Ice Fishing Line Market Size

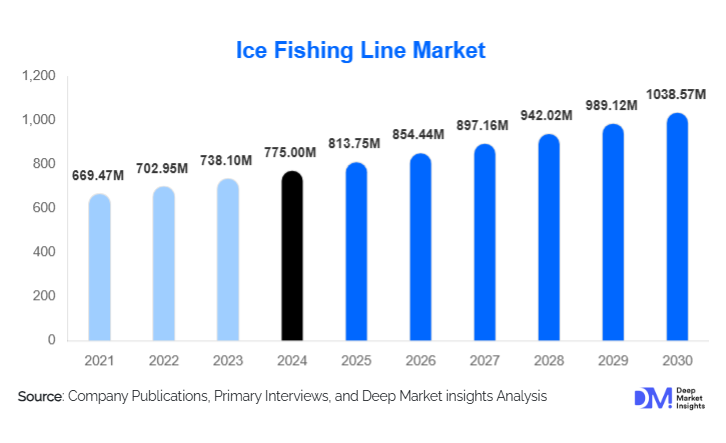

According to Deep Market Insights, the global ice fishing line market size was valued at USD 775.00 million in 2024 and is projected to grow from USD 813.75 million in 2025 to reach USD 1,038.57 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The ice fishing line market growth is primarily driven by rising participation in recreational winter fishing, technological advancements in cold-resistant line materials, and increasing consumer preference for high-performance and premium fishing gear designed specifically for sub-zero environments.

Key Market Insights

- Fluorocarbon ice fishing lines dominate the market due to superior invisibility, abrasion resistance, and low stretch in icy waters.

- North America leads global demand, supported by a strong ice fishing culture in the U.S. and Canada and high per-capita spending on fishing equipment.

- Mid-range ice fishing lines account for the largest revenue share, balancing affordability and performance for recreational anglers.

- E-commerce is the fastest-growing distribution channel, driven by online education, product reviews, and direct-to-consumer strategies.

- Asia-Pacific is the fastest-growing regional market, fueled by rising winter sport participation and increasing disposable income.

- Premiumization and sustainability trends are encouraging innovation in biodegradable coatings and low-memory polymer blends.

What are the latest trends in the ice fishing line market?

Premium and High-Sensitivity Line Adoption

Ice anglers are increasingly adopting premium, high-sensitivity fishing lines that offer enhanced bite detection and reduced line memory under freezing conditions. Fluorocarbon and hybrid-coated lines are gaining traction due to their ability to remain supple in extreme cold while maintaining strength and abrasion resistance. This trend is elevating average selling prices and shifting demand from basic monofilament products toward technologically advanced solutions.

Growth of Digital and Direct-to-Consumer Sales

Online retail platforms and brand-owned e-commerce channels are transforming how ice fishing lines are purchased. Consumers increasingly rely on instructional videos, angler reviews, and influencer recommendations when selecting specialized lines. Subscription-based seasonal gear kits and bundled offerings are also emerging, improving customer retention and smoothing seasonal sales fluctuations.

What are the key drivers in the ice fishing line market?

Rising Participation in Recreational Ice Fishing

Ice fishing has evolved into a mainstream recreational activity across North America and Europe, supported by organized tournaments, guided expeditions, and winter sport festivals. This growth in participation directly drives demand for specialized ice fishing lines that offer reliability and performance in harsh winter conditions.

Advancements in Cold-Resistant Materials

Innovations in polymer science, including fluorocarbon resins, hybrid braiding, and low-water-absorption coatings, are significantly improving product performance. These advancements enhance sensitivity, reduce ice buildup, and extend product lifespan, encouraging frequent upgrades among anglers.

What are the restraints for the global market?

Seasonal and Climate Dependency

The ice fishing line market is highly seasonal and dependent on consistent winter conditions. Shorter ice seasons caused by climate variability can reduce fishing activity, impacting annual sales volumes and inventory planning for manufacturers and retailers.

Raw Material Price Volatility

Fluctuations in the prices of specialty polymers and fluorocarbon materials can increase production costs and compress margins, particularly for smaller manufacturers that lack pricing power.

What are the key opportunities in the ice fishing line industry?

Expansion into Emerging Cold-Climate Regions

Eastern Europe, Northern China, and Central Asia present untapped growth opportunities due to strong winter fishing traditions and increasing government investment in winter tourism infrastructure. Localized production and targeted branding can help manufacturers penetrate these markets.

Sustainable and Eco-Friendly Product Development

Growing environmental awareness is creating opportunities for biodegradable lines, recyclable spools, and reduced microplastic-shedding materials. Companies that align with sustainability standards can gain a competitive advantage, particularly in European export markets.

Material Type Insights

Fluorocarbon ice fishing lines lead the global market, accounting for approximately 38% of total revenue in 2024, primarily due to their superior performance characteristics in clear and icy water conditions. Fluorocarbon lines offer near invisibility underwater, low stretch, high abrasion resistance, and minimal water absorption, making them highly effective in sub-zero environments where fish exhibit cautious behavior. These attributes have made fluorocarbon the preferred choice among experienced anglers targeting species such as walleye, trout, and panfish in clear, frozen lakes, directly contributing to its revenue leadership.

Monofilament ice fishing lines continue to maintain a strong presence, particularly among beginner and recreational anglers, due to their affordability, ease of handling, and forgiving knot strength. This segment benefits from entry-level participation and casual fishing activity, especially in family-oriented ice fishing setups. Meanwhile, braided and hybrid-coated lines are witnessing growing adoption among advanced anglers seeking higher tensile strength, enhanced sensitivity, and reduced diameter for deeper or multi-species ice fishing. Although these segments hold smaller shares individually, they are expected to grow steadily as premiumization and performance-driven purchasing trends strengthen globally.

Line Strength Insights

Ice fishing lines in the 4–8 lb test range dominate the market with nearly 34% share in 2024, as this strength range offers the optimal balance between sensitivity and strength required for the most commonly targeted ice fishing species, including panfish and walleye. These species account for a significant proportion of recreational ice fishing activity, particularly in North America and Northern Europe, driving consistent demand for mid-strength lines. The versatility of this segment allows anglers to fish in varying depths while maintaining bite detection accuracy, making it the most widely adopted line strength category.

Lines below 4 lb test are preferred for ultra-light and high-sensitivity applications, particularly for shallow-water panfish fishing where subtle bite detection is critical. Conversely, lines above 15 lb test cater to niche but important use cases such as pike, lake trout, and multi-species ice fishing in deeper or structurally complex waters. While these heavier lines represent a smaller share of total volume, they command higher price points and contribute disproportionately to value growth in premium segments.

Application Insights

Recreational ice fishing represents the largest application segment, accounting for approximately 72% of total global demand in 2024. This dominance is supported by widespread participation in hobbyist ice fishing, family-oriented winter outdoor activities, and community-based fishing events across cold-climate regions. Recreational anglers tend to replace fishing lines frequently due to wear, freezing damage, and seasonal upgrades, creating a stable replacement-driven demand cycle that underpins market growth.

Professional and tournament ice fishing remains a smaller segment in absolute terms, but it is the fastest-growing application category. Growth in this segment is driven by increased sponsorships, organized competitions, media coverage, and social media-driven visibility of competitive ice fishing. Professional anglers typically prefer premium fluorocarbon and hybrid lines, accelerating value growth and innovation within this segment.

Distribution Channel Insights

Specialty fishing and outdoor retail stores remain the leading distribution channel, accounting for approximately 45% of global market share in 2024. Their dominance is driven by the technical nature of ice fishing lines, where in-store expertise, product recommendations, and hands-on guidance play a crucial role in purchase decisions. These stores are particularly influential for first-time buyers and premium product purchasers.

However, e-commerce and direct-to-consumer channels now represent over 27% of global sales and are expanding rapidly. Growth in online channels is supported by increased access to educational content, detailed product comparisons, and influencer marketing. Digital platforms are also enabling manufacturers to bypass intermediaries, improve margins, and engage directly with consumers through subscription models and bundled seasonal offerings.

| By Material Type | By Line Strength | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 46% of the global ice fishing line market in 2024, making it the largest regional market worldwide. The United States leads demand, particularly across the Midwest and Northern states such as Minnesota, Wisconsin, Michigan, and North Dakota, where ice fishing is deeply embedded in regional culture. Canada follows closely, driven by extensive freshwater resources, long winter seasons, and high per-capita participation rates.

Key growth drivers in North America include strong recreational fishing infrastructure, high disposable income, frequent equipment upgrades, and widespread participation in organized ice fishing tournaments. Additionally, the presence of leading manufacturers and well-developed retail networks further supports sustained regional dominance.

Europe

Europe holds around 28% of the global market share, led by Sweden, Finland, Norway, and Russia. Ice fishing in this region is both a traditional activity and a recreational sport, supported by government-backed winter tourism initiatives and cultural familiarity with cold-climate fishing. Regional growth is driven by increasing emphasis on sustainable outdoor recreation, strong adoption of premium fishing equipment, and rising participation in winter sports tourism. Northern and Eastern European countries benefit from long ice seasons, stable participation rates, and growing cross-border tourism focused on winter fishing experiences.

Asia-Pacific

Asia-Pacific accounts for approximately 15% of the global ice fishing line market and is the fastest-growing region, with a CAGR exceeding 8.5%. Northern China, Japan, and South Korea are the primary contributors, supported by rising disposable income, growing interest in winter recreational activities, and increased government promotion of cold-climate sports tourism. Regional growth is further supported by expanding e-commerce penetration, improving access to premium imported fishing gear, and increasing the influence of digital content showcasing ice fishing techniques and equipment.

Latin America

Latin America remains a niche market due to limited climatic suitability for ice fishing. However, outbound demand for imported ice fishing gear is gradually increasing among affluent consumers and hobbyists in countries such as Brazil, Argentina, and Chile. This demand is largely driven by international travel to North America and Europe, exposure through digital media, and the growing popularity of niche winter sport experiences among high-income segments.

Middle East & Africa

Demand in the Middle East & Africa remains minimal due to climatic constraints and a lack of natural ice fishing environments. Sales are primarily driven by expatriate communities, specialty retailers, and limited hobbyist participation.

Growth opportunities in this region are largely indirect, supported by outbound tourism, e-commerce imports, and niche demand from collectors and professional anglers rather than domestic participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Fishing Line Market

- Berkley

- Sufix

- Seaguar

- Stren

- Clam Outdoors

- Piscifun

- PowerPro

- Vicious Fishing

- KastKing

- Momoi Fishing