and hospitality sectors increasingly incorporate instant print cameras as value-added experiences. Export-driven demand from manufacturing hubs (Japan, China) supports regional adoption globally.

| By Technology / Printing Mechanism | By Product Type / Format | By Film / Print Type / Consumable | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The U.S. and Canada collectively account for 32% of the global market in 2024. Demand is driven by disposable income, strong retail presence, and interest in event photography. North American consumers favor premium, nostalgic, and hybrid digital-film cameras.

Europe

Europe holds 26% of the global market, led by the U.K., Germany, and France. Growth is moderate but steady, with consumers preferring sustainable and premium-format instant print cameras. Photographic and cultural applications are particularly popular.

Asia-Pacific

Asia-Pacific (38% share) is the fastest-growing region. China and Japan drive demand for hybrid and film-based devices, while India and Southeast Asia are emerging markets with a high CAGR (8–10%). Social media influence, gifting culture, and travel trends accelerate adoption.

Latin America

Brazil, Mexico, and Argentina represent a growing but smaller share (4–5%). Outbound tourism and rising disposable income are fueling incremental demand for premium and event-oriented instant print cameras.

Middle East & Africa

These regions account for 3–4% of the global market. Key markets include the UAE, Saudi Arabia, and South Africa, driven by luxury gifting, tourism, and premium consumer segments. Intra-African adoption is also expanding.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Instant Print Camera Market

- Fujifilm

- Polaroid

- Kodak

- HP

- Leica

- Canon

- Lomography

- Nikon

- Ricoh

- Samsung

- MiNT Camera

- Instax (Fujifilm brand)

- MiP Photography

- Snap Inc

- Polaroid Originals

Recent Developments

- In May 2025, Fujifilm launched a hybrid digital-film instant camera targeting Gen Z consumers, with app connectivity and customizable print options.

- In April 2025, Polaroid introduced a compact, zero-ink model with faster printing and eco-friendly consumables, enhancing adoption in emerging markets.

- In February 2025, Kodak expanded its film cartridge production in Asia-Pacific to meet rising demand for instant print devices in China and India.