Home Bookshelf Speakers Market Size

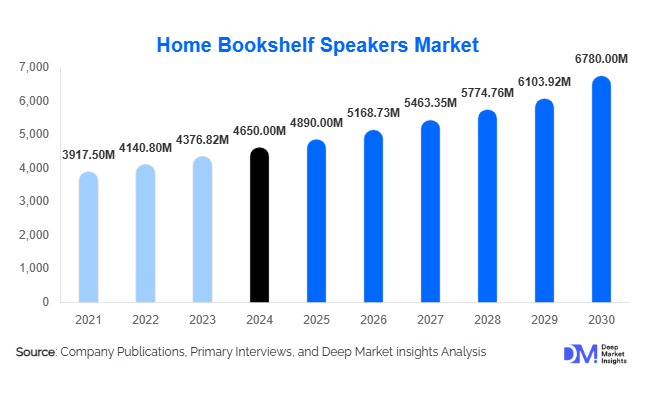

According to Deep Market Insights, the global home bookshelf speakers market size was valued at USD 4,650 million in 2024 and is projected to grow from USD 4,890 million in 2025 to reach USD 6,780 million by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of smart home devices, rising demand for compact yet high-fidelity home audio solutions, and the proliferation of wireless and multi-room entertainment systems among global consumers.

Key Market Insights

- Wireless and smart bookshelf speakers are gaining prominence, with consumers increasingly preferring Bluetooth and Wi-Fi-enabled systems that integrate with voice assistants and IoT ecosystems.

- Mid-range and premium segments are expanding, fueled by rising disposable income and growing interest in high-fidelity home audio experiences among urban households.

- North America dominates the global market, driven by early adoption of smart home technologies and the widespread use of home entertainment systems.

- Asia-Pacific is the fastest-growing region, with China, India, and Japan driving demand due to urbanization, rising middle-class wealth, and increased digital content consumption.

- Technological innovations, including wireless multi-room connectivity, app-based sound customization, and AI-powered audio optimization, are reshaping consumer preferences and product offerings.

- E-commerce platforms are becoming a key distribution channel, facilitating direct-to-consumer sales and expanding market reach across emerging and developed regions.

Latest Market Trends

Smart Home Integration Driving Demand

Home bookshelf speakers are increasingly being integrated into smart home ecosystems, enabling voice control, multi-room audio, and IoT connectivity. Consumers are seeking devices that can seamlessly interact with digital assistants such as Alexa, Google Assistant, and Siri. Smart functionality, combined with compact designs, allows these speakers to fit easily in living rooms, bedrooms, and home offices, enhancing their appeal among tech-savvy users. Manufacturers are increasingly focusing on app-based controls, personalized audio settings, and firmware updates to provide a future-proof experience.

Wireless and Multi-Room Audio Adoption

Wireless bookshelf speakers, including Bluetooth and Wi-Fi-enabled devices, are becoming mainstream. Multi-room connectivity allows consumers to link multiple speakers throughout their homes, creating immersive audio experiences without cumbersome wiring. This trend is particularly popular in North America and Europe, where consumers value convenience and flexibility. Emerging technologies such as low-latency Bluetooth, mesh networking, and AI-based room calibration are further enhancing user experience and driving product differentiation.

Home Bookshelf Speakers Market Drivers

Rising Home Entertainment Consumption

The surge in streaming services, gaming platforms, and digital content consumption has fueled demand for high-quality home audio solutions. Bookshelf speakers provide compact yet high-fidelity sound, enabling immersive experiences without occupying the space of floor-standing systems. Consumers increasingly prioritize audio quality for movies, music, and gaming, driving steady market growth.

Growing Adoption of Wireless and Smart Technologies

Consumers are shifting from traditional wired systems to wireless solutions that offer enhanced convenience and integration. Voice control, multi-room setups, and mobile app functionalities allow seamless operation and customization. This trend has significantly accelerated sales, particularly among younger urban demographics.

Increasing Disposable Income and Urbanization

Rising middle-class households in APAC, Europe, and LATAM are investing in mid-range and premium audio systems. Compact bookshelf speakers are ideal for urban apartments and smaller living spaces, offering a blend of aesthetics and performance. This demographic trend is a key growth driver, particularly in emerging economies such as India, China, and Brazil.

Market Restraints

High Competition and Price Sensitivity

The market is highly fragmented, with numerous global and regional players competing in mid-range and premium segments. Price competition can erode profit margins and slow market expansion. Market players must balance affordability with technological features to maintain competitiveness.

Rapid Technological Obsolescence

Continuous innovation in wireless connectivity, smart home integration, and audio technologies can make existing products obsolete quickly. Companies face pressure to invest in R&D and product upgrades to retain market relevance, which can increase operational costs and impact profitability.

Home Bookshelf Speakers Market Opportunities

Expansion into Emerging Markets

Emerging economies in APAC and LATAM present substantial opportunities due to growing disposable income, urbanization, and increasing digital content consumption. Companies can target mid-range and premium segments, leveraging e-commerce and localized marketing strategies to capture new consumers. Countries such as India, China, and Brazil are expected to see accelerated adoption in the next five years.

Integration with Advanced Audio Technologies

Opportunities exist in high-resolution audio, app-controlled sound customization, AI-based audio optimization, and modular speaker designs. Innovating in these areas can appeal to audiophiles and tech-savvy consumers, enabling brands to differentiate their offerings and command higher margins.

Export and International Demand

Markets with high disposable income but limited local manufacturing capacity, such as Australia, Japan, and Western Europe, offer strong export potential. Brands that focus on quality, smart connectivity, and wireless capabilities can benefit from these high-demand regions and establish a strong international presence.

Product Type Insights

Active/powered speakers dominate the global bookshelf speakers market, accounting for approximately 42% of the market share in 2024. This dominance is primarily driven by the convenience of built-in amplifiers and wireless connectivity options, allowing consumers to enjoy easy setup and seamless integration with modern smart devices. Passive speakers, on the other hand, appeal strongly to audiophiles who prioritize customization and superior sound quality. These speakers can be paired with high-end amplifiers to deliver premium audio performance, making them a preferred choice for enthusiasts seeking ultimate fidelity. Wireless bookshelf speakers constitute 38% of the market, reflecting the growing adoption of Bluetooth and Wi-Fi technologies, which enable effortless streaming from smartphones, tablets, and computers. The high-fidelity (Hi-Fi) speaker segment continues to grow as consumers increasingly demand superior audio quality for music listening and home theater setups. Meanwhile, premium speakers attract affluent buyers who seek both aesthetic appeal and high-end sound experiences in their homes.

Application Insights

Home entertainment systems remain the leading application segment with a 48% share in 2024, fueled by the rising popularity of streaming platforms, immersive gaming, and cinematic home experiences. Gaming and streaming setups are witnessing rapid growth, as digital content consumption surges and consumers seek compact yet high-performance audio solutions. Emerging applications such as home office setups and digital learning environments are gaining traction, particularly in post-pandemic urban households. These setups often require high-quality, space-efficient speakers for video conferencing, online classes, and multimedia consumption, further contributing to overall market growth.

Distribution Channel Insights

Online retail dominates with a 35% market share, driven by the convenience of e-commerce, wide product selection, and direct-to-consumer access. Consumers increasingly prefer to compare products, read reviews, and purchase smart, wireless, and high-fidelity speakers online. Offline consumer electronics stores, specialty audio retailers, and OEM channels remain important, particularly in emerging markets where in-person demonstration of sound quality influences purchasing decisions. The rapid growth of e-commerce platforms is expected to expand market reach and accelerate adoption rates across all regions.

| By Product Type | By Price Range | By Application / End-Use | By Connectivity | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market in 2024, with the U.S. and Canada leading demand. The premium segment drives this growth, as consumers increasingly seek high-fidelity audio systems that deliver superior sound quality. High disposable income, early adoption of smart home technologies, and strong penetration of home entertainment systems further support market expansion. Wireless and multi-room speakers are particularly popular, as North American consumers increasingly integrate bookshelf speakers into connected smart home ecosystems. The convenience of app-based audio control and AI-powered sound customization also contributes to regional growth.

Europe

Europe accounts for 28% of the global market, with Germany, the U.K., and France leading demand. In Western Europe, consumers are investing heavily in premium and high-quality audio equipment to enhance home entertainment experiences. This trend is supported by growing disposable income, widespread awareness of smart home technology, and a preference for sustainable, eco-friendly audio products. Wireless connectivity adoption is accelerating, driven by demand for multi-room audio solutions and seamless streaming from smartphones and other devices. Premium speakers are particularly popular among affluent households seeking both aesthetic appeal and superior sound fidelity.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in China, India, and Japan, with an expected CAGR of 6–7% during 2025–2030. Rapid urbanization, rising disposable incomes, and increasing digital content consumption are primary growth drivers. Consumers in these countries are enhancing their home entertainment setups, fueling demand for both mid-range and premium bookshelf speakers. The growth of e-commerce and online retail platforms in APAC also supports accessibility to smart, wireless, and high-fidelity audio solutions. Additionally, the popularity of gaming, streaming, and home theater systems among younger populations accelerates adoption.

Latin America

Brazil and Mexico are key markets in Latin America, where growing urbanization and rising disposable incomes are driving the adoption of mid-range bookshelf speakers. E-commerce expansion facilitates access to premium and smart speaker options, while increasing interest in home entertainment, gaming, and music streaming further supports regional demand. The market is gradually diversifying, with online retail gaining prominence over traditional offline channels.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are the primary contributors to the MEA bookshelf speakers market. Premium and smart speakers dominate, supported by urbanization, luxury consumer trends, and the integration of connected devices in modern homes. High disposable income, increasing penetration of smart home ecosystems, and rising interest in home entertainment setups, particularly among affluent households, are key drivers of regional growth. E-commerce adoption is also enhancing market access across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Bookshelf Speakers Market

- Bose Corporation

- Sonos, Inc.

- Sony Corporation

- Yamaha Corporation

- Klipsch Group

- Bowers & Wilkins

- Harman International

- Polk Audio

- Denon

- JBL

- Focal

- Edifier

- Wharfedale

- Cambridge Audio

- KEF

Recent Developments

- In March 2025, Sonos launched a new line of AI-powered bookshelf speakers with room calibration and voice assistant integration for multi-room setups.

- In February 2025, Bose introduced premium wireless bookshelf speakers with a modular design for compact urban spaces, targeting high-income urban consumers.

- In January 2025, Yamaha expanded its wireless speaker portfolio to APAC, enhancing online direct-to-consumer sales and smart home compatibility.