Household Tofu Machine Market Size

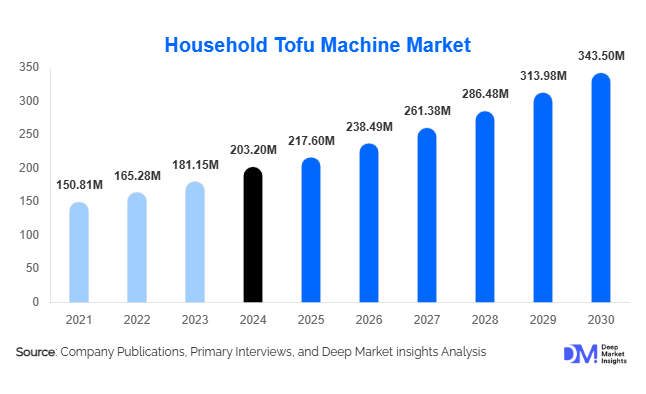

According to Deep Market Insights, the global household tofu machine market size was valued at USD 203.2 million in 2024 and is projected to grow from USD 217.6 million in 2025 to reach USD 343.5 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of plant-based diets, increasing consumer interest in home-based soy product preparation, and technological advancements in compact kitchen appliances that simplify tofu production for everyday users.

Key Market Insights

- Growing consumer adoption of plant-based diets is fueling demand for convenient, home-scale tofu-making solutions across major markets.

- Smart tofu machines with automatic temperature, grinding, and coagulation controls are reshaping the household segment through enhanced user convenience.

- Asia-Pacific dominates the market due to tofu’s deep-rooted cultural consumption and expanding middle-class demand for health-focused appliances.

- North America and Europe are the fastest-growing regions, driven by veganism trends, rising lactose intolerance rates, and the popularity of soy-based protein substitutes.

- E-commerce distribution channels are becoming the primary sales avenue for household tofu machines, offering greater reach and competitive pricing.

- Technological innovation and product miniaturization are enabling compact designs suited for small urban kitchens, further boosting adoption.

Latest Market Trends

Smart and Automated Tofu Machines

Manufacturers are increasingly integrating automation and smart technologies such as one-touch operation, self-cleaning functions, and digital control panels. These innovations allow users to produce soy milk, tofu, and other plant-based products with minimal effort. IoT-enabled devices are beginning to emerge, providing app connectivity for recipe customization and process monitoring. Such advancements cater to tech-savvy consumers and align with the growing demand for multifunctional kitchen appliances.

Rising Popularity of DIY Plant-Based Foods

The growing home-based food culture and emphasis on food transparency are encouraging consumers to make tofu from scratch. DIY tofu-making not only appeals to health-conscious individuals but also supports sustainability goals by reducing packaging waste. This trend is amplified by social media communities promoting homemade vegan recipes and influencers demonstrating tofu-making tutorials, fostering stronger consumer engagement with tofu machines.

Market Drivers

Increasing Demand for Plant-Based Protein

The global shift toward plant-based nutrition is a key driver for household tofu machines. As consumers seek sustainable, non-animal protein sources, tofu’s nutritional benefits, rich in protein, calcium, and iron, have positioned it as a staple in vegetarian and flexitarian diets. The convenience of making fresh tofu at home is further stimulating appliance purchases, particularly in urban households and among fitness-oriented consumers.

Technological Advancements in Kitchen Appliances

Continuous innovations in compact design, energy efficiency, and multifunctional features are propelling market expansion. New-generation tofu machines integrate soy milk grinding, heating, and pressing into a single automated process, significantly reducing preparation time. Portable, cordless, and noise-reduced variants are gaining popularity, enhancing user experience and making tofu-making accessible to first-time users.

Market Restraints

High Initial Cost and Limited Awareness

While tofu machines offer long-term benefits, their relatively high initial cost and limited consumer awareness outside East Asia restrict market penetration. Many potential buyers remain unaware of the machine’s versatility beyond tofu, such as its ability to make soy milk or almond milk, creating an educational gap that hampers adoption in emerging regions.

Maintenance and Cleaning Challenges

Some consumers perceive tofu-making as messy or time-consuming due to residue buildup and cleaning requirements. Machines with multiple detachable components require regular maintenance, which can deter users who prefer low-effort appliances. This challenge is prompting manufacturers to focus on developing easy-to-clean, dishwasher-safe, and self-cleaning models.

Market Opportunities

Vegan and Sustainable Living Boom

The accelerating global vegan movement presents a strong opportunity for household tofu machine manufacturers. Collaborations with vegan chefs, health influencers, and plant-based brands are expected to expand product visibility. Additionally, as sustainability becomes a purchasing priority, tofu machines are being marketed as eco-friendly alternatives to pre-packaged soy products that generate plastic waste.

Product Customization and Recipe Integration

Manufacturers are increasingly embedding smart recipe databases and app-based customization features. This allows consumers to experiment with textures, flavors, and additives like herbs or spices, enhancing the tofu-making experience. Partnerships with recipe platforms and AI-driven personalization tools could open new revenue streams in premium market segments.

Product Type Insights

Fully automatic tofu machines dominate the segment, driven by their ease of use and time efficiency. Semi-automatic models remain popular among budget-conscious consumers who prefer manual control over tofu texture and firmness. Mini and portable tofu machines are witnessing rapid adoption, particularly among single-person households, students, and small families with limited kitchen space.

Distribution Channel Insights

Online retail leads the market, supported by rising e-commerce penetration and direct-to-consumer strategies from leading brands. Online platforms offer detailed product comparisons, user reviews, and flexible payment options, enhancing consumer confidence. Offline channels, including specialty kitchen appliance stores and supermarkets, continue to play a role in regions where in-person demonstrations influence purchasing decisions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest market share, with China, Japan, and South Korea as dominant contributors. Deep-rooted tofu consumption, rising urbanization, and the availability of localized brands make the region the global leader. Japan’s preference for technologically advanced and compact appliances further strengthens market growth.

North America

North America is the fastest-growing region, driven by rising vegan populations and the popularity of DIY soy products. The U.S. market, in particular, shows strong traction for mid- to high-end tofu machines among health-conscious consumers and small cafes promoting plant-based menus.

Europe

Europe’s growth is fueled by increasing consumer awareness of sustainable diets and environmental impact. Countries such as Germany, the U.K., and France are witnessing high adoption among urban consumers who value organic and homemade plant-based foods.

Middle East & Africa

This region remains nascent but shows potential due to expanding vegan communities and growing interest in imported Asian kitchen appliances. Manufacturers are beginning to explore distribution partnerships to penetrate emerging urban markets in the UAE, South Africa, and Israel.

Latin America

Latin America’s market growth is moderate but gaining momentum, particularly in Brazil and Mexico, where plant-based diets are expanding rapidly. Increasing disposable income and health-conscious trends support the gradual adoption of tofu-making appliances.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Tofu Machine Market

- Joyoung Co., Ltd.

- SoyaJoy

- Bear Electric Appliance Co., Ltd.

- Donlim Kitchen Appliances

- Supor

- Midea Group

- Royalstar

- Tefal (Groupe SEB)

Recent Developments

- In July 2025, Joyoung launched a new AI-integrated tofu and soy milk maker featuring app-based texture customization and automatic cleaning functions.

- In March 2025, Bear Electric introduced a compact 1-liter tofu machine designed for small kitchens and solo consumers, highlighting portability and low energy use.

- In January 2025, Supor partnered with Alibaba’s Tmall to enhance its online tofu appliance sales through livestream product demos and recipe-based marketing campaigns.