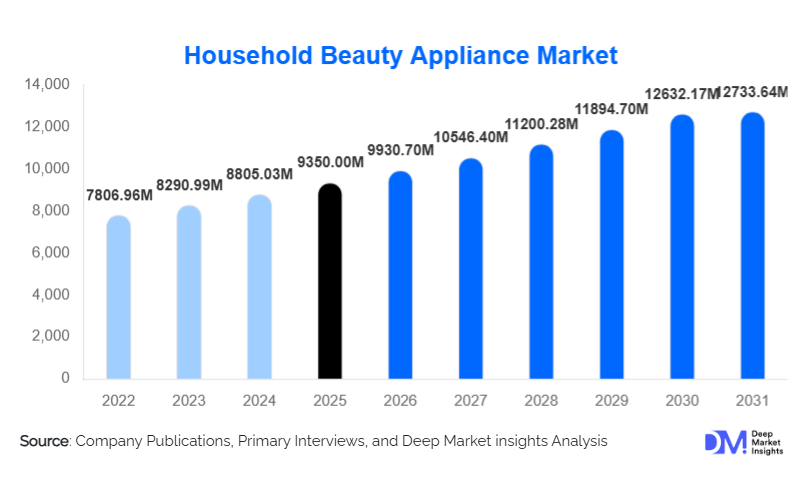

Household Beauty Appliance Market Size

According to Deep Market Insights, the global household beauty appliance market size was valued at USD 9350 million in 2025 and is projected to grow from USD 9930.7 million in 2026 to reach USD 12733.64 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The household beauty appliance market growth is primarily driven by increasing consumer preference for at-home grooming solutions, rising awareness of personal care and hygiene, and continuous technological innovation across hair care, skin care, and oral beauty devices. Growing disposable incomes, urbanization, and the influence of digital media and beauty influencers are further accelerating adoption across both developed and emerging economies.

Key Market Insights

- Hair care appliances dominate global demand, supported by frequent replacement cycles and universal consumer usage.

- Rechargeable and cordless appliances lead technology adoption, accounting for over 60% of new product sales due to portability and convenience.

- Asia-Pacific represents the largest market share, driven by population scale, rising middle-class income, and strong manufacturing ecosystems.

- North America remains the premium innovation hub, with high penetration of smart and connected beauty appliances.

- E-commerce and D2C channels are reshaping distribution, enabling brands to reach global consumers directly.

- Premiumization and smart feature integration are improving margins and extending product lifecycles.

What are the latest trends in the household beauty appliance market?

Smart and Connected Beauty Devices

One of the most prominent trends in the household beauty appliance market is the integration of smart and connected technologies. Devices equipped with sensors, AI-based personalization, and mobile app connectivity are enabling users to customize settings based on hair type, skin sensitivity, or oral health needs. Smart hair straighteners that regulate heat automatically and app-connected facial cleansing devices that provide usage analytics are gaining popularity, particularly among tech-savvy and premium consumers. This trend enhances user experience, improves safety, and encourages brand loyalty through software-driven ecosystems.

Rising Demand for Multi-Functional Appliances

Consumers are increasingly favoring multi-functional beauty appliances that combine multiple grooming functions into a single device. Hair styling tools that integrate drying, curling, and straightening capabilities, as well as skin care devices offering cleansing, toning, and anti-aging functions, are seeing strong adoption. This trend is driven by space constraints in urban households, cost efficiency, and convenience, especially among younger consumers and frequent travelers.

What are the key drivers in the household beauty appliance market?

Shift Toward At-Home Grooming and Self-Care

The structural shift toward at-home grooming has emerged as a key growth driver for the household beauty appliance market. Consumers are increasingly investing in personal care devices to replicate salon-quality results at home, driven by convenience, hygiene awareness, and long-term cost savings. This trend has particularly boosted demand for hair styling tools, IPL hair removal devices, and facial treatment appliances.

Technological Advancements and Product Innovation

Continuous innovation in heating elements, battery efficiency, safety sensors, and ergonomic design is significantly enhancing product performance. Advanced technologies such as ionic conditioning, ceramic and tourmaline coatings, microcurrent therapy, and LED-based skin treatments are expanding the functional scope of household beauty appliances. These innovations are enabling manufacturers to command higher price points while improving consumer satisfaction.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Despite strong growth potential, high price sensitivity in emerging economies remains a key restraint. Premium beauty appliances are often perceived as discretionary purchases, limiting adoption among lower- and middle-income consumers. The presence of low-cost, unbranded alternatives further intensifies pricing pressure and affects brand penetration.

Intense Competition and Margin Pressure

The household beauty appliance market is highly competitive, with frequent product launches and aggressive pricing strategies. Rapid commoditization, especially in mass-market segments, leads to margin pressure and short product lifecycles, requiring continuous innovation and marketing investments from manufacturers.

What are the key opportunities in the household beauty appliance industry?

Expansion in Emerging Economies

Emerging markets such as India, Indonesia, Vietnam, Brazil, and parts of Africa present significant untapped potential. Rising urban populations, increasing beauty consciousness, and improving access to e-commerce platforms are expanding the addressable consumer base. Localized manufacturing and affordable mid-premium product offerings can unlock large-scale adoption in these regions.

Sustainable and Energy-Efficient Product Development

Growing regulatory focus on energy efficiency, product safety, and sustainability presents opportunities for manufacturers to differentiate through eco-friendly designs. Appliances with lower energy consumption, recyclable materials, and extended durability are gaining traction among environmentally conscious consumers and regulators alike.

Product Type Insights

Hair care appliances account for the largest share of the household beauty appliance market, contributing approximately 38% of global revenue in 2025. This dominance is supported by high-frequency usage and replacement demand. Skin care appliances represent the fastest-growing product category, driven by rising interest in anti-aging, acne treatment, and facial cleansing solutions. Oral beauty appliances, particularly electric toothbrushes, maintain steady demand due to recurring replacement cycles and health awareness. Nail care and hair removal devices continue to gain traction, supported by innovation in compact and painless technologies.

Technology Insights

Rechargeable and battery-powered appliances dominate the market, accounting for nearly 62% of total sales in 2025. Cordless operation, fast charging, and improved battery life have significantly enhanced usability. Smart and connected appliances, while still a niche segment, are growing at double-digit rates and are expected to play a critical role in premium market expansion over the forecast period.

Distribution Channel Insights

Online retail channels represent the fastest-growing distribution segment, accounting for approximately 41% of global sales in 2025. E-commerce platforms and direct-to-consumer websites enable brands to offer competitive pricing, wider product assortments, and personalized marketing. Offline retail, including specialty stores and brand-owned outlets, continues to play a crucial role in premium product sales, where hands-on demonstrations influence purchase decisions.

End-Use Insights

Residential consumers dominate the household beauty appliance market, contributing nearly 78% of total demand in 2025. Growing preference for personal grooming at home and increasing beauty awareness across genders support this dominance. Professional end users, including salons and spas, represent a smaller but high-value segment, particularly for premium and durable appliances designed for frequent use.

| By Product Type | By Technology | By Price Range | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest market share at approximately 42% in 2025, driven by strong demand from China, Japan, South Korea, and India. Rising disposable incomes, expanding middle-class populations, and strong domestic manufacturing capabilities support regional growth. India is the fastest-growing country in the region, with double-digit CAGR supported by urbanization and e-commerce penetration.

North America

North America accounts for around 26% of the global market, led by the United States. High adoption of premium and smart beauty appliances, strong brand presence, and innovation-driven demand characterize this region. Consumers show strong willingness to pay for advanced features and performance.

Europe

Europe represents a mature but stable market, with strong demand from Germany, the U.K., and France. Sustainability, safety standards, and premium design are key purchasing factors influencing European consumers.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growth is supported by rising beauty consciousness and improving access to branded appliances through online retail channels.

Middle East & Africa

The Middle East & Africa region shows steady growth, supported by premium demand in GCC countries and rising urban consumption in South Africa and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|