Hearing Protector Market Size

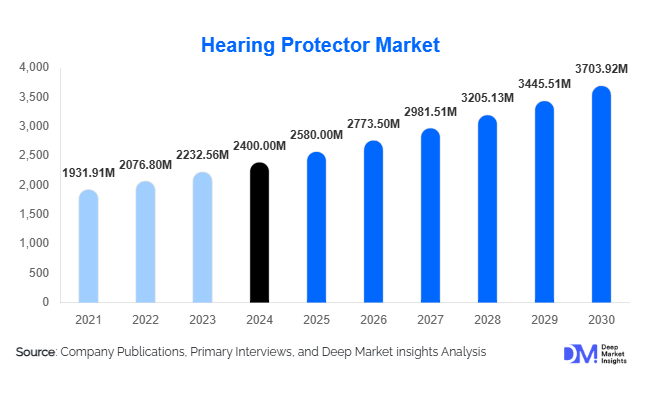

According to Deep Market Insights, the global hearing protector market size was valued at USD 2,400 million in 2024 and is projected to grow from USD 2,580.00 million in 2025 to reach USD 3,703.92 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). This growth is driven by tightening occupational safety regulations, increasing awareness of noise-induced hearing loss, and the rise of smart and connected hearing protection devices across industrial and recreational sectors.

Key Market Insights

- Industrial safety enforcement continues to expand worldwide, making hearing protection mandatory across high-noise sectors such as manufacturing, mining, and construction.

- Technological innovation is reshaping the market, with electronic earmuffs, Bluetooth connectivity, and real-time noise monitoring entering mainstream use.

- North America dominates global demand owing to strict OSHA standards and mature industrial infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization and expanding workforce protection programs in China and India.

- Consumer and recreational use of hearing protectors is expanding, encompassing shooting sports, live music, and personal wellness applications.

- Customization and comfort improvements are boosting compliance rates, particularly through custom-molded earplugs and lightweight materials.

Latest Market Trends

Smart and Connected Hearing Protection

Hearing protectors are evolving into intelligent wearables. Bluetooth-enabled earmuffs and in-ear devices with integrated microphones allow workers to communicate safely in noisy environments. Advanced models include real-time exposure tracking, mobile-app connectivity, and data analytics for occupational health reporting. This technological convergence not only enhances user convenience but also supports enterprise compliance programs by collecting verifiable exposure data. The trend is accelerating across defense, aviation, and oil & gas sectors, where both protection and communication are mission-critical.

Customization and Comfort Enhancements

Manufacturers are emphasizing ergonomics and personalized fit. Custom-molded earplugs, reusable silicone materials, and lightweight earmuff designs are improving comfort and driving adoption among users who previously resisted protective equipment due to discomfort. As a result, compliance rates in regulated industries are rising, directly translating to higher market penetration. Furthermore, sustainability trends such as recyclable materials and biodegradable foam inserts are influencing purchasing decisions in Europe and North America.

Hearing Protector Market Drivers

Rising Awareness of Occupational Hearing Loss

Increasing public health campaigns and corporate safety initiatives have elevated awareness about permanent hearing loss caused by prolonged noise exposure. Governments and organizations are imposing stricter exposure limits, ensuring companies invest in certified hearing protection devices for their employees.

Industrial Expansion and Urban Infrastructure Growth

Rapid industrialization and construction activity in developing economies such as India, China, and Brazil have expanded the addressable market for hearing protection. Heavy machinery, power generation, mining, and transportation infrastructure all produce high noise levels, necessitating protective equipment for workers and contractors.

Product Innovation and Material Advancements

Continuous R&D investment has yielded electronic noise-cancelling earmuffs, hybrid devices combining protection and communication, and eco-friendly materials. These innovations not only improve safety but also broaden use cases to consumer and defense segments, creating new revenue streams for manufacturers.

Market Restraints

Low User Compliance and Fit Issues

Despite availability, many workers still neglect proper usage due to discomfort, heat retention, or perceived interference with communication. Inconsistent fit and lack of training can compromise protection, limiting real-world effectiveness and slowing adoption in cost-sensitive industries.

Cost Sensitivity in Emerging Markets

In developing regions, budget constraints and informal workforces hinder large-scale adoption. Cheaper substitutes or reliance on engineering noise controls often delay procurement of certified devices, reducing market potential among small and medium enterprises.

Hearing Protector Market Opportunities

Integration of IoT and Smart Technologies

Embedding sensors and connectivity into hearing protectors presents a significant opportunity. IoT-enabled HPDs can monitor noise levels, track exposure duration, and transmit compliance data to centralized dashboards. This integration supports predictive safety management and appeals to industrial buyers seeking digital transformation.

Emerging Market Safety Regulations

Countries in the Asia-Pacific, Latin America, and the Middle East are tightening workplace safety norms. Initiatives such as India’s “Make in India” and China’s industrial modernization programs are encouraging localized manufacturing and greater PPE adoption, unlocking vast new demand for affordable, certified hearing protection.

Defense and Specialized Industrial Demand

Military and aviation sectors increasingly require advanced hearing protection with situational-awareness features. Contracts for tactical communication headsets and electronic HPDs offer high-margin opportunities for established manufacturers and technology entrants.

Product Type Insights

Earplugs represent the dominant product category, accounting for approximately 42% of the 2024 global market. Their affordability, portability, and adaptability across multiple sectors make them the first choice for industrial buyers. Earmuffs occupy the second position, favored in high-noise continuous-exposure settings. Hybrid and smart protectors, though niche, are the fastest-growing segment, projected to expand above 10% CAGR as connectivity becomes standard in professional PPE.

Application Insights

Manufacturing and industrial applications account for approximately 36% of global demand, driven by the high prevalence of noise-intensive processes. Construction, mining, and oil & gas follow, supported by infrastructure projects and energy exploration. Recreational use spanning shooting sports, live concerts, and consumer wellness is expanding rapidly, adding diversity to end-use revenue streams.

Distribution Channel Insights

Direct B2B procurement channels dominate sales, particularly in large manufacturing and defense contracts. However, online and retail distribution is gaining traction as consumers purchase HPDs for personal use. E-commerce platforms and safety-equipment distributors are expanding product accessibility, especially for reusable and custom-fit models.

| By Product Type | By Protection Level | By End-Use Industry | By Distribution Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with around 30–35% share in 2024. The U.S. drives demand through stringent OSHA mandates and extensive industrial and defense applications. Canada contributes additional growth through the mining and energy sectors. The region’s mature compliance culture supports consistent replacement cycles and adoption of premium electronic HPDs.

Europe

Europe accounts for roughly 25% of global revenue. Countries such as Germany, the U.K., and France enforce strong worker-safety regulations under EU Directive 2003/10/EC. European buyers increasingly prefer sustainable, reusable earplugs and low-carbon manufacturing processes, stimulating innovation in eco-materials and circular PPE models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at 8–9% CAGR. China and India are the primary growth engines, driven by large-scale manufacturing and infrastructure investments. Rising workforce awareness, government enforcement, and local production are rapidly closing the compliance gap with Western markets.

Middle East & Africa

MEA contributes an 8–10% share in 2024. Oil & gas operations in the GCC and mining in South Africa sustain steady demand. Government-funded infrastructure and industrial diversification programs (e.g., Saudi Vision 2030) are expected to boost PPE purchases, including hearing protection.

Latin America

Latin America holds around a 5–8% share, led by Brazil, Mexico, and Argentina. Growing mining, automotive, and manufacturing industries are fostering the gradual adoption of certified HPDs. Regional initiatives promoting occupational health standards will further accelerate market penetration through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hearing Protector Market

- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- DuPont (Safety Division)

- Avon Rubber plc

- Uvex Safety Group

- Ansell Limited

- Kimberly-Clark Corporation

- Bullard Company

- Moldex-Metric Inc.

- E.A.R. Inc.

- Radians Inc.

- Peltor Brand (by 3M)

- Etymotic Research Inc.

- Hellberg Safety AB

Recent Developments

- June 2025 – 3M launched a new series of AI-enabled electronic earmuffs that integrate Bluetooth connectivity and real-time noise-exposure tracking for industrial users.

- April 2025 – Honeywell announced an investment in a smart-PPE manufacturing facility in India to cater to Asia-Pacific demand growth.

- February 2025 – MSA Safety introduced a line of eco-friendly earplugs using biodegradable materials targeting European sustainability mandates.