Hearables Market Size

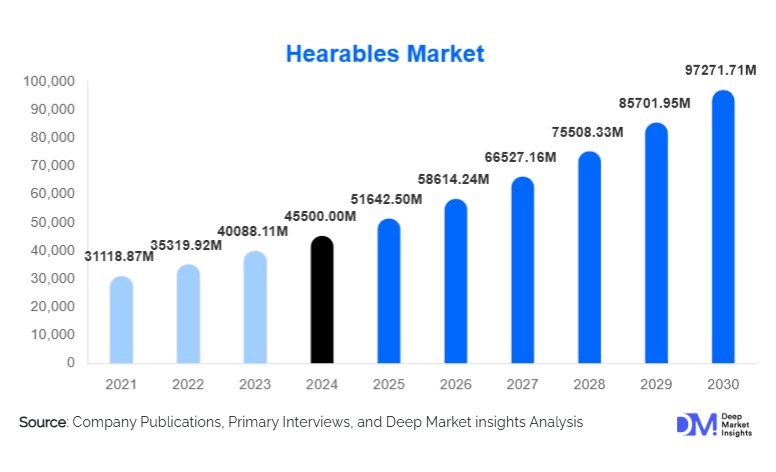

According to Deep Market Insights, the global hearables market size was valued at USD 45,500.00 million in 2024 and is projected to grow from USD 51,642.50 million in 2025 to reach USD 97,271.71 million by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The hearables market is experiencing accelerated growth driven by rising adoption of wireless audio devices, the integration of health and biometric monitoring features, and expanding demand for medically oriented hearing aids and assistive technologies. Robust smartphone penetration, aging global populations, and rapid advancements in AI-driven audio processing continue to position hearables as a dominant category within the broader wearables ecosystem.

Key Market Insights

- True Wireless Stereo (TWS) earbuds dominate the hearables industry, supported by mainstream consumer adoption and integration with smartphones and entertainment platforms.

- Healthcare-focused hearables, including digital hearing aids and implants, are expanding rapidly due to aging populations and growing awareness of hearing health.

- Asia-Pacific leads global volume growth, driven by low-cost manufacturing, expanding middle-class consumption, and local OEM proliferation.

- North America remains the largest revenue-generating region, attributed to premium device sales, OTC hearing aid policies, and strong brand penetration.

- AI-powered audio enhancement, biometric sensing, and voice-assistant integration are emerging as core differentiators across new product launches.

- Industrial hearables are gaining traction as organizations emphasize workplace safety, seamless communication, and hands-free productivity.

What are the latest trends in the hearables market?

AI-Enhanced and Sensor-Integrated Hearables

The newest generation of hearables integrates AI-driven speech enhancement, adaptive noise cancellation, biometric authentication, and contextual audio processing. These advancements enable real-time environmental recognition, personalized audio profiles, and precise voice pickup even in noisy environments. AI-powered models are increasingly used for fitness tracking, stress detection, sleep analysis, and biometric verification, turning hearables into multi-functional wellness devices. The rising need for hands-free control and seamless integration with virtual assistants (Siri, Google Assistant, Alexa) strengthens the adoption of smart hearables across both consumer and enterprise applications.

Healthcare Convergence and Assistive Hearables

Hearables are rapidly evolving into medical-grade devices, transforming traditional hearing aids through digital connectivity, app-based tuning, and AI-powered sound adaptation. The approval of OTC hearing aids in regions like the U.S. has dramatically expanded accessibility, providing new avenues for innovation and competition. Hybrid consumer-medical devices, earbuds with built-in amplification, fall detection, hearing assessments, or heart-rate monitoring, are emerging as a major trend. Cochlear implants and assistive listening devices are also advancing through wireless synchronization, smartphone pairing, and cloud-based program management, enabling remote care and personalized user experiences.

What are the key drivers in the hearables market?

Surge in Wireless Audio Adoption

Global migration from wired to wireless audio ecosystems is one of the strongest market drivers, accelerated by smartphone manufacturers removing 3.5mm jacks and promoting Bluetooth-dependent accessories. Consumers prioritize portability, comfort, and high-fidelity audio, leading to explosive TWS earbud adoption. Improvements in battery efficiency, Bluetooth codecs, and ergonomic designs have made wireless hearables the default choice for daily entertainment, calls, and commuting experiences.

Growing Healthcare Demand and Aging Populations

As hearing loss becomes more prevalent, demand for digital hearing aids, cochlear implants, and assistive listening devices is rising. Aging populations across Europe, North America, Japan, and China are driving sustained high-value consumption in the medical hearables segment. Device miniaturization, Bluetooth-enabled control, and remote clinic support are increasing acceptance among older adults. Government subsidies and OTC market expansion further accelerate adoption.

What are the restraints for the global market?

High Cost of Premium Hearables and Hearing Aids

Advanced hearables, especially those equipped with AI, ANC, and health sensors, remain costly to produce. Price-sensitive markets in LATAM, Africa, and Southeast Asia struggle with adoption, slowing global penetration. Medical-grade hearing aids are also expensive, limiting access for low-income consumers despite growing demand. Manufacturers face cost pressures from high component pricing and complex supply chains.

Regulatory, Privacy, and Data-Security Challenges

As hearables collect biometric, environmental, and potentially health-related data, regulatory compliance becomes complex. Hearing aids and medical hearables must meet stringent certification requirements across regions, lengthening product development cycles. Privacy concerns related to continuous audio monitoring, location tracking, and medical data storage may reduce consumer trust and slow adoption of advanced models.

What are the key opportunities in the hearables industry?

Health & Wellness–Driven Hearables

The convergence of biometric sensors, medical diagnostics, and AI wellness coaching is creating new revenue pathways. Hearables capable of heart-rate monitoring, stress detection, hearing assessments, sleep analysis, and fitness tracking offer immense potential. Healthcare providers are exploring hearables for telemedicine, remote diagnostics, and continuous monitoring, defining new consumer and clinical applications for ear-based sensing.

Expansion in Emerging Markets and Localized Manufacturing

APAC, LATAM, and parts of Africa present significant volume expansion opportunities, especially for cost-effective wireless earbuds and entry-level hearing aids. Rising income levels and rapid urbanization widen the addressable market. Governments promoting electronics manufacturing, such as “Make in India” and China’s local production policies, are encouraging investments in regional factories, lowering production costs and improving supply-chain resilience.

Product Type Insights

TWS earbuds dominate the market, capturing nearly half of global revenue due to their convenience, portability, and seamless integration with smartphones and digital entertainment. Over-ear and on-ear headphones remain strong among gamers, professionals, and audiophiles seeking superior audio fidelity and noise isolation. Hearing aids and cochlear implants form a critical medical sub-sector, driven by aging demographics and technological upgrades, including Bluetooth connectivity, AI-based sound tuning, and extended battery performance. Industrial hearables, engineered for workplace safety and efficient communication, are emerging rapidly as enterprises adopt hands-free operational tools across manufacturing, logistics, and field service sectors.

Application Insights

Consumer audio applications dominate due to high entertainment and communication usage. Healthcare applications are rapidly expanding, with digital hearing aids and implants becoming core tools for managing hearing impairment. Industrial applications, spanning safety, training, and communication, are gaining momentum as companies integrate wearable tech into frontline operations. Fitness and wellness hearables equipped with biometric sensors are also growing quickly, driven by rising interest in personalized health insights and continuous monitoring.

Distribution Channel Insights

Online retail leads hearables distribution, boosted by e-commerce penetration, influencer-driven marketing, and rapid comparison tools. Offline electronics stores remain important for premium purchases, while audiology clinics dominate the hearing-aid and medical device segment. Direct-to-consumer (D2C) brands are gaining traction through subscription models, app-managed ecosystems, and aggressive digital advertising. B2B channels are increasingly relevant for industrial hearables as companies procure devices in bulk for operational use.

User Type Insights

Consumers aged 18–35 are the largest adopters of TWS earbuds and wireless headphones, driven by entertainment, social media, and mobile-first lifestyles. Middle-aged and older adults (45+) dominate demand for hearing aids and medically oriented hearables. Enterprise users, including frontline workers, technicians, and warehouse teams, represent a fast-growing segment adopting industrial-grade hearables for productivity and safety enhancement.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest revenue-generating region, driven by premium device adoption, strong healthcare infrastructure, and widespread use of AI-enabled hearables. The U.S. leads the region, supported by OTC hearing-aid policies, robust consumer spending, and high penetration of smart devices.

Europe

Europe demonstrates strong uptake of medical hearables due to aging demographics and favorable reimbursement models. Germany, France, and the U.K. lead the adoption of hearing aids and premium audio devices. Sustainability-driven consumers are accelerating demand for long-lasting, energy-efficient hearables.

Asia-Pacific

APAC is the fastest-growing region in terms of volume, driven by China and India. Local production ecosystems, competitive pricing, and tech-savvy younger populations fuel demand. Japan and South Korea support strong adoption of hearing aids and premium audio technology. APAC accounts for nearly 30% of global hearables consumption.

Latin America

LATAM shows rising interest in budget and mid-range hearables. Brazil and Mexico lead growth, driven by expanding smartphone penetration and increasing availability of affordable wireless earbuds.

Middle East & Africa

MEA demand is growing steadily due to rising income levels and expanding retail networks. Africa shows high potential in the hearing-health sector, with governments improving access to diagnostic and audiology services. GCC countries exhibit a strong demand for premium audio devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the smartHearables Market

- Apple

- Samsung Electronics

- Sony Corporation

- Bose Corporation

- Sennheiser

- Jabra (GN Group)

- Xiaomi

- Logitech

- LG Electronics

- Philips

- Skullcandy

- Bang & Olufsen

- Beyerdynamic

- Sonova

- Demant A/S

Recent Developments

- In March 2025, Apple introduced advanced conversational AI features for AirPods Pro, enhancing real-time noise suppression and personalized spatial audio.

- In January 2025, Samsung released a new series of Galaxy Buds with integrated health sensors capable of heart-rate and stress monitoring.

- In October 2024, Sonova launched a hybrid consumer-hearing aid device enabling seamless switching between entertainment audio and medical-grade amplification.