Induction Cookware Market Size

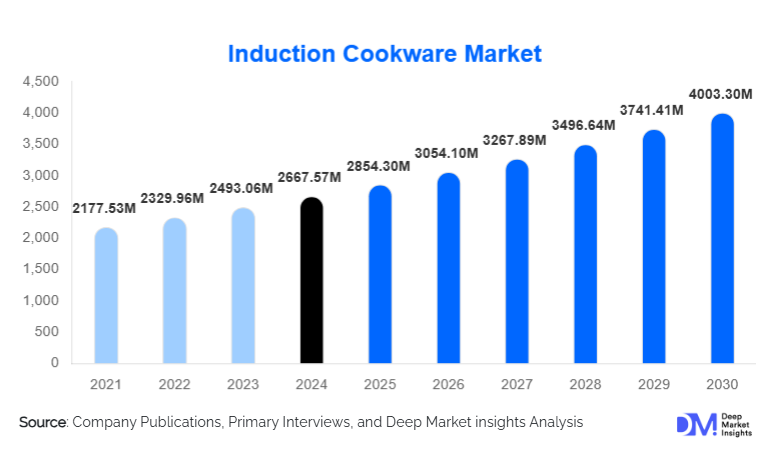

According to Deep Market Insights, the global induction cookware market size was valued at USD 2,667.57 million in 2024 and is projected to grow from USD 2,854.30 million in 2025 to reach USD 4,003.30 million by 2030, expanding at a CAGR of 7.00% during the forecast period (2025–2030). The induction cookware market growth is primarily driven by the rapid adoption of induction cooktops worldwide, rising energy efficiency regulations, increasing urbanization, and growing consumer preference for safe, precise, and environmentally sustainable cooking solutions.

Key Market Insights

- Rising adoption of induction cooktops across residential and commercial kitchens is directly accelerating demand for induction-compatible cookware.

- Stainless steel and multi-layered cookware dominate due to durability, uniform heat distribution, and professional-grade performance.

- Asia-Pacific leads global demand, supported by urbanization, government electrification programs, and expanding middle-class populations.

- Commercial foodservice is the fastest-growing end-use segment, driven by cloud kitchens, QSRs, and hospitality modernization.

- Mid-range cookware remains the largest price segment, balancing affordability with performance and brand trust.

- Technological advancements, including impact-bonded bases and eco-friendly coatings, are reshaping product differentiation.

What are the latest trends in the induction cookware market?

Premiumization and Multi-Layer Material Innovation

The induction cookware market is witnessing a strong premiumization trend, with consumers increasingly opting for multi-layered stainless steel, hybrid composite cookware, and enameled cast iron products. These offerings deliver superior heat retention, longer product life, and enhanced cooking precision. Premium cookware brands are emphasizing ergonomic designs, scratch-resistant coatings, and aesthetic appeal to align with modern modular kitchen trends. This trend is particularly pronounced in North America and Europe, where consumers are willing to pay higher prices for long-lasting, professional-grade cookware.

Growth of E-Commerce and Direct-to-Consumer Channels

Online retail is emerging as the fastest-growing distribution channel for induction cookware. Brand-owned websites and e-commerce marketplaces enable customers to compare specifications, access reviews, and receive product education on induction compatibility. Manufacturers are increasingly investing in digital marketing, influencer partnerships, and virtual product demonstrations. Subscription-based cookware replacement models and bundled cookware sets are also gaining traction, improving customer lifetime value and repeat purchases.

What are the key drivers in the induction cookware market?

Global Transition Toward Energy-Efficient Cooking

Government-led initiatives promoting electric cooking solutions are a major driver of the induction cookware market. Induction cooktops offer up to 90% energy efficiency compared to traditional gas cooking, supporting national decarbonization and energy-saving goals. As households and institutions transition to induction appliances, demand for compatible cookware rises in parallel.

Expansion of Commercial and Cloud Kitchens

The rapid growth of cloud kitchens, QSR chains, and institutional food services is accelerating the adoption of induction cooking systems. Induction cookware is preferred in commercial kitchens due to faster heating, improved safety, reduced ventilation requirements, and lower operational costs. This shift is creating sustained demand for heavy-duty, commercial-grade induction cookware with higher margins.

What are the restraints for the global market?

Higher Initial Cost of Induction-Compatible Cookware

Induction cookware requires ferromagnetic materials and specialized manufacturing processes, making it more expensive than conventional cookware. Price sensitivity in emerging markets limits rapid adoption, particularly in rural and semi-urban regions where gas cooking remains dominant.

Consumer Awareness and Compatibility Challenges

Limited consumer understanding regarding induction compatibility continues to act as a restraint. Confusion around materials such as aluminum and copper restricts broader adoption, increasing the need for labeling clarity and consumer education initiatives.

What are the key opportunities in the induction cookware industry?

Smart and Connected Cookware Ecosystems

The integration of sensors, temperature control indicators, and app-enabled cooking guidance presents a significant opportunity in the premium segment. Smart induction cookware that communicates with induction cooktops can enhance cooking precision and safety, opening new revenue streams for manufacturers.

Government Electrification and Institutional Procurement

Public housing projects, hospitals, and educational institutions are increasingly procuring induction-based kitchen infrastructure. Large-scale government procurement programs create long-term, volume-driven opportunities for cookware manufacturers aligned with regulatory and sustainability standards.

Product Type Insights

Frying pans and skillets dominate the induction cookware market, accounting for approximately 32% of total market share in 2024, driven by high replacement frequency and universal usage. Sauce pans and stock pots follow, supported by everyday household cooking needs. Multi-cookware sets are gaining popularity due to cost efficiency and convenience, particularly among first-time induction users and newly urban households. Pressure cookers and grill pans are experiencing steady growth in the Asia-Pacific region, driven by regional cooking preferences and compact kitchen requirements.

Material Insights

Stainless steel cookware leads the market with a 41% share in 2024, owing to its durability, corrosion resistance, and compatibility with professional kitchens. Cast iron holds a strong position in premium segments due to superior heat retention, while carbon steel is gaining traction among performance-focused consumers. Aluminum cookware with bonded induction bases continues to serve the economy and mid-range segments, particularly in emerging markets.

End-Use Insights

The residential segment accounts for approximately 58% of global demand, driven by urban households and induction cooktop penetration. Commercial foodservice is the fastest-growing end-use, expanding at over 9% CAGR, fueled by cloud kitchens, hospitality chains, and institutional catering. Hospitals, corporate cafeterias, and educational institutions are emerging as stable demand generators due to safety and energy efficiency requirements.

Distribution Channel Insights

Offline retail remains the dominant channel, contributing around 62% of sales, as consumers prefer physical inspection of cookware weight, base thickness, and finish. However, online channels are growing rapidly, supported by digital-native brands, influencer marketing, and increasing consumer confidence in e-commerce purchases. Direct-to-consumer strategies are improving margins and brand loyalty.

| By Product Type | By Material Type | By End Use | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the induction cookware market with approximately 38% share in 2024. China represents the largest single market, supported by domestic manufacturing scale and widespread industrial adoption. India is the fastest-growing country, with a CAGR exceeding 10%, driven by urban housing growth and government electrification initiatives. Japan and South Korea contribute through demand for premium and technologically advanced cookware.

Europe

Europe accounts for nearly 29% of global market share, led by Germany, France, the U.K., and Italy. Regulatory pressure to reduce gas usage and improve energy efficiency is accelerating induction adoption. European consumers demonstrate a strong preference for sustainable, long-life cookware products.

North America

North America holds around 21% market share, driven by premium cookware demand and growing induction penetration in urban residential and commercial kitchens. The U.S. dominates regional demand, supported by high disposable incomes and strong brand presence.

Latin America

Latin America contributes approximately 7% of global demand, with Brazil and Mexico leading adoption. Market growth is gradual, supported by appliance modernization and expanding middle-income households.

Middle East & Africa

The Middle East & Africa region accounts for about 5% of the market, driven by hospitality infrastructure development in the UAE and Saudi Arabia, alongside premium residential demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|