Immersive Horror Games Market Size

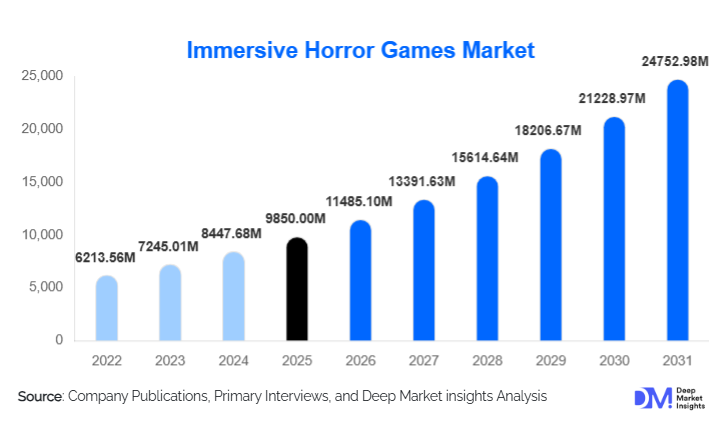

According to Deep Market Insights, the global immersive horror games market size was valued at USD 9,850 million in 2025 and is projected to grow from USD 11,485.10 million in 2026 to reach USD 24,752.98 million by 2031, expanding at a CAGR of 16.6% during the forecast period (2026–2031). The immersive horror games market growth is primarily driven by rising demand for highly realistic and emotionally engaging gaming experiences, rapid adoption of virtual reality (VR) and mixed reality technologies, and increasing consumer preference for narrative-driven, psychological horror gameplay.

Key Market Insights

- VR-based immersive horror games are the fastest-growing segment, benefiting from advancements in haptic feedback, spatial audio, and motion tracking.

- Single-player narrative horror titles dominate global revenues, as players increasingly favor story-rich and psychologically intense experiences.

- North America leads the global market, supported by high consumer spending, advanced gaming infrastructure, and a strong developer ecosystem.

- Asia-Pacific is the fastest-growing region, driven by rapid VR adoption, expanding gaming populations, and rising disposable incomes.

- Premium one-time purchase models remain dominant, though in-game purchases and episodic DLCs are gaining traction.

- Location-based entertainment (LBE), including VR arcades and horror escape rooms, is emerging as a high-margin growth channel.

What are the latest trends in the immersive horror games market?

Rise of VR-First and Mixed-Reality Horror Experiences

Developers are increasingly prioritizing VR-first horror titles designed specifically for head-mounted displays rather than adapting traditional games. These experiences leverage room-scale movement, realistic environmental interaction, and spatial sound to induce deeper fear responses. Mixed-reality horror, blending real-world environments with digital threats, is also gaining traction, particularly in experimental and location-based formats. This trend is reshaping player expectations by delivering heightened immersion and sensory realism that conventional platforms cannot replicate.

AI-Driven Adaptive Horror Gameplay

Artificial intelligence is playing a growing role in immersive horror games by enabling adaptive difficulty, unpredictable enemy behavior, and dynamic storytelling. AI systems can analyze player behavior, fear responses, and decision-making patterns to adjust pacing, scare intensity, and narrative outcomes in real time. This personalization enhances replayability and emotional engagement, making AI-powered horror experiences particularly attractive to both hardcore gamers and content creators.

What are the key drivers in the immersive horror games market?

Advancements in Immersive Gaming Technologies

Rapid improvements in VR headsets, graphics engines, motion capture, and real-time rendering are significantly improving the quality of immersive horror experiences. Lower hardware costs and better performance have made immersive gaming more accessible to a broader audience, directly supporting market expansion.

Growing Demand for Experiential and Emotional Entertainment

Modern gamers increasingly seek emotionally intense and memorable experiences rather than purely skill-based gameplay. Immersive horror games fulfill this demand by combining fear, storytelling, and interactivity. Streaming platforms and social media have further amplified interest, as horror content performs strongly in live-streamed and recorded formats.

What are the restraints for the global market?

High Development Costs and Technical Complexity

Developing immersive horror games requires significant investment in advanced graphics, AI systems, sound design, and testing to ensure player comfort and safety. These high costs can limit market entry for smaller studios and increase financial risk.

Health, Safety, and Regulatory Concerns

Motion sickness, psychological stress, and age-appropriate content regulations present challenges for developers. Compliance with health guidelines and regional rating standards can delay releases and increase operational costs.

What are the key opportunities in the immersive horror games industry?

Expansion of Location-Based Entertainment (LBE)

VR arcades, horror-themed attractions, and immersive escape rooms represent a major growth opportunity. These venues enable premium pricing and attract consumers seeking social, out-of-home experiences. Urban centers in Asia-Pacific and the Middle East are emerging as strong demand hubs for LBE horror installations.

Cross-Industry Applications Beyond Entertainment

Immersive horror environments are increasingly used in military, law enforcement, and emergency response training to simulate high-stress scenarios. Additionally, controlled horror experiences are being explored in psychological therapy and resilience training, opening new non-gaming revenue streams.

Platform Type Insights

VR headset-based immersive horror games account for approximately 34% of global market revenue in 2025, making them the leading platform segment. This dominance is driven by the platform’s ability to deliver unparalleled sensory immersion through room-scale movement, spatial audio, haptic feedback, and 360-degree visual environments. Horror as a genre benefits disproportionately from VR adoption, as fear intensity, psychological engagement, and presence are significantly amplified compared to traditional platforms. Premium pricing of VR titles and accessories further contributes to higher average revenue per user, reinforcing this segment’s leadership.

PC-based immersive horror games remain a strong and stable segment, supported by high-performance hardware availability, advanced graphics capabilities, and active modding communities that extend game lifecycles. PC platforms also serve as the primary development and testing environment for experimental horror mechanics, including AI-driven enemies and procedural scare generation. Console-based immersive horror games continue to benefit from large installed user bases across PlayStation and Xbox ecosystems. Consoles offer a balance between accessibility and performance, enabling developers to reach mass audiences with polished horror titles. Meanwhile, mobile immersive horror games represent a smaller but rapidly evolving segment, driven by casual gaming adoption, AR-enabled horror experiences, and increasing smartphone processing power, particularly in emerging markets.

Gameplay Format Insights

Single-player narrative horror games dominate the immersive horror games market with nearly 41% market share in 2025. This leadership is primarily driven by strong consumer preference for story-driven psychological horror, where controlled pacing, atmospheric tension, and narrative depth are central to the experience. Developers are increasingly leveraging cinematic storytelling, branching narratives, and environmental storytelling to deliver emotionally intense, personalized fear experiences that resonate across global audiences.

Multiplayer cooperative horror games are the fastest-growing gameplay format, gaining popularity among younger demographics and social gamers seeking shared fear and collaborative survival experiences. Streaming culture and content creation on platforms such as Twitch and YouTube have further accelerated adoption, as cooperative horror content performs strongly with online audiences. Competitive multiplayer horror remains a niche segment but is expanding steadily through asymmetrical gameplay formats and esports-adjacent experimentation. While currently smaller in revenue contribution, this segment benefits from high replayability and community-driven engagement models.

Revenue Model Insights

Premium one-time purchases account for over 52% of the total immersive horror games market revenue, reflecting strong consumer willingness to pay upfront for high-quality, content-rich horror experiences. This revenue model is particularly dominant in VR and AAA horror titles, where production quality, realism, and narrative depth justify premium pricing.

In-game purchases and downloadable content (DLC) are growing at a faster rate than base game sales, driven by episodic horror storytelling, expansion packs, cosmetic customization, and post-launch narrative extensions. Developers increasingly use DLC models to extend game lifecycles and stabilize recurring revenue streams. Subscription-based revenue models are gaining traction through cloud gaming services and bundled game libraries, especially in North America and Europe. These models lower entry barriers for players and encourage experimentation with immersive horror titles, benefiting both publishers and emerging developers.

End-Use Environment Insights

Home entertainment remains the dominant end-use environment, accounting for approximately 63% of total market demand in 2025. Growth in this segment is driven by widespread adoption of consoles, gaming PCs, and standalone VR headsets, coupled with increasing time spent on digital entertainment. Improvements in home VR comfort and accessibility are further strengthening this segment’s leadership.

Commercial gaming centers and VR arcades represent the fastest-growing end-use segment, expanding at over 19% CAGR. Growth is fueled by urbanization, demand for social gaming experiences, and the ability of location-based venues to offer premium, high-intensity horror experiences that are difficult to replicate at home. Theme parks, immersive attractions, and professional training simulations are emerging as niche but high-value applications. Horror-based simulations are increasingly used in military, emergency response, and psychological resilience training, adding diversification and long-term stability to market demand.

| By Platform Type | By Gameplay Format | By Revenue Model | By End-Use Environment |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global immersive horror games market in 2025, making it the largest regional market. The United States dominates regional demand due to high consumer spending on premium gaming content, early adoption of VR hardware, and the presence of major game developers and publishers. Strong digital distribution infrastructure, widespread broadband access, and a mature streaming ecosystem further support market growth. Canada contributes steadily through a vibrant indie development scene and strong adoption of narrative-driven horror games.

Europe

Europe holds around 22% market share, led by the U.K., Germany, and France. Regional growth is driven by strong console penetration, increasing VR headset adoption, and cultural acceptance of psychological and narrative-driven horror genres. European consumers show high engagement with story-rich and experimental horror titles, while government support for creative industries and game development incentives in countries such as Germany and France further bolsters market expansion.

Asia-Pacific

Asia-Pacific represents approximately 31% of the global market and is the fastest-growing region, with a CAGR exceeding 18%. Growth is driven by rapidly expanding gaming populations in China, Japan, and South Korea, alongside strong esports culture and rising disposable incomes. Significant investments in VR infrastructure, government-backed digital entertainment initiatives, and widespread mobile gaming adoption are accelerating immersive horror game consumption. Japan’s strong legacy in horror game development and South Korea’s advanced gaming infrastructure further enhance regional leadership.

Latin America

Latin America accounts for a smaller but steadily expanding share of the immersive horror games market. Brazil and Mexico are key growth markets, driven by rising digital distribution, increasing affordability of gaming hardware, and a growing young gamer population. Improved internet penetration and mobile-first gaming behavior are enabling broader access to immersive horror content, particularly through PC and mobile platforms.

Middle East & Africa

The Middle East & Africa region is emerging as a high-potential growth frontier. Countries such as the UAE and Saudi Arabia are investing heavily in gaming ecosystems, entertainment hubs, and VR arcades as part of broader economic diversification strategies. High disposable incomes and strong demand for premium entertainment experiences are supporting immersive horror adoption. South Africa contributes through a growing console and PC gaming base, while regional investments in digital infrastructure are expected to accelerate long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Immersive Horror Games Market

- Capcom

- Konami Holdings

- Sony Interactive Entertainment

- Microsoft Gaming

- Meta Platforms

- Electronic Arts

- Ubisoft

- Bandai Namco Entertainment

- Square Enix

- Take-Two Interactive

- Tencent Games

- Nexon

- Valve Corporation

- NetEase Games

- Epic Games