High-End Lighting Market Size

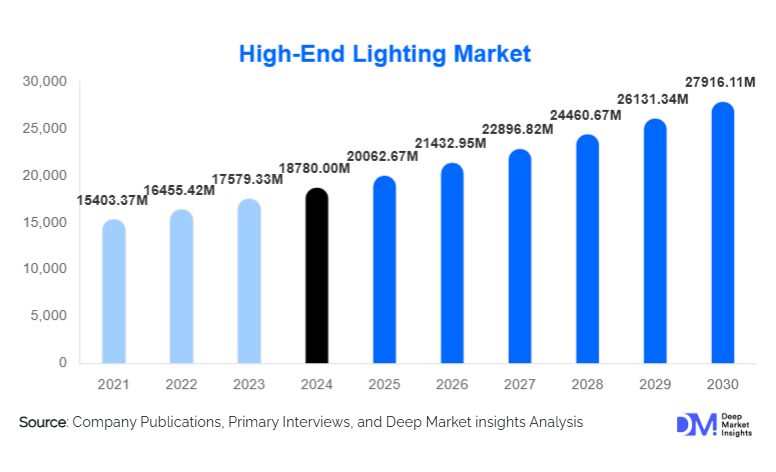

According to Deep Market Insights, the global high-end lighting market size was valued at USD 18,780.00 million in 2024 and is projected to grow from USD 20,062.67 million in 2025 to reach USD 27,916.11 million by 2030, expanding at a CAGR of 6.83% during the forecast period (2025–2030). This market growth is primarily driven by rising investments in luxury real estate, the rapid adoption of LED and smart lighting technologies, growing emphasis on interior aesthetics, and the expansion of premium hospitality and commercial infrastructure worldwide.

Key Market Insights

- LED-based high-end lighting dominates the market, supported by energy efficiency, design flexibility, and sustainability mandates in new constructions.

- Smart and IoT-enabled lighting solutions are accelerating adoption as premium homes, hotels, and commercial buildings shift toward automation and ambience control.

- Asia-Pacific leads global demand, driven by rapid urbanization, luxury housing expansion, and commercial construction growth in China, India, and Southeast Asia.

- Europe remains a major hub for design-centric luxury lighting, with strong exports from Italy, Germany, and Nordic countries.

- Hospitality and luxury residential sectors continue to be the largest end-use segments, accounting for nearly half of global high-end lighting consumption.

- Customization, artisanal craftsmanship, and architectural lighting innovations are reshaping product development strategies for premium lighting brands.

What are the latest trends in the high-end lighting market?

Architectural & Ambient Lighting as a Design Statement

High-end lighting is becoming a central design element in luxury interiors, transcending functional illumination. Architectural fixtures, such as recessed lighting, cove lighting, accent lighting, and integrated wall/ceiling luminaires, are increasingly used to define spatial aesthetics, mood, and visual hierarchy. Designers and architects are collaborating closely with manufacturers to create bespoke lighting installations tailored to specific projects. This trend is especially visible in luxury hotels, upscale residences, and premium retail environments where ambience, atmosphere, and brand identity are elevated through lighting design. Adaptive and tunable lighting, which adjusts colour temperature throughout the day to align with circadian rhythms, is also gaining traction in wellness-driven spaces.

Smart, Connected, and IoT Lighting Integration

With the rise of smart homes and intelligent buildings, high-end lighting is rapidly adopting IoT capabilities. Fixtures now integrate with mobile apps, voice assistants, building management systems, and AI-powered control platforms. These technologies enable personalised mood settings, remote access, energy optimisation, and dynamic lighting effects. High-net-worth consumers and luxury property developers increasingly prefer connected lighting ecosystems, making IoT a key differentiator in the premium segment. Smart, wireless dimming systems and automation-ready LEDs are becoming standard in new luxury constructions, while retrofit modules are enabling digital upgrades in older buildings.

What are the key drivers in the high-end lighting market?

Growth in Luxury Real Estate & Hospitality Infrastructure

Rapid expansion of luxury apartments, villas, resorts, boutique hotels, and high-end commercial spaces is significantly boosting demand for premium lighting solutions. Developers prioritise lighting as an aesthetic and experiential feature, not merely a utility. This has increased the consumption of decorative chandeliers, pendant lights, designer lamps, and architectural installations. Tourism-led investments in hotels and resorts, especially in the Asia-Pacific, the Middle East, and Europe, further amplify high-end lighting demand as hospitality brands compete through ambience and visual appeal.

Consumer Shift Toward Aesthetic & Custom Lighting

Affluent consumers are increasingly viewing lighting as an integral component of interior decor, wellness, and lifestyle expression. Customizable fixtures, artisanal craftsmanship, and luxury finishes such as blown glass, hand-forged metal, and contemporary sculptural designs are driving premiumization. Homeowners are willing to invest in statement pieces, fully integrated lighting systems, and smart-enabled decorative installations. This shift toward personalised and experiential lighting fuels category expansion across luxury residential, retail, and hospitality segments.

Energy Efficiency, LED Adoption & Green Building Compliance

Global regulations restricting inefficient lighting and promoting LED adoption have accelerated the transition to high-end LED solutions. LEDs offer superior energy savings, longer lifespan, and enhanced design flexibility, allowing manufacturers to create intricate and artistic fixtures. LEED-certified buildings, ESG-driven corporate projects, and government incentives for efficient lighting have increased the installation of advanced LED luminaires in premium commercial and institutional environments. This sustainability-driven pivot continues to be a major tailwind for high-end lighting manufacturers.

What are the restraints for the global market?

High Cost of Premium Lighting Products

High-end lighting involves luxury materials, sophisticated engineering, designer collaborations, and smart-technology integration, all of which significantly elevate product costs. For many consumers and smaller developers, these prices can be prohibitive. The high upfront expense also deters adoption in price-sensitive markets, slowing penetration despite rising global construction activity. Custom fixtures, in particular, involve long lead times and specialised installation, further increasing the overall project cost.

Complexity of Installation & Retrofitting

Integrating premium lighting into existing buildings, especially smart or architectural fixtures, often requires structural modification, new wiring systems, or compatibility upgrades to electrical infrastructure. This complexity raises labour costs, extends project timelines, and reduces retrofit willingness among consumers. In heritage or older buildings, installation constraints can make high-end lighting adoption technically challenging, limiting market scalability.

What are the key opportunities in the high-end lighting industry?

Emerging Demand in APAC, the Middle East & Latin America

Rapid urban development, rising luxury real estate investments, and expanding hospitality infrastructure in China, India, the UAE, Saudi Arabia, Indonesia, and Brazil represent major growth opportunities. High-net-worth individuals in these regions increasingly invest in upscale home interiors, while governments promote premium commercial and tourism projects. Manufacturers offering region-specific designs or cost-optimised luxury collections can unlock significant market share.

Smart Luxury Lighting Ecosystems

The integration of intelligent lighting with home automation, AI-driven energy management, and IoT platforms enables brands to expand into complete lighting ecosystems rather than standalone products. This presents opportunities for subscription-based services, cloud-enabled lighting analytics, and digitally enhanced ambience systems in luxury hotels, retail, and high-end residential complexes. As consumers embrace voice control, app-based customisation, and dynamic mood lighting, the market for smart luxury fixtures will expand rapidly.

Product Type Insights

Chandeliers and pendant lights dominate high-end lighting demand due to their visual impact and central role in luxury interior design. These fixtures serve as statement pieces in hotel lobbies, upscale dining areas, and premium residences. Ceiling and wall-mounted lights remain essential in architectural lighting, providing uniform illumination and aesthetic layering. Outdoor and landscape lighting is gaining momentum with rising investments in luxury resorts, villas, and urban beautification projects. Designer table and floor lamps continue to attract consumers seeking personalized and flexible lighting accents within living spaces.

Application Insights

Luxury residential applications account for the largest share of high-end lighting installations, driven by premium home renovations and upscale apartment developments. The hospitality segment, comprising luxury hotels, resorts, and fine-dining establishments, shows strong growth due to its reliance on ambience-driven design. High-end retail stores increasingly use accent lighting to enhance brand identity and product visibility. Museums, galleries, and cultural institutions rely on precision lighting for artwork preservation and display, while premium corporate offices adopt modern architectural lighting to reinforce brand aesthetics and improve employee experience.

Distribution Channel Insights

Offline channels, including specialty lighting showrooms, interior design studios, and direct B2B procurement, dominate the high-end lighting market. Luxury lighting buyers prefer in-person evaluation of fixtures, materials, and finishes, often working closely with designers on customization. Online channels, however, are growing, driven by digital catalogs, AR/VR visualization tools, and direct-to-consumer e-commerce portals for premium lighting brands. Hybrid retail models and virtual design consultations are emerging as new pathways for customer engagement.

End-User Insights

Residential homeowners, interior designers, architects, and hospitality developers constitute the largest end-user groups. Luxury hotels and resorts remain high-volume buyers due to frequent renovations and brand-standard upgrades. Premium commercial and office spaces are increasingly investing in architectural and smart lighting to enhance workplace aesthetics and efficiency. Institutional buyers such as museums, academic buildings, and government cultural centers seek precision lighting for display and architectural enhancement. Outdoor and urban development authorities contribute to the demand for high-end façade and landscape lighting.

| By Technology | By Product Type | By Connectivity Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a major market for high-end lighting, supported by strong luxury housing demand, premium hospitality infrastructure, and high adoption of smart home technologies. The U.S. accounts for the majority share, driven by affluent consumers, large-scale commercial developments, and renovation activity across luxury residences and boutique hotels. The region also leads in smart lighting integration, with significant adoption of IoT-enabled fixtures and automated lighting systems.

Europe

Europe is a global hub for luxury lighting design and manufacturing, with Italy, Germany, Denmark, and France dominating premium exports. High cultural appreciation for artisanal craftsmanship and contemporary design fuels domestic consumption. Renovation of heritage buildings, museums, and luxury hotels contributes significantly to demand. Strong sustainability regulations further accelerate LED adoption and architectural lighting upgrades throughout Western and Northern Europe.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, driven by massive urbanization, luxury real estate growth, and expanding hospitality chains across China, India, and Southeast Asia. Rising disposable income and increasing preference for designer interiors are boosting the adoption of premium lighting in high-rise apartments, villas, malls, and hotels. Smart city initiatives and energy-efficiency regulations further propel LED-based high-end lighting installations.

Latin America

Latin America is experiencing steady growth, led by Brazil, Mexico, and Chile, where upscale residential projects and luxury retail spaces are increasing. Hospitality-led tourism development, urban regeneration projects, and premium commercial spaces are contributing to rising lighting installations. Affluent consumers in metropolitan areas increasingly seek imported designer fixtures and smart lighting systems.

Middle East & Africa

MEA shows strong demand for high-end lighting, driven by mega real estate projects, luxury hotels, and high-income residential developments in the UAE, Saudi Arabia, and Qatar. Architectural lighting for landmarks, cultural institutions, and outdoor landscapes is particularly prominent. Africa’s premium hotel and tourism sectors are gradually adopting high-end lighting solutions as international chains expand into the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High-End Lighting Market

- Signify (Philips Lighting)

- OSRAM Licht AG

- Acuity Brands

- Lutron Electronics

- Artemide Group

- FLOS S.p.A.

- Delta Light

- Moooi

- Visual Comfort & Co.

- Restoration Hardware

- Louis Poulsen

- Hubbardton Forge

- Tech Lighting

- Circa Lighting

- Vibia Lighting

Recent Developments

- In March 2025, Signify launched a new portfolio of ultra-efficient architectural LEDs designed for luxury hospitality and commercial environments, integrating circadian rhythm features and smart automation.

- In January 2025, Artemide announced the expansion of its Milan design facility to increase production of custom sculptural luminaires for international luxury projects.

- In December 2024, FLOS introduced a premium wireless lighting range featuring a modular design and app-based ambience control for high-end residential use.