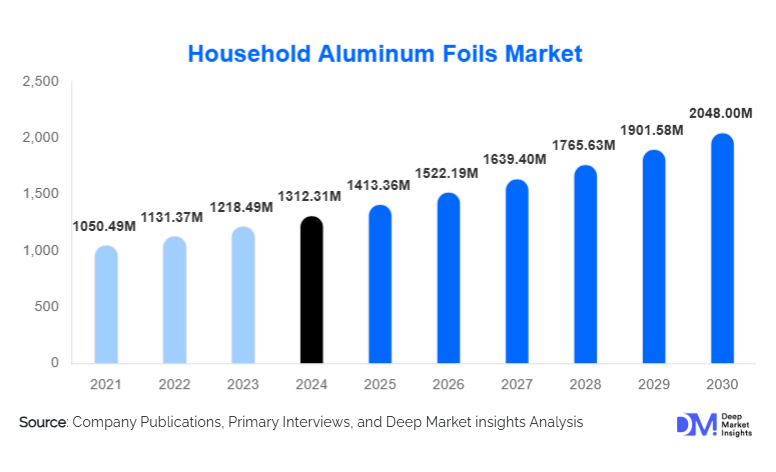

Household Aluminum Foils Market Size

According to Deep Market Insights, the global household aluminum foils market size was valued at USD 1,312.31 million in 2024 and is projected to grow from USD 1,413.36 million in 2025 to reach USD 2,048.00 million by 2030, expanding at a CAGR of 7.70% during the forecast period (2025–2030). The household aluminum foils market growth is supported by steady demand from residential households, rising home cooking and food storage activities, and the expansion of modern retail and private-label brands across both developed and emerging economies.

Key Market Insights

- Household aluminum foil remains a staple kitchen product due to its versatility across cooking, baking, grilling, and food storage applications.

- Standard household foils (9–12 microns) dominate demand, offering an optimal balance between cost, strength, and usability.

- North America and Europe together account for over 50% of global demand, driven by high per-capita consumption and premium product adoption.

- Asia-Pacific is the fastest-growing region, supported by urbanization, rising disposable incomes, and expanding modern retail penetration.

- Private-label and mid-range branded products are gaining market share, particularly in price-sensitive and high-volume markets.

- Sustainability and recyclability are increasingly influencing consumer purchasing decisions and brand strategies.

What are the latest trends in the household aluminum foils market?

Shift Toward Heavy-Duty and Convenience Formats

Consumers are increasingly opting for heavy-duty and extra-heavy-duty aluminum foils that offer better tear resistance and performance during grilling and baking. Pre-cut foil sheets and foil containers are also gaining popularity due to their convenience, reduced wastage, and consistent portion sizing. These formats are particularly востребованы in North America and Europe, where time efficiency and ease of use are key purchasing drivers.

Rising Focus on Sustainable Packaging and Recycling

Sustainability is becoming a central trend in the household aluminum foils market. Manufacturers are emphasizing recyclable packaging, increased use of recycled aluminum content, and eco-friendly refill packs. Retailers are promoting aluminum foil as a more sustainable alternative to plastic wraps, reinforcing its circular economy credentials. This trend is especially strong in Europe, where environmental regulations and consumer awareness are shaping product innovation.

What are the key drivers in the household aluminum foils market?

Growth in Home Cooking and Food Storage

Increased home cooking, baking, and meal preparation have structurally raised demand for household aluminum foils. The product’s ability to preserve freshness, withstand high temperatures, and offer hygienic food protection makes it indispensable in daily household use. This driver remains strong even as post-pandemic lifestyles normalize.

Urbanization and Expanding Middle-Class Population

Rapid urbanization in Asia-Pacific, Latin America, and parts of the Middle East is driving the adoption of modern kitchen essentials. Rising disposable incomes and exposure to western cooking practices are accelerating foil usage in emerging markets, contributing to steady volume growth.

What are the restraints for the global market?

Volatility in Aluminum Raw Material Prices

Fluctuations in primary aluminum prices directly affect production costs and profit margins. Manufacturers operating in the economy and private-label segments face pricing pressure, limiting their ability to pass on cost increases to consumers.

Emergence of Reusable Alternatives

Silicone food covers, beeswax wraps, and reusable containers are gaining traction among environmentally conscious consumers. While still niche, these alternatives pose a long-term substitution risk, particularly in premium urban markets.

What are the key opportunities in the household aluminum foils market?

Premiumization and Value-Added Products

There is a growing opportunity in premium offerings such as non-stick foils, grill-specific foils, and thicker gauges. These products command higher margins and cater to consumers seeking durability and enhanced performance.

Emerging Market Expansion and E-Commerce Growth

Asia-Pacific, Africa, and Latin America present significant untapped potential. The rapid growth of e-commerce grocery platforms allows brands to reach new consumers directly, improve margins, and build private-label portfolios.

Product Type Insights

Standard household aluminum foils account for approximately 42% of global demand in 2024, making them the dominant product type in the market. Their leadership is primarily driven by an optimal balance between affordability, strength, and versatility, allowing them to meet a wide range of everyday household needs such as food wrapping, baking, and freezer storage. These foils are widely adopted across both developed and emerging markets due to their compatibility with mass retail distribution and private-label offerings, which further enhances their accessibility and volume sales.

Heavy-duty and extra-heavy-duty aluminum foils represent the fastest-growing product category, supported by rising consumer preference for grilling, roasting, and high-temperature cooking. Growth in outdoor cooking cultures, barbecue trends, and oven-based meal preparation—particularly in North America, Australia, and parts of Europe—has significantly increased demand for thicker foils that offer higher tear resistance and durability. Meanwhile, pre-cut foil sheets and household foil containers are gaining traction in premium and urban households, driven by convenience, portion control, reduced wastage, and increased adoption among time-constrained consumers and high-income households.

Application Insights

Food wrapping and storage dominate household aluminum foil applications, accounting for nearly 38% of the total market share in 2024. This segment’s leadership is driven by high-frequency daily usage, strong food preservation properties, and widespread consumer reliance on aluminum foil to extend shelf life, prevent contamination, and retain freshness. Increasing consumption of leftovers, meal prepping, and frozen foods continues to reinforce demand for foil-based storage solutions.

Cooking and baking applications follow closely, supported by rising home cooking trends and the growing popularity of oven-based recipes. Aluminum foil’s superior heat conductivity and moisture retention make it a preferred material for baking and roasting. Grilling applications are experiencing above-average growth, particularly in regions with strong outdoor cooking traditions such as North America, Australia, and parts of the Middle East. Seasonal grilling activities and social dining trends are accelerating demand for heavy-duty foil variants within this application segment.

Distribution Channel Insights

Supermarkets and hypermarkets remain the leading distribution channel, accounting for approximately 47% of global household aluminum foil sales in 2024. Their dominance is driven by high consumer footfall, extensive shelf space, and aggressive promotion of private-label products, which offer competitive pricing and consistent quality. Bulk packaging options and in-store promotions further strengthen sales through this channel.

Online retail is the fastest-growing distribution channel, supported by the expansion of e-commerce grocery platforms, convenience-driven purchasing behavior, and subscription-based household essentials models. Consumers increasingly prefer online platforms for bulk purchases, price comparisons, and doorstep delivery, particularly in urban markets. The growth of direct-to-consumer (D2C) brand strategies is also enabling manufacturers to improve margins and enhance customer engagement.

End-User Insights

Residential households account for nearly 90% of total market demand, underscoring the highly consumer-centric nature of the household aluminum foils market. Consistent daily usage, high replacement frequency, and strong integration into routine cooking and storage practices make residential consumers the primary demand driver globally.

Small food service operators and home-based food businesses represent a growing niche segment, particularly in densely populated urban areas across the Asia-Pacific and Latin America. The rise of cloud kitchens, home bakers, and micro-caterers has increased demand for cost-effective, hygienic, and easy-to-use food wrapping and cooking solutions, providing incremental growth opportunities beyond traditional household usage.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 27% of the global household aluminum foils market share in 2024, led by the United States. Regional growth is driven by high per-capita consumption, widespread adoption of heavy-duty foil formats, and strong demand for grilling and baking applications. The region also benefits from advanced retail infrastructure, high penetration of private-label brands, and consumer willingness to pay for premium and convenience-oriented foil products. Sustainability awareness and recycling programs further support long-term market stability.

Europe

Europe accounts for nearly 25% of global demand, with Germany, the U.K., France, and Italy serving as major markets. Growth in this region is primarily driven by stringent sustainability regulations, high recycling awareness, and consumer preference for environmentally responsible packaging. Demand for recycled aluminum foil, refill packs, and paper-based packaging formats is increasing, influencing product innovation. Strong baking traditions and high home-cooking participation also contribute to steady consumption.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 5.8%. Growth is fueled by rapid urbanization, rising disposable incomes, expanding middle-class populations, and increasing penetration of modern retail formats. China and India lead volume growth due to population scale and changing food consumption habits, while Japan and South Korea drive demand for premium, pre-cut, and convenience-focused aluminum foil products. The rise of e-commerce grocery platforms further accelerates regional market expansion.

Latin America

Latin America is experiencing steady growth, with Brazil and Mexico dominating regional demand. Rising middle-class consumption, increased adoption of packaged food habits, and improving modern retail infrastructure are key growth drivers. Urbanization and the gradual shift from traditional food storage methods to modern kitchen solutions are supporting consistent foil demand across the region.

Middle East & Africa

The Middle East demonstrates strong per-capita consumption, particularly in GCC countries, driven by grilling-intensive cooking practices, high disposable incomes, and a preference for durable household products. Africa represents a long-term growth opportunity, supported by increasing urbanization, expanding retail penetration, and gradual adoption of modern household cooking and storage practices. Population growth and improving living standards are expected to drive sustained demand over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Aluminum Foils Market

- Reynolds Consumer Products

- Amcor

- Novelis

- Hindalco Industries

- UACJ Corporation

- Alcoa Corporation

- Norsk Hydro

- Constellium

- Gränges

- JW Aluminum