Hairline Powder Market Size

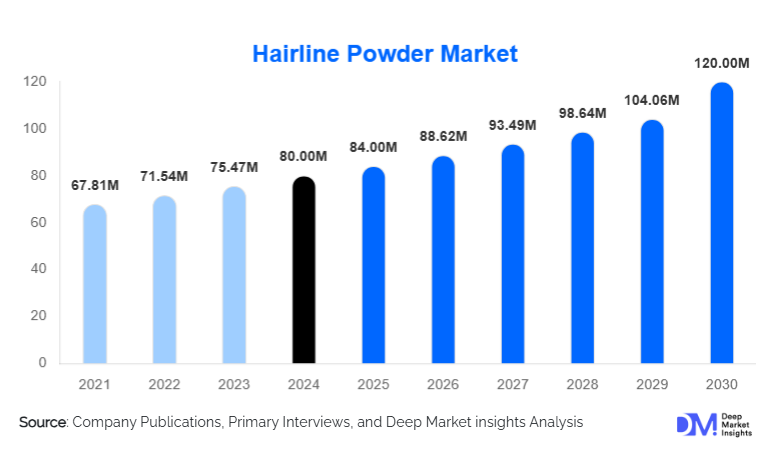

According to Deep Market Insights, the global hairline powder market size was valued at USD 80 million in 2024 and is projected to grow from USD 84 million in 2025 to reach USD 120 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by rising aesthetic and grooming awareness, increasing demand for non-invasive cosmetic solutions, and rapid adoption of online and e-commerce retail channels.

Key Market Insights

- Non-invasive cosmetic solutions are fueling adoption, as hairline powders offer immediate visual improvement without surgical intervention.

- Asia-Pacific dominates the market, led by China, India, South Korea, and Southeast Asia, driven by increasing disposable income and beauty awareness.

- Online sales channels are rapidly expanding, providing consumers with access to diverse product ranges, virtual shade matching, and subscription models.

- The male grooming segment is emerging as a growth driver, with rising acceptance of cosmetic solutions for hairline correction.

- Product innovation, including improved pigment adherence, long-wear formulations, and natural/organic ingredients, is enhancing market competitiveness.

- Social media and influencer marketing are shaping consumer preferences and accelerating adoption across regions.

What are the latest trends in the hairline powder market?

Advanced Formulations and Natural Ingredients

Manufacturers are focusing on creating powders with superior adhesion, longer wear, non-transfer properties, and realistic color blending. There is a notable trend toward natural and organic ingredients, catering to the growing consumer preference for clean beauty products. Shades are being customized for diverse hair types and ethnicities, enabling wider adoption in multi-ethnic markets. Products also increasingly offer semi-permanent or long-lasting cosmetic effects without compromising safety.

Digital and E-Commerce Integration

Brands are leveraging online channels for global reach, virtual shade-matching tools, and DTC subscription models. Social media influencers and tutorials educate consumers on application techniques, enhancing brand trust and adoption. E-commerce platforms enable price transparency, easy comparison, and faster replenishment, driving repeat purchases and brand loyalty.

What are the key drivers in the hairline powder market?

Rising Aesthetic and Grooming Awareness

Global consumers are increasingly conscious of personal appearance, hairline aesthetics, and scalp health. Social media platforms and beauty influencers have amplified the focus on hairline coverage, creating strong demand for quick cosmetic solutions. Men and women of all age groups are now more open to using cosmetic powders for hairline enhancement, driving market growth.

Non-Invasive Cosmetic Alternatives

Hairline powders offer an immediate, safe, and cost-effective alternative to surgical hair restoration or prescription treatments. The convenience of daily application without long-term commitment appeals to a wide demographic, making it a preferred choice for moderate thinning or hairline coverage. This factor significantly contributes to steady adoption across consumer segments.

Growth of Online and Social Media Channels

The rise of e-commerce platforms and influencer marketing has greatly improved product accessibility. Brands can showcase tutorials, application guides, and shade-matching tools to educate consumers, expanding market reach. Subscription-based offerings and digital promotions further stimulate demand, especially among tech-savvy younger consumers.

What are the restraints for the global market?

Efficacy Limitations

Hairline powders may not provide convincing results for severe hair loss or very sparse hair. Issues such as color mismatch, transfer to clothing or hats, reduced adherence in humid or sweaty conditions, and visibility under certain lighting conditions can affect consumer satisfaction, restraining broader adoption.

Regulatory and Safety Concerns

Strict cosmetic regulations across regions demand compliance with ingredient safety, labeling, and microbial standards. Non-compliant or low-quality products can deter consumer trust. Additionally, perceptions of messiness or unnatural appearance, if not addressed by formulation or marketing, may limit market penetration.

What are the key opportunities in the hairline powder market?

Expansion in Asia-Pacific and Emerging Markets

Asia-Pacific represents the largest and fastest-growing market due to rising disposable incomes, growing awareness of personal grooming, and expanding e-commerce penetration. Countries such as China, India, South Korea, and Southeast Asia offer significant untapped potential for both domestic and export-driven brands.

Product Innovation and Personalization

New formulations with improved pigment adherence, water and sweat resistance, longer wear, and natural ingredients can create differentiation. Personalized products, virtual shade-matching tools, refill packs, and subscription-based offerings are emerging opportunities for companies to increase customer engagement and lifetime value.

Male Grooming Segment Growth

Increasing acceptance of male grooming and cosmetic use presents a strong opportunity. Tailored marketing, shade ranges, applicator design, and influencer campaigns targeting male consumers are expected to contribute significantly to market expansion.

Product Type Insights

Temporary hairline powders dominate the market, accounting for nearly 65% of global revenue in 2024, due to ease of use, affordability, and minimal commitment. Semi-permanent and permanent variants are emerging in the premium segment, catering to consumers seeking longer-lasting results. Shade customization and applicator innovation are key differentiators driving consumer preference within each product type.

Application Insights

Covering bald spots is the leading application segment, accounting for approximately 50% of global market revenue in 2024. Consumers primarily purchase products to achieve immediate visual improvement of thinning areas or visible scalp patches. Hairline recession correction and hair thickening applications are growing steadily, particularly among younger and middle-aged demographics seeking subtle enhancement.

Distribution Channel Insights

Offline channels, including salons, specialty stores, pharmacies, and retail outlets, hold approximately 65% of the market share in 2024, reflecting the importance of trial and shade-matching services. Online channels, however, are the fastest-growing segment, offering convenience, wider shade selection, subscription services, and influencer-led marketing. E-commerce penetration is particularly strong in Asia-Pacific and North America.

End-User Insights

Female consumers account for roughly 60% of the global market in 2024, although male grooming is rapidly emerging. Daily cosmetic users represent the largest end-use segment, while professional stylists and salons contribute to a smaller but growing share. Export-driven demand is particularly notable in Latin America, the Middle East, and Africa, where imported powders cater to urban populations with higher disposable incomes and aesthetic awareness.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 20% of the global market, with the U.S. leading demand due to high disposable income, awareness of aesthetic grooming, and strong online penetration. Canadian consumers are increasingly adopting male grooming and cosmetic solutions, driving incremental growth.

Europe

Europe represents about 25% of the market in 2024. Key countries include the U.K., Germany, and France, where regulatory standards are high and consumers prioritize natural ingredients and safety. Demand is steady, with growth driven by premium product adoption and cosmetic innovation.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, with a 2024 share of approximately 32–35%. China, India, South Korea, and Southeast Asia drive demand due to rising disposable incomes, urbanization, and social media influence. The region shows a strong preference for dark shades, temporary powders, and online retail models.

Latin America

Brazil, Argentina, and Mexico are emerging markets for hairline powders, with growing interest in aesthetic grooming and e-commerce adoption. Outbound imports dominate due to limited local production, focusing on affordable and mid-range products.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is an emerging market driven by high-income consumers and luxury product adoption. Africa, the production hub for some cosmetic ingredients, also sees growing domestic demand in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hairline Powder Market

- Mamonde

- The Face Shop

- Boldify

- Maycheer

- Sevich

- Bunee

- Goiple

- Root Touch Up

- Melange Boutique

- Icycheer

- HairMax

- Style My Hair

- LuxHair Cosmetics

- ScalpPerfect

- HairLine Pro

Recent Developments

- In March 2025, Mamonde launched a new semi-permanent hairline powder line in South Korea with improved adhesion and sweat resistance, targeting male consumers.

- In January 2025, Boldify expanded distribution across India and Southeast Asia, introducing virtual shade-matching tools for e-commerce customers.

- In February 2025, Sevich partnered with social media influencers in North America to promote a new organic hairline powder formulation emphasizing natural ingredients and clean beauty standards.