Hydromassage Bed Market Size

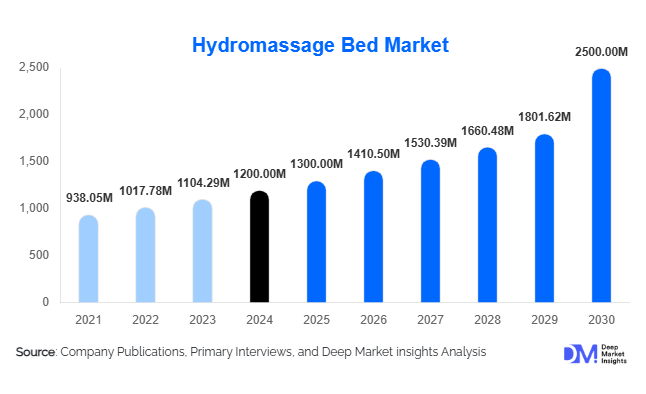

According to Deep Market Insights, the global hydromassage bed market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,300 million in 2025 to reach USD 2,500 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The hydromassage bed market growth is primarily driven by increasing consumer focus on wellness and relaxation, rising adoption of non-invasive therapies, and integration of smart technologies such as AI and IoT for personalized massage experiences.

Key Market Insights

- Demand for wellness-oriented solutions is accelerating globally, with consumers and commercial establishments seeking stress relief and therapeutic products.

- Commercial adoption dominates the market, particularly in spas, wellness centers, and rehabilitation facilities that aim to enhance service offerings.

- North America leads the market, driven by high disposable incomes and a strong culture of health and wellness adoption.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class wealth, urbanization, and increasing awareness of health benefits.

- Technological integration, including smart beds with customizable pressure, temperature controls, and app-based usage analytics, is redefining product appeal and consumer engagement.

- Emerging markets and regulatory support are encouraging manufacturers to expand production and improve accessibility through local manufacturing initiatives.

Latest Market Trends

Integration of Smart Technologies

Hydromassage beds are increasingly incorporating IoT, AI, and app-based controls for personalized experiences. Users can now customize massage intensity, duration, and heat settings, while commercial operators can monitor usage patterns, optimize maintenance schedules, and provide tailored therapy plans. This trend is driving higher adoption in wellness centers, gyms, and rehabilitation clinics that value efficiency and customer satisfaction.

Wellness-Oriented Commercial Applications

Commercial use of hydromassage beds in spas, fitness clubs, and rehabilitation centers continues to expand. These beds are positioned as premium wellness solutions, promoting relaxation, muscle recovery, and stress relief. Integration with loyalty programs and health tracking apps further strengthens the market, appealing to health-conscious consumers seeking technologically advanced wellness options.

Hydromassage Bed Market Drivers

Growing Wellness Awareness

Increasing global awareness of physical and mental wellness is fueling demand. Consumers and commercial establishments are investing in non-invasive therapies for stress reduction, muscle relaxation, and post-workout recovery, boosting hydromassage bed adoption.

Technological Advancements

Innovations such as ergonomic designs, adjustable water pressure, heat therapy, and connectivity with mobile apps are enhancing the user experience. These advancements help differentiate premium products and drive sales in both commercial and residential segments.

Rising Disposable Incomes in Emerging Markets

Urbanization and income growth in regions like Asia-Pacific and Latin America are enabling more consumers to invest in wellness products. The rising affordability of premium and mid-range hydromassage beds is expanding market reach significantly.

Market Restraints

High Acquisition and Maintenance Costs

The initial purchase and maintenance of hydromassage beds are expensive, limiting adoption among small wellness centers and residential users. Cost sensitivity may slow market penetration, particularly in price-conscious regions.

Regulatory and Compliance Challenges

Varying health and safety regulations across countries can complicate market entry and product approval. Compliance costs and delayed certifications may restrict the speed of new product launches.

Hydromassage Bed Market Opportunities

Expansion into Emerging Economies

Markets such as India, China, Brazil, and Mexico are witnessing rising demand due to increasing health awareness and disposable incomes. Manufacturers can leverage local production, partnerships with wellness centers, and targeted marketing campaigns to capture market share.

Integration with IoT and AI Technologies

Smart hydromassage beds that allow customization, predictive maintenance, and real-time analytics offer unique selling points. Incorporating AI-driven therapy suggestions and IoT-based usage monitoring can attract premium clients and commercial buyers.

Product Type Insights

Fixed hydromassage beds dominate the market, accounting for approximately 60% of the global share in 2024. Their durability, reliability, and preference in commercial applications like spas and rehabilitation centers drive this segment’s leadership. Adjustable and portable beds are gaining traction, especially in residential and boutique wellness markets.

Application Insights

Commercial applications represent the largest segment, driven by spas, wellness centers, and fitness clubs. Residential use is growing steadily as consumers increasingly adopt at-home wellness solutions. Rehabilitation and medical therapy applications are emerging as new avenues, supporting post-operative recovery and physiotherapy treatments.

Distribution Channel Insights

Direct sales by manufacturers and online platforms dominate market distribution. Partnerships with wellness chains, spas, and fitness clubs ensure bulk adoption, while e-commerce facilitates consumer access to residential models. Multi-channel distribution helps manufacturers reach both commercial and residential end-users effectively.

End-Use Segment Insights

Commercial end-users remain the primary driver of market growth, with wellness centers, spas, and rehabilitation facilities adopting hydromassage beds for premium offerings. Residential end-use is expanding, particularly in North America and the Asia-Pacific. Emerging applications in the medical and physiotherapy sectors further extend market potential. Export-driven demand is led by North America and Europe, with Asia-Pacific and Latin America showing robust growth prospects.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a significant share (35% in 2024), led by the U.S. and Canada. High disposable incomes, wellness awareness, and a mature commercial spa sector are driving adoption. Advanced technology integration is also supporting growth in this region.

Europe

Europe accounts for 28% of the global market in 2024, with Germany, the U.K., and France leading demand. Wellness-focused hospitality, urban health centers, and high adoption of premium products make Europe a stable market with moderate growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India leading the expansion. Rising urbanization, disposable income, and health consciousness are driving the rapid adoption of hydromassage beds in both commercial and residential sectors.

Latin America

Brazil and Mexico show steady growth due to increasing wellness awareness and luxury spa development. The region is emerging as an important market for premium commercial solutions.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are key markets. Luxury wellness adoption and high disposable incomes in the Middle East, combined with Africa’s emerging wellness tourism sector, are driving market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hydromassage Bed Market

- JTL Enterprises

- Aquamassage

- Sidmar

- Trautwein

- Meden-Inmed

- Böckelt

- FRANCE REVAL

- NM Stahlgerate

- OG Wellness Technologies

- Somethy

- ITC Co., Ltd.

- Unbescheiden

- Vismara

- Oshima Industries

- Hydromassage Inc.

Recent Developments

- In June 2025, Sidmar launched a new smart hydromassage bed with AI-based therapy personalization, targeting commercial wellness centers in North America and Europe.

- In April 2025, Aquamassage expanded production facilities in China to meet rising demand in the Asia-Pacific and improve export capabilities.

- In February 2025, JTL Enterprises introduced an eco-friendly hydromassage bed line with water-efficient technology and app-controlled features for residential users.