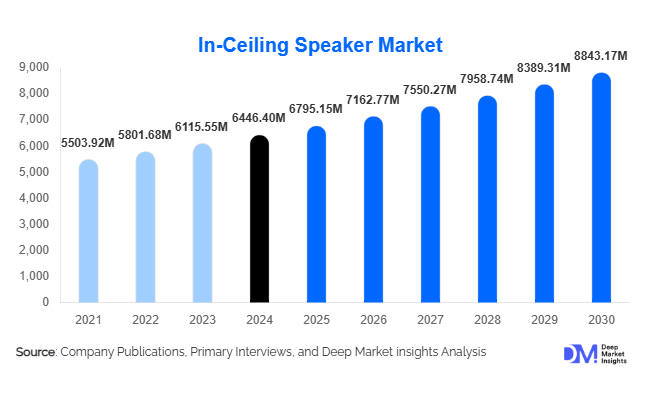

In-Ceiling Speaker Market Size

According to Deep Market Insights, the global in-ceiling speaker market size was valued at USD 6,446.40 million in 2024 and is projected to grow from USD 6,795.15 million in 2025 to reach USD 8,843.17 million by 2030, expanding at a CAGR of 5.41% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of smart homes, rising demand for high-quality home theater and multi-room audio systems, and expansion of commercial and institutional infrastructure requiring integrated audio solutions.

Key Market Insights

- Smart home adoption is fueling demand for Wi-Fi and Bluetooth-enabled in-ceiling speakers, allowing consumers to control audio systems via mobile apps and voice assistants.

- Residential applications dominate the market, as homeowners increasingly invest in aesthetically integrated audio solutions for home theaters, living rooms, and multi-room setups.

- Commercial and institutional adoption is rising, driven by offices, hotels, restaurants, and educational institutions seeking background music and PA systems to enhance customer and employee experiences.

- North America and Europe collectively account for the largest market share, while Asia-Pacific is emerging as the fastest-growing region due to urbanization, infrastructure development, and rising disposable income.

- Technological innovation, including compact designs, wireless connectivity, and high-fidelity sound, is reshaping consumer preferences and enabling premium solutions in both residential and commercial spaces.

What are the latest trends in the in-ceiling speaker market?

Smart and Connected Audio Integration

Integration of in-ceiling speakers with smart home ecosystems is a key trend. Wi-Fi and Bluetooth-enabled models are gaining traction due to compatibility with voice assistants, remote control via mobile apps, and multi-room audio systems. This trend aligns with consumer preferences for convenience and seamless automation in residential spaces. Additionally, smart speakers are being increasingly adopted in commercial settings, providing centralized control for background music and PA systems, enhancing operational efficiency in offices, retail stores, and hotels.

Premium Residential and Home Theater Applications

Home theater systems are driving high-value adoption of in-ceiling speakers. Consumers are upgrading to immersive audio experiences with multi-speaker configurations, subwoofers, and surround sound setups. Compact designs and aesthetic integration with ceilings make in-ceiling speakers more desirable than traditional standalone options. In parallel, rising disposable income in developed regions enables households to invest in premium solutions with advanced sound quality and wireless features, expanding the market for high-end residential audio systems.

What are the key drivers in the in-ceiling speaker market?

Growing Smart Home Penetration

Increasing adoption of smart homes worldwide is driving demand for connected in-ceiling speakers. Consumers prefer integrated audio solutions that work with voice assistants and mobile applications. The proliferation of IoT devices has accelerated adoption, particularly in North America and Europe, where multi-room audio and smart home setups are mainstream.

Expansion of Commercial Infrastructure

Hotels, restaurants, offices, and retail spaces are investing in in-ceiling speakers for background music and PA systems to improve customer and employee experience. Public infrastructure projects in airports, educational institutions, and hospitals also contribute to rising demand for high-performance audio solutions.

Technological Advancements

Advancements in wireless technology, energy efficiency, and acoustic design have enhanced the performance and aesthetics of in-ceiling speakers. Compact, slim-profile designs, coupled with high-fidelity sound, are attracting consumers in both residential and commercial segments.

What are the restraints for the global market?

High Initial Cost

Premium in-ceiling speaker systems, especially smart and multi-room solutions, come with high upfront costs. This restricts adoption in price-sensitive markets, particularly in developing regions. Consumers may opt for alternative audio solutions like soundbars or portable speakers to reduce costs.

Competition from Alternative Audio Solutions

Portable speakers, soundbars, and wall-mounted systems offer easier installation and lower costs, creating competition for in-ceiling speakers. This limits penetration in segments where consumers prioritize affordability and ease of setup over integrated audio solutions.

What are the key opportunities in the in-ceiling speaker market?

Smart Home and IoT Integration

The rise of smart homes provides opportunities to introduce Wi-Fi and Bluetooth-enabled in-ceiling speakers that can be integrated into multi-room audio systems. Voice assistant compatibility, app-based control, and home automation integration offer significant growth potential for residential applications.

Expansion in Commercial and Institutional Sectors

Hotels, offices, retail stores, airports, and educational institutions are increasingly adopting high-performance in-ceiling speakers for background music and PA systems. Partnerships with real estate developers and system integrators can help manufacturers capture these large-scale commercial opportunities.

Emerging Markets Growth

APAC and MEA regions are witnessing rapid urbanization and infrastructure development. Rising disposable incomes and new real estate projects create high demand for residential and commercial audio solutions. Localized manufacturing, cost-effective products, and collaborations with real estate developers are key opportunities to capture market share in these regions.

Product Type Insights

Smart in-ceiling speakers (Wi-Fi/Bluetooth-enabled) are the leading product type, accounting for approximately 35% of the 2024 market. Their popularity is driven by smart home adoption and wireless connectivity, enabling multi-room audio and voice assistant integration. Stereo and surround sound speakers remain significant in home theater setups, while subwoofers cater to niche premium demand for enhanced bass performance.

Application Insights

Home theater systems are the largest application segment, contributing roughly 40% of 2024 revenue. Residential installations dominate volume, but commercial applications such as background music and PA systems in offices, hotels, and educational institutions are gaining traction. Smart home integration and IoT-enabled applications are the fastest-growing sub-segments, reflecting consumer preference for automated audio experiences.

Distribution Channel Insights

E-commerce platforms accounted for approximately 28% of the 2024 market and are the fastest-growing distribution channel. Online platforms provide convenience, product variety, and price transparency. Direct B2B sales remain important for commercial projects, while retail stores and system integrators cater to residential and specialized installations.

End-Use Insights

Residential applications dominate, driven by smart home adoption, home theaters, and multi-room audio. Commercial and institutional segments are experiencing strong growth, particularly in hospitality, office, and educational sectors. Emerging sectors, including healthcare and public infrastructure, are starting to adopt integrated audio systems, creating additional market opportunities. Export-driven demand from North America and Europe to developing APAC regions is also significant.

| By Product Type | By Installation Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, accounting for 38% of the global market share in 2024. The U.S. leads due to high smart home penetration, commercial infrastructure, and consumer spending on premium audio. Canada shows steady adoption in residential smart homes and commercial setups.

Europe

Europe holds approximately 30% of the 2024 market share, led by Germany and the U.K. Demand is driven by smart home adoption, commercial projects, and premium home theater systems. Southern and Eastern Europe exhibit moderate growth, primarily through residential applications.

Asia-Pacific

APAC is the fastest-growing region with an estimated CAGR of 8% through 2030. China, India, Japan, and South Korea are major contributors, driven by urbanization, real estate development, and rising middle-class income. Emerging smart home adoption in India and China is rapidly boosting residential market demand.

Middle East & Africa

MEA demand is led by the UAE, Saudi Arabia, and South Africa, supported by luxury residential projects and commercial infrastructure. Regional growth is moderate but rising due to new construction projects and commercial audio system adoption.

Latin America

Brazil and Mexico are the leading markets, with moderate growth driven by commercial applications and premium residential installations. Export-driven demand from North America and Europe contributes to the segment’s expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the In-Ceiling Speaker Industry

- Bose Corporation

- Sonos, Inc.

- Harman International (Samsung)

- Klipsch Group, Inc.

- Yamaha Corporation

- Bowers & Wilkins

- Denon

- Polk Audio

- Definitive Technology

- Focal-JMlab

- Monitor Audio

- Bang & Olufsen

- JBL Professional

- Niles Audio

- Russound

Recent Developments

- In June 2025, Sonos launched a new multi-room smart in-ceiling speaker system with enhanced wireless connectivity and voice assistant integration.

- In March 2025, Bose Corporation introduced energy-efficient, high-fidelity in-ceiling speakers designed for commercial installations in hotels and office complexes.

- In January 2025, Klipsch expanded its home theater in-ceiling speaker portfolio in North America, focusing on premium sound quality and compact aesthetics for residential applications.