Hybrid Mattress Market Size

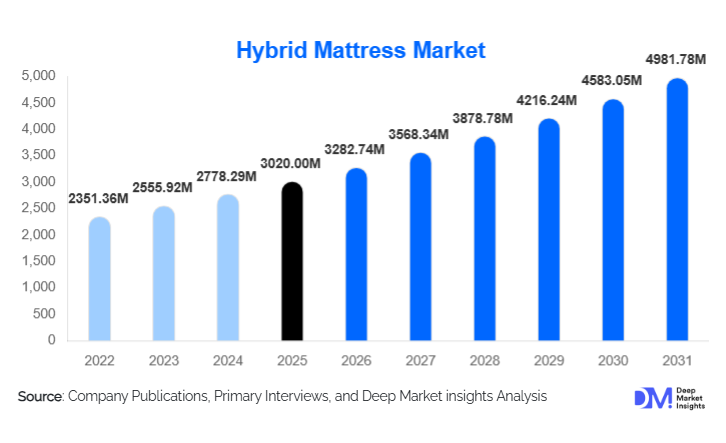

According to Deep Market Insights, the global hybrid mattress market size was valued at USD 3,020.00 million in 2024 and is projected to grow from USD 3,282.74 million in 2025 to reach USD 4,981.78 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The hybrid mattress market growth is driven by rising consumer awareness of sleep health, increasing preference for premium and comfort-oriented bedding products, and the growing adoption of hybrid designs that combine foam-based pressure relief with innerspring support systems.

Key Market Insights

- Hybrid mattresses are rapidly replacing traditional innerspring products due to superior comfort, durability, and motion isolation.

- Mid-range and premium price segments dominate global sales, reflecting consumer willingness to invest in sleep quality.

- North America leads the global market, supported by high replacement rates and strong direct-to-consumer (DTC) penetration.

- Asia-Pacific is the fastest-growing region, driven by urban housing growth, rising disposable incomes, and brand premiumization.

- E-commerce and DTC channels are reshaping distribution, offering trial periods, transparent pricing, and faster market penetration.

- Material innovation, including cooling foams, zoned coils, and sustainable components, is becoming a key competitive differentiator.

What are the latest trends in the hybrid mattress market?

Premiumization and Advanced Sleep Technologies

The hybrid mattress market is witnessing a strong shift toward premium and luxury offerings. Consumers are increasingly opting for advanced hybrid mattresses that integrate zoned coil systems, multi-layer foam constructions, and cooling technologies designed to regulate body temperature. Smart features such as sleep tracking sensors, adjustable firmness layers, and compatibility with smart beds are also gaining traction, particularly in developed markets. This trend is enabling manufacturers to command higher price points while enhancing brand differentiation and customer loyalty.

Sustainable and Eco-Friendly Mattress Materials

Sustainability has emerged as a key trend influencing purchasing decisions. Manufacturers are increasingly incorporating eco-friendly materials such as organic latex, recycled steel coils, and low-emission foams. Certifications related to environmental safety and chemical emissions are becoming critical for consumer trust. Brands promoting circular economy initiatives, including mattress recycling and reduced packaging waste, are gaining a competitive advantage, particularly among environmentally conscious consumers in Europe and North America.

What are the key drivers in the hybrid mattress market?

Rising Awareness of Sleep Health and Wellness

Growing awareness of the impact of sleep quality on physical and mental health is a primary driver of hybrid mattress adoption. Consumers are increasingly prioritizing ergonomic support, spinal alignment, and pressure relief, all of which are key benefits offered by hybrid mattresses. Healthcare professionals and wellness influencers are further reinforcing the importance of high-quality mattresses, supporting long-term market growth.

Expansion of Online and Direct-to-Consumer Channels

The rapid expansion of online mattress retailing has transformed consumer access to hybrid mattresses. DTC brands offer competitive pricing, extended trial periods, and easy returns, reducing purchase risk and accelerating adoption. Digital marketing and data-driven personalization are enabling brands to reach targeted consumer segments more effectively, particularly younger demographics and urban households.

What are the restraints for the global market?

High Product Costs Compared to Conventional Mattresses

Hybrid mattresses are priced higher than traditional foam or innerspring alternatives due to complex construction and premium materials. This limits adoption in price-sensitive markets, particularly in emerging economies. While mid-range hybrids are gaining traction, affordability remains a key challenge for mass-market penetration.

Volatility in Raw Material Prices

Fluctuations in the prices of steel, foam chemicals, and latex significantly impact production costs. Manufacturers face margin pressure during periods of raw material inflation, which can lead to higher retail prices or reduced profitability, acting as a restraint on market expansion.

What are the key opportunities in the hybrid mattress industry?

Growth in Hospitality and Contract Sales

The global hospitality sector is increasingly upgrading bedding standards to enhance guest comfort. Hybrid mattresses are becoming the preferred choice for hotels, resorts, serviced apartments, and vacation rentals due to their durability and comfort balance. Long-term supply contracts and bulk procurement present stable revenue opportunities for manufacturers.

Rising Demand in Asia-Pacific Urban Housing

Rapid urbanization and residential construction across the Asia-Pacific present significant growth opportunities. As middle-class consumers upgrade from basic bedding products to branded mattresses, hybrid models are increasingly positioned as aspirational products. Local manufacturing and region-specific product customization can further accelerate market penetration.

Product Type Insights

Hybrid mattresses combining pocketed coils with memory foam continue to dominate the global market, accounting for approximately 42% of global revenue in 2024. Their dominance is primarily driven by their ability to provide an optimal balance between contouring comfort and structural support, which caters to a wide range of consumers seeking both durability and ergonomic relief. Pocketed coil and latex hybrids are increasingly preferred in the premium segment due to their longevity, natural material composition, and sustainable manufacturing practices, appealing to environmentally conscious buyers. Additionally, gel-infused foam hybrids are gaining traction, particularly in warmer regions and urban apartments, due to their superior cooling properties and improved heat dissipation, which enhance overall sleep quality. Technological integration, such as zoned coils, advanced foam layering, and smart temperature-regulating foam,s further supports the growth of these product types, making them the leading segment globally.

Application Insights

The residential segment remains the largest application area, contributing nearly 68% of global demand in 2024. This growth is driven by replacement purchases, rising disposable incomes, and increased consumer awareness of the health benefits associated with high-quality sleep products. Urban housing expansions in emerging markets are also fueling residential demand. The hospitality segment is the fastest-growing application globally, as hotels, resorts, and luxury serviced apartments increasingly adopt hybrid mattresses to provide guests with enhanced comfort, durability, and ergonomic support. Factors such as premium guest experiences, rising tourism, and the expansion of five-star and boutique hotels drive this segment. Healthcare facilities are also increasingly investing in hybrid mattresses to improve patient comfort, prevent pressure ulcers, and ensure compliance with regulatory standards in hospitals and long-term care facilities.

Distribution Channel Insights

Direct-to-consumer (DTC) online channels account for approximately 34% of total sales, benefiting from aggressive digital marketing, consumer-friendly trial periods, and easy returns. Specialty mattress and furniture retailers remain critical for premium and luxury products, where in-store testing and expert consultation influence purchasing decisions. Institutional and contract sales are becoming increasingly important for the hospitality and healthcare sectors, driven by bulk procurement, standardization requirements, and long-term supply agreements. E-commerce growth and DTC penetration are particularly strong in North America and Europe, while emerging markets in APAC are witnessing increasing online adoption due to improved logistics and digital payment ecosystems.

End-User Insights

Individual consumers remain the largest end-user group, motivated by rising awareness of sleep health, comfort, and ergonomic support. Hotels and resorts represent a high-value segment, prioritizing durability, brand reliability, and guest satisfaction. Corporate housing projects, luxury real estate developments, and healthcare institutions are emerging end-use markets, offering consistent demand for high-performance hybrid mattresses. The growth in these segments is fueled by urbanization, hospitality expansions, and increasing emphasis on wellness-oriented products, highlighting a shift from price-driven purchases to value-based, health-conscious decisions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global hybrid mattress market in 2024, with the United States as the largest contributor. Regional growth is driven by high replacement rates, strong DTC channel penetration, and widespread consumer preference for premium and technologically advanced sleep solutions. Product innovation, brand loyalty, and health-conscious purchasing trends support continued adoption. Additionally, rising demand from the hospitality sector, particularly boutique hotels and urban resorts, provides a steady growth engine. Consumers in North America increasingly favor mattresses with cooling gels, pressure-relief layers, and smart sleep technology, further reinforcing market leadership.

Europe

Europe holds nearly 27% of the global market share, with Germany, the U.K., and France leading demand. The growth is primarily driven by rising disposable incomes, premiumization trends, and high awareness of sustainable and eco-friendly mattress materials. Consumers increasingly prefer certifications such as OEKO-TEX and eco-labels, promoting environmentally responsible products. Additionally, robust hospitality development in urban and tourist-centric cities is accelerating hybrid mattress adoption in the premium and luxury segments. DTC channels are expanding across Europe, supported by strong digital infrastructure and logistics networks, which facilitate convenient access to hybrid mattress products.

Asia-Pacific

Asia-Pacific represents about 24% of the global market and is the fastest-growing region, expanding at a 11% CAGR. Growth is driven by rapid urbanization, rising disposable incomes, and increased awareness of sleep wellness in China, India, Japan, and Australia. The residential segment sees strong uptake due to new housing projects and apartment complexes in urban centers, while hospitality expansions in tourist destinations are boosting demand for premium and mid-range hybrids. Young, tech-savvy consumers are adopting e-commerce platforms, enabling DTC brands to rapidly scale in the region. Cooling gel hybrids are particularly favored in tropical climates, while premium pocketed coil and latex hybrids are gaining traction among affluent consumers.

Latin America

Latin America accounts for approximately 6% of global demand, with Brazil and Mexico leading adoption. Regional growth is supported by a growing middle class, increasing awareness of premium bedding products, and gradual urbanization. The residential segment remains the primary driver, as consumers replace traditional mattresses with hybrid solutions for improved comfort and durability. Expansion in hospitality, particularly in tourist-heavy regions like Cancun and Rio de Janeiro, is also stimulating market growth. E-commerce adoption is increasing, allowing online penetration into smaller cities and semi-urban markets.

Middle East & Africa

The Middle East & Africa region holds nearly 5% of the market, driven by high-income urban residential demand in the UAE, Saudi Arabia, and Qatar, alongside hospitality infrastructure expansion. Luxury hotels, resorts, and premium serviced apartments are significant end-users, driving bulk procurement of hybrid mattresses. Government-backed tourism initiatives, increased foreign investment in hospitality, and rising awareness of health and wellness products are key growth drivers. Cooling foam and gel-infused hybrids are particularly popular due to high ambient temperatures in the region, while eco-friendly and durable pocketed coil options are preferred for premium installations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Hybrid Mattress Market

- Tempur Sealy International

- Serta Simmons Bedding

- Sleep Number Corporation

- Casper Sleep

- Purple Innovation

- Kingsdown

- King Koil

- Hästens

- Corsicana Mattress Company

- Spring Air

- Kurlon Enterprise

- Sleepwell

- Sealy

- Stearns & Foster

- Simmons