Hockey Sticks Market Size

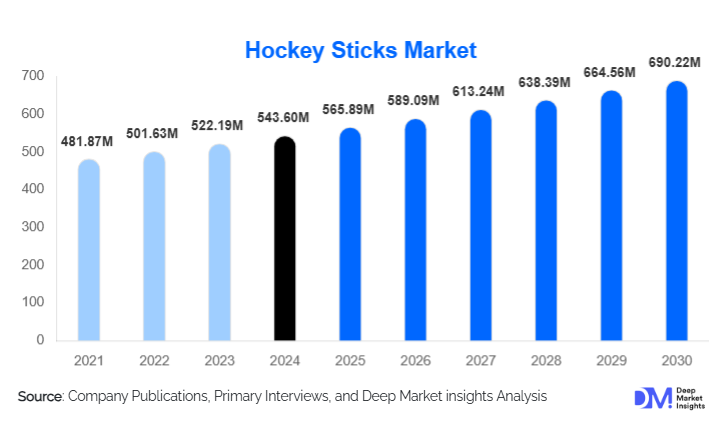

According to Deep Market Insights, the global hockey sticks market size was valued at USD 543.60 million in 2024 and is projected to grow from USD 565.89 million in 2025 to reach USD 690.22 million by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). The hockey sticks market growth is driven by rising participation in ice hockey and field hockey across professional and amateur levels, increasing investment in sports infrastructure, and continuous innovation in composite materials that enhance stick performance, durability, and customization.

Key Market Insights

- Composite hockey sticks dominate global demand, accounting for over 70% of total market revenue due to superior strength-to-weight ratios and performance benefits.

- Ice hockey sticks represent the largest product category, supported by strong professional leagues and high participation levels in North America and Europe.

- North America leads the global market, driven by the U.S. and Canada’s deeply entrenched hockey culture and premium product adoption.

- Asia-Pacific is the fastest-growing regional market, fueled by government-backed sports programs and expanding youth participation in field hockey.

- Mid-range price segments (USD 50–150) account for the largest volume sales, balancing affordability and performance.

- Online and direct-to-consumer channels are rapidly reshaping purchasing behavior, particularly among younger and amateur players.

What are the latest trends in the hockey sticks market?

Advanced Composite Material Innovation

Manufacturers are increasingly investing in next-generation composite materials that enhance puck control, shot accuracy, and durability. Carbon fiber layering, vibration-dampening technologies, and optimized flex profiles are becoming standard features in high-performance sticks. These innovations allow players to customize sticks based on position, playing style, and strength, driving premiumization across professional and elite amateur segments. As a result, the premium hockey sticks category continues to outpace overall market growth.

Customization and Digital Engagement

Customization is emerging as a defining trend, with brands offering tailored flex ratings, blade curves, grip textures, and shaft lengths through digital platforms. Direct-to-consumer models enable manufacturers to gather player data and deliver personalized products, enhancing customer loyalty and margins. Online configurators, virtual fitting tools, and athlete-led product launches are further strengthening brand engagement, especially among youth and club-level players.

What are the key drivers in the hockey sticks market?

Growth in Organized Hockey Participation

Rising participation in youth, school, and amateur hockey programs is a major growth driver. National federations and educational institutions are expanding structured leagues and training academies, particularly in the Asia-Pacific and Europe. This has increased demand for entry-level and mid-range sticks, supported by frequent replacement cycles among younger players.

Professional League Expansion and Visibility

The commercial expansion of professional hockey leagues has significantly increased global visibility for the sport. Broadcast exposure, international tournaments, and athlete endorsements directly influence consumer purchasing decisions, driving demand for high-performance sticks that replicate professional equipment standards.

What are the restraints for the global market?

High Cost of Premium Hockey Sticks

Advanced composite hockey sticks often retail above USD 200, limiting accessibility for recreational players and price-sensitive regions. This cost barrier restricts market penetration in developing economies, where affordability remains a key purchasing criterion.

Raw Material Price Volatility

Fluctuations in the prices of carbon fiber and resins used in composite sticks can impact manufacturing costs and profit margins. Manufacturers must balance pricing strategies with cost pressures, which can slow adoption during periods of raw material inflation.

What are the key opportunities in the hockey sticks industry?

Emerging Market Expansion

Asia-Pacific and Latin America present significant growth opportunities due to increasing sports participation and government-backed hockey development programs. Countries such as India, China, and Argentina are expanding field hockey infrastructure, creating strong demand for affordable yet high-quality sticks. Early localization and partnerships with national federations can offer long-term advantages for manufacturers.

Sustainable and Eco-Friendly Stick Development

Sustainability is becoming an important differentiator, particularly in Europe and North America. Manufacturers investing in recyclable composites, bio-based resins, and responsible sourcing can strengthen brand positioning and appeal to environmentally conscious consumers while meeting emerging regulatory expectations.

Product Type Insights

Ice hockey sticks dominate the global market, accounting for approximately 58% of total revenue in 2024, supported by high average selling prices and strong professional adoption. Field hockey sticks represent a significant share, driven by widespread participation in Europe, Asia-Pacific, and Latin America. Street and roller hockey sticks serve niche recreational segments, offering steady but lower-value demand. Composite sticks lead across all product types, while wooden and aluminum sticks maintain relevance in entry-level and training applications.

Application Insights

Professional and elite-level play represents the highest-value application segment, characterized by frequent replacement and premium product demand. Amateur and club-level hockey accounts for the largest volume share, driven by expanding leagues and community participation. Youth and beginner applications are growing rapidly, supported by school programs and introductory hockey initiatives, particularly in emerging markets.

Distribution Channel Insights

Specialty sports retail stores continue to dominate hockey stick sales, accounting for over 50% of global revenue due to expert guidance and physical product evaluation. However, online and direct-to-consumer channels are the fastest-growing distribution routes, offering convenience, customization, and competitive pricing. Institutional procurement by schools, clubs, and federations provides stable bulk demand, particularly for entry-level sticks.

End-Use Insights

Schools, colleges, and training academies represent the fastest-growing end-use segment, supported by public and private investment in sports education. Professional leagues maintain steady high-value demand, while recreational and community sports contribute consistent replacement-driven growth. Adaptive hockey programs and mixed-gender leagues are emerging as new end-use applications, expanding the overall addressable market.

| By Hockey Type | By Material Type | By Player Category | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the hockey sticks market with approximately 38% market share in 2024. Canada alone contributes nearly 18% of global demand, driven by cultural affinity, professional leagues, and high adoption of premium composite sticks. The U.S. market benefits from growing youth participation and expanding collegiate hockey programs.

Europe

Europe accounts for around 28% of global market share, led by Germany, Sweden, Finland, and the U.K. Strong club systems, international tournaments, and sustained field hockey participation support steady demand across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR above 7%. India dominates field hockey stick demand, while China and Japan are increasing investments in sports infrastructure. Rising youth participation and export-driven manufacturing growth are key contributors.

Latin America

Latin America holds approximately 5% of global demand, with Argentina as the primary contributor due to its strong field hockey tradition. Growth is supported by regional tournaments and school-level participation.

Middle East & Africa

The Middle East & Africa region remains nascent but growing, supported by sports diversification initiatives in the UAE and South Africa. Increasing institutional participation is gradually expanding demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Hockey Sticks Market

- Bauer Hockey

- CCM Hockey

- Warrior Sports

- STX

- True Hockey

- Grays Hockey

- Adidas Hockey

- Kookaburra Sport

- Sherwood Hockey

- Easton Hockey

- Osaka Hockey

- Gryphon Hockey

- Mazon Hockey

- Ritual Hockey

- Franklin Sports