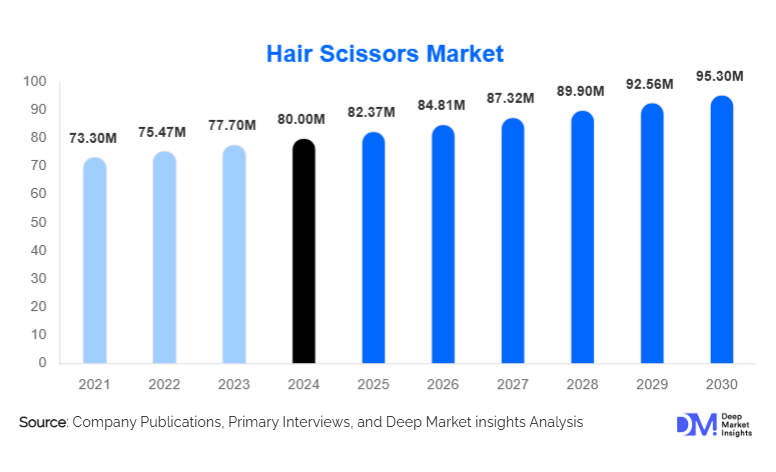

Hair Scissors Market Size

According to Deep Market Insights, the global hair scissors market size was valued at USD 80.00 million in 2024 and is projected to grow from USD 82.37 million in 2025 to reach USD 95.30 million by 2030, expanding at a CAGR of 2.96% during the forecast period (2025–2030). Growth in the market is primarily driven by the rising professionalization of salon services, increasing consumer spending on grooming, and strong demand for ergonomically advanced, premium-grade hair-cutting tools. The shift toward specialty steels, Japanese forging craftsmanship, and high-precision blade technologies is reshaping the competitive landscape. Additionally, expanding salon networks in the Asia-Pacific and the rapid adoption of online retail channels are accelerating global sales, making the market increasingly dynamic and innovation-driven.

Key Market Insights

- Premium and professional-grade scissors dominate revenue share, driven by strong adoption among stylists, barbers, and high-end salons.

- E-commerce and D2C channels are rapidly expanding, enabling global accessibility and lowering entry barriers for new brands.

- Asia-Pacific leads the global market in both consumption and growth rate, fueled by booming salon ecosystems and rising disposable incomes.

- Japan and Germany remain global hubs for premium scissor manufacturing, known for superior metallurgy, edge retention, and craftsmanship.

- Ergonomics and blade innovation, including convex edges, titanium coatings, and offset handles, are key differentiators affecting purchasing decisions.

- Counterfeit and low-cost imports present a challenge, increasing the need for authenticated retail channels and brand protection measures.

What are the latest trends in the hair scissors market?

Premiumization and Craftsmanship-Led Differentiation

A significant trend shaping the market is the rise of premiumization, where stylists and barbers increasingly seek high-end, handcrafted scissors built with Japanese VG-series steel or German precision forging. These tools promise longer edge life, smoother cutting action, and reduced wrist strain. Brands are leveraging artisanal heritage, limited-edition collections, and advanced blade geometries to justify premium pricing. Additionally, professionals are shifting away from disposable or low-cost tools toward investment-grade equipment that enhances performance and longevity. This premiumization trend is redefining market positioning, especially in Europe, North America, and Japan.

Technology-Enabled Purchasing and Product Personalization

Digital transformation is rapidly influencing purchasing behavior. AR-based handle fitting, 3D product visualization, and AI-driven recommendation tools are being integrated into online stores, helping stylists choose scissors tailored to hand size, cutting style, and experience level. E-commerce platforms now provide authenticity verification, review-based ranking systems, and real-time customer support for precision tools. Custom engraving, modular thumb rests, specialized coatings, and blade-width customization are also emerging, enabling brands to differentiate in a crowded marketplace. This trend strongly appeals to younger professionals entering the beauty and grooming industry.

What are the key drivers in the hair scissors market?

Growing Professional Salon and Barber Ecosystem

The rapid global expansion of barbershops, grooming studios, unisex salons, and cosmetology institutes has significantly increased the need for professional-grade cutting tools. Stylists require multiple scissors, straight, thinning, blending, and detailing, to offer modern haircut styles, driving repeat purchases and higher per-user spending. The trend is especially strong in emerging markets across Asia-Pacific, where salon density and customer footfall have surged in urban centers, elevating both value and volume demand for hair scissors.

Rising Preference for Ergonomic, High-Performance Tools

Modern stylists increasingly prioritize tools that reduce hand fatigue and enhance precision, leading to strong adoption of ergonomic designs such as offset handles, swivel thumbs, and lightweight titanium-coated blades. Professional performance expectations have heightened, with demand for tools providing controlled cutting, noise reduction, and minimal drag. As salons emphasize service quality and stylist productivity, premium scissors with advanced engineering gain widespread traction.

What are the restraints for the global market?

Proliferation of Low-Cost Imitations and Counterfeits

Widespread availability of low-cost, counterfeit scissors, particularly through online marketplaces, poses a significant constraint to brand reputation and revenue. These products often compromise on material quality, edge retention, and safety, resulting in shorter tool life and inconsistent cutting performance. Their presence creates pricing pressure on authentic brands and increases the burden of customer education and channel verification.

Raw Material Cost Fluctuations and Production Complexity

Premium scissors rely on high-grade steel alloys, including VG10, cobalt-infused stainless steel, and titanium coatings. Price volatility in these materials directly impacts manufacturing costs. Hand-forged production, while valued for craftsmanship, demands highly skilled labor and long production cycles, limiting scalability. Manufacturers must continually balance quality, cost stability, and production efficiency to remain competitive.

What are the key opportunities in the hair scissors industry?

Digitally Driven Direct-to-Professional Sales Models

The shift toward online purchasing offers brands the opportunity to reach stylists globally without depending on traditional distributors. Subscription-based sharpening services, trade-in programs, and digital fit-assessment tools enhance customer loyalty and lifetime value. Brands embracing D2C channels can capture higher margins and build deeper relationships with their professional customer base.

Expansion Across Asia-Pacific and Emerging Markets

Rising grooming culture, urbanization, and increasing disposable incomes in markets such as India, China, Indonesia, and the Philippines make APAC the strongest growth opportunity. Large-scale training academies and government-backed skill development programs further expand the installed base of stylists who require professional scissors. Localizing production, establishing sharpening hubs, and offering region-specific product lines can significantly accelerate penetration.

Product Type Insights

Thinning and texturizing shears dominate the market, accounting for approximately 28% of global revenue in 2024. Their widespread use in layering, blending, and modern textured haircut styles has made them essential tools for both stylists and barbers. Straight cutting scissors remain the foundational tool category, while specialized detailing shears continue to gain traction in high-end salons. Multi-functional scissors, combining thinning and cutting features, are emerging as value-driven alternatives for entry-level professionals.

Application Insights

Professional salons represent the largest application segment, contributing to over 42% of the global market in 2024. These establishments maintain multiple pairs per stylist and replace tools more frequently due to high usage intensity. Barbershops are the fastest-growing segment, supported by the global rise of men’s grooming. Home-use consumers continue to grow in volume through mass-market e-commerce channels, though they contribute a smaller share of total revenue due to lower average selling prices.

Distribution Channel Insights

Specialist offline retailers and salon-supply stores lead the market with a 35% share, as professional stylists prefer hands-on evaluation before purchasing premium tools. However, e-commerce and D2C websites are expanding rapidly, offering extensive product visibility, personalization, and authentication systems. Marketplaces such as Amazon, Alibaba, and regional platforms are driving volume sales, while premium brands focus on curated online experiences and digital fit-guidance tools.

User Type Insights

Professional stylists and barbers form the core user base of the hair scissors market, demanding high-performance tools with advanced ergonomics. Students and trainees in cosmetology schools represent a growing user segment, driving demand for mid-range starter kits. Hobbyists and home users contribute significantly to unit sales but account for a smaller share of revenue due to a preference for budget-friendly products. Over time, improved access to online tutorials and grooming trends has expanded the home-user category worldwide.

Skill Level Insights

Intermediate to advanced stylists account for the majority of premium scissor purchases, as they seek specialized tools to refine cutting techniques. Entry-level stylists prioritize affordability and versatility, often purchasing multi-purpose scissors or training kits. Master-level stylists, educators, and platform artists represent the highest-value niche, frequently investing in artisan-crafted, limited-edition, and custom-engineered scissors that support high-precision work.

| By Product Type | By Application / End Use | By Distribution Channel | By Material Type | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America commands a notable share of global demand, driven by high stylist density, premium salon cultures, and strong adoption of advanced grooming tools. The U.S. leads the region with robust purchasing power and a well-established ecosystem of barber academies and beauty schools. Demand is also supported by rapid e-commerce adoption and high brand consciousness among professionals.

Europe

Europe maintains a strong premium market segment, especially in Germany, the U.K., France, and Italy. German-made scissors have a global reputation for precision engineering, while broader EU markets emphasize ergonomics, product safety compliance, and sustainable manufacturing. Europe’s high professional standards and mature salon industries make it a consistent revenue-generating region for high-end brands.

Asia-Pacific

Asia-Pacific is the world’s largest and fastest-growing region for hair scissors. The expansion of salons and barber chains in China and India, combined with Japan’s leadership in metallurgy and scissor craftsmanship, makes APAC central to both production and consumption. Rising fashion consciousness and grooming culture among young demographics further accelerate growth. The region accounts for approximately 36% of the global market share in 2024.

Latin America

Latin America shows growing demand, especially in Brazil and Mexico, where barbershop culture has expanded rapidly. Affordability remains a key factor, boosting sales of mid-range and mass-market scissors. Local distributors and barber academies are strengthening the region’s professional grooming ecosystem, gradually increasing adoption of higher-quality tools.

Middle East & Africa

ME&A displays rising interest in premium grooming tools, particularly in the UAE, Saudi Arabia, and South Africa. Luxury grooming lounges and Western-style barber franchises are gaining momentum. Africa also represents a significant opportunity for volume-driven sales, supported by burgeoning youth populations and increased urban grooming trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Scissors Market

- Mizutani Scissors

- Hikari Corporation

- KAI (Kasho)

- Joewell (Tokosha)

- Jaguar (Solingen)

- Kamisori

- Saki Shears

- Matsuzaki

- Dragonfly Shears

- Takai

- Excellent Shears

- Hair Tools Ltd.

- Kenchii

- Fagaci

- Matteck Japan