Film Photography Camera Market Size

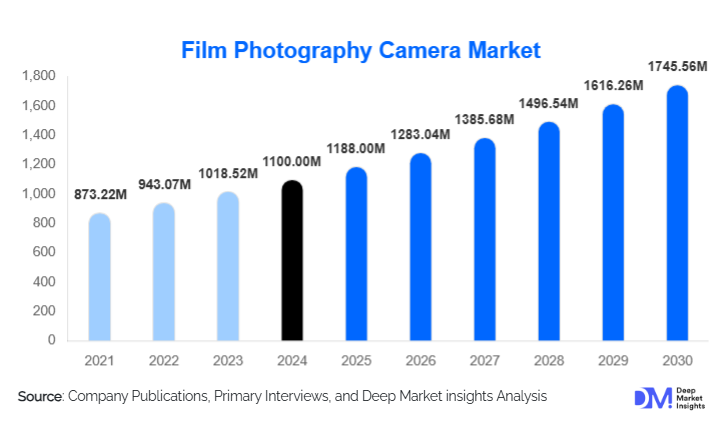

According to Deep Market Insights, the global film photography camera market size was valued at USD 1,100 million in 2024 and is projected to grow from USD 1,188.00 million in 2025 to reach USD 1,745.56 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The market’s growth is primarily driven by the resurgence of analog culture among younger generations, the expansion of hobbyist and educational demand, and renewed investments in hybrid film-digital camera innovations by global manufacturers.

Key Market Insights

- Resurgence of analog and vintage aesthetics is driving film camera demand globally, especially among Millennials and Gen Z hobbyists seeking tangible creative experiences.

- 35mm cameras dominate the market, holding over 55% share in 2024 due to their affordability, availability, and ease of use.

- Asia-Pacific emerges as the fastest-growing region, with strong demand in Japan, India, and China driven by creative hobbyist communities and rising disposable incomes.

- Hobbyist and enthusiast users account for 60% of global demand, marking a significant shift from traditional professional-only usage.

- Online retail channels contribute nearly half of total sales, supported by the rise of e-commerce platforms and secondary resale markets for vintage cameras.

- Hybrid analog-digital technologies and instant film innovations are shaping the future trajectory of this niche yet rapidly growing market.

What are the latest trends in the film photography camera market?

Analog Revival Driven by Youth Culture

Film photography has experienced a remarkable comeback, especially among younger demographics seeking creative authenticity. Millennials and Gen Z consumers are rediscovering film photography for its distinctive grain, color tone, and unpredictability elements that contrast digital perfection. Social media platforms such as Instagram and TikTok have amplified the film aesthetic, creating communities of analog enthusiasts who celebrate slower, more intentional photography. Camera makers are responding with limited-edition reissues of classic models and affordable entry-level film cameras, while brands such as Fujifilm and Kodak are reintroducing discontinued film stocks to meet surging demand. This nostalgia-driven revival is transforming film photography from a declining industry into a fashionable lifestyle pursuit.

Hybrid Film-Digital Integration

Manufacturers are increasingly integrating digital technology with traditional film systems. Hybrid cameras that combine film capture with digital scanning or instant-print capabilities are gaining traction. For example, new models emulate the tactile feel of film while offering digital convenience for archiving and sharing. These innovations are appealing to both hobbyists and professionals who desire analog authenticity with modern flexibility. Instant film systems with smartphone connectivity and high-resolution scanning apps are bridging generations of photographers, making the analog workflow more accessible and shareable in a digital ecosystem.

What are the key drivers in the film photography camera market?

Nostalgia and Cultural Aesthetics

The emotional connection to analog photography remains a major growth driver. Consumers are valuing imperfections, texture, and the tactile feel of physical prints. This nostalgia has turned film cameras into collectibles and revived demand for both refurbished vintage cameras and newly manufactured models. The aesthetic appeal of film, amplified through social media, has led to a 20–25% rise in 35mm film sales in the past two years, signaling the strength of emotional and cultural drivers behind market growth.

Educational and Creative-Arts Demand

Film photography’s inclusion in art schools, creative programs, and photography courses has significantly boosted camera and film sales. Educational institutions use film photography as a teaching tool to foster understanding of exposure, light, and composition. This institutional demand has revitalized small-scale film labs, darkrooms, and suppliers, reinforcing an entire ecosystem around analog photography. Governments and universities are also funding creative-arts programs that include analog photography, adding stability to this niche demand base.

Hobbyist Expansion and Social Community Growth

Online communities, workshops, and photo walks have spurred participation among amateur photographers worldwide. This trend has created a ripple effect, increasing demand for entry-level cameras and film processing services. E-commerce and secondhand marketplaces such as eBay and Etsy have also made vintage cameras more accessible. The expanding enthusiast base has turned film photography into a mainstream creative hobby, sustaining market growth and promoting brand loyalty.

What are the restraints for the global market?

Limited Supply Chain and Rising Production Costs

The limited production of new film cameras and the shrinking availability of analog film stock represent major challenges. Manufacturing mechanical cameras requires skilled craftsmanship and specialized components that have become expensive due to low production volumes. Film processing labs are also fewer in number, leading to regional bottlenecks. The rising cost of silver halide materials and chemical restrictions in some markets further elevate production costs, limiting market scalability.

Competition from Digital Photography

Despite the analog revival, digital and smartphone photography continue to dominate due to convenience, low cost, and instant results. The high recurring cost of film rolls, development, and scanning discourages some potential users. Moreover, the long learning curve of film photography may deter casual users, keeping the market niche and dependent on dedicated enthusiasts.

What are the key opportunities in the film photography camera industry?

Emerging Markets and Educational Collaborations

Expanding analog education programs and creative communities in Asia-Pacific and Latin America present strong opportunities. By partnering with schools, universities, and art collectives, manufacturers can introduce affordable camera kits and training programs that create long-term users. India and Southeast Asia, for instance, are witnessing rapid growth in analog photography clubs, presenting untapped market potential for film and camera makers.

Hybrid and Instant Film Technologies

The integration of instant-print and hybrid digital-film systems offers a promising growth avenue. Cameras that allow users to shoot film while simultaneously digitizing the image appeal to a new generation seeking an analog feel with digital convenience. This hybrid segment is expected to grow at over 10% CAGR during 2025–2030, outpacing traditional models. Additionally, the popularity of instant film photography in events, parties, and weddings supports recurring sales of consumables and accessories.

Premium Collector and Limited-Edition Segments

The collector market for vintage and limited-edition film cameras is expanding rapidly. Reissues of iconic models such as the Leica M6 and Pentax Spotmatic have seen strong sales among enthusiasts and investors. Manufacturers can leverage brand heritage to create high-margin, limited-edition releases. This niche caters to professionals and collectors willing to pay premium prices for craftsmanship, exclusivity, and mechanical artistry, driving profitability despite modest volumes.

Product Type Insights

35mm film cameras dominate the global market, accounting for nearly 55% of the total value in 2024. Their affordability, availability of film stock, and suitability for beginners make them the most popular category worldwide. Instant cameras follow, driven by social and event photography trends. Medium and large-format cameras maintain steady professional demand, primarily in fine art and studio applications. The hybrid film-digital segment, though small today, is expected to post double-digit growth as new technologies bridge analog and digital workflows.

Application Insights

Film cameras are widely used across hobbyist, professional, and educational applications. Hobbyists account for approximately 60% of the total market value, fueled by personal projects, creative expression, and social trends. Professional photographers continue to use medium and large formats for editorial, fashion, and fine-art purposes. Educational institutions remain key users, integrating film photography into creative curricula. Additionally, camera rental services and analog workshops are rising, creating secondary application channels that sustain recurring usage.

Distribution Channel Insights

Online retail accounts for nearly 50% of total market value, thanks to global e-commerce platforms and niche analog camera stores operating online. Vintage and used camera marketplaces thrive on direct-to-consumer trade and collector engagement. Offline specialty retailers continue to serve professional and collector segments through repair services and curated camera inventories. The secondary resale market has become a crucial growth driver, facilitating the circulation of refurbished film cameras and extending product life cycles.

End-User Insights

Hobbyists and enthusiasts are the largest end-user group, representing over 60% of the market. Professional photographers comprise around 25%, mainly in fine-art and fashion sectors, while educational institutions and collectors make up the remaining share. The fastest-growing sub-segment is educational adoption, as art schools and photography programs revive analog techniques. Collectors and premium buyers contribute strongly to profitability through limited-edition and vintage camera purchases.

| By Product Type | By Film Type | By Price Range | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents approximately 35% of the global market value in 2024, led by the United States. High disposable incomes, strong collector communities, and a well-established vintage camera market underpin regional dominance. Growth remains steady as workshops, analog photography exhibitions, and film festivals encourage wider participation. The presence of major brands such as Kodak continues to support ecosystem sustainability.

Europe

Europe accounts for around 28% of the market in 2024. Countries like Germany, the U.K., and France have deep analog traditions and active communities of collectors and photographers. The region benefits from the strong distribution of European camera brands such as Leica and Rollei. Fine-art institutions and analog festivals further reinforce film photography’s cultural relevance. Growth is moderate but consistent, supported by premium and collector demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding roughly 30% of the global market share in 2024. Japan remains a manufacturing hub and cultural leader in analog photography, while China and India are witnessing surging adoption among younger photographers. Creative-arts education and the popularity of film photography clubs have positioned APAC as a key growth engine. Forecast CAGR for the region exceeds 9% through 2030, driven by hybrid camera innovations and online retail expansion.

Latin America

Latin America holds about 6% market share in 2024. Brazil, Mexico, and Argentina are experiencing growing interest in film photography through online communities and art collectives. The region’s rising middle class and cultural emphasis on creative expression support steady growth in demand for affordable entry-level cameras and imported film stock.

Middle East & Africa

The Middle East and Africa represent the smallest share (<5%) but show emerging potential in creative hubs such as Dubai, Cape Town, and Nairobi. These cities are developing analog art scenes, supported by rising disposable incomes and boutique photography studios. Regional demand is expected to grow gradually through cultural initiatives and tourism-linked creative experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Film Photography Camera Market

- Leica

- Hasselblad

- Pentax

- Nikon

- Canon

- Fujifilm

- Kodak

- Lomography

- Polaroid

- Mamiya

- Rollei

- Olympus

- Holga

- Konica Minolta

- Contax

Recent Developments

- In September 2025, Leica reissued its iconic M6 35mm film camera, citing unprecedented demand from younger photographers and collectors.

- In July 2025, Fujifilm announced expanded instant-film production capacity in Japan to meet global demand for Instax products.

- In May 2025, Pentax confirmed the development of a new mechanical film SLR, signaling renewed investment in analog systems.