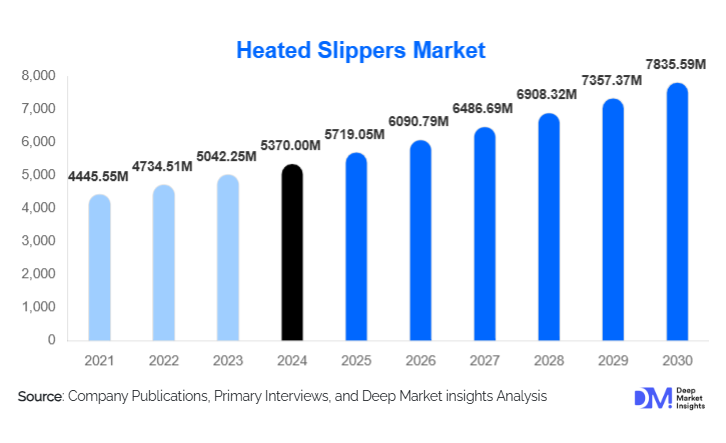

Heated Slippers Market Size

According to Deep Market Insights, the global heated slippers market size was valued at USD 5,370.00 million in 2024 and is projected to grow from USD 5,719.05 million in 2025 to reach USD 7,835.59 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The heated slippers market growth is primarily driven by rising demand for energy-efficient personal heating solutions, increasing adoption of wellness and therapeutic footwear, and growing consumer preference for smart, comfort-enhancing home products.

Key Market Insights

- Battery-powered heated slippers dominate the market, supported by portability, rechargeable technology, and growing use in residential settings.

- Carbon fiber heating elements are becoming the industry standard due to faster heating, uniform heat distribution, and enhanced durability.

- Online retail channels account for the largest share, driven by direct-to-consumer strategies, competitive pricing, and wider product availability.

- North America leads global demand, supported by cold climates, high disposable income, and strong awareness of wellness products.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and expanding e-commerce penetration.

- Medical and therapeutic usage is emerging as a high-growth application, particularly among aging populations and individuals with circulation-related conditions.

What are the latest trends in the heated slippers market?

Smart and Adjustable Temperature Technologies

Manufacturers are increasingly integrating multi-temperature controls, automatic shut-off mechanisms, and smart sensors into heated slippers. These features allow users to customize warmth levels while improving safety and energy efficiency. Premium models are experimenting with app-enabled controls and adaptive heating that responds to ambient temperature and body heat. This trend is particularly prominent in developed markets, where consumers are willing to pay higher prices for advanced comfort and safety features.

Sustainable Materials and Energy Efficiency

There is a growing focus on sustainability, with manufacturers adopting recycled fabrics, eco-friendly insulation, and energy-efficient batteries. Consumers are becoming more conscious of environmental impact, pushing brands to optimize battery life and reduce energy consumption. Lightweight synthetic and blended materials are increasingly preferred as they balance comfort, durability, and cost-effectiveness while supporting scalable manufacturing.

What are the key drivers in the heated slippers market?

Rising Demand for Energy-Efficient Personal Heating

With increasing energy costs and a push toward reducing household heating expenses, consumers are adopting localized heating products. Heated slippers provide targeted warmth at a fraction of the energy required for centralized heating, making them an attractive solution for cost-conscious households in colder regions.

Growing Aging Population and Health Awareness

The global aging population is driving demand for heated slippers as a therapeutic aid. These products are widely used to improve blood circulation, relieve joint stiffness, and manage cold sensitivity associated with arthritis and diabetes. Increased recommendations from healthcare professionals and wellness practitioners are supporting consistent, year-round demand.

Expansion of E-Commerce and Direct-to-Consumer Sales

The rapid expansion of e-commerce platforms has significantly increased product visibility and accessibility. Online channels enable consumers to compare features, read reviews, and access a wide range of price points, accelerating adoption across both developed and emerging markets.

What are the restraints for the global market?

Battery Safety and Product Durability Concerns

Battery-powered heated slippers face challenges related to overheating risks, limited battery lifespan, and safety compliance. Ensuring adherence to international safety standards increases production costs and can limit participation from smaller manufacturers.

Seasonal Demand Variability

Despite growing therapeutic usage, demand remains heavily concentrated during colder months. This seasonality creates inventory management challenges and revenue fluctuations, particularly for manufacturers with limited product diversification.

What are the key opportunities in the heated slippers industry?

Expansion into Medical and Therapeutic Segments

Heated slippers designed specifically for medical and wellness applications present a significant opportunity. Products targeting arthritis care, diabetic foot health, and post-operative recovery can command premium pricing and benefit from institutional demand through clinics, hospitals, and wellness centers.

Growth in Emerging Cold-Climate Urban Markets

Urban regions in Asia-Pacific, Eastern Europe, and parts of Latin America are experiencing rising demand for affordable personal heating solutions. Localized manufacturing, region-specific designs, and partnerships with e-commerce platforms can help manufacturers tap into these high-growth markets.

Product Type Insights

Battery-powered heated slippers are expected to account for approximately 52% of the global market in 2024, making them the leading product type segment. Their dominance is primarily driven by portability, cordless convenience, and advances in rechargeable battery technology. Modern lithium-ion batteries offer longer heating durations, faster charging, and improved safety, making these products suitable for use at home, in the office, and on the go. Consumers increasingly prefer battery-powered models as they allow unrestricted movement, particularly in residential settings where flexibility and comfort are prioritized.

Plug-in electric heated slippers continue to maintain steady demand, especially in residential environments where consistent power access is available. These models are preferred by cost-sensitive consumers due to their lower upfront price and unlimited heating duration without battery degradation. USB-powered heated slippers are emerging as a niche but growing segment, particularly among travelers, remote workers, and office users seeking lightweight, low-power, and portable warming solutions. Although their heating capacity is relatively lower, ease of use with laptops and power banks supports gradual adoption.

Heating Technology Insights

Carbon fiber heating elements lead the global heated slippers market with an estimated 48% share in 2024. This leadership is driven by carbon fiber’s high thermal efficiency, uniform heat distribution, flexibility, and extended lifespan. These attributes make carbon fiber particularly suitable for both mid-range and premium products, enabling faster heating while maintaining consistent warmth without hotspots.

Metal wire heating elements remain widely used in the economy and entry-level heated slippers due to their lower production cost and established manufacturing processes. However, they are gradually losing share due to relatively higher energy consumption and reduced durability. Graphene-based heating technologies are gaining traction in the premium segment, supported by their ultra-lightweight structure, rapid heat response, and superior energy efficiency. While adoption is currently limited by higher costs, graphene is expected to see accelerated uptake as manufacturing scales and prices decline.

Distribution Channel Insights

Online retail dominates the heated slippers market with nearly 57% share in 2024, driven by the rapid expansion of e-commerce platforms, direct-to-consumer (D2C) brand strategies, and increasing consumer comfort with online purchasing. Online channels allow manufacturers to offer a broader product range, competitive pricing, customer reviews, and detailed product comparisons, which are particularly important for technology-enabled comfort products.

Offline retail channels, including specialty footwear stores, pharmacies, wellness outlets, and hypermarkets, remain relevant, especially among older consumers who prefer physical product inspection and immediate purchase. Offline channels also play a crucial role in medical and therapeutic segments, where professional recommendations and in-store demonstrations influence buying decisions. However, their overall market share is gradually declining as online penetration continues to rise globally.

End-Use Insights

Residential use represents the largest end-use segment, accounting for around 63% of total demand in 2024. This dominance is driven by household comfort needs during colder months, rising energy costs encouraging localized heating solutions, and increased time spent at home. Heated slippers are increasingly viewed as essential winter comfort products rather than discretionary accessories.

Medical and therapeutic applications are the fastest-growing end-use segment, expanding at over 11% CAGR. Growth is supported by the increasing prevalence of arthritis, diabetes-related cold sensitivity, and circulation disorders among aging populations. Heated slippers are widely used in pain management and wellness routines, leading to higher repeat purchases and premium pricing. Hospitality and commercial usage are emerging as a premium niche, particularly in luxury resorts, wellness retreats, and cold-climate hotels offering heated footwear as part of enhanced guest comfort experiences.

| By Product Type | By Heating Technology | By Material Type | By Temperature Control | By End-Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global heated slippers market share in 2024, led by the U.S. and Canada. Long winter seasons, high household heating costs, strong purchasing power, and widespread awareness of wellness and therapeutic products drive regional growth. Consumers in this region show a high willingness to invest in premium and smart heated slippers, particularly those with safety certifications and adjustable temperature controls. Well-established e-commerce infrastructure and strong brand presence further support sustained demand.

Europe

Europe accounts for nearly 29% of global demand, with Germany, the U.K., France, and Nordic countries leading adoption. Growth in this region is strongly supported by cold climates, rising energy prices, and strict energy-efficiency regulations that encourage personal heating solutions over centralized heating. European consumers also demonstrate a strong preference for sustainable materials and durable products, benefiting manufacturers offering eco-friendly and high-quality heated slippers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR of over 11%. China and Japan dominate regional demand, supported by rapid urbanization, aging populations, expanding middle-class income, and booming e-commerce penetration. In several East Asian markets, limited central heating in residential buildings further accelerates the adoption of personal heating products. Rising awareness of health and wellness, combined with competitive pricing from local manufacturers, is significantly boosting market expansion.

Latin America

Latin America represents an emerging market for heated slippers, with demand concentrated in colder regions such as Chile and Argentina. Growth is driven by seasonal temperature drops, rising disposable income, and increasing exposure to global consumer brands through e-commerce. Although market penetration remains relatively low, improving logistics infrastructure and growing urban populations are expected to support steady long-term growth.

Middle East & Africa

Demand in the Middle East & Africa remains niche, primarily limited to high-altitude and cooler regions, as well as premium hospitality applications. Growth is gradual but supported by rising adoption of premium home comfort products, increasing luxury tourism, and higher spending capacity in select markets. As awareness of wellness-oriented lifestyle products increases, the region is expected to witness incremental demand growth, particularly in upscale residential and hospitality segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Heated Slippers Market

- Sunbeam

- Beurer

- Therapedic

- Dr. Scholl’s

- Sharper Image

- ActionHeat

- Volt Resistance

- Mobile Warming

- Snow Deer

- Ororo