HUD Helmets Market Size

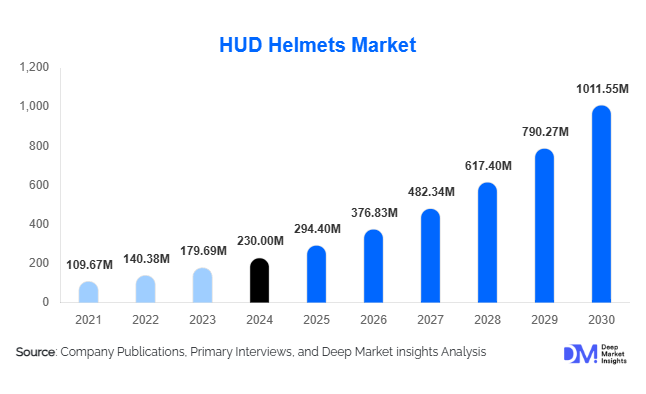

According to Deep Market Insights, the global HUD helmets market size was valued at USD 230 million in 2024 and is projected to grow from USD 294.4 million in 2025 to reach USD 1,011.55 million by 2030, expanding at a CAGR of 28.0% during the forecast period (2025–2030). The market growth is driven by increasing motorcycle safety awareness, advancements in augmented reality (AR) and wearable display technologies, and integration of smart connectivity features enhancing rider experience and situational awareness.

Key Market Insights

- Full-face HUD helmets dominate the global market, accounting for nearly 60% of total sales in 2024, driven by higher safety standards and feature integration potential.

- AR-enabled HUD helmets lead technology adoption, representing over 57% of the global share due to their immersive navigation and hazard alert functionalities.

- Embedded connectivity solutions are overtaking tethered systems, supported by rider preference for cable-free smart devices and seamless Bluetooth/5G integration.

- Europe and North America collectively account for over 60% of global market share, while Asia-Pacific is emerging as the fastest-growing region with a CAGR above 18% through 2030.

- Technological convergence with mobility ecosystems—such as integration with EV scooters, telematics, and fleet management platforms—is reshaping the industry.

- Premiumization and safety-driven consumer behavior are enabling manufacturers to sustain higher margins despite declining display and sensor costs.

Latest Market Trends

AR and Smart Connectivity Integration

The integration of augmented reality (AR) overlays and smart connectivity features such as GPS navigation, voice assistance, and real-time hazard alerts is transforming the riding experience. Riders can access navigation, speed, and incoming call information within their line of sight, improving convenience and safety. The shift toward 5G and V2X (vehicle-to-everything) communication is enabling live traffic updates and predictive analytics for riders. Leading brands are embedding micro-OLED displays and waveguide optics to achieve lightweight, high-resolution visuals without obstructing vision.

Industrial and Defense Applications Expanding Adoption

Beyond consumer motorcycles, HUD helmets are gaining traction in industrial safety and defense sectors. In construction, logistics, and aviation, these helmets enhance worker safety by displaying instructions and hazard warnings. Defense forces are integrating HUD systems into pilot and soldier helmets for improved situational awareness and tactical advantage. The convergence of IoT and AR technologies within helmet systems is creating multi-sectoral demand, expanding the overall addressable market beyond leisure riders.

Localization and “Smart Manufacturing” Initiatives

Government initiatives such as “Make in India” and “Made in China 2025” are boosting local production of smart helmets. Investments in electronics manufacturing and wearable technologies are reducing costs and encouraging domestic brands to enter the segment. Countries like India and China are rapidly becoming both production and consumption hubs for affordable HUD helmets, supported by a growing base of two-wheeler users and favorable safety regulations.

HUD Helmets Market Drivers

Rising Safety Awareness and Regulatory Mandates

With the increasing two-wheeler accidents globally, governments are tightening helmet safety regulations. Consumers are shifting toward advanced helmets that not only offer protection but also assist in navigation and hazard detection. Countries in Asia-Pacific, Europe, and North America are introducing stricter compliance norms that indirectly boost the adoption of HUD helmets.

Advancements in Display and Wearable Technologies

Miniaturization of components and falling prices of sensors, micro-OLEDs, and processors are driving product innovation. AR projection systems are now compact enough to fit within standard helmet designs, allowing manufacturers to offer high-tech solutions without compromising comfort or weight.

Growth of Connected and Premium Motorcycle Segments

The surge in sales of premium motorcycles and electric scooters is directly influencing the HUD helmet market. Riders are willing to invest in smart accessories that enhance connectivity and performance. Integration with motorcycle OEMs’ infotainment systems further amplifies demand for HUD-equipped helmets.

Market Restraints

High Product Cost and Limited Affordability

HUD helmets remain priced significantly higher than conventional helmets, limiting adoption in price-sensitive markets. Despite technological advancements, cost barriers persist due to expensive components like micro-displays and sensors.

Technical Limitations and Certification Challenges

Battery life, visibility under strong sunlight, additional helmet weight, and complex safety certifications are key hurdles for wider acceptance. Manufacturers must continuously innovate to meet regulatory and user comfort requirements simultaneously.

HUD Helmets Market Opportunities

OEM and Mobility Platform Partnerships

Collaboration with motorcycle and EV manufacturers presents a major opportunity for HUD helmet makers. OEM-integrated packages and telematics-based subscription services can drive recurring revenue while enhancing brand reach and adoption.

Expansion into Industrial and Defense Sectors

Industrial workforce safety and defense modernization programs are opening new growth channels. AR-enabled helmets for maintenance workers, pilots, and soldiers provide real-time information and reduce operational errors, positioning this technology beyond leisure applications.

Premiumization and Feature-Driven Upselling

Manufacturers can capitalize on consumer preference for premium, feature-rich helmets. Integration of biometric sensors, cloud connectivity, and AI-based hazard detection offers differentiation and higher average selling prices. This trend supports strong profit margins even as component costs decline.

Product Type Insights

Among helmet types, full-face HUD helmets dominate the market with nearly 60% share in 2024. Their superior safety profile and greater internal space for sensors and displays make them ideal for advanced integrations. Modular helmets occupy the second position, appealing to touring and commuter riders who value flexibility. Open-face and half-helmets remain niche segments, primarily in warmer climates or low-speed urban usage.

Technology Insights

AR HUD systems lead the market, accounting for approximately 58% share in 2024. These systems combine real-world views with projected navigation and hazard data, creating a safer and more immersive experience. Conventional HUD and waveguide technologies are gradually being replaced by advanced microdisplay systems with higher brightness and lower power consumption.

End-Use Insights

The consumer motorcycle segment accounts for nearly 65% of total demand, fueled by rising personal mobility and recreational riding trends. Commercial fleet operators—particularly last-mile delivery and logistics firms—are increasingly adopting HUD helmets for rider monitoring and navigation efficiency. Industrial and defense applications are smaller in volume but represent the fastest-growing segments due to safety and operational benefits.

| Helmet Type | Display Technology | Connectivity | Power Supply | Functionality | End-User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America held around 30% market share in 2024. The U.S. leads demand with a strong base of premium motorcycle owners and early technology adopters. Growth is also supported by safety regulations and high consumer awareness regarding rider protection technologies.

Europe

Europe dominated the global HUD helmets market with approximately 32% share in 2024. Germany, the U.K., and France are key markets where strict safety standards and innovation-driven consumer preferences sustain demand. The region also hosts several technology-focused helmet manufacturers.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, expanding at nearly 18–20% CAGR through 2030. China and India are major production hubs and end-user markets due to high two-wheeler ownership and local manufacturing incentives. Japan and South Korea contribute to the premium segment demand driven by tech-oriented consumers.

Latin America

Latin America accounts for less than 10% of global market share but is showing steady adoption, particularly in Brazil and Mexico. Growing motorcycle culture and rising disposable incomes are contributing to moderate demand for mid-range HUD helmets.

Middle East & Africa

This region represents 5–8% of the global market, with GCC countries such as the UAE and Saudi Arabia showing interest in premium smart helmets. Industrial safety and defense contracts are emerging secondary demand sources in Africa and the Middle East.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the HUD Helmets Market

- BMW Motorrad

- SHOEI Co., Ltd.

- Jarvish Inc.

- NUVIZ Inc.

- Reevu

- Skully Technologies

- DigiLens Inc.

- Sena Technologies Inc.

- CrossHelmet (Borderless Inc.)

- Bell Helmets

- AGV (Dainese Group)

- LiveMap

- Intelligent Cranium Helmets LLC

- Livall Tech Co., Ltd.

- EyeLights

Recent Developments

- In August 2025, Jarvish Inc. unveiled its next-generation AR HUD helmet featuring integrated 5G modules for live traffic analytics and over-the-air software updates.

- In June 2025, BMW Motorrad announced its new smart helmet series with embedded navigation and head-up projection aligned with its connected bike ecosystem.

- In March 2025, SHOEI Co. partnered with DigiLens to co-develop lightweight waveguide displays aimed at reducing helmet weight by 15%.

- In January 2025, Sena Technologies launched its “Sena Vision” lineup integrating communication intercom, AR HUD display, and advanced hazard detection.