In-Store Music Service Market Size

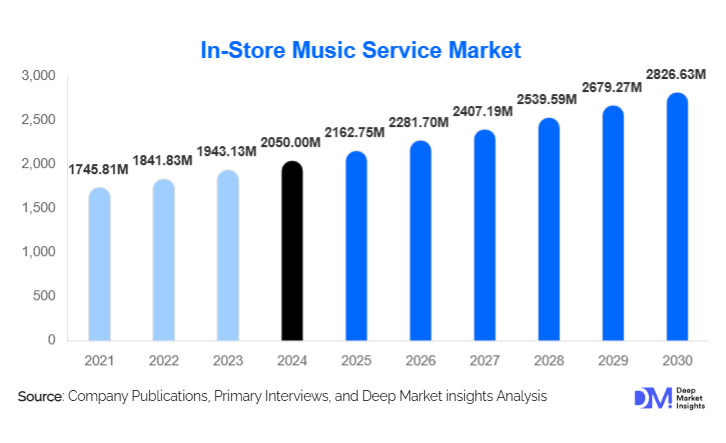

According to Deep Market Insights, the global in-store music service market size was valued at USD 2,050.00 million in 2024 and is projected to grow from USD 2,162.75 million in 2025 to reach USD 2,826.63 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The in-store music service market growth is primarily driven by the resurgence of brick-and-mortar retail, increasing focus on experiential customer engagement, and rising adoption of cloud-based, licensed music platforms across retail, hospitality, and commercial environments.

Key Market Insights

- Cloud-based music platforms dominate deployment, accounting for over 60% of total installations due to scalability and centralized control.

- Retail and hospitality together contribute more than 65% of global demand, driven by brand experience optimization.

- North America leads the market due to strong licensing enforcement and high enterprise adoption.

- Asia-Pacific is the fastest-growing region, supported by rapid retail formalization and hospitality infrastructure expansion.

- Subscription-based licensing models remain the most preferred, offering predictable pricing and compliance assurance.

- AI-driven music curation and analytics integration are reshaping service differentiation and premium offerings.

What are the latest trends in the in-store music service market?

AI-Powered Music Personalization

Artificial intelligence is increasingly being used to curate playlists based on customer demographics, time of day, footfall patterns, and brand identity. Advanced platforms dynamically adjust music tempo and genre to influence dwell time and purchasing behavior. This trend is particularly strong among large retail chains and QSR operators, where marginal improvements in customer engagement translate into measurable revenue gains. AI-driven dashboards also enable centralized performance monitoring across multi-location networks.

Integration with Digital Signage and In-Store Media

In-store music services are converging with digital signage, in-store advertising, and audio messaging platforms. Retailers are leveraging synchronized audio-visual experiences to reinforce promotions and brand storytelling. This integration supports higher contract values for service providers and allows monetization through targeted audio advertisements, especially in supermarkets, malls, and transportation hubs.

What are the key drivers in the in-store music service market?

Rising Focus on Experiential Retail

As physical stores compete with e-commerce, retailers are prioritizing immersive experiences that differentiate in-store visits. Professionally curated and licensed music enhances brand perception, improves customer mood, and increases dwell time, making it a core component of experiential retail strategies. This driver is particularly influential in fashion, specialty retail, and lifestyle stores.

Shift Toward Cloud-Based SaaS Models

The transition from on-premise systems to cloud-based SaaS platforms is accelerating adoption. Cloud delivery enables real-time updates, remote troubleshooting, and scalability across hundreds or thousands of locations. Subscription pricing models further lower upfront costs, encouraging adoption among mid-sized chains and franchise operators.

Stricter Music Licensing Compliance

Increasing enforcement of public performance rights across North America and Europe is pushing businesses toward compliant in-store music solutions. Penalties for unlicensed music usage are encouraging migration from consumer streaming misuse to professional services that bundle content, licensing, and technology.

What are the restraints for the global market?

Price Sensitivity Among Small Businesses

Independent retailers and small cafés often perceive in-store music services as non-essential expenses, particularly in emerging markets. This price sensitivity limits penetration within the long tail of small businesses, despite growing awareness of compliance risks.

Informal Use of Consumer Streaming Platforms

Despite regulatory efforts, many businesses continue to misuse personal streaming accounts due to a lack of awareness or weak enforcement in certain regions. This informal usage constrains full market monetization, especially in developing economies.

What are the key opportunities in the in-store music service industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East present strong growth opportunities due to rapid urbanization, organized retail expansion, and hospitality investments. Countries such as India, Vietnam, Indonesia, Saudi Arabia, and the UAE are witnessing increased demand for professional in-store music solutions aligned with international brand standards.

Omnichannel Brand Experience Integration

Opportunities are expanding for platforms that integrate in-store music with mobile apps, loyalty programs, and digital marketing ecosystems. Unified brand audio strategies across physical and digital touchpoints enable higher-value enterprise contracts and long-term client retention.

Service Type Insights

Licensed background music streaming services dominate the market, accounting for approximately 46% of global revenue in 2024. Their leadership is supported by ease of deployment, regulatory compliance, and affordable subscription pricing. Customized music programming services are gaining traction among premium retailers seeking differentiated brand identities, while integrated audio-visual solutions are increasingly adopted by large commercial spaces and malls.

Business Model Insights

Subscription-based licensing models account for nearly 58% of total market revenue, driven by predictable pricing and recurring revenue structures. Enterprise multi-location contracts represent the fastest-growing sub-segment, as large retailers and hospitality groups centralize procurement and standardize audio experiences across global footprints.

End-Use Industry Insights

Retail stores represent the largest end-use segment, contributing roughly 41% of global demand in 2024. Hospitality follows closely, driven by hotels, restaurants, cafés, and QSRs emphasizing customer ambiance. Healthcare facilities, fitness centers, and transportation hubs are emerging as high-growth application areas, particularly for calming or high-energy curated audio environments.

| By Service Type | By Delivery Model | By Business Model | By End-Use Industry | By Store Format |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market, led by the United States with over 26% share. Strong licensing enforcement, mature retail infrastructure, and high cloud adoption support sustained demand. Canada contributes to steady growth through hospitality and franchise retail expansion.

Europe

Europe holds around 27% of the market, driven by the UK, Germany, and France. Strict public performance regulations and widespread franchise networks support consistent adoption. Eastern Europe is emerging as a faster-growing sub-region.

Asia-Pacific

Asia-Pacific represents nearly 24% of global revenue and is the fastest-growing region, with a CAGR exceeding 10%. China, India, Japan, South Korea, and Australia lead demand, supported by retail formalization and hospitality growth.

Latin America

Latin America accounts for roughly 7% of the market, led by Brazil and Mexico. Growth is supported by urban retail development and the increasing penetration of international brands.

Middle East & Africa

The Middle East & Africa region holds about 8% share, with strong demand from the UAE and Saudi Arabia, driven by tourism, premium retail, and mall infrastructure investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the In-Store Music Service Market

- Mood Media

- Soundtrack Your Brand

- PlayNetwork

- Cloud Cover Music

- SiriusXM for Business

- Imagesound

- Auracle Sound

- Kasimu

- NSM Music

- Custom Channels

- Qsic

- Rockbot

- SoundMachine

- Feed FM

- Brandtrack