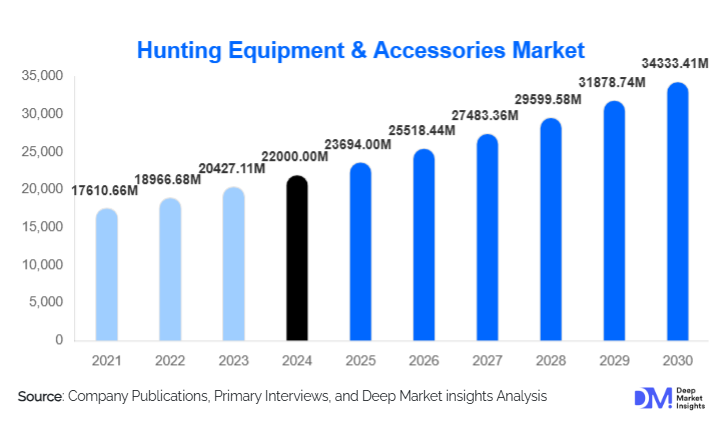

Hunting Equipment & Accessories Market Size

According to Deep Market Insights, the global hunting equipment accessories market size was valued at USD 22,000.00 million in 2024 and is projected to grow from USD 23,694.00 million in 2025 to reach USD 34,333.41 million by 2030, expanding at a CAGR of 7.70% during the forecast period (2025–2030). Market growth is primarily driven by the rising popularity of outdoor recreation, increasing demand for technologically advanced optics and accessories, expansion of regulated hunting programs, and a surge in wildlife-tourism-driven gear requirements across emerging regions.

Key Market Insights

- Accessories and ammunition remain the highest-demand product categories, driven by recurring purchases and increasing interest in precision sport shooting.

- North America dominates the global market, accounting for nearly 50% of global sales due to a strong recreational hunting culture.

- Asia-Pacific is the fastest-growing region, supported by rising disposable income, outdoor tourism, and emerging hunting communities.

- Technological advancements in optics, GPS navigation, and thermal imaging are reshaping consumer purchasing behavior.

- Expansion of wildlife tourism and guided hunting expeditions is boosting demand for rental gear, premium accessories, and high-performance apparel.

- Sustainable and eco-friendly gear, including non-lead ammunition and biodegradable decoys, is rapidly gaining traction.

What are the latest trends in the hunting equipment & accessories market?

Technology-Integrated Hunting Gear Leading Consumer Demand

The market is seeing rapid adoption of technologically sophisticated products such as GPS-enabled tools, thermal and night-vision scopes, digital rangefinders, and AI-supported wildlife-tracking equipment. These innovations enhance accuracy, safety, and precision, particularly for complex terrain and big-game hunting. Modern hunters increasingly prioritise gear that enhances stealth, visibility, and situational awareness. Wearable devices, emergency locators, and smart scent control systems appeal particularly to younger hunters seeking advanced and immersive outdoor experiences.

Rise of Performance Apparel and Eco-Friendly Gear

Advanced camouflage fabrics, scent-control clothing, moisture-wicking textiles, and temperature-adaptive materials are reshaping the apparel segment. Environmental concerns are also accelerating the transition toward eco-friendly materials and non-toxic ammunition. Brands are investing in biodegradable decoys, sustainable camo patterns, and recycled-fibre hunting apparel. This trend aligns with stricter compliance standards and growing consumer preference for responsible, low-impact hunting practices.

What are the key drivers in the hunting equipment & accessories market?

Growing Participation in Outdoor Recreation & Hunting Sports

Increasing participation in outdoor activities, wildlife tourism, recreational shooting, and nature-focused lifestyles has significantly boosted demand for hunting equipment. Countries like the U.S., Canada, Germany, and Nordic nations are experiencing a revitalised interest in hunting as a leisure pursuit. This rising engagement supports demand for firearms, ammunition, optics, safety gear, and apparel across both regular and first-time hunters.

Innovation in Optics, Safety Gear & Navigation Devices

Advancements in thermal imaging, high-definition scopes, lightweight binoculars, and GPS-based tools are driving adoption across amateur and professional hunters. Precision optics improve targeting accuracy, while wearable trackers and digital safety systems reduce risk. The shift toward performance-driven gear has increased consumer willingness to spend on premium accessories, which offer strong margins and long-term growth potential.

Regulated Hunting Programs & Wildlife Tourism

Government-backed hunting permits, conservation-linked licensing, and wildlife tourism are elevating demand for specialised gear. Safari hunting, big-game expeditions, and guided outdoor experiences often mandate gear upgrades for safety and compliance. Outfitters and tourism operators increasingly procure bulk equipment, boosting sales of optics, apparel, knives, safety tools, and survival kits.

What are the restraints for the global market?

Strict Regulatory Frameworks & Firearm Restrictions

Complex licensing laws, restrictions on firearms, ammunition regulations, and varying regional hunting policies limit market expansion. Several countries impose strict import/export rules for gun-related accessories, reducing cross-border trade opportunities. Public resistance to hunting in specific markets also affects participation levels and restricts growth potential in Europe and parts of Asia.

High Costs of Premium Equipment

Advanced optics, thermal imaging devices, high-performance apparel, and specialised accessories can be expensive, limiting adoption among casual hunters. Economic downturns and lower disposable incomes particularly impact the purchase of non-essential accessories. As price-sensitive consumers seek budget equipment, premium brands may face slowed growth in certain regions.

What are the key opportunities in the hunting equipment & accessories industry?

Tech-Enabled Hunting Experiences

The growing appetite for digital tools presents significant opportunities. AI-driven tracking apps, smart decoys, ballistic calculators, Bluetooth-enabled scopes, and GPS wearables can redefine precision hunting. Manufacturers investing in electronics integration and smart accessories can capture a rapidly growing premium niche.

Expansion into Emerging Markets & Rental-Based Models

Asia-Pacific, Latin America, and parts of Eastern Europe remain largely untapped for high-quality gear. Rising middle-class incomes and wildlife tourism growth support new demand. Rental models, particularly for premium optics and gear, also present scalable opportunities for outfitters and manufacturers, lowering entry barriers for new hunters.

Sustainable & Ethical Hunting Solutions

Eco-friendly ammunition, biodegradable lures, and recycled material apparel offer strong differentiation. Stricter environmental regulations and conscious consumerism drive demand for low-impact gear. Brands that invest in sustainable manufacturing can position themselves as long-term leaders in ethical hunting equipment.

Product Type Insights

Ammunition dominates with nearly 35–40% of market share due to recurring consumption and mandatory restocking among hunters and shooting enthusiasts. Optics, including scopes, night-vision, and rangefinders, represent one of the fastest-growing categories, driven by technological advancements. Apparel and gear continue expanding as hunters increasingly adopt specialized camouflage, scent-control clothing, and performance-based textiles. Accessories such as decoys, lures, knives, and survival tools see steady demand due to their importance in multi-terrain hunting environments.

Application Insights

Big game and recreational hunting account for the largest share at approximately 40–45% of global demand. Small-game and bird hunting segments remain strong in Europe and North America, while predator control and pest management applications expand in rural markets. Target shooting and sport shooting represent rising demand engines as more consumers engage in range training, competitive shooting, and precision sports.

Distribution Channel Insights

Specialty sporting goods stores dominate distribution with a commanding 70–80% share, reflecting trust, regulatory compliance, and the need for expert guidance in equipment selection. Online platforms are rapidly gaining traction for apparel, optics, and accessories, driven by digital reviews and price transparency. Direct-to-consumer channels and brand-owned online stores are expanding, especially for premium optics and apparel.

End-User Insights

Individual recreational hunters make up 80–85% of market demand. Commercial users, including wildlife outfitters, safari operators, and government agencies, constitute the remaining share. Growth is strong among survivalists, bushcraft enthusiasts, and outdoor adventure tourists, expanding demand beyond traditional hunting communities.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for nearly 50% of global market revenue, led by the U.S., where hunting culture, recreational shooting, and wildlife management programs are deeply rooted. High disposable income supports high adoption of premium optics and accessories. Canada contributes significantly through its robust big-game hunting segment and expanding outdoor recreation culture.

Europe

Europe holds around 15–20% market share, driven by Germany, France, Italy, Finland, and Sweden. Regulated hunting frameworks support demand for compliant gear, with growing preference for premium optics and sustainable ammunition. Bow hunting and sport shooting are expanding, particularly in Central and Northern Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region with rising demand from China, India, Australia, and Southeast Asia. Increased wildlife tourism, growing middle-class income, and expanding outdoor recreation contribute to rapid adoption. Australia remains a mature market with significant demand for optics, apparel, and accessories.

Latin America

Brazil, Argentina, and Chile show rising interest in hunting tourism and recreational shooting. Wildlife-rich regions attract international tourists, boosting demand for guiding outfitters and gear rentals.

Middle East & Africa

Africa’s safari hunting culture drives robust demand for premium optics, ammunition, and apparel. South Africa, Namibia, and Tanzania lead commercial hunting demand. In the Middle East, high-income populations in the UAE, Qatar, and Saudi Arabia increasingly participate in hunting tourism, driving outbound and domestic equipment purchases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Hunting Equipment & Accessories Market

- Vista Outdoor Inc.

- Beretta Holding S.A.

- American Outdoor Brands Corp.

- Browning Arms Company

- Savage Arms

- Buck Knives Inc.

- Swarovski Optik

- Leupold & Stevens Inc.

- Hornady Manufacturing

- Vortex Optics

- Remington Ammunition

- Sig Sauer

- Carl Zeiss AG (Hunting Optics Division)

- Sitka Gear

- Mossy Oak

Recent Developments

- In March 2025, Vista Outdoor expanded its ammunition manufacturing capacity in the U.S. to meet rising sport-shooting demand.

- In January 2025, Swarovski Optik launched a new generation of lightweight long-range spotting scopes aimed at premium hunting markets.

- In June 2024, Sitka Gear introduced a full eco-friendly apparel line using recycled fibers and biodegradable waterproof coatings.