Heated Socks Market Size

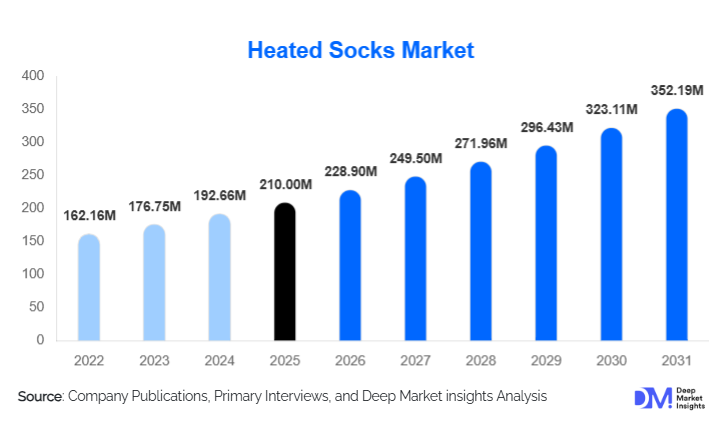

According to Deep Market Insights, the global heated socks market size was valued at USD 210.00 million in 2025 and is projected to grow from USD 228.90 million in 2026 to reach USD 352.19 million by 2031, expanding at a CAGR of 9.0% during the forecast period (2026–2031). The market growth is primarily driven by rising adoption of wearable heating solutions across cold-climate regions, increasing participation in winter sports and outdoor recreation, and growing use of heated socks in industrial, medical, and military applications where thermal protection and comfort are critical.

Key Market Insights

- Battery-powered heated socks dominate global demand, supported by portability, extended heating duration, and suitability for outdoor and professional use.

- Outdoor sports and recreation remain the largest end-use segment, driven by skiing, hiking, mountaineering, and winter tourism activities.

- North America leads global consumption, supported by high disposable income, cold climates, and strong adoption of premium wearable technologies.

- Asia-Pacific is the fastest-growing region, driven by rising disposable income, expanding manufacturing capacity, and increasing participation in outdoor activities.

- E-commerce channels account for the largest share of sales, supported by global brand access, product comparison, and direct-to-consumer strategies.

- Technological advancements in battery efficiency and heating materials are improving durability, comfort, and overall consumer acceptance.

What are the latest trends in the heated socks market?

Shift Toward Lightweight and High-Efficiency Heating Systems

Manufacturers are increasingly focusing on lightweight designs that combine flexible textiles with energy-efficient heating elements. Carbon fiber and graphene-based heating technologies are gaining traction due to their uniform heat distribution, faster warm-up times, and lower energy consumption. These advancements are allowing manufacturers to reduce bulk while extending heating duration, addressing long-standing consumer concerns related to comfort and wearability. As a result, heated socks are increasingly viewed as practical everyday winter accessories rather than niche technical products.

Growing Adoption of Smart and Temperature-Controlled Wearables

The integration of smart features such as adjustable temperature settings, remote controls, and mobile-app-based heat regulation is emerging as a key trend. These features allow users to customize heating levels based on ambient conditions and activity intensity. Smart heated socks are particularly popular among athletes and professionals operating in variable cold environments, reinforcing premium segment growth and supporting higher average selling prices.

What are the key drivers in the heated socks market?

Rising Demand from Outdoor Sports and Winter Tourism

The expansion of winter sports tourism and outdoor recreational activities has significantly increased demand for heated socks. Skiers, snowboarders, mountaineers, and hikers increasingly rely on wearable heating solutions to maintain comfort and prevent cold-related injuries during prolonged exposure to low temperatures. Growth in adventure tourism across Europe, North America, and Asia-Pacific continues to support this demand.

Increasing Industrial and Occupational Safety Requirements

Heated socks are gaining adoption in industries such as construction, mining, oil & gas, and cold-chain logistics. Employers are increasingly investing in thermal safety gear to enhance worker productivity and reduce cold-related health risks. Stricter occupational safety standards in cold environments are reinforcing institutional procurement of heated apparel, including socks.

What are the restraints for the global market?

High Product Costs and Battery Replacement Expenses

Compared to conventional thermal socks, heated socks carry significantly higher upfront costs, particularly in premium segments. Battery replacement and maintenance expenses further increase total cost of ownership, limiting adoption in price-sensitive markets and among mass consumers.

Durability and Washability Concerns

Despite technological improvements, concerns related to electronic component durability and washing limitations persist. Product failures or reduced lifespan can negatively impact consumer confidence, particularly in industrial and medical use cases where reliability is critical.

What are the key opportunities in the heated socks industry?

Expansion into Medical and Therapeutic Applications

Heated socks are increasingly being used to manage circulatory disorders, arthritis, and neuropathy-related conditions. Growing awareness of non-invasive thermal therapies and rising home healthcare adoption present significant opportunities for medical-grade heated socks with certified safety and therapeutic benefits.

Emerging Market Penetration and Local Manufacturing

Rising cold-climate workforce demand in Asia-Pacific, Eastern Europe, and Latin America presents opportunities for localized manufacturing and cost-optimized product offerings. Government-backed manufacturing initiatives and export-oriented production strategies can further support market expansion.

Product Type Insights

Battery-powered heated socks dominate the market, accounting for approximately 64% of global revenue in 2025. These products are preferred for their independence from external power sources and longer heating duration, making them ideal for outdoor sports, military, and industrial applications. USB-rechargeable models are gaining traction in casual and lifestyle segments due to convenience and lower costs, while hybrid designs are emerging in premium categories targeting extended-use scenarios.

Heating Technology Insights

Carbon fiber heating elements lead the market with an estimated 52% share in 2025, driven by flexibility, durability, and efficient heat distribution. Metallic wire-based systems continue to be used in economy products, while graphene-based technologies are rapidly gaining adoption in premium offerings due to superior thermal conductivity and energy efficiency.

End-Use Insights

Outdoor sports and recreation account for approximately 38% of global demand, followed by industrial and occupational use. Medical and therapeutic applications represent the fastest-growing segment, supported by aging populations and increasing prevalence of circulation-related conditions. Military and defense usage remains stable, driven by cold-region deployments and training requirements.

Distribution Channel Insights

E-commerce marketplaces and direct-to-consumer platforms collectively account for nearly 44% of global sales, benefiting from global reach, product comparison tools, and brand-led marketing. Specialty outdoor and sports retailers remain important for premium and professional-grade products, while medical supply stores serve therapeutic segments.

| By Product Type | By Heating Technology | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of global market revenue in 2025, led primarily by the United States, followed by Canada. Strong participation in winter sports such as skiing, snowboarding, and hiking continues to drive consumer demand for heated socks across recreational and professional segments. High disposable income levels support the uptake of premium heated apparel, while widespread awareness of wearable heating technologies accelerates adoption. In addition, industrial demand from construction, oil & gas, cold-chain logistics, and public safety sectors further strengthens regional market dominance.

Europe

Europe represents around 29% of global demand, with Germany, France, the U.K., and Nordic countries accounting for the majority of regional consumption. Prolonged winter seasons, colder average temperatures, and a strong culture of outdoor activities sustain consistent demand. Industrial safety regulations across manufacturing, infrastructure, and logistics sectors also support institutional procurement of heated socks. Furthermore, Europe shows rising adoption in medical and therapeutic applications, particularly among aging populations in Western and Northern Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 17%. China, Japan, and South Korea dominate regional demand due to a combination of large-scale manufacturing capabilities and increasing consumer acceptance of wearable heating products. Rising disposable incomes, expanding winter tourism, and growing interest in outdoor recreation are supporting market growth. Additionally, regional manufacturers benefit from cost-efficient production and strong export demand to North America and Europe, further accelerating market expansion.

Latin America

Latin America holds a smaller but steadily growing market share, driven by demand from high-altitude and colder regions in Chile and Argentina. Outdoor recreation, mountaineering, and adventure tourism contribute to product adoption, particularly among premium consumer segments. While overall penetration remains limited compared to developed regions, increasing availability of imported heated apparel and gradual growth in disposable income are supporting market development.

Middle East & Africa

Demand in the Middle East & Africa is primarily driven by military, industrial, and niche recreational applications. High-altitude regions, energy-sector operations, and specialized occupational environments generate steady demand for heated socks. In parts of Africa, mining and infrastructure projects operating in cooler climates contribute to institutional demand, while the Middle East shows selective uptake in premium outdoor and expedition-based activities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The heated socks market share is moderately consolidated, with the top five players accounting for approximately 41% of global revenue. Market leaders benefit from strong brand recognition, technological differentiation, and established distribution networks.

Key Players in the Heated Socks Market

- Therm-ic

- Lenz Products

- Savior Heat

- Volt Resistance

- Fieldsheer

- ActionHeat

- Mobile Warming

- Ororo

- Snow Deer

- Gerbing Heated Clothing

- Venture Heat

- Heat Holders

- Thermrup

- Day Wolf Heated Wear

- Gobi Heat