In-Home Karaoke Market Size

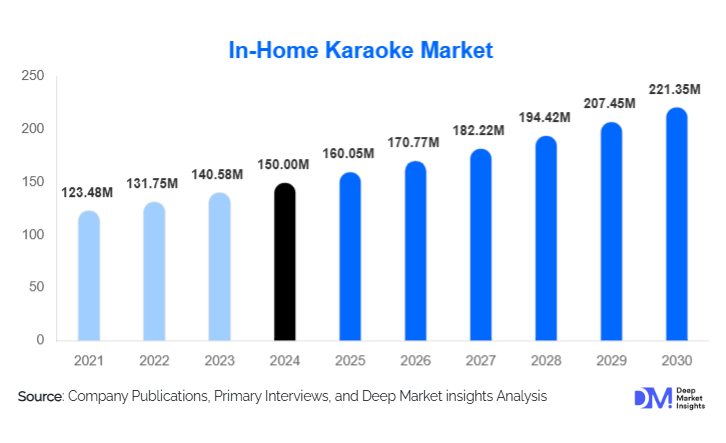

According to Deep Market Insights, the global in-home karaoke market size was valued at USD 150.00 million in 2024 and is projected to grow from USD 160.05 million in 2025 to reach USD 221.35 million by 2030, expanding at a CAGR of 6.7% during the forecast period (2025–2030). The in-home karaoke market growth is driven by the rapid expansion of home entertainment ecosystems, increasing consumer preference for interactive and social entertainment, and continuous technological advancements such as AI-enabled vocal enhancement, cloud-based song libraries, and smart device integration.

Key Market Insights

- Smart and cloud-connected karaoke systems are gaining traction, driven by demand for real-time song updates, AI pitch correction, and subscription-based content libraries.

- Asia-Pacific dominates the global market, supported by strong cultural adoption of karaoke and robust domestic manufacturing in China, Japan, and South Korea.

- Mid-range karaoke systems (USD 100–300) account for the largest revenue share, balancing affordability with advanced features.

- Online retail channels lead distribution, fueled by e-commerce growth and direct-to-consumer brand strategies.

- Residential households represent the primary end-use segment, accounting for more than 85% of total demand.

- AI-driven personalization and social sharing features are reshaping user engagement and increasing repeat usage.

What are the latest trends in the in-home karaoke market?

AI-Enabled and Smart Karaoke Systems

Artificial intelligence has become a defining trend in the in-home karaoke market. Manufacturers are increasingly embedding AI-powered pitch correction, vocal coaching, and performance analytics into karaoke systems to enhance user experience. These features enable amateur singers to improve their vocal quality in real time, making karaoke more accessible and engaging. Smart systems integrated with mobile applications allow users to customize sound profiles, track performance history, and share recordings on social media platforms. This trend is particularly popular among younger demographics and digital content creators, accelerating the adoption of premium and mid-range smart karaoke solutions globally.

Subscription-Based Content Ecosystems

The shift toward subscription-based song libraries is transforming revenue models in the in-home karaoke market. Cloud-connected systems provide access to extensive, regularly updated music catalogs across multiple languages and genres. This reduces reliance on physical media and increases customer retention through recurring revenue streams. Partnerships with music streaming platforms and regional content providers are enabling localized offerings, which are especially important in the Asia-Pacific and emerging markets. As broadband penetration improves globally, subscription-driven karaoke ecosystems are expected to become the standard.

What are the key drivers in the in-home karaoke market?

Expansion of Home Entertainment and Social Interaction

The growing focus on at-home leisure and social entertainment is a major driver of the in-home karaoke market. Consumers are increasingly investing in interactive entertainment that can be enjoyed with family and friends. Karaoke systems complement smart TVs, gaming consoles, and sound systems, positioning them as essential components of modern home entertainment setups. Urban households and hybrid work lifestyles have further amplified demand for engaging in indoor activities.

Technological Convergence and Ease of Use

Advancements in wireless connectivity, compact hardware design, and seamless integration with smartphones and smart TVs have significantly improved usability. Plug-and-play functionality, wireless microphones, and rechargeable systems have lowered barriers to adoption. These innovations are driving higher penetration across both developed and emerging markets.

What are the restraints for the global market?

High Content Licensing and Regional Restrictions

One of the key restraints in the in-home karaoke market is the cost and complexity associated with music licensing. Securing rights across multiple regions increases operational expenses and can limit song availability, particularly in emerging markets. These challenges can impact pricing and reduce competitiveness for smaller manufacturers.

Price Sensitivity and Competition from Mobile Apps

In price-sensitive regions, low-cost unbranded devices and free or freemium mobile karaoke applications compete directly with dedicated hardware systems. While apps offer convenience, they often lack audio quality and immersive experience, creating a trade-off that manufacturers must address through value-driven pricing strategies.

What are the key opportunities in the in-home karaoke industry?

Emerging Market Expansion

Rapid urbanization, rising disposable incomes, and increasing internet penetration in markets such as India, Southeast Asia, Latin America, and the Middle East present significant growth opportunities. Penetration of branded karaoke systems remains relatively low in these regions, allowing new entrants and existing players to capture first-mover advantages through localized products and pricing.

Integration with Content Creation and Live Streaming

The rise of home-based digital creators and live-streaming platforms offers new growth avenues. Karaoke systems tailored for content creation, with features such as studio-grade microphones and direct streaming integration, are expected to attract influencers and aspiring musicians, expanding the market beyond traditional entertainment use.

Product Type Insights

Standalone karaoke machines continue to dominate the in-home karaoke market, accounting for approximately 38% of global revenue in 2024. Their dominance is largely due to their ease of use, plug-and-play functionality, affordability, and broad price availability, which make them highly accessible to a wide consumer base. The strong adoption in the Asia-Pacific region is further bolstered by cultural affinity for karaoke, home entertainment traditions, and the availability of localized song libraries. Smart karaoke systems, on the other hand, represent the fastest-growing segment, driven by AI-powered vocal enhancement, cloud-based song libraries, real-time pitch correction, and seamless smartphone or smart TV integration. This segment is particularly appealing to tech-savvy consumers and younger users who seek interactive and socially shareable entertainment experiences. Microphone-only and TV-integrated systems cater to budget-conscious consumers and households with minimal space, while gaming console-compatible karaoke devices target casual singers and younger demographics, leveraging the gaming ecosystem to increase engagement.

Connectivity Insights

Connectivity remains a key determinant of market adoption. Online and cloud-connected karaoke systems capture nearly 48% of the global market, fueled by demand for real-time content updates, interactive features, and subscription-based music access. Consumers increasingly prefer the ability to access vast libraries of multilingual songs, personalize their singing experience, and share performances across social media platforms. Hybrid connectivity systems, which combine offline storage with online access, are gaining traction in regions with inconsistent internet infrastructure, offering flexibility and reliability. Purely offline systems continue to serve entry-level users and rural markets, providing affordability and ease of use where broadband penetration is limited.

Distribution Channel Insights

Online retail channels dominate, accounting for approximately 52% of global sales. The growth of e-commerce platforms and brand-owned websites enables consumers to compare prices, access detailed product reviews, and purchase conveniently from home. These channels also support direct-to-consumer marketing strategies, subscription bundle offerings, and product customization. Offline retail remains important for premium and high-end systems, where hands-on demonstrations, superior audio testing, and expert guidance influence purchase decisions. Specialty electronics stores and music-focused retail outlets also play a role in building brand trust and facilitating in-person experiences.

End-Use Insights

Residential households represent the largest end-use segment, contributing over 85% of total demand. Growth is strongest among urban families, young professionals, and middle-to-high income households seeking interactive home entertainment solutions. Additionally, the rising popularity of home-based content creation is creating a rapidly emerging segment, growing at a CAGR of over 12%. This trend is fueled by social media, live streaming platforms, and short-form video content creation, which drive demand for smart karaoke systems with AI vocal enhancement, studio-quality microphones, and cloud-connected song libraries.

| By Product Type | By Connectivity | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global in-home karaoke market with approximately 42% market share in 2024. China accounts for nearly 18% of global demand, driven by a strong manufacturing base, cultural affinity for karaoke, and increasing disposable incomes. Premium system adoption in Japan and South Korea is fueled by technology-savvy populations, high smartphone penetration, and the presence of established local karaoke brands. India is the fastest-growing market in the region, with a CAGR exceeding 13%, propelled by urbanization, rising middle-class income, increasing broadband penetration, and growing digital content consumption. Overall regional growth is supported by favorable demographics, cultural entertainment trends, and a high penetration of connected devices.

North America

North America holds around 26% of the global market, with the United States leading demand. High disposable income, widespread adoption of smart homes, and preference for premium consumer electronics are key growth drivers. AI-enabled karaoke systems and subscription-based content services are particularly popular, meeting the needs of consumers seeking interactive, home-based social entertainment. Canada also shows steady growth, supported by rising urban household entertainment spending and the trend toward family-friendly interactive devices. Increasing awareness of social entertainment and music-based wellness experiences further fuels regional adoption.

Europe

Europe accounts for approximately 18% of the global market, with Germany, the U.K., and France as the largest contributors. Regional growth is driven by rising consumer interest in home entertainment, music-based leisure, and technology-integrated devices. Adoption of smart karaoke systems is higher in Western Europe, where households prioritize interactive, AI-enhanced, and subscription-driven solutions. The region also benefits from a strong e-commerce infrastructure and cultural openness to home-based entertainment, with growing demand among younger demographics and urban families.

Latin America

Latin America contributes steadily to global demand, led by Brazil and Mexico. Growth is driven by expanding e-commerce penetration, rising affordability of mid-range systems, and increasing awareness of interactive home entertainment. Social media influence and mobile gaming trends also encourage the adoption of karaoke systems. Entry-level and smart-integrated devices are witnessing stronger growth due to rising disposable incomes among urban middle-class consumers and growing interest in family-oriented leisure activities.

Middle East & Africa

The Middle East & Africa region shows emerging potential, particularly in the UAE and Saudi Arabia, driven by high-income households, growing urbanization, and preference for premium home entertainment systems. Rapid adoption of smart homes, strong purchasing power, and exposure to global trends in social entertainment are key drivers. Additionally, increasing broadband penetration and cultural interest in interactive leisure activities are expanding demand for AI-enabled and cloud-connected karaoke systems in urban centers across this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the In-Home Karaoke Market

- Yamaha Corporation

- Sony Group Corporation

- Panasonic Corporation

- Pioneer Corporation

- Bose Corporation

- Singing Machine Company

- MagicSing

- TJ Media

- iKarao

- Karaoke USA

- Platinum Karaoke

- Acesonic

- BMB Corporation

- VocoPro

- MiCare