Helicopter Aerial Photography Market Size

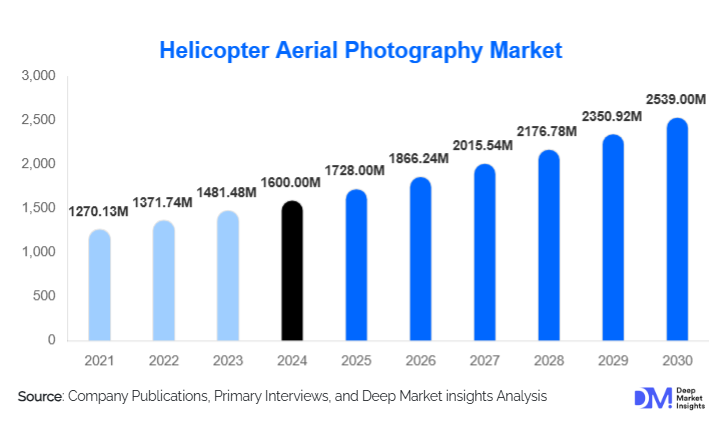

According to Deep Market Insights, the global helicopter aerial photography market size was valued at USD 1,600.00 million in 2024 and is projected to grow from USD 1,728.00 million in 2025 to reach USD 2,539.00 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). Market growth is primarily driven by rising infrastructure development activities, increasing adoption of advanced imaging technologies such as LiDAR and thermal sensors, and growing demand for real-time aerial intelligence across government, energy, and defense sectors.

Key Market Insights

- Infrastructure and construction surveying remains the largest application segment, supported by large-scale urbanization and transport corridor development projects globally.

- Government and public-sector agencies dominate demand, accounting for a significant share of long-term and high-value aerial imaging contracts.

- North America leads the global market due to strong defense spending, energy asset monitoring, and advanced aviation infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rapid infrastructure expansion in China, India, and Southeast Asia.

- LiDAR and multi-sensor imaging adoption is accelerating, transforming helicopter photography into data-driven geospatial intelligence services.

- Project-based imaging contracts remain dominant, although long-term monitoring agreements are gaining traction in utilities and environmental applications.

What are the latest trends in the helicopter aerial photography market?

Integration of Advanced Imaging and Analytics

The market is increasingly shifting from traditional visual documentation toward analytics-driven aerial intelligence. Service providers are integrating LiDAR, thermal, and multispectral sensors with AI-powered analytics platforms to deliver actionable insights such as asset condition assessment, vegetation encroachment analysis, and terrain modeling. This transition is significantly increasing the average revenue per mission and strengthening long-term client relationships, particularly in energy, mining, and infrastructure sectors.

Growth of Disaster Response and Climate Monitoring Applications

The rising frequency of climate-related disasters has elevated the role of helicopter aerial photography in emergency response and environmental monitoring. Governments and insurance providers are relying on helicopters for rapid post-disaster damage assessment, wildfire thermal mapping, flood modeling, and landslide monitoring. The ability to operate in restricted or inaccessible areas gives helicopters a distinct advantage over drones, reinforcing their relevance in time-critical missions.

What are the key drivers in the helicopter aerial photography market?

Global Infrastructure and Energy Investments

Massive investments in transportation networks, renewable energy installations, oil & gas pipelines, and utility grids are driving sustained demand for helicopter-based aerial imaging. Helicopters are particularly suited for linear asset inspections and complex terrains, making them indispensable for infrastructure lifecycle management. Emerging economies in the Asia-Pacific and the Middle East are contributing significantly to this demand through public infrastructure modernization programs.

Technological Advancements in Sensor Payloads

Advancements in gyro-stabilized camera systems, high-resolution sensors, and modular payload configurations are enhancing data accuracy and operational efficiency. Helicopters’ ability to carry heavier and more sophisticated payloads for extended durations positions them as the preferred platform for high-precision imaging tasks, supporting market growth across commercial and defense applications.

What are the restraints for the global market?

High Operating and Maintenance Costs

Helicopter aerial photography involves significant capital and operational expenditure, including fuel costs, maintenance, pilot training, and regulatory compliance. These high costs can limit market entry for smaller players and constrain profit margins, particularly in price-sensitive regions.

Regulatory and Airspace Restrictions

Complex aviation regulations, especially in urban and cross-border operations, can delay project execution and increase compliance costs. Obtaining flight permissions and adhering to varying national airspace rules remain key challenges that can restrict market scalability.

What are the key opportunities in the helicopter aerial photography industry?

Smart City and Urban Planning Initiatives

Government-led smart city programs present significant opportunities for helicopter aerial photography providers. High-resolution urban mapping, traffic analysis, and infrastructure monitoring require precise and flexible aerial platforms, creating long-term demand for helicopter-based imaging services integrated with digital twin and GIS platforms.

Expansion of Environmental and Conservation Monitoring

Increasing emphasis on climate resilience, biodiversity conservation, and sustainable land use is opening new avenues for helicopter aerial photography. Applications such as deforestation tracking, coastal erosion monitoring, and wildlife population surveys are gaining funding support from governments and international agencies, offering stable growth opportunities.

Product Type Insights

Light helicopters dominate the market due to their cost efficiency, maneuverability, and suitability for urban and short-duration missions, accounting for the largest share of deployments. Medium helicopters are widely used in energy, offshore, and long-range survey applications, while heavy helicopters serve niche, high-payload requirements such as large-scale LiDAR mapping and defense operations. Continuous fleet modernization and sensor upgrades are enhancing productivity across all helicopter categories.

Application Insights

Infrastructure and construction surveying represents the leading application segment, driven by ongoing urban development and transportation projects. Energy and utility asset monitoring is the fastest-growing application, supported by renewable energy expansion and grid modernization. Media, tourism, and real estate applications continue to generate high-margin projects, while disaster management and defense surveillance are emerging as critical growth areas.

End-Use Insights

Government and public-sector agencies account for the largest share of demand, supported by infrastructure planning, disaster management, and national security requirements. Commercial enterprises, particularly in energy, mining, and real estate, represent a growing share of market revenue. Defense and military end users rely on helicopter aerial photography for reconnaissance, border surveillance, and tactical intelligence, contributing to stable long-term demand.

| By Application | By Imaging Technology | By Helicopter Type | By End User | By Contract Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global market, led by the United States. Strong demand from defense, homeland security, energy infrastructure monitoring, and environmental agencies underpins regional dominance. Widespread use of aerial surveillance for pipeline inspection, disaster response, and land management supports consistent demand. Advanced aviation infrastructure, skilled operators, and high adoption of cutting-edge imaging technologies further strengthen regional growth.

Asia-Pacific

Asia-Pacific accounts for around 29% of the market and is the fastest-growing region. China and India drive demand through large-scale infrastructure development, smart city initiatives, transportation network planning, and renewable energy projects. Rising government investments in urban monitoring and environmental assessment support expansion. Australia and Japan contribute through mining surveys, coastal monitoring, and precision environmental mapping applications.

Europe

Europe represents nearly 21% of global demand, with Germany, the U.K., France, and Norway as key markets. Offshore wind energy inspections, urban planning, transportation corridor mapping, and environmental compliance requirements drive steady demand. Strong regulatory frameworks and sustainability-focused policies encourage the use of high-resolution aerial imaging across public and private sectors.

Middle East & Africa

The Middle East & Africa region holds about 11% of the global market, supported by oil & gas asset monitoring, mega infrastructure developments, border surveillance, and security applications. The UAE and Saudi Arabia lead regional demand through large-scale construction and energy projects. South Africa plays an important role as a regional hub for mining surveys, land assessment, and environmental monitoring activities.

Latin America

Latin America accounts for approximately 7% of the global market. Brazil, Mexico, and Chile drive demand through mining exploration, agricultural monitoring, urban expansion, and infrastructure planning. Increasing public and private investment in geospatial data collection, along with gradual adoption of advanced aerial imaging technologies, continues to support regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Helicopter Aerial Photography Market

- Fugro

- Bristow Group

- CHC Helicopter

- PHI Aviation

- NHV Group

- Babcock International

- Erickson Incorporated

- McDermott Aviation

- Abu Dhabi Aviation

- Gulf Helicopters

Recent Developments

- In May 2025, Airbus Helicopters highlighted increased use of crewed aerial imaging for infrastructure inspection and cinematic production, complementing drone-based services.