Haptic Suit Market Size

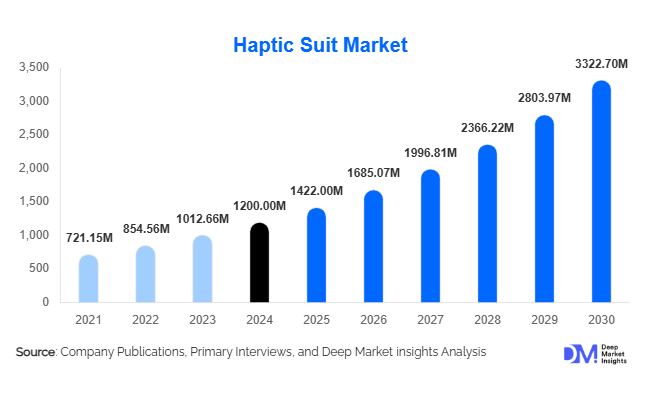

According to Deep Market Insights, the global haptic suit market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,422 million in 2025 to reach USD 3,322 million by 2030, expanding at a CAGR of 18.5% during the forecast period (2025–2030). The haptic suit market growth is primarily driven by increasing adoption of immersive technologies, rising demand for realistic VR and AR experiences, and expanding applications across gaming, healthcare, and military training sectors.

Key Market Insights

- Gaming and entertainment dominate the adoption of haptic suits, driven by the consumer demand for more immersive and interactive virtual experiences.

- Healthcare and rehabilitation applications are expanding rapidly, using haptic suits for surgical training, physical therapy, and patient recovery simulations.

- North America holds a significant share of the global haptic suit market due to technological innovation hubs and high adoption in the gaming and healthcare sectors.

- Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea, where gaming, education, and training simulations are driving demand for haptic technologies.

- Technological integration, including VR/AR systems, AI-powered simulations, and full-body haptic feedback, is enhancing market growth and user adoption.

- Military and defense training applications are emerging, providing risk-free immersive training solutions for soldiers and emergency responders.

Latest Market Trends

Integration of Haptics with VR/AR Applications

Haptic suits are increasingly integrated with virtual and augmented reality platforms, providing tactile feedback that enhances realism in immersive experiences. In gaming, users can feel impacts, textures, and environmental stimuli, making virtual worlds more engaging. Healthcare applications leverage haptic feedback for surgical simulations and patient rehabilitation, enabling realistic training without risk. Military and defense training increasingly employs haptic suits to simulate combat and emergency scenarios, improving readiness while reducing injury risks.

Wearable Technology and Comfort-Driven Innovation

Emerging trends in lightweight, flexible, and ergonomically designed haptic suits are enhancing user comfort and adoption. Developers are prioritizing battery efficiency, wireless connectivity, and modular designs to accommodate diverse applications. This trend attracts not only gamers but also professionals in healthcare, training, and industrial simulation markets. Advances in materials, sensors, and actuators allow full-body tactile feedback, contributing to a seamless and immersive user experience.

Haptic Suit Market Drivers

Rising Demand for Immersive Experiences

The surge in VR and AR adoption across gaming, education, and professional training is a key driver. Haptic suits enable users to feel virtual objects, textures, and environmental effects, enhancing the realism and engagement of simulations. This demand is growing rapidly among consumers seeking lifelike gaming experiences and industries leveraging virtual training for cost-effective and risk-free skill development.

Technological Advancements in Sensors and Actuators

Continuous improvements in haptic technology, including high-precision sensors, motion tracking, and tactile actuators, are increasing performance and affordability. Companies are investing heavily in R&D to enhance responsiveness, comfort, and compatibility with VR/AR systems, driving wider adoption in gaming, healthcare, and military applications.

Expansion in Healthcare and Rehabilitation

Haptic suits are increasingly applied in medical training, rehabilitation, and therapeutic interventions. They provide realistic simulations for surgical training and physical therapy, improving patient outcomes. Rising healthcare expenditures and demand for technology-driven rehabilitation solutions are accelerating market growth.

Market Restraints

High Cost of Advanced Haptic Suits

Premium haptic suits with full-body tactile feedback remain expensive due to high manufacturing costs and sophisticated technology components. This limits adoption, particularly in emerging markets, and restricts usage to high-end consumers or professional applications.

Integration Challenges with Existing VR/AR Platforms

Technical difficulties in ensuring compatibility, seamless software integration, and real-time response limit the widespread adoption of haptic suits. Users and developers must overcome these hurdles to achieve smooth experiences, posing a barrier to market growth.

Haptic Suit Market Opportunities

Expansion in Gaming and Entertainment Applications

The gaming industry remains the largest opportunity for haptic suits. Developers are incorporating tactile feedback in immersive VR titles, esports, and multiplayer experiences. Rising consumer demand for interactive gaming experiences and content creation in virtual worlds presents substantial growth potential. Haptic suits also facilitate realistic simulations in interactive theme parks and virtual arenas, expanding beyond conventional home gaming setups.

Healthcare and Rehabilitation Adoption

Hospitals, rehabilitation centers, and medical training institutions are increasingly adopting haptic suits for surgical simulations, patient therapy, and neurological rehabilitation. Integration with VR training platforms allows cost-effective, low-risk skill development for medical professionals, driving adoption in this high-value sector.

Product Type Insights

Full-body haptic suits dominate the market due to their ability to deliver immersive tactile feedback across the entire body. These suits are extensively used in VR gaming, military simulations, and healthcare training, where realism and multi-sensory engagement are critical. Segment growth is primarily driven by the demand for highly immersive experiences, with gamers, medical professionals, and defense personnel seeking realistic physical feedback to enhance performance and learning. Modular or partial haptic suits, such as gloves, vests, and foot modules, are also gaining traction for specialized applications. These offer lower-cost entry points and target specific interactions like hand movements, torso stimulation, or localized feedback, making them appealing for niche markets and cost-sensitive consumers.

Application Insights

Gaming and entertainment remain the largest application segment, fueled by the desire for immersive experiences. Here, enhanced tactile feedback allows gamers to feel impacts, textures, and environmental cues, significantly improving engagement. Healthcare and rehabilitation applications follow closely, driven by the therapeutic utility of haptic suits in physical therapy, patient rehabilitation, and surgical training, where simulating real-world sensations improves learning outcomes and recovery rates. Military and defense adoption continues to grow, as haptic suits enable realistic combat training without physical risk. Industrial training and simulation applications are emerging rapidly, with haptic suits creating safe environments to practice hazardous tasks, operate machinery, or learn complex procedures remotely, reducing risk and improving skill acquisition.

Distribution Channel Insights

Online direct-to-consumer (D2C) channels dominate the haptic suit market, allowing manufacturers to sell through official websites, VR accessory platforms, and e-commerce marketplaces. Specialist VR/AR retailers and professional solution providers continue to support institutional and B2B sales, particularly for healthcare, military, and industrial clients. Bundled hardware/software packages are becoming increasingly popular, offering integrated VR experiences that combine haptic suits with training or entertainment platforms, which enhances value for both individual and institutional buyers.

Age Group Insights

The 18–35 age group is the primary consumer for gaming and entertainment, leveraging immersive VR and haptic experiences. Professionals aged 25–50 dominate demand in healthcare, industrial, and military training applications, reflecting the need for precision, realistic simulations, and performance enhancement. Adoption among older users remains limited but is growing in therapeutic and rehabilitation contexts, driven by increasing awareness of technology-assisted recovery programs.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share of the global haptic suit market, accounting for approximately 38% of the 2024 market. Growth is driven by widespread VR and AR adoption, a strong gaming culture, and advanced healthcare infrastructure. The presence of leading technology companies and startups, combined with significant investments in R&D, defense simulations, and entertainment applications, further strengthens the market. North American consumers benefit from early access to innovative products, fueling demand for both full-body and modular haptic suits. Gaming and entertainment remain the leading segments, with enhanced immersion driving continuous adoption.

Europe

Europe accounts for around 28% of the global market, led by Germany, the U.K., and France. Regional growth is driven by the integration of haptic technology in automotive interfaces, medical training, and professional simulation environments. European manufacturers prioritize ergonomic and high-precision haptic suits, enhancing user comfort and feedback accuracy. In addition, growing healthcare adoption for rehabilitation and surgical simulations supports market expansion. The gaming and entertainment segment also contributes significantly, with an emphasis on high-quality tactile experiences that complement VR and AR content.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, Japan, South Korea, and Australia. Booming consumer electronics industries in these countries have accelerated the production and adoption of haptic-enabled devices, supporting growth in gaming, entertainment, industrial training, and education. Rising disposable incomes, increasing VR/AR penetration, and a strong gaming culture are major drivers. Industrial and educational applications of haptic technology, including remote skill training and professional simulations, are expanding rapidly, contributing to regional market leadership in innovation and adoption.

Latin America

Latin America is an emerging market, with key growth seen in Brazil, Mexico, and Argentina. Current adoption is primarily in gaming and training applications, but improving technology infrastructure and increasing interest in VR experiences are expected to accelerate growth. Local startups and VR-focused educational institutions are beginning to explore haptic integration, further supporting adoption in both consumer and professional segments.

Middle East & Africa

While smaller in market share, the Middle East and Africa are witnessing growth through niche applications in professional training, military simulations, and select gaming markets. Government-backed investments in technology hubs, VR innovation centers, and defense R&D initiatives support regional expansion. Adoption is being driven by high-income consumers, military institutions, and early adopters seeking immersive VR and AR experiences enhanced with haptic feedback.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Haptic Suit Market

- bHaptics Inc.

- Teslasuit

- HaptX

- SenseGlove

- Neosensory

- AxonVR

- Woojer

- Cybershoes

- VRgineers

- 3dRudder

- BeBop Sensors

- NeuroDigital Technologies

- HapticsVR

- Immersion Corporation

- VRgluv

Recent Developments

- In June 2025, Teslasuit launched a new lightweight, full-body haptic suit optimized for VR training and rehabilitation applications.

- In May 2025, bHaptics introduced the TactSuit X40, targeting high-end gaming and esports immersive experiences with enhanced tactile resolution.

- In March 2025, HaptX partnered with leading defense contractors to integrate haptic feedback into virtual military training simulations.