Headwear Market Size

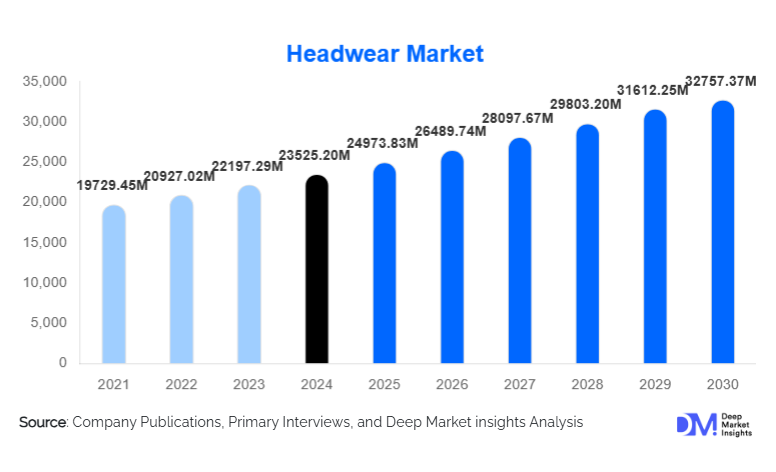

According to Deep Market Insights, the global headwear market size was valued at USD 23,525.20 Million in 2024 and is projected to grow from USD 24,973.83 Million in 2025 to reach USD 32,757.37 Million by 2030, expanding at a CAGR of 6.07% during the forecast period (2025–2030). The headwear market growth is primarily driven by rising fashion consciousness, expanding athleisure and streetwear trends, increased adoption of protective and performance headgear, and accelerating demand from emerging regions with growing disposable incomes.

Key Market Insights

- Caps and hats dominate global demand, accounting for nearly 60% of the total market due to their versatility across fashion, lifestyle, and functional applications.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, youth fashion adoption, and expanding e-commerce penetration.

- Adults represent the largest user demographic, contributing nearly 85% of global headwear consumption in 2024.

- Protective and functional headwear is expanding quickly as safety regulations tighten across construction, industrial, and outdoor sports sectors.

- Sustainability is redefining product innovation, with companies adopting recycled polyester, organic cotton, and eco-friendly technical fabrics.

- Online and D2C channels are reshaping distribution, offering global reach and enabling niche brands to scale rapidly.

What are the latest trends in the headwear market?

Sustainability & Eco-Friendly Materials Take Center Stage

Globally, consumers, especially Millennials and Gen Z, are prioritizing ethically produced, environmentally conscious fashion items. This is pushing headwear brands to adopt organic cotton, recycled polyester, responsibly sourced wool, and biodegradable trims. Major brands are also launching “green collections” with transparent supply chains, water-efficient dyeing processes, and recyclable packaging. As sustainability becomes a core purchase criterion, eco-friendly headwear is transitioning from a niche to a mainstream offering. Companies adopting responsible sourcing practices are gaining stronger brand loyalty and higher price acceptance, reinforcing a long-term shift in market behavior.

Rise of Athleisure, Streetwear & Performance Headwear

Athleisure and streetwear trends continue to influence headwear design and demand. Performance headwear, such as moisture-wicking caps, UV-protection sun hats, winter thermal beanies, and breathable sports caps, is seeing strong uptake among fitness-conscious and outdoor-active consumers. Streetwear brands and celebrity collaborations are shaping global fashion cycles, fueling demand for branded caps, limited-edition drops, and customized designs. Social media is further accelerating trend adoption, making headwear a fast-moving fashion accessory with sustained growth momentum.

What are the key drivers in the headwear market?

Global Surge in Fashion & Lifestyle Demand

The headwear market is significantly driven by rising fashion consciousness and the increasing integration of hats and caps into daily lifestyle and street fashion. Consumers now view headwear not only as functional products but as identity expressions and style statements. With the popularity of casual wear, outdoor lifestyles, and athleisure apparel, fashion headwear maintains strong and consistent global demand. Influencer-led trends, celebrity brand collaborations, and the rise of fast fashion further accelerate this driver.

Growing Adoption of Protective & Functional Headgear

Safety regulations in construction, manufacturing, industrial sectors, and transportation are strengthening globally. This is creating strong institutional demand for certified helmets and protective headgear. In addition, rising participation in motorcycling, cycling, hiking, skiing, and adventure sports is boosting sales of performance and protective helmets. The dual emphasis on safety and comfort is driving companies to innovate using lightweight composites, impact-resistant shells, and breathable performance materials.

Rapid Growth of E-Commerce & D2C Retail

The rise of online retail has revolutionized the headwear market. Direct-to-consumer (D2C) brands can now reach global audiences without physical retail presence, while established brands use digital channels to launch limited collections, personalized designs, and premium lines. The convenience of online customization, real-time reviews, and broad style availability fuels consumer adoption. Online penetration is growing especially fast in APAC, Europe, and North America, greatly contributing to overall market growth.

What are the restraints for the global market?

Seasonality & Climate Dependence

Headwear categories such as winter beanies, sun hats, and specific climate-oriented accessories experience strong seasonality. Manufacturers and retailers face difficulties maintaining balanced inventories, resulting in stock surpluses or shortages during off-seasons. Seasonal fluctuations challenge forecasting accuracy and can reduce year-round profitability for climate-dependent product lines.

Price Pressure & Raw Material Cost Volatility

Cotton, wool, and synthetic fiber costs are prone to fluctuations due to global supply chain disruptions, energy prices, and environmental policy shifts. Rising input costs strain manufacturer margins, especially in premium and sustainable segments. Moreover, competition from low-cost producers in Asia places pressure on global brands to maintain competitive pricing without compromising quality or sustainability.

What are the key opportunities in the headwear industry?

Explosive Growth in Emerging Markets

Asia-Pacific, Latin America, and Africa are experiencing rapid urbanization, rising disposable incomes, and increasing exposure to global fashion trends. Youth-driven markets like India, Indonesia, Nigeria, and Brazil are embracing headwear across lifestyle, sports, and work applications. These fast-growing consumer groups offer substantial opportunities for both mass-market and premium brands. Companies entering early with region-tailored designs and strategic online distribution can gain a strong competitive advantage.

Sustainable & Ethical Product Lines

Demand for eco-friendly headwear is accelerating, creating opportunities for brands to differentiate through organic fibers, recycled materials, and closed-loop production systems. Sustainability certifications, traceable supply chains, and biodegradable packaging strengthen brand trust. This shift supports higher-margin products and appeals strongly to environmentally conscious buyers. Brands leading in sustainability will benefit from regulatory support and premium consumer segments.

Expansion of Technical & Performance Headwear

The rise of outdoor recreation, adventure travel, cycling, running, skiing, and hiking is creating strong demand for technical headwear. Innovations such as breathable fabrics, water-resistant coatings, thermal insulation, and UV protection offer opportunities to tap into high-performance niches. Regulatory emphasis on workplace safety is also boosting demand for industrial helmets and protective gear. Companies investing in R&D for advanced materials and ergonomic designs are poised to capture significant long-term value.

Product Type Insights

Caps and hats represent the largest product type segment in the market, capturing ~59.8% of global demand in 2024. Their dominance stems from versatile use across fashion, lifestyle, sports, travel, and sun protection. Baseball caps, bucket hats, snapbacks, and fedoras remain popular due to their adaptability to fashion cycles and broad appeal across demographics. The wide availability of designs, customization options, and brand merchandising further supports strong global uptake. This segment remains the anchor revenue generator for brands worldwide.

Application Insights

Casual and lifestyle applications account for more than half of total headwear usage. Fashion-driven demand, streetwear popularity, and the widespread use of caps and hats for personal identity expression drive this segment’s dominance. Meanwhile, sports & outdoor headwear is rapidly expanding, supported by rising global participation in fitness, running, cycling, and adventure activities. Protective applications, such as construction helmets and industrial safety headgear, continue to grow as workplace safety regulations strengthen globally.

Distribution Channel Insights

Online and D2C channels lead global headwear distribution, driven by the convenience of e-commerce, broader style availability, and rapid adoption among urban consumers. E-commerce platforms allow brands to reach international markets while offering customization and limited-edition drops. Offline retail, particularly specialty stores, department stores, and sports outlets, still plays a strong role, especially in premium or branded categories requiring tactile experience. Wholesale and institutional procurement remain important for safety helmets and functional headwear.

End-User Insights

Adults represent the largest consumer group, contributing nearly 85% of market demand. Their higher purchasing power, broader fashion preferences, and more frequent participation in sports and outdoor activities drive strong consumption. Children’s headwear forms a smaller but stable segment, mainly influenced by school uniforms, sun-protection requirements, and winter wear in colder climates. Gender-neutral and unisex fashion trends are boosting demand across both men’s and women’s categories.

| By Product Type | By Material Type | By End User | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for roughly 25–28% of global headwear demand in 2024, led by the U.S. market with strong sports culture, premium lifestyle trends, and high adoption of branded caps. The region’s robust e-commerce ecosystem and interest in outdoor recreation contribute to strong growth. Premium headwear, licensed sports merchandise, and technical performance caps are particularly popular.

Europe

Europe contributes approximately 15–20% of global market share, driven by strong demand for seasonal winter headwear, fashion-forward styles, and sustainable materials. Countries such as the U.K., Germany, France, and Italy lead consumption. European consumers show a higher preference for eco-conscious products and premium craftsmanship, making the region a key market for sustainable headwear brands.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 30–35% of the global market. China, India, Japan, and Southeast Asia are driving growth, supported by rising fashion adoption, expanding middle-class populations, and rapid e-commerce penetration. Youth trends, urban streetwear fashion, and outdoor sports participation fuel strong demand across price segments. APAC is expected to maintain the highest CAGR through 2030.

Latin America

Latin America contributes around 5–7% of global demand, with Brazil, Mexico, and Argentina emerging as high-potential markets. Growing sports culture, urbanization, and rising disposable incomes are pushing demand for both fashion and functional headwear. Outdoor lifestyle trends and cross-border e-commerce are influencing market expansion.

Middle East & Africa

MEA accounts for 5–8% of the global market share. The region displays strong cultural headwear traditions, high demand for sun-protective headwear, and increasing adoption of global fashion trends. Africa’s industrial and construction sectors drive institutional demand for protective helmets. Gulf nations show robust growth in premium and luxury-branded headwear.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Headwear Market

- Nike, Inc.

- Adidas AG

- Puma SE

- New Era Cap Company

- Under Armour, Inc.

- Lacoste

- Gucci (Guccio Gucci S.p.A.)

- Topgolf Callaway Brands Corp

- Boardriders

- New Balance, Inc.

- The Gap, Inc.

- Superdry Plc

- Flexfit (Yupoong)

- Kangol

- Columbia Sportswear Company

Recent Developments

- In March 2025, Nike launched a new line of sustainable caps using ocean-recycled polyester, strengthening its circular fashion portfolio.

- In January 2025, New Era debuted its smart-cap prototype with integrated UV sensors targeted at outdoor sports communities.

- In February 2025, Puma announced the expansion of its performance headwear division with new moisture-wicking and breathable fabric technologies.