Home Webcam Market Size

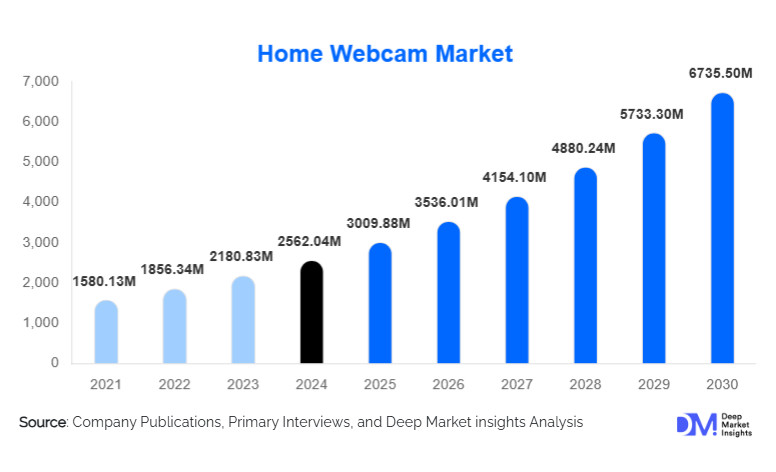

According to Deep Market Insights, the global home webcam market size was valued at USD 2,562.04 million in 2024 and is projected to grow from USD 3,009.88 million in 2025 to reach USD 6,735.50 million by 2030, expanding at a CAGR of 17.48% during the forecast period (2025–2030). The home webcam market growth is primarily driven by the sustained adoption of hybrid work models, rapid expansion of online education, and the accelerating creator economy that demands high-quality video, audio, and AI-enabled features for home-based use.

Key Market Insights

- Advanced and AI-enabled webcams are driving value growth, as consumers upgrade from basic HD models to Full HD and 4K devices with auto-framing and noise reduction.

- Residential and home office usage dominates demand, supported by long-term remote and hybrid work adoption across developed and emerging economies.

- Online distribution channels lead global sales, driven by D2C platforms, e-commerce marketplaces, and influencer-led product discovery.

- North America holds the largest market share, while Asia-Pacific is the fastest-growing region due to digital education and SME digitization.

- Mid-priced webcams (USD 50–100) account for the largest revenue share, balancing affordability with performance and feature upgrades.

- Privacy and data security features, such as physical shutters and on-device AI processing, are becoming key purchase criteria.

What are the latest trends in the home webcam market?

AI-Driven Video Enhancement and Software Differentiation

One of the most prominent trends in the home webcam market is the integration of AI-powered software capabilities. Features such as auto-framing, face tracking, eye-contact correction, background blur, and real-time noise suppression are increasingly embedded at the device or application level. These enhancements significantly improve video conferencing and streaming quality, particularly in low-light or non-ideal home environments. Vendors are also bundling proprietary software ecosystems with webcams, enabling firmware upgrades, customization, and premium feature unlocks, which helps differentiate products and improve long-term customer retention.

Rising Demand from Content Creators and Streamers

The rapid growth of the global creator economy is reshaping webcam demand. Streamers, podcasters, and social media creators increasingly require 4K resolution, HDR, high frame rates, and accurate color reproduction. Purpose-built creator webcams, often bundled with lighting and audio integrations, are gaining traction. This trend is pushing average selling prices upward and expanding the premium segment of the market, particularly in North America, Europe, and parts of Asia-Pacific.

What are the key drivers in the home webcam market?

Normalization of Remote and Hybrid Work

The continued normalization of hybrid work environments remains a major growth driver. Enterprises and freelancers alike are investing in home productivity tools, including webcams that offer professional-grade video quality. Even as office attendance partially recovers, replacement demand and upgrades to higher-resolution webcams are sustaining market momentum.

Expansion of Online Education and Telehealth

Online education platforms and home-based teleconsultations are driving sustained volume demand. Students, educators, and healthcare professionals increasingly require reliable webcams with clear video and audio output, particularly in emerging economies where digital access is expanding rapidly.

What are the restraints for the global market?

Improved Built-in Laptop Cameras

Continuous improvement in integrated laptop and monitor cameras reduces first-time demand for external webcams, particularly in the entry-level segment. This trend places pricing pressure on basic HD models and shifts growth toward replacement and premium upgrades.

Privacy and Data Security Concerns

Rising awareness of data privacy and surveillance risks can slow adoption if not adequately addressed. Consumers increasingly expect physical privacy shutters, transparent data policies, and local AI processing to mitigate these concerns.

What are the key opportunities in the home webcam industry?

AI Monetization and Subscription-Based Features

Manufacturers have opportunities to monetize AI capabilities through software subscriptions and premium feature tiers. On-device AI that enhances privacy while delivering superior video quality is expected to unlock higher margins and long-term recurring revenue streams.

Emerging Market Digitization and Education Programs

Government-backed digital education initiatives and SME digitization programs in Asia-Pacific, Latin America, and the Middle East present strong volume growth opportunities. Localized product offerings and institutional procurement channels can accelerate penetration in these regions.

Product Type Insights

Advanced webcams, including Full HD and 4K models equipped with autofocus, HDR, low-light correction, and noise-reduction microphones, dominate the home webcam market, accounting for nearly 38% of global revenue in 2024. The leadership of this segment is driven by its broad applicability across home offices, online education, professional collaboration, and content creation, offering a strong balance between performance and affordability. Consumers increasingly prefer advanced webcams as direct replacements for built-in laptop cameras, particularly in hybrid work environments where video quality impacts professional communication.

Standard USB webcams continue to serve price-sensitive consumers, particularly in emerging markets and entry-level education use cases, but their market share is gradually declining due to limited feature sets. Meanwhile, AI-enabled webcams represent the fastest-growing product sub-segment, driven by rising demand for intelligent video optimization features such as auto-framing, facial recognition, background blur, eye-contact correction, and real-time noise suppression. These features are especially attractive to professionals and creators seeking studio-like performance without complex hardware setups. Integrated smart cameras compatible with home ecosystems are also gaining traction, as consumers increasingly seek multifunctional devices that can support video communication, home security, and smart-home automation within a single platform.

Resolution Insights

Full HD (1080p) webcams hold the largest share of the home webcam market, representing approximately 46% of total demand in 2024. This segment leads due to its optimal balance between price, bandwidth efficiency, and video quality, making it suitable for video conferencing, online learning, and everyday content creation. Full HD has effectively become the industry standard resolution for professional and educational use, supported by widespread platform compatibility and affordable pricing.

Ultra HD (4K) webcams are the fastest-growing resolution segment, driven primarily by content creators, professional streamers, designers, and high-income remote professionals who require superior image clarity, higher frame rates, and improved color accuracy. Declining sensor and chipset costs, along with increasing availability of high-speed broadband, are accelerating 4K adoption. HD (720p) webcams continue to see demand in cost-sensitive regions and institutional deployments, but are gradually losing relevance as users upgrade to higher resolutions.

Distribution Channel Insights

Online distribution channels dominate the global home webcam market, contributing nearly 58% of total sales in 2024. Brand-owned direct-to-consumer (D2C) websites and major e-commerce platforms enable consumers to compare specifications, access reviews, and benefit from competitive pricing and frequent promotions. The growth of online channels is further supported by global logistics networks, cross-border e-commerce, and increasing consumer comfort with purchasing electronics online.

Offline retail channels, including electronics stores and IT resellers, remain relevant for enterprise procurement, institutional education contracts, and bundled PC sales. However, their market share continues to decline as manufacturers prioritize digital-first strategies and reduce dependency on physical retail infrastructure. The shift toward online channels has also enabled smaller brands to gain global visibility, intensifying competition and accelerating price transparency across regions.

End-Use Insights

Residential and home office use represents the largest end-use segment, accounting for approximately 44% of the global home webcam market in 2024. This dominance is driven by the normalization of hybrid work, freelancing, and virtual collaboration, prompting consumers to invest in external webcams for improved video quality and professional presence.

Education is the fastest-growing end-use segment, supported by hybrid learning models, government-led digital education initiatives, and increasing penetration of online tutoring platforms. Schools and households are increasingly adopting affordable Full HD webcams to support long-term digital learning infrastructure. Content creation and streaming deliver the highest average selling prices, as creators prioritize premium features such as 4K resolution, high frame rates, and AI-powered enhancements. Telehealth adoption is steadily expanding demand for secure, high-quality home webcams, particularly for remote consultations, elderly care, and mental health services, where video clarity and data privacy are critical.

| By Product Type | By Resolution | By Distribution Channel | By End Use | By Price Band |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global home webcam market, making it the largest regional contributor. The United States leads regional demand due to widespread adoption of hybrid and remote work models, a mature creator economy, and high replacement cycles for premium electronic devices. Strong broadband infrastructure, high disposable income, and early adoption of AI-enabled technologies further support demand for advanced and 4K webcams. Canada also contributes steadily, driven by digital education and enterprise collaboration needs.

Asia-Pacific

Asia-Pacific represents about 31% of the global market and is the fastest-growing region, recording double-digit growth. China, India, Japan, and South Korea are the primary demand centers, supported by rapid digital education adoption, expanding SME ecosystems, and large-scale work-from-home participation. Government initiatives promoting digital classrooms, coupled with the region’s strong electronics manufacturing base, are accelerating affordability and availability. Rising middle-class income and increasing participation in online content creation further strengthen regional growth momentum.

Europe

Europe holds nearly 22% of the global home webcam market, driven by strong demand in Germany, the U.K., and France. Growth in this region is supported by high regulatory emphasis on data privacy, driving demand for webcams with physical privacy shutters and on-device AI processing. Premium upgrades, widespread adoption of remote work policies, and strong enterprise demand for secure video communication solutions continue to fuel market expansion.

Latin America

Latin America accounts for roughly 6% of global demand, with Brazil and Mexico leading adoption. Growth is primarily driven by expanding online education, remote customer support services, and increasing digital exports. Rising smartphone and broadband penetration, along with improving e-commerce infrastructure, are gradually accelerating webcam adoption across residential and institutional users.

Middle East & Africa

The Middle East & Africa region contributes about 7% of the global market, led by the UAE and Saudi Arabia. Growth is supported by rapid smart home adoption, government-led digital transformation initiatives, and expanding remote workforce participation. Investments in digital services, education infrastructure, and smart city projects are creating sustained demand for home webcams, particularly in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|