Hospital Furniture Market Size

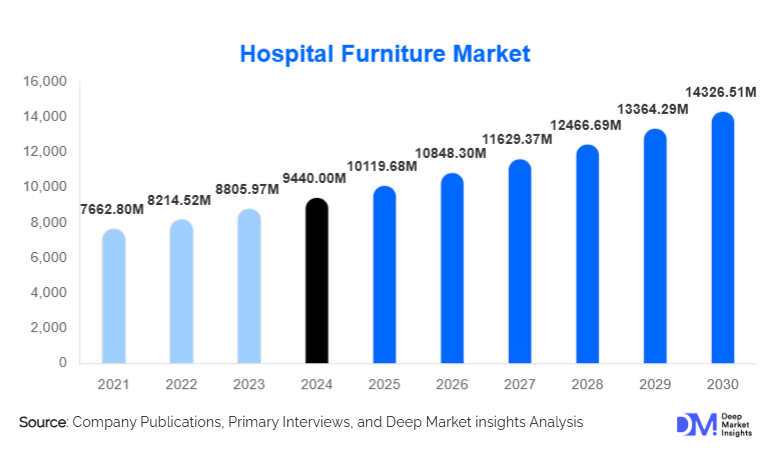

According to Deep Market Insights, the global hospital furniture market size was valued at USD 9,440 million in 2024 and is projected to grow from USD 10,119.68 million in 2025 to reach USD 14,326.51 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by the rapid expansion of healthcare infrastructure globally, rising demand for ergonomic and patient-centric furniture, and the integration of smart and electric furniture solutions in hospitals and specialty clinics.

Key Market Insights

- Hospital beds remain the largest product segment, reflecting growing demand across ICUs, general wards, and long-term care facilities.

- Metal-based furniture dominates the material segment, due to its durability, ease of sterilization, and suitability for critical care environments.

- Public hospitals are the leading end-users, driving bulk procurement and contributing to over 45% of global demand.

- Asia-Pacific is the fastest-growing regional market, fueled by government healthcare investments and rapid hospital construction in China, India, and Southeast Asia.

- Technological adoption, including electric beds, connected furniture, and smart monitoring systems, is reshaping hospital infrastructure and care delivery efficiency.

- Replacement and refurbishment demand in developed markets is emerging as a recurring revenue stream, driven by modernization and compliance requirements.

What are the latest trends in the hospital furniture market?

Smart and Electric Hospital Furniture Adoption

Hospitals worldwide are increasingly adopting electric and smart furniture solutions, such as motorized beds, integrated nurse-call systems, and connected patient monitoring. These innovations improve patient comfort, enhance staff efficiency, and reduce injury risks. Smart beds equipped with sensors can monitor patient movement, alert caregivers to critical events, and support remote monitoring, particularly in ICU and long-term care settings. Adoption of electric furniture is higher in developed regions, while emerging economies are gradually integrating mid-range motorized solutions as healthcare modernization expands.

Focus on Infection Control and Ergonomics

Healthcare facilities are prioritizing furniture that supports infection prevention and ergonomic care. Antimicrobial surfaces, easy-to-clean metal furniture, and ergonomic designs for nurses and patients are becoming standard. Regulatory mandates and hospital accreditation requirements reinforce this trend, pushing manufacturers to innovate with materials that minimize microbial growth, enhance durability, and support efficient clinical workflows. Modular furniture that can be disinfected or replaced quickly is increasingly preferred in surgical and ICU environments.

What are the key drivers in the hospital furniture market?

Expansion of Healthcare Infrastructure

Rapid urbanization and population growth are driving new hospital construction and clinic expansion worldwide. Governments in the Asia-Pacific, the Middle East, and Africa are investing heavily in public health infrastructure, creating high-volume procurement opportunities for hospital furniture. Private hospitals and specialty clinics are also expanding to meet growing demand for high-quality care, particularly in urban and semi-urban regions.

Growing Aging Population

The increasing proportion of elderly patients globally is fueling demand for specialized furniture, including adjustable beds, recliners, and mobility-friendly seating. Aging populations in North America, Europe, and East Asia contribute to higher hospitalization rates and long-term care needs, which in turn support growth in ergonomic and advanced hospital furniture segments.

Emphasis on Patient Safety and Comfort

Healthcare providers are increasingly focused on reducing hospital-acquired infections and improving patient outcomes. Hospitals are investing in furniture designed for hygiene, safety, and ease of handling, including overbed tables, bedside cabinets, and examination chairs with antimicrobial coatings. Furniture that enhances patient experience and minimizes caregiver strain is becoming a critical consideration in procurement.

What are the restraints for the global market?

High Initial Costs

Advanced hospital furniture, particularly electric and smart beds, involves significant upfront investment. Cost constraints are a key barrier, especially for public hospitals and healthcare providers in developing regions. Budget limitations often result in slower adoption of premium furniture solutions.

Procurement Complexity and Replacement Cycles

Hospital furniture procurement involves long tender processes, regulatory approvals, and extended replacement cycles due to the durability of products. These factors can delay revenue realization for manufacturers and limit short-term market growth, particularly in public healthcare systems with strict procurement protocols.

What are the key opportunities in the hospital furniture industry?

Government Infrastructure Investments

Significant investments by governments in hospital construction, renovation, and expansion represent a long-term growth opportunity. Bulk procurement projects for public hospitals in Asia-Pacific, the Middle East, and Africa are expected to drive market growth. Manufacturers that comply with public tender specifications and offer standardized, high-durability furniture are well-positioned to capture these opportunities.

Integration of Smart and Connected Solutions

The demand for furniture integrated with sensors, electric adjustments, and patient monitoring capabilities is increasing globally. Hospitals are willing to invest in smart beds, modular storage, and connected examination furniture to enhance operational efficiency and patient care. Manufacturers that innovate in smart solutions can access premium pricing and establish long-term partnerships with advanced healthcare facilities.

Replacement and Refurbishment in Developed Markets

Replacement demand in North America and Europe is a recurring revenue opportunity, driven by the modernization of aging hospital infrastructure. Furniture upgrades to meet infection control, ergonomic, and sustainability standards create steady demand. Modular and recyclable furniture solutions are particularly attractive, supporting hospitals’ long-term operational efficiency and compliance needs.

Product Type Insights

Hospital beds dominate the market, accounting for approximately 38% of global demand in 2024. Electric and semi-electric beds are growing rapidly due to patient comfort and clinical efficiency requirements. Operating room furniture and examination tables are expanding, supported by surgical and diagnostic facility growth. Storage units and waiting area furniture are also witnessing steady demand, especially in emerging markets where new hospitals are being built.

Application Insights

Hospitals and clinics are the primary end-users, representing over 70% of market demand. Long-term care and rehabilitation centers are emerging as a high-growth segment due to aging populations. Ambulatory surgical centers and specialty clinics require compact and modular furniture, further driving demand for innovative solutions. Private hospitals and medical tourism hubs are investing in premium and ergonomic furniture to enhance patient experience and branding.

| By Product Type | By Material Type | By Functionality | By End-Use Facility | By Procurement Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, with the U.S. and Canada accounting for over 26% of global demand in 2024. High healthcare expenditure, frequent replacement cycles, and technology adoption drive furniture sales. Hospitals increasingly adopt smart beds, ergonomic chairs, and advanced storage solutions to improve patient care and operational efficiency.

Europe

Europe accounts for approximately 27% of the market. Germany, the U.K., and France lead regional demand, driven by refurbishment projects and strict regulatory standards. The replacement market is strong, with hospitals upgrading furniture to meet safety, ergonomic, and sustainability requirements.

Asia-Pacific

Asia-Pacific is the fastest-growing region with over 24% share in 2024 and is expected to experience double-digit growth. China, India, and Southeast Asia are expanding public and private hospital infrastructure rapidly. Rising middle-class healthcare access and government modernization programs further accelerate demand for both new installations and smart furniture.

Middle East & Africa

Middle East & Africa account for around 9% of the market. Investments in healthcare infrastructure in Saudi Arabia, the UAE, and South Africa drive demand for hospital beds, OR furniture, and modular storage units.

Latin America

Latin America holds approximately 8% of the market, with Brazil and Mexico leading. Growing private healthcare investment and modernization of existing hospitals support furniture demand, though infrastructure expansion is slower than in the Asia-Pacific.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hospital Furniture Market

- Stryker Corporation

- Hill-Rom Holdings

- Getinge AB

- Medline Industries

- Steelcase Health

- Arjo AB

- LINET Group

- Invacare Corporation

- Baxter International

- Stiegelmeyer GmbH

- Krug Furniture

- Herman Miller Healthcare

- Favero Health Projects

- Narang Medical

- Paramount Bed Holdings