Hostels Market Size

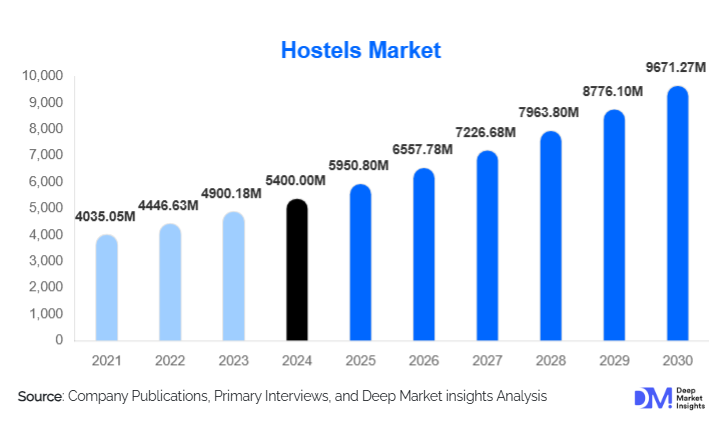

According to Deep Market Insights, the global hostels market size was valued at USD 5,400.00 million in 2024 and is projected to grow from USD 5,950.80 million in 2025 to reach USD 9,671.27 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The hostels market growth is primarily driven by the resurgence of international tourism, increasing demand for budget-friendly and experience-oriented accommodation, and the rapid rise of solo travelers, students, and digital nomads seeking affordable yet socially engaging lodging options.

Key Market Insights

- Hostels are evolving into lifestyle-oriented accommodations, integrating co-working spaces, curated social events, and private-room offerings alongside traditional dormitories.

- Urban and city-center hostels dominate demand, benefiting from proximity to transport hubs, tourist attractions, and nightlife districts.

- Europe leads the global market, supported by a dense tourism ecosystem and a strong backpacking culture.

- Asia-Pacific is the fastest-growing region, driven by expanding youth populations, domestic tourism growth, and rising affordability of air travel.

- Digital nomads and long-stay travelers are emerging as high-value customer segments, increasing average length of stay and ancillary revenue.

- Technology adoption, including mobile check-in, smart pricing, and digital community platforms, is reshaping hostel operations globally.

What are the latest trends in the hostels market?

Lifestyle and Hybrid Hostel Concepts Gaining Popularity

Modern hostels are increasingly positioning themselves as lifestyle destinations rather than purely budget accommodations. Operators are introducing hybrid formats that combine dormitory beds with private rooms, social lounges, bars, and communal kitchens. Many hostels now host live music, city tours, and networking events, transforming properties into social hubs for travelers. This trend is particularly prominent in Europe and the Asia-Pacific region, where travelers prioritize experiences and community interaction alongside affordability.

Technology-Driven Hostel Operations

Digital transformation is accelerating across the hostel market. Mobile-first booking systems, contactless check-ins, smart lockers, and dynamic pricing models are improving operational efficiency and customer satisfaction. Some hostel chains are deploying proprietary apps that enable guests to connect with fellow travelers, book local experiences, and extend stays digitally. Technology adoption is also enabling better yield management, helping operators stabilize revenues amid seasonal demand fluctuations.

What are the key drivers in the hostels market?

Growth in Budget and Experiential Travel

Global travelers, particularly millennials and Gen Z, increasingly prioritize experiences over luxury accommodations. Hostels align strongly with this preference by offering affordable stays combined with social engagement, cultural immersion, and local experiences. The expansion of low-cost airlines and flexible travel policies has further supported the growth of hostel-based travel, especially for short city breaks and multi-destination trips.

Rise of Solo Travel and Youth Mobility

The steady increase in solo travel, student exchange programs, and working holiday visas is driving consistent demand for hostels. Hostels provide safe, cost-effective, and socially interactive environments, making them particularly attractive to first-time international travelers and younger demographics. This trend has been observed strongly across Europe, Southeast Asia, and Latin America.

What are the restraints for the global market?

Regulatory and Zoning Constraints

Hostel development in major cities often faces regulatory hurdles related to zoning laws, occupancy limits, and safety compliance. In several markets, local authorities impose restrictions on shared accommodations, increasing compliance costs and slowing new property development. These regulatory challenges are particularly pronounced in North America and parts of Western Europe.

Seasonality and Revenue Volatility

The hostels market is highly sensitive to tourism seasonality, resulting in fluctuating occupancy rates and revenue streams. Off-peak periods can significantly impact profitability, especially for independent operators with high fixed costs. Managing cash flow during low-demand seasons remains a key operational challenge.

What are the key opportunities in the hostels industry?

Digital Nomad and Long-Stay Hostel Models

The rise of remote work presents a major opportunity for hostel operators. Properties offering co-working spaces, high-speed internet, and long-stay pricing packages are attracting digital nomads seeking affordable, community-driven accommodations. Countries introducing digital nomad visas are further strengthening demand for this segment.

Expansion into Emerging Tourism Markets

Emerging economies in Asia-Pacific, Latin America, and Eastern Europe offer significant growth potential due to rising domestic tourism and limited penetration of organized hostel chains. Lower real estate costs and supportive tourism policies make these regions attractive for new hostel developments.

Accommodation Type Insights

Mixed-use hostels, offering both shared dormitories and private rooms, dominate the market due to their ability to attract diverse traveler profiles and stabilize occupancy rates. Shared dormitories remain the most affordable option and are popular among backpackers and students, while private rooms are increasingly preferred by couples, older travelers, and long-stay guests seeking privacy without hotel-level pricing.

Traveler Type Insights

Backpackers and budget leisure travelers account for the largest share of hostel demand, driven by affordability and social interaction. Students and academic travelers represent a fast-growing segment, supported by international exchange programs and educational travel. Digital nomads and long-stay travelers are emerging as high-value customers, contributing to longer average stays and higher per-guest spending.

Distribution Channel Insights

Online travel agencies and digital booking platforms dominate hostel reservations, accounting for a majority of bookings due to convenience, price transparency, and peer reviews. Direct bookings through hostel websites are growing as operators invest in digital marketing and loyalty programs. Walk-in bookings remain relevant in high-traffic tourist destinations, particularly in developing markets.

| By Ownership & Operating Model | By Price Tier | By Traveler Type | By Location Type | By Accommodation Configuration |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 38% of the global hostels market in 2024, led by Germany, France, Spain, and the U.K. The region benefits from a well-established backpacking culture, dense transport networks, and strong inbound tourism volumes.

Asia-Pacific

Asia-Pacific holds around 32% market share and is the fastest-growing region, with countries such as China, India, Thailand, Japan, and Indonesia driving demand. Rapid urbanization, youth travel, and domestic tourism growth are key factors.

North America

North America represents roughly 17% of the market, supported by urban tourism and increasing acceptance of hostels among older and solo travelers in major U.S. and Canadian cities.

Latin America

Latin America accounts for about 8% of global demand, with strong growth in Mexico, Brazil, and Colombia, driven by backpacker tourism and improving travel infrastructure.

Middle East & Africa

This region contributes nearly 5% of the global market, with emerging hostel demand in the UAE, Morocco, South Africa, and Kenya, supported by tourism diversification initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hostels Market

- Generator Hostels

- A&O Hostels

- HI Hostels

- YHA (Youth Hostels Association)

- Meininger Hotels

- Selina Hospitality

- Freehand Hotels

- St Christopher’s Inns

- Safestay

- Wombats Hostels

- Zostel

- Lub d Hostels

- Mad Monkey Hostels

- Base Backpackers

- Plus Hostels