Hospitality Buildings Market Size

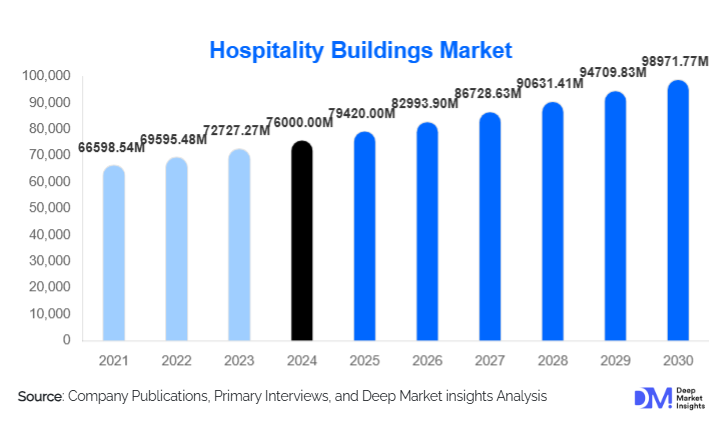

According to Deep Market Insights, the global hospitality buildings market size was valued at USD 76,000.00 million in 2024 and is projected to grow from USD 79,420.00 million in 2025 to reach USD 98,971.77 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The market growth is primarily driven by the strong recovery of global tourism, resurgence of business travel, rising investments in resort and leisure infrastructure, and increasing demand for mid-scale and branded hotel developments across emerging economies.

Key Market Insights

- Hotels account for over half of total hospitality building investments, driven by aggressive expansion strategies of global hotel chains.

- Asia-Pacific dominates new hospitality construction activity, supported by tourism-led infrastructure development in China, India, and Southeast Asia.

- Adaptive reuse of commercial buildings into hotels is accelerating, particularly across North America and Europe.

- Mid-scale and 4-star hospitality buildings are expanding fastest, balancing affordability, occupancy stability, and operating margins.

- Sustainability-driven construction practices, including green materials and energy-efficient designs, are becoming standard across new projects.

- Technology integration, such as smart building systems and modular construction, is reshaping cost structures and project timelines.

What are the latest trends in the hospitality buildings market?

Rise of Sustainable and Green Hospitality Buildings

Sustainability has become a defining trend in hospitality construction. Developers are increasingly adopting green building certifications, renewable energy systems, water recycling infrastructure, and low-carbon construction materials. Governments and institutional investors are prioritizing ESG-compliant hospitality assets, making sustainability a prerequisite rather than a differentiator. Net-zero hotels, biophilic architecture, and climate-resilient resort designs are gaining traction, particularly in Europe, North America, and the Middle East. This shift is reducing long-term operating costs while enhancing asset valuation and regulatory compliance.

Adaptive Reuse and Mixed-Use Hospitality Developments

The conversion of underutilized offices, retail centers, and heritage properties into hospitality buildings is expanding rapidly. Adaptive reuse projects lower capital expenditure, shorten development timelines, and align with urban regeneration policies. Mixed-use developments that integrate hotels with retail, residential, and entertainment spaces are becoming common in metropolitan markets. These projects improve land-use efficiency and create diversified revenue streams, making them attractive to both public and private investors.

What are the key drivers in the hospitality buildings market?

Global Tourism Recovery and Expansion

The rebound in international and domestic tourism remains the strongest driver for hospitality building demand. Leisure travel has surpassed pre-pandemic levels in several regions, driving the construction of resorts, destination hotels, and boutique properties. Emerging tourism destinations are witnessing accelerated hotel pipeline growth supported by government-led tourism promotion and infrastructure spending.

Expansion of Branded Hotel Chains

Global hotel brands are expanding aggressively through asset-light models, franchising, and management contracts. This has significantly increased demand for standardized hotel buildings across mid-scale and economy segments. Chain-backed properties benefit from brand recognition, financing access, and higher occupancy rates, making them the preferred choice for developers and investors.

What are the restraints for the global market?

Rising Construction and Financing Costs

Escalating prices of steel, cement, and skilled labor have increased overall project costs, impacting profitability and delaying new developments. Higher interest rates and tighter credit conditions are also restricting access to financing, particularly for independent developers and small-scale projects.

Regulatory and Environmental Compliance Challenges

Stricter zoning laws, sustainability mandates, and building safety regulations have increased development complexity and approval timelines. Compliance costs can significantly impact project feasibility, especially in mature markets with rigorous environmental standards.

What are the key opportunities in the hospitality buildings industry?

Tourism-Led Infrastructure Development Programs

Government-backed tourism master plans across Asia-Pacific, the Middle East, and Africa present long-term growth opportunities. Mega tourism projects, visa liberalization policies, and public-private partnerships are driving demand for large-scale hospitality buildings, including resorts, convention hotels, and integrated leisure complexes.

Smart and Modular Construction Technologies

The adoption of modular construction, prefabrication, and smart building systems is transforming hospitality development economics. These technologies reduce construction timelines, improve cost predictability, and enhance energy efficiency. Developers adopting smart infrastructure gain competitive advantages through lower lifecycle costs and faster project delivery.

Building Type Insights

Hotels remain the dominant building type, accounting for approximately 52% of the global hospitality buildings market in 2024. Resorts follow, driven by experiential and leisure tourism demand. Serviced apartments and extended-stay properties are growing rapidly due to long-stay business travel and corporate relocation needs. Alternative hospitality buildings such as boutique hotels and branded hostels are expanding in urban and cultural destinations, catering to experience-driven travelers.

Ownership & Development Model Insights

Chain-owned and managed properties lead the market with a 46% share, supported by asset-light expansion strategies. Franchise-based and management contract models are increasingly preferred, enabling rapid global footprint expansion while reducing capital intensity. Independent properties continue to dominate niche and heritage segments.

Construction Type Insights

New-build projects represent around 58% of the total market value, particularly in emerging tourism markets. Renovation and retrofit activity is strong in mature regions, driven by brand upgrades and sustainability mandates. Adaptive reuse projects are growing fastest, especially in urban North America and Europe.

End-Use Insights

Leisure tourism accounts for approximately 44% of total demand, supported by resorts and destination hotels. Business travel and MICE-related hospitality buildings are recovering steadily, particularly in global financial hubs. Long-stay and serviced accommodation demand is rising due to corporate mobility and hybrid work trends.

| By Building Type | By Ownership & Development Model | By Construction Type | By Location | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global hospitality buildings market with a 38% share in 2024. China, India, Japan, Indonesia, and Thailand are major demand centers. India is the fastest-growing market, supported by domestic tourism growth and large-scale hotel pipeline additions.

North America

North America accounts for approximately 26% of the global market value, driven by the U.S. and Canada. Renovation, brand conversion, and adaptive reuse projects dominate activity, supported by strong domestic travel and urban tourism demand.

Europe

Europe represents around 21% of the market, led by France, Germany, Spain, and the U.K. Sustainability-focused renovation and heritage hotel development are key growth drivers.

Middle East & Africa

The region holds nearly 10% share, driven by mega tourism projects in the UAE and Saudi Arabia, along with resort development across Africa’s prime leisure destinations.

Latin America

Latin America contributes about 5% of global demand, with Mexico and Brazil leading hotel construction activity linked to tourism and business travel growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hospitality Buildings Market

- Marriott International

- Hilton Worldwide

- Accor

- InterContinental Hotels Group (IHG)

- Hyatt Hotels Corporation

- Wyndham Hotels & Resorts

- Radisson Hotel Group

- Jin Jiang International

- Shangri-La Group

- Melia Hotels International

- Minor International

- Choice Hotels International

- Mandarin Oriental Hotel Group

- Four Seasons Hotels & Resorts

- NH Hotel Group