Hand Sanitizer Dispenser Market Size

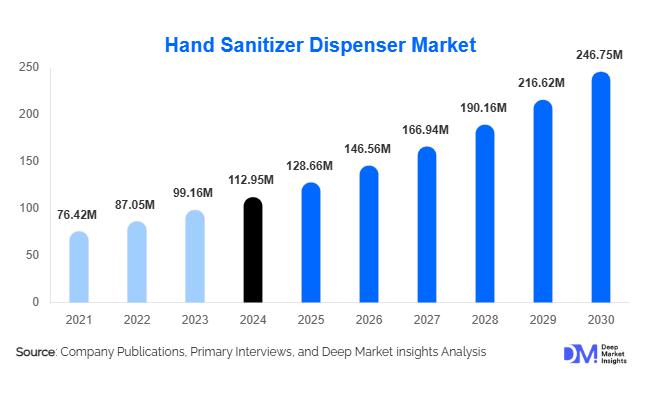

According to Deep Market Insights, the global hand sanitizer dispenser market size was valued at USD 112.95 million in 2024 and is projected to grow from USD 128.66 million in 2025 to reach USD 246.75 million by 2030, expanding at a CAGR of 13.91% during the forecast period (2025–2030). The market growth is primarily driven by increasing public hygiene awareness, stringent government regulations on sanitation in public and commercial spaces, and the rising adoption of automatic and touchless dispensers across healthcare, commercial, and educational facilities globally.

Key Market Insights

- Automatic and touchless dispensers dominate the market, particularly in healthcare and commercial sectors, due to their hygiene benefits and compliance with infection control protocols.

- North America leads the global market, supported by stringent sanitation standards and high adoption of smart dispenser technologies in hospitals and offices.

- Europe is the fastest-growing region, driven by increasing demand for eco-friendly, refillable dispensers and strict environmental regulations.

- Asia-Pacific is emerging as a high-growth market, led by rising urbanization, healthcare investments, and public awareness campaigns in India, China, and Southeast Asia.

- Technological adoption, including IoT-enabled dispensers and sensor-based automation, is reshaping market preferences and creating opportunities for premium and connected devices.

- E-commerce and online channels are becoming critical distribution points, especially for residential and small-business purchases.

What are the latest trends in the hand sanitizer dispenser market?

Shift Toward Automatic and Touchless Dispensers

The demand for touchless dispensers has surged due to growing hygiene awareness and infection prevention concerns. Hospitals, corporate offices, and educational institutions are increasingly adopting sensor-based dispensers to reduce cross-contamination. Automatic dispensers, often integrated with refill monitoring and IoT features, are becoming standard in premium installations. This trend is reshaping procurement priorities and driving the adoption of higher-margin, technologically advanced dispensers.

Sustainable and Eco-Friendly Solutions

Eco-conscious designs are gaining traction globally. Refillable dispensers made from recycled plastics or stainless steel are preferred in Europe and North America. Regulatory support for sustainable products, combined with growing consumer awareness, is driving investments in environmentally friendly dispensers. Manufacturers are innovating to reduce single-use plastic waste and incorporate biodegradable materials while maintaining durability and hygiene compliance.

What are the key drivers in the hand sanitizer dispenser market?

Rising Hygiene Awareness Post-Pandemic

The COVID-19 pandemic permanently increased awareness of hand hygiene, leading to sustained demand for dispensers in healthcare, offices, schools, and public spaces. Contactless dispensers are particularly favored for reducing cross-contamination and complying with institutional hygiene standards. Continuous adoption in both commercial and residential sectors is expected to maintain steady market growth.

Government Regulations and Public Health Initiatives

Governments worldwide have mandated hygiene standards across hospitals, schools, and public spaces. Compliance with certifications and hygiene audits drives institutional demand for dispensers. Public infrastructure investments, including in airports, transit hubs, and government buildings, are supporting large-scale adoption of automatic and wall-mounted dispensers.

Technological Advancements

Integration of sensors, IoT monitoring, and refill tracking systems enhances user convenience, improves efficiency, and reduces operational costs. These features appeal to commercial and healthcare buyers willing to invest in premium solutions. Smart dispensers enable real-time monitoring of sanitizer usage, optimizing maintenance schedules and providing actionable insights for facility managers.

What are the restraints for the global market?

High Initial Investment for Advanced Dispensers

Automatic and sensor-based dispensers require higher upfront costs, including installation and maintenance, limiting adoption among small businesses and residential users. Cost-sensitive buyers often opt for manual dispensers, which restricts market penetration for premium solutions.

Raw Material Price Volatility

Fluctuations in the cost of plastics, stainless steel, and electronic components affect manufacturing expenses and product pricing. Supply chain disruptions can also lead to delays, impacting delivery timelines and reducing adoption in price-sensitive markets.

What are the key opportunities in the hand sanitizer dispenser industry?

Integration of IoT and Smart Technologies

IoT-enabled dispensers with usage tracking, remote monitoring, and automated refill alerts are gaining popularity in hospitals, offices, and large institutions. This presents opportunities for manufacturers to introduce premium, high-margin products that provide data-driven solutions for hygiene compliance.

Expansion in Emerging Economies

Rapid urbanization, rising disposable income, and government hygiene campaigns in India, China, Brazil, and Southeast Asia are creating new markets. Cost-effective, reliable dispensers are in demand for schools, hospitals, and public facilities. Market entrants can leverage local partnerships to expand reach in these emerging regions.

Sustainability and Eco-Friendly Designs

Demand for refillable and biodegradable dispensers is increasing, particularly in Europe and North America. Eco-conscious consumers and institutional buyers are preferring dispensers made from recycled materials or corrosion-resistant metals. This trend allows manufacturers to introduce differentiated, premium products while contributing to environmental sustainability.

Product Type Insights

Automatic/touchless dispensers dominate the market, particularly in healthcare and commercial sectors, accounting for approximately 42% of the global market in 2024. Manual dispensers remain popular in residential and budget-conscious segments, while portable and countertop dispensers are increasingly used in offices, hotels, and smaller establishments. Gel dispensers hold 45% market share, being preferred for ease of application and compatibility with automatic dispensers. Plastic dispensers lead the material segment at 55% share due to cost-effectiveness, while stainless steel units are gaining traction in premium installations.

Application Insights

Healthcare and hospitals are the largest end-use segment, accounting for 38% of the global market in 2024. Commercial offices, educational institutions, and hospitality sectors are witnessing rapid adoption. Emerging applications include public transport hubs, airports, and government buildings, driven by regulatory requirements. Residential demand is also growing via e-commerce channels, reflecting rising hygiene awareness among households. Export-driven demand is strong in Europe and North America, with APAC acting as a manufacturing hub.

Distribution Channel Insights

E-commerce platforms dominate sales, particularly for residential and small-business purchases. Direct institutional sales and OEM partnerships remain significant for hospitals, corporate offices, and educational institutions. Retail channels, including pharmacies and supermarkets, cater primarily to manual dispensers and refill packs. Increasing digital presence of manufacturers and direct-to-consumer models is driving adoption globally.

| By Type | By Mechanism | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market in 2024, led by the U.S. and Canada. High regulatory standards in hospitals, offices, and public spaces, along with early adoption of smart dispensers, drive market growth. Demand is shaped by healthcare facility upgrades and government-led hygiene campaigns.

Europe

Europe holds around 28% of the 2024 market, led by Germany, the UK, and France. Strong preference for eco-friendly and sustainable dispensers, combined with stringent environmental and sanitation regulations, drives growth. The region is also witnessing increased adoption of IoT-enabled dispensers in commercial and healthcare sectors.

Asia-Pacific

APAC is the fastest-growing region, led by India, China, and Southeast Asia. Urbanization, rising public hygiene awareness, and investments in hospitals and schools are driving growth. Governments are promoting sanitation initiatives, further supporting adoption in both commercial and institutional segments.

Latin America

Brazil, Mexico, and Argentina are emerging markets, with demand primarily from hospitals and corporate offices. Adoption remains moderate but is growing due to public health campaigns and increasing awareness of infection control.

Middle East & Africa

Demand is moderate in the Middle East, led by the UAE and Saudi Arabia, driven by high-income populations and modern infrastructure. Africa’s demand is primarily from urban centers and hospitals, with emerging interest in commercial facilities and schools.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hand Sanitizer Dispenser Market

- GOJO Industries

- Kimberly-Clark

- Essity AB

- Purell

- Deb Group

- Rubbermaid Commercial Products

- Medline Industries

- 3M

- Lion Corporation

- Cintas Corporation

- SC Johnson Professional

- SATO

- P&G Professional

- Handsantizer.com

- Virox Technologies

Recent Developments

- In March 2025, GOJO Industries launched a new IoT-enabled automatic dispenser line, providing real-time refill monitoring and usage analytics for healthcare facilities.

- In January 2025, Kimberly-Clark introduced sustainable, refillable dispensers across Europe, made from recycled plastics and stainless steel, to meet rising eco-conscious demand.

- In February 2025, Essity AB expanded its distribution network in APAC, focusing on hospitals and schools, to capitalize on rising hygiene awareness and government initiatives.