Household Kitchen Rail Kits Market Size

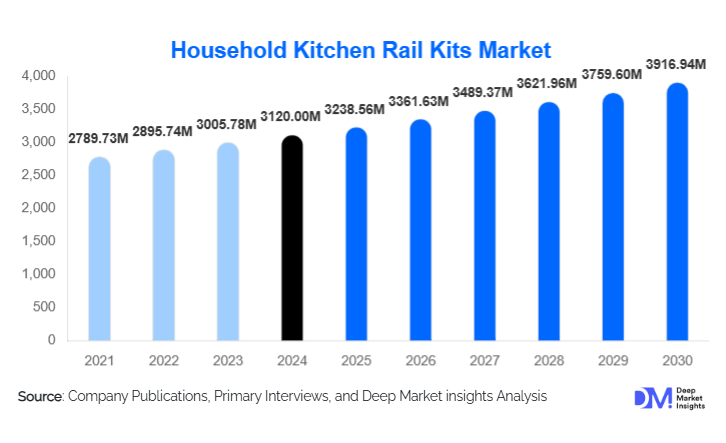

According to Deep Market Insights, the global household kitchen rail kits market size was valued at USD 3,120.00 million in 2024 and is projected to grow from USD 3,238.56 million in 2025 to reach USD 3,916.94 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of modular kitchens, increasing demand for space-efficient kitchen organization solutions, and the growing popularity of DIY home improvement products across both developed and emerging economies.

Key Market Insights

- Wall-mounted kitchen rail kits dominate global demand due to ease of installation, affordability, and compatibility with modular kitchens.

- Stainless steel remains the most preferred material, accounting for the largest revenue share owing to durability, corrosion resistance, and premium aesthetics.

- Asia-Pacific leads the global market, supported by rapid urban housing development and expanding middle-class consumption.

- North America drives premium and DIY kit adoption, fueled by strong home renovation spending and e-commerce penetration.

- Online distribution channels are the fastest-growing, enabling direct-to-consumer sales, customization, and competitive pricing.

- Mid-range kitchen rail kits dominate pricing segments, balancing quality, design, and affordability for mass-market consumers.

What are the latest trends in the household kitchen rail kits market?

Rising Adoption of Modular and Expandable Rail Systems

Manufacturers are increasingly offering modular and expandable kitchen rail kits that allow users to add or remove accessories such as hooks, spice racks, utensil holders, and shelves. This flexibility aligns with evolving consumer preferences for customizable kitchens and supports long-term usability without complete replacement. Modular rail systems are particularly popular in urban apartments where kitchen layouts frequently change due to rentals or renovations.

Growth of DIY-Friendly Installation Designs

DIY-compatible kitchen rail kits with pre-drilled mounting points, snap-fit accessories, and minimal tool requirements are gaining traction globally. Consumers are increasingly influenced by online tutorials, social media home-organization content, and cost-saving motivations. This trend has significantly expanded the addressable consumer base, especially in North America and Europe.

What are the key drivers in the household kitchen rail kits market?

Expansion of Modular Kitchens Worldwide

The growing penetration of modular kitchens is a major driver for kitchen rail kits. Urban housing developments increasingly favor modular designs due to space optimization, standardized layouts, and modern aesthetics. Kitchen rail kits complement these systems by providing flexible, vertical storage solutions that enhance functionality without increasing footprint.

Increasing Focus on Organized and Hygienic Kitchens

Consumers are prioritizing organized kitchens that improve workflow, cleanliness, and visual appeal. Rail kits help reduce countertop clutter, improve utensil accessibility, and promote better hygiene by enhancing air circulation. Stainless steel and antimicrobial-coated rail systems are particularly benefiting from this trend.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

In developing economies, cost-conscious consumers often opt for low-cost alternatives such as plastic hooks or basic shelving. Premium kitchen rail kits face adoption challenges unless manufacturers introduce value-engineered offerings tailored to local purchasing power.

Installation Limitations in Older Housing Stock

Kitchens with uneven walls, weak structural support, or non-standard layouts can restrict the effective installation of rail kits. This limits adoption in older residential buildings unless customized or professional installation solutions are offered.

What are the key opportunities in the household kitchen rail kits industry?

Smart and Advanced Material Integration

Opportunities are emerging in the integration of advanced materials and smart features such as antimicrobial coatings, rust-resistant nano-finishes, and modular locking mechanisms. Premium consumers are increasingly willing to pay for enhanced durability, safety, and design sophistication.

Growth in Online and Direct-to-Consumer Sales

The rapid expansion of e-commerce platforms presents significant opportunities for both new entrants and established brands. Online channels enable global reach, product bundling, customization, and direct engagement with consumers, while reducing dependence on physical retail infrastructure.

Product Type Insights

Wall-mounted kitchen rail kits dominate the market, accounting for approximately 38% of global revenue in 2024. Their strong market position is primarily driven by their ease of installation, compatibility with a wide range of kitchen accessories, and adaptability to various kitchen layouts. These kits provide a practical solution for maximizing vertical space, especially in compact urban apartments where countertop space is limited. Under-cabinet rail kits follow in popularity, preferred for their discreet design and ability to optimize storage in smaller kitchens. Meanwhile, magnetic and ceiling-hung rail kits are emerging as niche solutions, appealing to premium buyers and design-conscious consumers who prioritize aesthetics alongside functionality. The rising trend of modular kitchen adoption is also fueling demand for wall-mounted kits, as they seamlessly integrate with pre-designed cabinetry layouts, enhancing both organization and visual appeal.

Material Insights

Stainless steel kitchen rail kits lead the market with nearly 42% share due to their exceptional durability, high load-bearing capacity, corrosion resistance, and long service life. These qualities make stainless steel particularly attractive for premium and mid-range segments, where consumers seek both longevity and aesthetic appeal. Aluminum rail kits are gaining traction owing to their lightweight properties, ease of installation, and modern metallic finish, making them suitable for DIY-oriented consumers. Meanwhile, polymer-based kits cater to the economy segment, offering affordability and resistance to moisture, making them a practical choice for budget-conscious buyers in emerging markets. Overall, material choice continues to be a key driver of consumer preference, with durability, design, and cost influencing purchasing decisions.

Distribution Channel Insights

Offline retail channels, including home improvement stores, specialty kitchen retailers, and department stores, accounted for around 54% of sales in 2024. These channels benefit from in-person demonstrations, immediate availability, and the ability to guide installation. However, online sales are growing at a faster pace, driven by convenience, extensive product assortments, competitive pricing, and increasing consumer comfort with e-commerce platforms. Brand-owned websites and e-commerce marketplaces enable manufacturers to offer bundled kits, customization options, and direct-to-consumer services, increasing both reach and profitability. The growing digital influence, social media-based home improvement content, and influencer recommendations are further accelerating online adoption, particularly in regions with high internet penetration like North America and Asia-Pacific.

End-Use Insights

Urban residential households represent the largest end-use segment, contributing nearly 67% of global demand. This growth is fueled by the proliferation of apartment living, rental housing, and the widespread adoption of modular kitchens in densely populated cities. Consumers increasingly prefer organized, hygienic, and space-efficient kitchens, which drives sustained demand for kitchen rail kits. Hospitality kitchens, including serviced apartments, boutique hotels, and vacation rentals, are emerging as a secondary growth segment. These establishments benefit from standardized kitchen layouts and require durable, easy-to-maintain rail kits to optimize storage, reduce clutter, and improve operational efficiency. The expansion of urban tourism and short-term rental markets further supports the adoption of kitchen rail solutions in hospitality settings.

| By Product Type | By Material | By Installation Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global household kitchen rail kits market with approximately 41% market share in 2024. China leads demand due to large-scale residential construction, rapid urbanization, and well-established domestic manufacturing capacity. The market in China is supported by strong government housing programs and rising disposable incomes, which are driving premium and mid-range kit adoption. India is the fastest-growing market, with a CAGR exceeding 10.5%, propelled by urban housing expansion, a growing middle class, and increasing awareness of organized and modular kitchen solutions. Key growth drivers in the region include rising urbanization, lifestyle modernization, increasing DIY home improvement trends, and e-commerce penetration that enables access to a wider consumer base.

North America

North America accounts for around 24% of global demand, led by the United States. Market growth is supported by a strong DIY culture, high home renovation spending, and consumer preference for premium kitchen upgrades. Online sales penetration is particularly high, driven by convenience, variety, and direct-to-consumer offerings. The region’s growth is fueled by increasing adoption of modular kitchens, focus on organized and hygienic interiors, and the willingness of homeowners to invest in durable, design-oriented kitchen solutions. Rising interest in eco-friendly and stainless-steel products also contributes to demand, while suburban and urban residential expansion supports continuous market development.

Europe

Europe holds nearly 21% market share, with Germany, the U.K., France, and Italy as key contributors. Demand is driven by premium kitchen renovations, sustainability-focused materials, and the adoption of modular and ergonomically designed interiors. Regional growth is supported by increasing disposable income, strong consumer focus on organized and hygienic kitchens, and a high propensity for DIY projects. Additionally, regulations promoting safety and quality standards for home improvement products encourage the adoption of durable, stainless-steel, and aluminum rail kits. The market also benefits from a robust e-commerce infrastructure and awareness of innovative kitchen organization solutions.

Middle East & Africa

The Middle East & Africa region accounts for about 8% of the market, with growth driven by residential infrastructure investments, particularly in the UAE and Saudi Arabia. Rising urbanization, expanding modern housing developments, and a growing expatriate population contribute to increased adoption of kitchen rail kits. Premium and mid-range products are preferred due to the demand for durable and aesthetically appealing solutions. Additionally, the proliferation of high-end residential projects and an emerging focus on modular, space-efficient kitchens act as key drivers in the region.

Latin America

Latin America represents approximately 6% of global demand, led by Brazil and Mexico. Urban housing expansion, increasing awareness of organized and modular kitchen solutions, and rising disposable incomes are the main growth drivers. The adoption of DIY installation kits is increasing, particularly among younger households, while mid-range and durable material kits gain traction in urban centers. E-commerce adoption is also rising, allowing consumers in major cities to access a wider variety of rail kits and accessories, which further stimulates market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Kitchen Rail Kits Market

- IKEA

- Häfele

- Blum

- Hettich

- Sugatsune

- Kesseböhmer

- Grass

- Richelieu Hardware

- Emuca

- Godrej Interio

- ASSA ABLOY

- Ozone Overseas

- Salice

- Häcker Kitchen Systems

- FGV Group