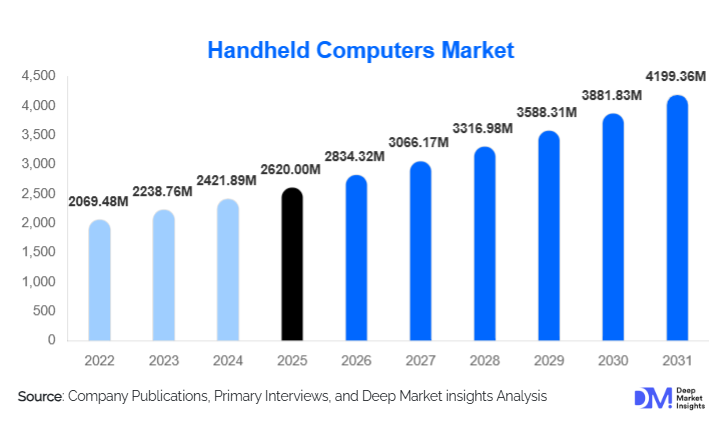

Handheld Computers Market Size

According to Deep Market Insights, the global handheld computers market size was valued at USD 2,620.00 million in 2025 and is projected to grow from USD 2,834.32 million in 2026 to reach USD 4,199.36 million by 2031, expanding at a CAGR of 8.18% during the forecast period (2026–2031). The market growth is primarily driven by rising enterprise mobility adoption, rapid expansion of e-commerce and logistics infrastructure, and increasing demand for rugged, secure, and real-time data capture devices across industrial and commercial environments.

Key Market Insights

- Rugged handheld computers dominate demand due to their durability, long lifecycle, and suitability for harsh industrial and outdoor environments.

- Android-based handheld computers lead the market, accounting for the majority of new deployments due to ease of integration and lower application development costs.

- Logistics and warehousing remain the largest end-use segment, supported by automation, omnichannel retail, and global trade growth.

- North America leads global demand, driven by warehouse automation, public safety digitization, and early technology adoption.

- Asia-Pacific is the fastest-growing regional market, supported by manufacturing expansion, e-commerce growth, and government-led digitalization initiatives.

- Integration of IoT, RFID, AI, and 5G is reshaping device capabilities and expanding use cases beyond traditional inventory management.

What are the latest trends in the handheld computers market?

Shift Toward Android and Software-Centric Ecosystems

The handheld computers market is witnessing a strong shift toward Android-based operating systems, replacing legacy proprietary and Windows platforms. Android’s open ecosystem allows enterprises to deploy custom applications quickly while reducing training and integration costs. Vendors are increasingly bundling hardware with device management software, security platforms, and analytics tools, transforming handheld computers into long-term enterprise mobility solutions rather than one-time hardware purchases.

Adoption of IoT-Enabled and 5G-Ready Devices

IoT-enabled handheld computers integrated with RFID, NFC, GPS, and real-time sensors are becoming standard across logistics, retail, and manufacturing environments. The gradual rollout of 5G connectivity is enabling faster data transmission, edge analytics, and real-time decision-making, particularly in large warehouses, ports, and smart factories. This trend is enhancing productivity while enabling advanced use cases such as predictive maintenance and real-time asset visibility.

What are the key drivers in the handheld computers market?

Growth in Logistics, Warehousing, and E-commerce

The global expansion of e-commerce and third-party logistics providers is a major growth driver for the handheld computers market. Warehouses and fulfillment centers rely heavily on handheld devices for inventory tracking, picking, packing, and shipping operations. Increasing demand for same-day delivery and real-time inventory visibility continues to accelerate large-scale device deployments.

Rising Demand for Rugged and Secure Enterprise Mobility

Enterprises are increasingly replacing consumer-grade smartphones with rugged handheld computers due to higher durability, better data security, and longer product lifecycles. These devices reduce downtime, lower total cost of ownership, and comply with enterprise security standards, making them critical for mission-critical operations in manufacturing, utilities, and public safety.

What are the restraints for the global market?

High Initial Device and Deployment Costs

Handheld computers involve higher upfront costs compared to consumer devices, which can limit adoption among small and medium-sized enterprises. Additional expenses related to software licensing, maintenance, and system integration further increase capital requirements, particularly in price-sensitive markets.

Rapid Technology Obsolescence

Frequent advancements in operating systems, connectivity standards, and hardware specifications can shorten replacement cycles. Enterprises face challenges in managing upgrades while maintaining compatibility with existing enterprise software systems.

What are the key opportunities in the handheld computers industry?

Government and Public Sector Digitalization

Governments worldwide are investing in digital public infrastructure, smart policing, border security, and emergency response systems. These initiatives create strong demand for secure, rugged handheld computers with GPS tracking, encrypted communication, and long-term support contracts, offering stable revenue opportunities for vendors.

Integration of AI and Advanced Analytics

The integration of AI-based image recognition, voice-assisted workflows, and predictive analytics into handheld computers is opening new high-margin opportunities. Vendors offering intelligent, data-driven mobility solutions are well-positioned to differentiate themselves and capture recurring software and services revenue.

Product Type Insights

Rugged handheld computers account for approximately 42% of the global market in 2024, making them the leading product type globally. Their dominance is driven by extensive adoption in logistics, manufacturing, field services, and public safety, where devices must withstand harsh conditions, drops, dust, and extreme temperatures. Enterprise non-rugged handheld computers, meanwhile, are increasingly deployed in retail, healthcare, and administrative environments where moderate durability is sufficient, but ease of use and software flexibility are critical. Wearable handheld computers, including ring scanners and wrist-mounted devices, are gaining traction in high-throughput warehouses and e-commerce fulfillment centers due to their hands-free operational benefits, which boost worker productivity and efficiency. The demand for rugged and wearable devices is further accelerated by growing automation initiatives, real-time inventory tracking needs, and the increasing pressure on businesses to minimize operational errors.

Operating System Insights

Android-based handheld computers dominate the market with an estimated 68% share in 2024. The wide adoption of Android is supported by its strong developer ecosystem, ease of integration with enterprise resource planning (ERP) and warehouse management systems (WMS), and cost-effectiveness for large-scale deployments. Windows-based devices continue to serve legacy industrial applications, while Linux and proprietary operating systems cater to specialized environments requiring customized control, security, or compliance features. The growth of Android-based devices is driven by the increasing demand for flexible, app-driven solutions that can support both enterprise mobility management and emerging IoT integrations, making it the platform of choice for large-scale enterprise adoption.

End-Use Industry Insights

Logistics and warehousing represent the largest end-use segment, contributing nearly 29% of total market revenue in 2024. The segment is expanding due to the global surge in e-commerce, omnichannel retail fulfillment, and the need for accurate, real-time inventory management. Retail adoption is also accelerating, fueled by rising consumer expectations for faster delivery and efficient stock management. Manufacturing, healthcare, and utilities are emerging as high-growth segments, driven by Industry 4.0 initiatives, predictive maintenance, and digital asset tracking. The growth in these segments is primarily propelled by the need for enterprise-grade mobility solutions that enhance operational efficiency, reduce errors, and provide actionable data insights for decision-making across supply chains and field operations.

Connectivity Insights

IoT-enabled handheld computers account for approximately 47% of global shipments in 2024, reflecting the growing need for devices that support RFID, NFC, GPS, and sensor-based tracking for real-time operational visibility. Wi-Fi plus cellular (4G/5G) devices are also increasingly adopted for remote operations, field service management, and cloud-connected enterprise workflows. The trend toward connectivity-enabled devices is fueled by the rising demand for predictive analytics, digital twin technologies, and integrated enterprise mobility platforms, allowing organizations to improve productivity, asset utilization, and operational decision-making.

| By Product Type | By Operating System | By End-Use Industry | By Connectivity |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global handheld computers market in 2024, led primarily by the United States. The region’s dominance is supported by advanced logistics networks, widespread warehouse automation, and early adoption of rugged enterprise mobility solutions in retail and public safety. Drivers for regional growth include government and enterprise investments in smart infrastructure, public safety digitization programs, and the integration of IoT-enabled devices in field operations. Strong technology adoption culture, coupled with demand for real-time data analytics and high operational efficiency, continues to propel handheld computer penetration across manufacturing, healthcare, and logistics sectors.

Europe

Europe accounts for around 22% of global demand, with Germany, the U.K., and France leading the market. Industrial automation, smart manufacturing adoption, and strict regulatory compliance are key growth drivers. European enterprises are increasingly deploying rugged and IoT-enabled handheld computers to enhance operational efficiency, monitor supply chain performance, and comply with safety and data security standards. The growth is also supported by government initiatives to digitize logistics and public services, particularly in urban centers, and the rising adoption of AI and edge analytics for manufacturing and warehouse management.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region, expanding at a CAGR of approximately 11.8%. Major demand centers include China, India, and Japan, driven by rapid industrialization, manufacturing expansion, and growing e-commerce infrastructure. Regional growth is fueled by government-led digitization initiatives, such as smart logistics programs and Industry 4.0 adoption, which encourage enterprises to invest in rugged and IoT-enabled handheld devices. Additionally, rising labor costs are encouraging automation, further boosting the need for wearable and productivity-enhancing handheld devices in warehouses and manufacturing units.

Latin America

Latin America contributes about 7% of global demand, with Brazil and Mexico leading adoption in retail, logistics, and warehouse modernization initiatives. Drivers for regional growth include the rise of e-commerce, the need to optimize supply chains, and increasing investment in enterprise mobility solutions by large retailers and logistics providers. Governments are also incentivizing digital infrastructure development, supporting broader adoption of connected devices and real-time inventory tracking systems across the region.

Middle East & Africa

The Middle East & Africa region holds nearly 8% market share, supported by investments in oil & gas, utilities, defense, and public infrastructure digitization. Drivers include large-scale enterprise and government projects, such as smart city initiatives, energy sector automation, and public safety modernization, which require rugged and IoT-enabled handheld computers. High-value applications in logistics, field service management, and energy monitoring are further accelerating device adoption. Additionally, the region benefits from emerging intra-regional trade and modernization of industrial operations, creating opportunities for new deployments in both urban and remote areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Handheld Computers Market

- Zebra Technologies

- Honeywell International

- Datalogic

- Panasonic Corporation

- Keyence Corporation

- Advantech

- Bluebird Group

- CipherLab

- Unitech Electronics

- Casio Computer