Hair Weave Market Size

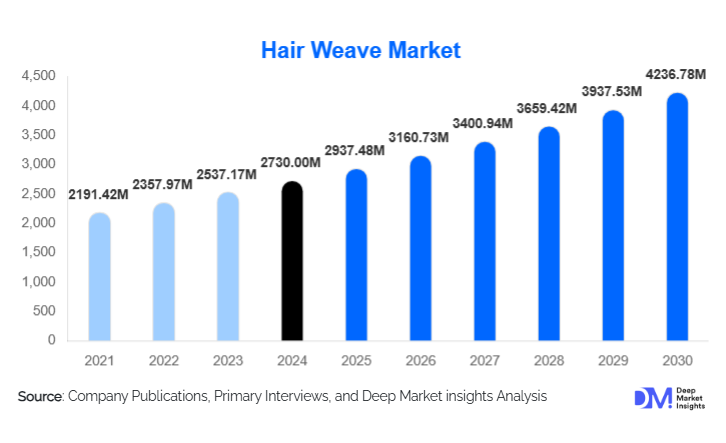

According to Deep Market Insights, the global hair weave market size was valued at USD 2,730.00 million in 2024 and is projected to grow from USD 2,937.48 million in 2025 to reach USD 4,236.78 million by 2030, expanding at a CAGR of 7.6% during the forecast period (2025–2030). Market expansion is driven by rising global beauty consciousness, surging demand for non-surgical hair enhancement solutions, increased consumption of premium human-hair weaves, and rapid growth of e-commerce channels that have made high-quality weaves accessible worldwide.

Key Market Insights

- Human-hair weaves dominate the market, accounting for nearly 70–75% of global revenue due to their natural look, durability, and styling versatility.

- North America leads the market with the largest revenue share in 2024, supported by high consumer spending on beauty and strong salon-driven demand.

- Asia-Pacific is the fastest-growing region, propelled by rising disposable incomes, growing online retail, and expanding fashion and grooming adoption among younger consumers.

- E-commerce-led distribution channels are reshaping purchase behavior, with direct-to-consumer brands gaining share through customization, convenience, and digital marketing.

- Medical and therapeutic hair-loss applications are emerging as strong demand drivers, expanding the consumer base beyond fashion-focused buyers.

- Ethical sourcing and supply-chain transparency are becoming competitive differentiators, especially for premium human-hair manufacturers.

What are the latest trends in the hair weave market?

Premium Human-Hair and Ethical Sourcing Gaining Momentum

The premiumization trend is reshaping consumer preferences, with buyers increasingly seeking natural-looking, ethically sourced virgin and Remy human-hair weaves. Demand is rising for traceable supply chains, certified ethical sourcing, and temple-donated or voluntarily contributed hair collected through transparent channels. Brands are adopting advanced processing techniques to preserve hair cuticles and quality while emphasizing fair-trade sourcing. As consumers become more conscious about authenticity and ethical standards, companies offering verified origin, better sustainability practices, and quality assurance are gaining a competitive edge in the premium weave segment.

Technology-Driven Customization and E-Commerce Expansion

The rapid adoption of digital tools, such as AI-powered color matching, AR-based virtual try-ons, and personalized ordering platforms, is transforming the consumer buying journey. Online channels are particularly influential among Gen Z and millennial users who prefer browsing styles, textures, and lengths online before purchasing. With enhanced video consultations and VR previews for hairstyle customization, brands are offering end-to-end digital experiences. Subscription-based models for maintenance products, home-installation kits, and automated re-ordering of frequently used weave types are turning hair weaves into recurring revenue streams for online-first companies.

What are the key drivers in the hair weave market?

Growing Incidence of Hair Loss and Medical Need

The increasing global prevalence of hair loss, stemming from alopecia, chemotherapy treatments, hormonal imbalances, postpartum hair thinning, and stress-driven shedding, is expanding the medical-use consumer base for hair weaves. Since human-hair weaves offer natural aesthetics and non-surgical volume enhancement, medical professionals and dermatologists are increasingly recommending them as temporary or long-term solutions. This shift has created a surge in demand for medical-grade, hypoallergenic, and lightweight weave options tailored for sensitive scalps.

Rising Beauty Consciousness and Celebrity/Social Media Influence

The global beauty landscape continues to evolve as influencers, celebrities, and digital content creators normalize diverse hairstyles and frequent style transitions. Social platforms like Instagram, TikTok, and YouTube have amplified the popularity of transformations using sew-ins, clip-ins, and quick weaves. Constant exposure to hairstyle trends encourages repeat purchases and experimentation, particularly among women aged 18–45, who represent the core consumer base. The desire for instant volume, length, and color without chemically processing natural hair is further propelling market growth.

E-Commerce Penetration and Improved Supply Chains

Advancements in hair sourcing, processing, and logistics have created more reliable supply chains for human-hair and premium synthetic weaves. Cross-border e-commerce enables manufacturers from Asia, Europe, and the U.S. to reach global customers efficiently. The increasing availability of fast shipping, flexible return policies, and wide product assortments on online marketplaces is accelerating adoption. Meanwhile, direct-to-consumer brands offer customized textures, colors, and bundles, strengthening consumer trust and loyalty.

What are the restraints for the global market?

Ethical and Regulatory Concerns in Human-Hair Sourcing

The human-hair supply chain is complex and often unregulated, with concerns involving unethical collection practices, non-transparent procurement, and exploitation in certain regions. As global scrutiny increases, brands face pressure to certify sourcing, ensure fair compensation for hair donors, and adopt traceability systems. Failure to meet ethical standards can lead to reputational risks and reduce consumer trust, especially among premium buyers.

Price Sensitivity and Competition from Synthetic Alternatives

Human-hair weaves, especially Remy and virgin varieties, command premium prices that many cost-conscious consumers cannot afford. This makes synthetic weaves an attractive alternative despite their lower durability. Fluctuations in human-hair availability, rising processing costs, and global supply-chain disruptions can further elevate retail prices, limiting market penetration in developing economies. Synthetic hair improvements are increasing competitive pressure on human-hair suppliers, constraining market margins.

What are the key opportunities in the hair weave industry?

Medical-Grade Weaves and Therapeutic Hair Solutions

With growing awareness of non-surgical hair-replacement solutions, the medical segment offers substantial growth potential. Customized medical-grade weaves designed for scalp sensitivity, breathable materials, and natural aesthetics can target individuals managing chemotherapy, alopecia, and androgenetic hair loss. Partnerships between dermatologists, oncology clinics, and weave manufacturers can accelerate market penetration. This segment is poised to become a major revenue contributor over the next decade.

Expansion into Emerging Markets and Cultural Styling Demand

Asia-Pacific, Africa, and Latin America present vast opportunities for growth due to rising disposable incomes, larger young populations, and deep cultural acceptance of weave-based hairstyles. Consumer spending on beauty is rising rapidly in India, Nigeria, Brazil, China, and South Africa, creating demand for both value synthetic weaves and mid-range human-hair products. Localization of marketing, region-specific textures, and culturally tailored weave offerings can unlock high-volume demand across these markets.

Product Type Insights

Hair weaves/extensions remain the dominant product type, accounting for nearly 60–65% of the global hair weave market in 2024. Their popularity stems from versatility, availability across price tiers, and suitability for both temporary and long-term styling. Human-hair weaves lead the value segment due to superior aesthetics and longevity, while premium synthetic blends are gaining traction as quality improves. Consumers increasingly prefer semi-permanent sew-ins and micro-link weaves for durability, though clip-ins are popular for flexible, short-term use. Product innovation, including lightweight wefts, seamless blends, and heat-friendly synthetic fibers, is strengthening consumer adoption globally.

Application Insights

Individual consumer use dominates the market, representing nearly 65–70% of total demand in 2024. Daily grooming, fashion versatility, and social-media-inspired trends are fueling adoption. Medical and therapeutic applications are the fastest-growing subsegment, driven by aging populations and rising incidences of hair-loss disorders. Entertainment and media industries continue to generate specialized demand for high-end, natural-looking human-hair extensions used in films, television, and modeling. Cultural and protective styling applications also remain strong among ethnic groups prioritizing natural hair health.

Distribution Channel Insights

Online retail channels hold a rapidly expanding share of global sales, with 30–40% of weave purchases occurring via e-commerce. Consumers favor online platforms for broader selection, transparent pricing, and customization options. Direct-to-consumer brands are thriving with personalized bundles, virtual consultations, and subscription-based reorder programs. Offline beauty supply stores and salons remain crucial for premium installations and professional guidance, while hybrid models combining online booking with salon-based installation services are creating new growth pathways.

End-User Insights

Individual consumers represent the largest and most influential end-user group, particularly women aged 18–45 seeking fashion-forward, protective, or convenience-driven hairstyles. Medical-use end users are rapidly increasing due to a rise in hair-loss disorders and higher awareness of non-surgical solutions. The entertainment/media category, spanning actors, models, influencers, and stage performers, remains a premium, high-spend segment driving demand for top-tier human-hair products. Emerging applications include specialized weaves for bridal styling, long-term protective wear, and cultural heritage-focused styling.

| By Product Type | By Hair Material | By Price Tier | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 30–35% share in 2024, driven by high beauty expenditure, strong salon culture, and established demand among African American consumers. The United States dominates regional sales due to advanced distribution networks, celebrity-driven trends, and rising acceptance of protective hairstyles. Demand for premium human-hair weaves remains particularly strong across urban centers.

Europe

Europe accounts for 15–20% of the market, with strong adoption in the U.K., France, and Germany. Growing interest in hair-enhancement solutions for both fashion and hair-loss treatment supports steady demand. Western Europe leads in premium purchases, while Eastern Europe shows expanding demand through e-commerce channels. Increasing multicultural populations and rising aesthetic grooming trends contribute to market stability.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 25–30% of global demand in 2024. India and China serve as both major manufacturers and increasingly significant consumer markets. Rising disposable incomes, fashion influence from K-beauty and J-beauty trends, and the growth of online retail platforms are accelerating adoption. Southeast Asian countries such as Indonesia, Malaysia, and the Philippines are emerging as lucrative mid-range markets.

Latin America

Latin America contributes 5–8% of global revenue, with Brazil, Mexico, and Argentina leading consumption. Local demand is shaped by the region’s strong beauty culture and increasing access to imported premium weaves. Economic improvements and expanding e-commerce availability are expected to support long-term growth.

Middle East & Africa

MEA holds 5–10% of the market but is expanding quickly, especially in South Africa, Nigeria, Kenya, and the UAE. African nations exhibit deep cultural integration of weave-based hairstyles, supporting high-volume demand. The Middle East, particularly the UAE and Saudi Arabia, contributes premium sales driven by affluent consumers and advanced retail infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Weave Market

- Evergreen Products Group Limited

- Artnature Inc.

- Aderans Co., Ltd.

- Indique Hair

- Donna Bella Hair

- Klix Hair Extensions

- Shake-N-Go, Inc.

- Great Lengths Universal Hair Extensions

- F.N. Longlocks

- Godrej Consumer Products Limited

- Luxy Hair

- Bellami Hair

- Raq Natural Hair

- Xuchang Longsheng

- Premium Lace Wigs

Recent Developments

- In March 2024, Evergreen Products Group announced expansions in its human-hair processing facilities to enhance ethical sourcing and traceability.

- In January 2025, Indique Hair launched an AI-driven virtual try-on platform for customized weave texture and length selection.

- In October 2024, Bellami Hair introduced a new line of eco-friendly synthetic fiber extensions designed to mimic human-hair quality with lower environmental impact.