Homogenizers Market Size

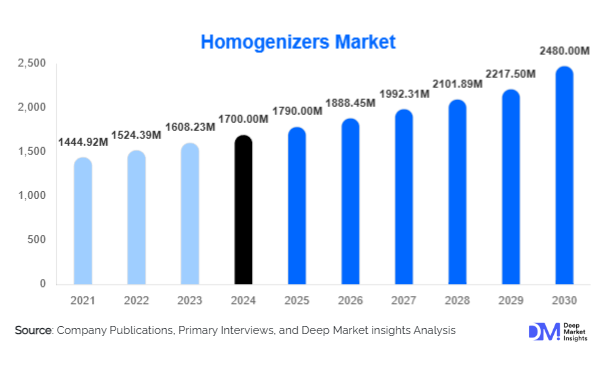

According to Deep Market Insights, the global homogenizers market size was valued at USD 1,700 million in 2024 and is projected to grow from USD 1,790 million in 2025 to reach USD 2,480 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The homogenizers market growth is primarily driven by rising demand across food & beverage, pharmaceutical, cosmetic, and chemical industries for uniform particle size distribution, high-quality emulsions, and advanced process control capabilities, alongside increasing adoption of smart and energy-efficient homogenization technologies.

Key Market Insights

- High-pressure and ultrasonic homogenizers dominate technology adoption, offering superior particle size reduction, emulsion stability, and process efficiency across industries.

- Asia Pacific leads global demand, driven by expanding food processing, biopharma, and cosmetic manufacturing sectors in China, India, and Southeast Asia.

- Food & beverage remains the largest end-use segment, particularly for dairy, beverages, sauces, and processed foods requiring high-quality homogenization.

- Smart and IoT-enabled homogenizers are transforming process control, predictive maintenance, and energy optimization in industrial applications.

- Export-driven industrial demand is increasing, as manufacturers in emerging economies invest in high-quality homogenizers to meet global standards and supply international markets.

- Continuous and inline systems are gaining preference over batch units, driven by automation, efficiency, and integration with modern production lines.

Latest Trends in Homogenizers Market?

Digital and Smart Homogenization

Manufacturers are increasingly integrating sensors, process analytics, and IoT-enabled control into homogenizers. Real-time monitoring of pressure, temperature, and flow allows predictive maintenance, operational optimization, and enhanced product consistency. Smart homogenizers are especially relevant in pharmaceuticals, biotech, and high-end food processing, where precision and reproducibility are critical. Cloud-based data platforms are emerging, enabling remote diagnostics, analytics, and optimization of production parameters, reducing downtime and operational costs.

Sustainability and Energy-Efficient Systems

Energy-efficient and water-saving homogenization systems are gaining traction, aligned with global sustainability initiatives. New designs focus on reducing energy consumption, recycling wastewater, and minimizing environmental impact. Processors increasingly prioritize systems that comply with green manufacturing standards, renewable energy integration, and low-carbon operations. These trends are shaping purchasing decisions across the food, cosmetics, and chemical industries, particularly in regions with strict environmental regulations.

Homogenizers Market Drivers

Rising Demand in the Food & Beverage Industry

Processed foods, dairy products, beverages, sauces, and functional drinks are driving consistent demand for homogenizers. Manufacturers require precise emulsification, particle size control, and uniformity to enhance product quality, shelf-life, and texture. Expanding global middle-class populations and urbanization in emerging markets further fuel growth in this segment.

Growth of Pharmaceutical and Biotech Applications

The pharmaceutical and biotechnology sectors require high-performance homogenizers for cell disruption, nanoemulsion, liposomal formulations, and drug delivery systems. Rapid growth in biologics, vaccines, and advanced therapies is stimulating demand for sophisticated homogenization equipment, particularly high-pressure and microfluidic systems.

Technological Advancements and Process Efficiency

Advances in homogenizer design, modularity, and automation improve throughput, reduce energy consumption, and simplify maintenance. Inline continuous systems, two-valve assemblies, and microfluidics are increasingly adopted to achieve consistent quality at scale. These innovations enhance productivity and reduce the total cost of ownership for industrial users.

Market Restraints

High Capital and Maintenance Costs

High-performance homogenizers, especially high-pressure and microfluidic systems, involve significant upfront investments and require skilled operation and maintenance. This can be a barrier for small to medium-scale processors, particularly in emerging markets.

Competition from Alternative Technologies

Alternative emulsification and mixing technologies, such as high-shear mixers, ultrasonic probes, and membrane emulsification, may reduce demand for traditional homogenizers in certain applications. This competitive pressure limits market penetration in price-sensitive or low-volume segments.

Homogenizers Market Opportunities

IoT-Enabled and Smart Systems

Integration of sensors, data analytics, and cloud platforms offers predictive maintenance, process optimization, and energy savings. Manufacturers adopting smart homogenizers can differentiate their offerings and provide value-added services to high-end industrial users.

Expansion in Emerging Markets

Emerging economies in Asia, Latin America, and Africa present high growth potential. Rising food processing, pharmaceutical production, and cosmetic manufacturing create demand for reliable and locally supported homogenization equipment. Policy incentives and industrial development programs support market entry and expansion.

Novel Applications and Niche End-Uses

Growth in plant-based foods, nanoemulsions, and liposomal formulations offers new market niches. Additionally, sustainable processing and portable units for decentralized operations are emerging as attractive applications, especially in specialized food, pharmaceutical, and cosmetic segments.

Product Type Insights

High-pressure homogenizers dominate the market due to their versatility and ability to deliver consistent particle size reduction. Medium-pressure systems are widely adopted for standard food and chemical applications, balancing cost and performance. Inline continuous systems are increasingly preferred for industrial operations due to automation and integration capabilities. Ultrasonic and microfluidic homogenizers are growing in niche pharmaceutical and biotech applications, where precision and fine particle control are critical.

Application Insights

Food & beverage is the leading application, driven by dairy, beverages, sauces, and functional products. Pharmaceutical and biotechnology applications are rapidly expanding due to biologics, vaccines, and advanced drug delivery systems. Cosmetic and personal care industries also show growing demand, particularly for nanoemulsions and stable formulations. Chemical and specialty fluid applications contribute to steady demand, particularly in coatings, emulsions, and industrial fluids.

Distribution Channel Insights

Direct sales by OEMs dominate, particularly for industrial and high-performance systems. Specialist distributors serve smaller processors and niche applications. Online and digital channels are growing, especially for bench-scale and laboratory homogenizers, allowing manufacturers to reach a broader customer base and offer service contracts, spare parts, and digital support.

End-Use Insights

Food & beverage remains the largest end-use segment, contributing around 30% of the 2024 market. Pharmaceuticals and biotechnology are the fastest-growing segments, requiring high-end systems with precision control. Cosmetics, specialty chemicals, and emerging plant-based or nanoemulsion applications are contributing incremental growth, often with export-driven demand from Asia, Latin America, and Africa.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America contributes approximately 25% of the global market, driven by advanced food processing, pharmaceutical, and biotech industries. Strong regulatory standards, early adoption of smart systems, and retrofitting of existing lines support steady growth.

Europe

Europe holds around 20% of the market, with Germany, France, the UK, Italy, and Spain as key markets. Stringent quality and safety norms, combined with sustainable manufacturing initiatives, drive demand. Growth is moderate, with early adoption of energy-efficient and digital systems.

Asia Pacific

Asia Pacific is the largest and fastest-growing region, with a 35% share of the 2024 market. China leads, followed by India, Japan, and Southeast Asia. Rapid industrialization, expansion of food, pharma, and cosmetic manufacturing, and export-oriented production drive robust growth with a CAGR of 6–7%.

Latin America

Brazil and Argentina are key markets, accounting for 5–7% of global revenue. Growth is linked to food processing, dairy, and local pharmaceutical production, with incremental export-driven demand.

Middle East & Africa

MEA contributes 5–7% of the market, with Saudi Arabia, UAE, and South Africa as major hubs. Investments in food processing infrastructure and local pharmaceutical manufacturing drive moderate growth. Intra-regional trade is also supporting demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Homogenizers Market

- GEA Group

- SPX Flow

- Krones AG

- Sonic Corporation

- IKA Works

- Avestin Inc.

- Bertoli (Interpump Group)

- Netzsch

- Simes SA

- FBF Italia

- Charles Ross & Son

- Silverson Machines

- APV (SPX brand)

- Microfluidics International

- Ystral GmbH

Recent Developments

- In 2025, GEA Group launched an advanced high-pressure homogenizer with IoT-enabled process control and predictive maintenance features.

- In 2025, SPX Flow expanded its microfluidics product line, targeting pharmaceutical nanoemulsion applications in the Asia Pacific.

- In 2024, IKA Works introduced a new inline ultrasonic homogenizer series optimized for cosmetic and personal care formulations.