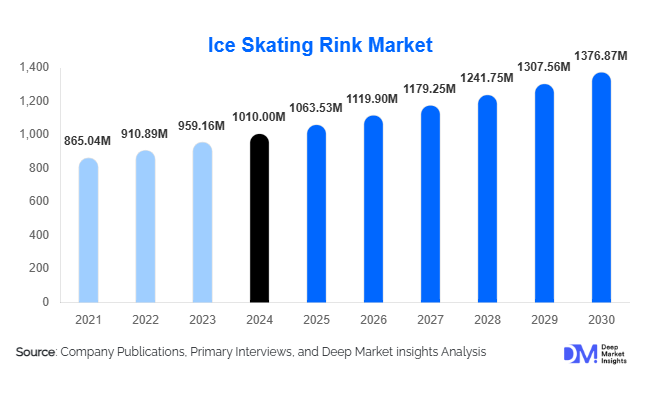

Ice Skating Rink Market Size

According to Deep Market Insights, the global ice skating rink market size was valued at USD 1,010.00 million in 2024 and is projected to grow from USD 1,063.53 million in 2025 to reach USD 1,376.87 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The ice skating rink market growth is primarily driven by rising investments in recreational and sports infrastructure, increasing popularity of experiential leisure activities, and the global expansion of indoor entertainment facilities across both cold and warm climate regions.

Key Market Insights

- Permanent indoor ice skating rinks dominate the global market due to year-round operability and suitability for professional sports and recreation.

- Recreational and leisure skating applications account for over half of global demand, driven by mall-based and community-centered rink installations.

- North America leads the market with a strong ice hockey culture and well-established sports infrastructure.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, mall expansion, and government-backed sports initiatives.

- Energy-efficient and eco-friendly rink technologies are increasingly adopted to reduce operating costs and carbon footprint.

- Temporary and modular ice skating rinks are gaining traction for seasonal events, tourism zones, and festivals.

What are the latest trends in the ice skating rink market?

Growth of Energy-Efficient and Sustainable Ice Rinks

Sustainability has emerged as a defining trend in the ice skating rink market. Operators and governments are increasingly adopting CO₂-based refrigeration systems, heat recovery technologies, and smart temperature controls to reduce energy consumption. These solutions can lower operational energy costs by up to 30–40%, making ice rinks viable even in regions with high electricity tariffs. Sustainability-driven designs are also aligned with ESG mandates, particularly in Europe and North America, where regulatory frameworks encourage low-emission recreational infrastructure.

Expansion of Ice Rinks in Non-Traditional and Warm Regions

Ice skating rinks are expanding beyond traditional cold-climate countries into regions such as the Middle East, Southeast Asia, and Latin America. Indoor rink construction in shopping malls, mixed-use developments, and hospitality projects is accelerating demand. Synthetic ice rinks and modular temporary installations are further supporting this trend by enabling skating experiences without intensive refrigeration, making ice skating accessible in warmer climates.

What are the key drivers in the ice skating rink market?

Rising Demand for Experiential Entertainment

Consumers increasingly prioritize experience-based leisure over traditional retail or passive entertainment. Ice skating rinks offer interactive, family-friendly experiences that enhance dwell time in malls and entertainment complexes. This driver is particularly strong in urban centers, where developers use ice rinks as anchor attractions to boost footfall and ancillary revenues.

Government Investment in Sports and Recreational Infrastructure

Governments worldwide are investing heavily in sports infrastructure to promote physical activity, youth training, and international competitiveness. Ice skating rinks are increasingly incorporated into multi-purpose sports complexes and public recreation facilities. Funding support, subsidies, and public–private partnership models are accelerating large-scale rink development, particularly in Asia-Pacific and Europe.

What are the restraints for the global market?

High Capital and Installation Costs

Permanent ice skating rinks require significant upfront investment for land, refrigeration systems, flooring, and structural insulation. These costs can deter smaller operators and limit adoption in price-sensitive markets. Long payback periods further constrain investment decisions, particularly for standalone facilities.

Energy Consumption and Maintenance Challenges

Ice rinks are energy-intensive facilities requiring continuous cooling and regular maintenance. High electricity prices in certain regions directly impact profitability. While energy-efficient technologies mitigate this issue, their higher initial costs present a trade-off that operators must carefully evaluate.

What are the key opportunities in the ice skating rink industry?

Temporary and Modular Ice Rink Installations

Temporary and modular ice skating rinks present a major opportunity for market expansion. These installations require lower capital investment and offer faster deployment, making them attractive for festivals, tourism destinations, and seasonal events. Their short payback periods and high footfall potential are drawing interest from commercial property owners and event organizers.

Professional Training and Sports Development Facilities

Growing interest in ice hockey, figure skating, and speed skating outside traditional markets is driving demand for professional-grade training rinks. National sports federations and private academies are investing in regulation-sized facilities to support athlete development and international competition participation, creating long-term demand for high-quality rink infrastructure.

Infrastructure Type Insights

Permanent indoor ice skating rinks account for approximately 46% of the global market in 2024, supported by consistent usage and suitability for both recreational and professional activities. Temporary and seasonal rinks are the fastest-growing segment, driven by mall-based pop-ups and tourism-led installations. Permanent outdoor rinks remain concentrated in colder regions and contribute a smaller but stable share of demand.

Technology Insights

Traditional refrigerated ice rinks dominate the market with nearly 62% share, owing to the superior ice quality required for professional sports. However, eco-friendly refrigeration systems and synthetic ice technologies are gaining adoption, particularly in regions prioritizing sustainability and cost efficiency.

Application Insights

Recreational and leisure skating leads the market with approximately 54% share of global demand, driven by public skating sessions and mall-based entertainment. Professional sports and training applications account for a significant share, supported by ice hockey and figure skating facilities. Entertainment and event-based applications, including shows and exhibitions, are emerging as high-growth niches.

End-Use Insights

Shopping malls and commercial complexes represent the largest end-use segment, contributing around 31% of total market demand. Tourism and hospitality facilities are growing rapidly as resorts integrate ice rinks to diversify guest experiences. Sports academies, educational institutions, and community centers continue to provide a steady baseline demand.

| By Infrastructure Type | By Rink Technology | By Application | By Ownership Model | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global ice skating rink market in 2024, led by the United States and Canada. Strong ice hockey participation, established rink infrastructure, and high recreational spending support sustained demand.

Europe

Europe accounts for nearly 29% of the market, driven by Germany, the U.K., France, and Nordic countries. Public funding for community rinks and professional sports facilities underpins steady growth.

Asia-Pacific

Asia-Pacific represents around 22% of global demand and is the fastest-growing region, expanding at over 9% CAGR. China, Japan, South Korea, and India are key growth markets, driven by mall expansion and government sports initiatives.

Latin America

Latin America contributes roughly 7% of the market, with Brazil and Mexico emerging as key adopters of indoor entertainment infrastructure.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of global demand, led by the UAE and Saudi Arabia, where indoor leisure infrastructure is expanding rapidly.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Ice Skating Rink Market

- CIMCO Refrigeration

- Johnson Controls

- Trane Technologies

- GEA Group

- Engie Refrigeration

- Daikin Industries

- Evapco

- Ice-World International

- Mammoth Ice

- Cold Dynamics

- Patinoire Concept

- Fives Group

- Northstar Ice Equipment

- Arctic Ice Arenas

- Turbo Refrigerating