Harness Saddlery Equipment Market Size

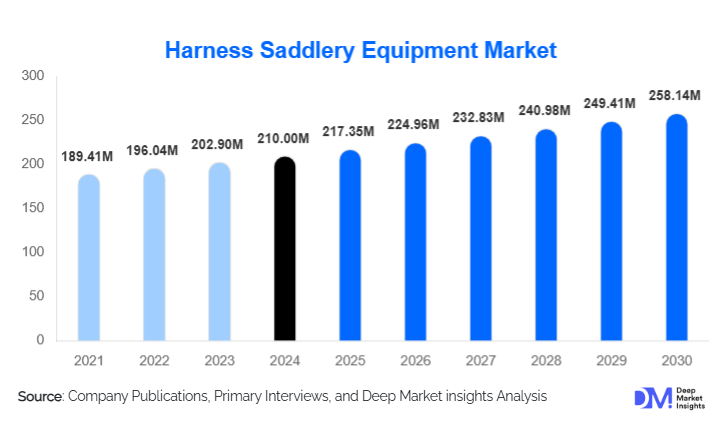

According to Deep Market Insights, the global harness saddlery equipment market size was valued at USD 210.00 million in 2024 and is projected to grow from USD 217.35 million in 2025 to reach USD 258.14 million by 2030, expanding at a CAGR of 3.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing participation in equestrian sports, rising demand for high-quality leather and synthetic equipment, and the expansion of leisure and tourism-based riding activities worldwide.

Key Market Insights

- The rising popularity of equestrian sports and recreational riding is boosting demand for performance-oriented harnesses and saddlery equipment, especially in North America and Europe.

- Technological advancements in material and design, including lightweight synthetic saddles, ergonomic harnesses, and smart performance-monitoring features, are enhancing user comfort and horse welfare.

- APAC is emerging as the fastest-growing region, driven by increasing disposable income, growing interest in leisure riding, and the expansion of equestrian clubs in China, India, and Australia.

- Offline retail remains the dominant distribution channel, particularly through specialty equestrian stores, while online platforms are rapidly gaining traction for global sales.

- Leather-based products maintain dominance due to durability, tradition, and preference among professional riders, though synthetic alternatives are rapidly growing in emerging markets.

- Export-driven demand is increasing from Europe and North America, while APAC and LATAM are key importers of high-quality saddlery equipment.

What are the latest trends in the harness saddlery equipment market?

Technologically Advanced Saddlery

Manufacturers are increasingly incorporating smart features into saddles and harnesses, such as sensors for monitoring horse gait, stress, and performance. Ergonomic and lightweight designs are becoming standard, particularly in competitive equestrian sports. Customizable products and premium leather options are expanding in high-end markets, while cost-effective synthetic alternatives are gaining traction among leisure riders. These innovations enhance horse comfort and rider performance, driving both professional and recreational adoption.

Growing Online Sales and E-commerce Penetration

The digitalization of sales channels is reshaping the harness saddlery market. Online platforms allow customers to browse product catalogs, compare specifications, and purchase equipment directly from manufacturers. Emerging markets in APAC and LATAM are experiencing accelerated growth through e-commerce, as these channels overcome geographic and retail accessibility limitations. Social media marketing, influencer promotions, and brand engagement campaigns are driving awareness and adoption among younger demographics.

What are the key drivers in the harness saddlery equipment market?

Increasing Equestrian Sports Participation

Professional competitions, riding schools, and recreational clubs are steadily increasing worldwide. In Europe and North America, growing participation in dressage, show jumping, and endurance riding has driven sustained demand for high-quality saddles and harnesses. Investment in equestrian academies and stables ensures consistent adoption of premium products, supporting long-term revenue growth.

Technological and Material Innovations

The adoption of synthetic materials, lightweight designs, and ergonomic harnesses is driving product differentiation. Riders and trainers are increasingly seeking equipment that combines durability, comfort, and performance enhancement. Smart saddlery products, integrated with wearable technology, provide actionable data for competitive riders, further accelerating adoption.

Growth in Tourism and Leisure Riding

Rising interest in recreational horse riding, equestrian tourism, and ranch-based leisure activities, particularly in APAC and LATAM, is creating new demand for saddlery products. Tour operators and riding schools are expanding their fleets, boosting both volume and revenue for harness and saddle manufacturers.

What are the restraints for the global market?

High Costs of Premium Products

Leather saddles and customized harnesses remain expensive, limiting accessibility for casual riders and emerging markets. Price sensitivity in APAC and LATAM reduces penetration, particularly for high-end products requiring skilled craftsmanship and quality materials.

Limited Awareness in Emerging Regions

While equestrian sports are growing in emerging regions, the lack of consumer education on horse welfare, safety, and premium equipment usage slows adoption. Training centers and awareness campaigns are required to improve market penetration and product acceptance.

What are the key opportunities in the harness saddlery equipment market?

Expansion into Emerging Regions

Countries such as China, India, and Brazil are underpenetrated markets with rising disposable income and growing equestrian clubs. Manufacturers can leverage these markets by offering cost-effective synthetic products and targeted marketing strategies. Increasing government support for tourism and rural equestrian activities further enhances market potential.

Integration of Smart and Performance-Oriented Saddlery

Smart harnesses and saddles with wearable technology for monitoring horse performance and rider efficiency present new growth avenues. High-end riders and training centers are increasingly adopting these solutions for competitive advantages, creating premium segments with higher profit margins.

Government and Policy Support

Government initiatives supporting equestrian sports, mounted police units, and rural tourism provide investment incentives for manufacturers. Programs like “Make in India” and industrial upgrades in China support local production, reduce dependency on imports, and encourage export-oriented manufacturing.

Product Type Insights

Saddles remain the leading product type, commanding approximately 40% of the 2024 market share. Their dominance is driven by versatility, ergonomic design, and adoption in both competitive and recreational equestrian activities. Western and dressage saddles are particularly preferred for professional riders due to their comfort and performance optimization. Harnesses continue to play a critical role in work, tourism, and leisure riding applications, while bridles, reins, and straps are experiencing steady growth among both recreational riders and competitive equestrian enthusiasts. The rising popularity of synthetic alternatives alongside traditional leather products is especially notable in emerging markets, where affordability, durability, and ease of maintenance are key purchasing factors. Technological advancements in design, lightweight materials, and customization options further reinforce the leading position of saddles in the global market.

Application Insights

Equestrian sports dominate the end-use segment, representing approximately 60% of total demand. Growth is propelled by dressage, show jumping, endurance, and competitive riding, where professional clubs and training facilities consistently invest in high-quality saddlery equipment. Leisure riding and tourism are emerging as high-growth applications in Asia-Pacific and Latin America, fueled by rising disposable incomes, recreational equestrian clubs, and adventure tourism initiatives. Agricultural and military applications maintain a steady presence, especially in regions relying on work animals for rural transport or mounted units. Tourism-driven riding, in particular, supports export demand from Europe and North America to emerging markets in APAC and LATAM, creating opportunities for both premium and mid-range product lines.

Distribution Channel Insights

Offline retail remains the largest channel, with a 65% share in 2024, due to customer trust, brand recognition, and hands-on product experience, especially in Europe and North America. Specialty equestrian stores, farm equipment outlets, and equestrian club retail points are primary distribution channels. However, online platforms are the fastest-growing channel, offering direct-to-consumer engagement, global reach, and detailed product comparison. E-commerce adoption is particularly strong in APAC and LATAM, where consumers increasingly leverage social media and online marketplaces to access both premium and affordable saddlery options, driving overall market expansion.

Traveler Type Insights

Professional riders and equestrian clubs constitute the largest consumer segment, consistently purchasing premium saddles, ergonomic harnesses, and performance-driven accessories. Recreational riders in tourism and leisure activities represent the fastest-growing segment globally, particularly in APAC and LATAM, driven by rising disposable incomes, urbanization, and increasing equestrian club memberships. Military and mounted police units form a niche but steady demand base, relying on durable and functional harnesses for operational purposes. The combination of professional demand and leisure-driven adoption ensures sustained market growth across multiple end-use segments.

Age Group Insights

Riders aged 31–50 years represent the largest market share, combining financial capacity with active engagement in both competitive and leisure riding. Younger riders (18–30 years) are driving growth for synthetic and cost-effective products, particularly in emerging markets where affordability and ease of maintenance are critical. Older riders (51+ years) remain a niche segment, preferring premium, ergonomic, and customizable saddlery, often emphasizing comfort, traditional leather quality, and long-term durability. Manufacturers are increasingly catering to multi-age segments through product diversification and customization options, which strengthens market resilience and adoption.

| By Product Type | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 35% of the 2024 market, led by the U.S. and Canada. Mature equestrian traditions, a high prevalence of professional riding clubs, and strong disposable income drive demand for premium saddles and customized harnesses. Growth is further supported by increased participation in leisure riding and equestrian tourism, as well as government-sponsored programs promoting competitive equestrian sports. Technological adoption, such as smart saddles and ergonomic designs, is also boosting product differentiation and driving market expansion in the region.

Europe

Europe holds around 30% of the global market, with Germany, the UK, and France as key contributors. Long-standing equestrian traditions, professional show-jumping and dressage cultures, and high adoption of advanced materials and ergonomic designs drive market growth. Premium and luxury saddlery dominate the region, fueled by consumer preference for durable leather products and innovative harnesses. Investments in equestrian clubs, tournaments, and competitive riding infrastructure further support demand, making Europe a stable and high-value market for harness saddlery equipment.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR of approximately 8%, led by China, India, and Australia. Rising middle-class wealth, growing urban equestrian clubs, and increased leisure riding tourism are the primary growth drivers. The proliferation of social media and e-commerce platforms accelerates market access, enabling consumers to purchase both mid-range synthetic and premium saddlery. Additionally, increasing interest in competitive equestrian sports and rural tourism initiatives in countries like India and China is driving the adoption of technologically advanced and cost-effective harness equipment.

Latin America

Brazil and Argentina represent the largest markets in Latin America, with increasing demand for leisure and adventure riding. Market growth is fueled by rising disposable incomes, adventure tourism trends, and the expansion of equestrian clubs. Outbound imports of premium leather and synthetic saddlery from Europe and North America are steadily increasing, driven by the need for high-quality and reliable products. Growth is also supported by domestic efforts to standardize equestrian training facilities and improve accessibility to recreational horse riding.

Middle East & Africa

MEA, led by the UAE and South Africa, shows growing demand for luxury and tourism-focused saddlery equipment. Africa remains a core production hub and a prominent equestrian tourism destination, while Middle Eastern demand is fueled by high-income consumers, luxury equestrian clubs, and competitive riding events. Infrastructure development for equestrian tourism, rising mounted police units, and investments in high-end horse-riding facilities further drive regional growth. The combination of tourism-led leisure riding and professional equestrian activities ensures a robust and expanding market presence in MEA.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Harness Saddlery Equipment Market

- Kerrits

- Pessoa

- Stubben

- Harry Hall

- Collegiate

- Thorowgood

- Passier

- Wintec

- Bates

- Hermès Sellier

- Schleese

- Kent & Masters

- Ovation

- Albion

- Prestige Italia