Household Hand Tools Market Size

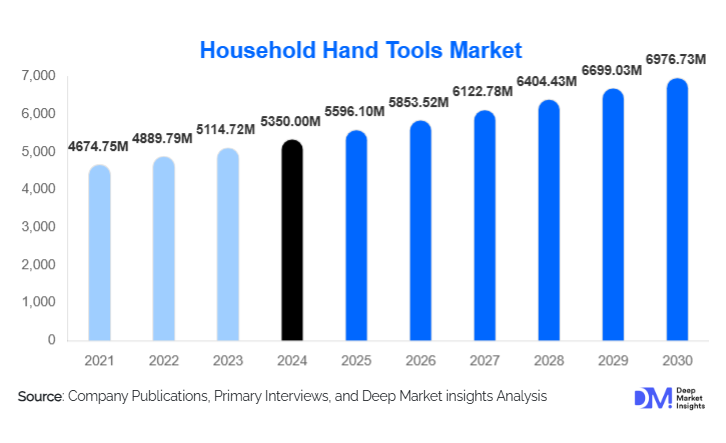

According to Deep Market Insights, the global household hand tools market size was valued at USD 5,350.00 million in 2024 and is projected to grow from USD 5,596.10 million in 2025 to reach USD 6,976.73 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of DIY home improvement projects, expanding e-commerce channels, and increasing residential construction and renovation activities globally.

Key Market Insights

- DIY culture is propelling tool demand, with homeowners increasingly performing maintenance and renovation tasks themselves, boosting the adoption of hand tools.

- E-commerce platforms are transforming distribution, enabling consumers worldwide to access a wider range of products, compare features, and purchase tools conveniently.

- North America dominates the market, driven by a high rate of homeownership, mature retail infrastructure, and strong DIY participation.

- Asia Pacific is the fastest-growing region, fueled by urbanization, rising middle-class incomes, and expanding residential construction in countries like China and India.

- Product innovation and ergonomic design improvements are enhancing tool usability and attracting new consumer segments, including hobbyists and senior users.

- Export-driven manufacturing hubs in the Asia Pacific are supplying hand tools globally, helping to meet cost-sensitive and professional demands across developed markets.

What are the latest trends in the household hand tools market?

DIY and Home Improvement Driving Market Growth

The surge in DIY culture is a significant trend, with consumers preferring to carry out basic repairs, home maintenance, and creative projects themselves. Influenced by online tutorials, social media content, and lifestyle trends, more households are maintaining multi-functional tool kits, expanding repeat purchases, and new product adoption. DIY-focused marketing and educational content from brands are helping increase consumer confidence and tool usage frequency.

Digital Retail Channels and E-commerce Expansion

Online sales of household hand tools are rapidly increasing, driven by convenience, accessibility, and detailed product information that allows consumers to compare features and pricing. Platforms also enable small and mid-sized brands to reach global consumers without heavy offline retail investments. Subscription tool kits, online-exclusive product bundles, and integrated reviews have further accelerated adoption.

What are the key drivers in the household hand tools market?

Rising DIY Culture and Home Renovation Trends

Homeowners are increasingly taking responsibility for routine repairs and cosmetic upgrades due to rising labor costs, the desire for customization, and the convenience of online guidance. This trend supports ongoing tool purchases, kit replacements, and expansion into specialized DIY tool segments, sustaining long-term growth in the market.

Product Innovation and Ergonomic Design

Manufacturers are introducing ergonomically designed, multi-functional, and lightweight tools that appeal to both experienced and novice users. Innovative materials and improved durability enhance usability, reduce fatigue, and make household tools more accessible for a broader demographic.

Expansion of E-commerce and Omnichannel Retail

The growth of online platforms allows a wider consumer reach and personalized product recommendations. Digital engagement strategies, including tutorial videos and virtual tool demonstrations, have created stronger consumer trust and adoption, particularly among younger demographics.

What are the restraints for the global market?

Volatility in Raw Material Prices

Steel and alloy metal price fluctuations affect manufacturing costs for household hand tools, potentially increasing retail prices and squeezing profit margins. Smaller manufacturers may face challenges in absorbing these costs without affecting affordability, particularly in price-sensitive markets.

Competition from Power Tools

While manual tools are essential for basic tasks, cordless and battery-operated tools are increasingly preferred for efficiency and convenience. This competition can restrain demand growth unless manufacturers highlight the simplicity, safety, and affordability of hand tools.

What are the key opportunities in the household hand tools market?

Emergence of DIY and Hobbyist Segments

The growing DIY and hobbyist segments provide opportunities to develop specialized kits and niche tools. Tools tailored for woodworking, crafting, and home décor assembly appeal to a younger, creative consumer base, extending market penetration beyond traditional maintenance tasks.

Regional Expansion in the Asia Pacific

Rapid urbanization, rising disposable income, and residential construction in China, India, and Southeast Asia offer significant growth potential. Companies can capitalize on infrastructure expansion and government-supported housing projects to increase tool adoption, both for households and small-scale professional users.

E-commerce and Omnichannel Growth

Investments in digital retail and omnichannel strategies provide opportunities for new entrants and established players to expand their market share. Bundled products, subscription models, and online education content strengthen customer engagement and brand loyalty.

Product Type Insights

General Purpose Tools dominate the global household hand tools market, accounting for approximately 83% of total revenue in 2024. This category includes essential tools such as screwdrivers, pliers, hammers, wrenches, and spanners, which are considered fundamental components of household toolkits worldwide. Their dominance is driven by high usage frequency, versatility across multiple applications, affordability, and recurring replacement demand. These tools are indispensable for everyday household repairs, furniture assembly, and basic maintenance, making them a non-discretionary purchase for most households.

Additionally, general-purpose tools benefit from widespread availability across both offline and online retail channels and are often sold as bundled kits, further boosting volume sales. Cutting tools (hand saws, utility knives, snips) and measuring & layout tools (tape measures, levels, squares) follow as secondary segments, supported by increasing adoption for precision-driven DIY projects, home renovation, and small-scale construction tasks. Growing consumer preference for accuracy, safety, and professional-grade outcomes in DIY work continues to support steady growth in these sub-segments.

Application Insights

The household hand tools market serves a broad range of applications, led by household DIY and maintenance, home renovation, hobbyist and craft activities, and residential construction. DIY and routine maintenance activities account for approximately 70% of total market demand, reflecting the essential and repetitive nature of these tasks. This segment is driven by rising labor costs, easy access to online tutorials, and increasing homeowner confidence in handling basic repairs independently.

Home renovation projects represent a significant secondary application, supported by remodeling trends, interior upgrades, and energy-efficiency improvements. Meanwhile, hobbyist and craft applications are emerging as a high-growth niche, particularly among younger consumers and creative enthusiasts engaged in woodworking, home décor assembly, and artistic projects. This segment benefits from social media influence, maker culture, and demand for specialized, precision-oriented tools, contributing incremental growth beyond traditional household use.

Distribution Channel Insights

Offline retail remains the dominant distribution channel, accounting for approximately 62% of total market revenue in 2024. Hardware stores, home improvement centers, hypermarkets, and specialized tool shops continue to attract consumers who prefer hands-on product evaluation, immediate availability, and in-store expert guidance. Offline channels are particularly strong in emerging markets and among older demographics, where trust and tactile assessment play a critical role in purchasing decisions.

However, online sales channels are rapidly gaining traction and represent the fastest-growing distribution segment. Digital platforms enable consumers to compare prices, access detailed specifications, read reviews, and purchase tools conveniently. The growth of online-exclusive tool kits, subscription-based offerings, bundled DIY solutions, and educational video content has significantly improved consumer engagement and conversion rates. As internet penetration and last-mile logistics improve globally, online channels are expected to steadily increase their share of total market sales.

End-Use Insights

Household DIY and maintenance remains the leading end-use segment, driven by frequent, recurring needs such as repairs, installations, and minor upgrades. This segment benefits from high tool ownership per household and strong replacement cycles. Residential construction represents another important end-use, as individual contractors and small trade professionals frequently rely on household-grade hand tools due to their portability and cost-effectiveness.

Hobbyist and creative applications are contributing incremental demand, particularly in urban markets where maker culture and personalization trends are gaining popularity. Additionally, export-driven demand from Asia Pacific manufacturing hubs plays a critical role in meeting global requirements for both household and professional users, ensuring stable supply and competitive pricing across regions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global household hand tools market with approximately 33.7% market share in 2024. Growth in this region is driven by high homeownership rates, a deeply embedded DIY culture, strong consumer purchasing power, and mature retail infrastructure. The U.S. dominates regional demand, supported by frequent home renovation activities, seasonal maintenance requirements, and widespread availability of premium tool brands. Canada contributes steady demand due to similar housing and DIY trends, while Mexico shows gradual growth fueled by urban residential development and expanding middle-class participation in home improvement.

Europe

Europe represents a significant share of the global market, with Germany, the UK, and France leading demand. Growth in this region is driven by eco-conscious DIY practices, energy-efficiency renovation projects, and a strong culture of home improvement. Consumers increasingly invest in durable, ergonomically designed tools aligned with sustainability values. Southern European countries such as Italy and Spain exhibit moderate growth, supported by a gradual recovery in residential construction and renovation spending.

Asia Pacific

Asia Pacific is the fastest-growing regional market, driven by rapid urbanization, expanding residential construction, and rising disposable incomes across China, India, Japan, and Australia. Growth is further supported by increasing DIY awareness, expanding e-commerce penetration, and strong export-oriented manufacturing ecosystems. China and India act as both major consumption markets and global production hubs, supplying cost-competitive tools worldwide, while Japan and Australia contribute stable demand for high-quality and precision tools.

Latin America

Latin America is experiencing steady growth, led by Brazil, followed by Argentina and Mexico. Market expansion is driven by urban housing development, rising DIY adoption in metropolitan areas, and improving retail accessibility. Price-sensitive consumers in the region favor affordable and durable tools, while professional users contribute incremental demand through small-scale construction and maintenance activities.

Middle East & Africa

The Middle East & Africa market is supported by new residential construction projects, infrastructure investments, and rising household disposable incomes. Key contributors include the UAE, Saudi Arabia, and South Africa, where urban expansion and housing initiatives are boosting tool demand. Growth is also driven by increasing expatriate populations and the gradual adoption of DIY practices, positioning the region as an emerging opportunity for market participants.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Manufacturers in the Household Hand Tools Market

- Stanley Black & Decker

- Apex Tool Group

- Snap-on Inc.

- Klein Tools Inc.

- Wiha Tools

- Wurth Group

- Ideal Industries

- TTi (Techtronic Industries)

- Great Wall Precision

- Knipex Tools

- Irwin Tools

- PHOENIX

- Channellock

- Tajima

- JPW Industries